- China

- /

- Electronic Equipment and Components

- /

- SHSE:688322

3 Global Growth Companies With High Insider Ownership Expecting 127% Earnings Growth

Reviewed by Simply Wall St

In the current global market landscape, characterized by declining consumer confidence and regulatory uncertainties impacting growth stocks, investors are increasingly focused on companies with robust insider ownership as a potential indicator of strong alignment between management and shareholder interests. As markets face headwinds such as persistent inflation and geopolitical tensions, identifying growth companies with significant insider stakes can offer insights into businesses that are well-positioned to navigate these challenges while potentially capitalizing on expected earnings growth.

Top 10 Growth Companies With High Insider Ownership Globally

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 32.1% | 39.9% |

| Vow (OB:VOW) | 12.9% | 120.9% |

| Pharma Mar (BME:PHM) | 11.9% | 40.1% |

| Laopu Gold (SEHK:6181) | 36.4% | 42.4% |

| CD Projekt (WSE:CDR) | 29.7% | 39.4% |

| Ortoma (OM:ORT B) | 27.7% | 73.4% |

| Elliptic Laboratories (OB:ELABS) | 22.6% | 89.9% |

| HANA Micron (KOSDAQ:A067310) | 18.3% | 125.9% |

| Fulin Precision (SZSE:300432) | 13.6% | 71% |

| Zhejiang Leapmotor Technology (SEHK:9863) | 15.2% | 60% |

Let's take a closer look at a couple of our picks from the screened companies.

Orbbec (SHSE:688322)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Orbbec Inc. designs, manufactures, and sells 3D vision sensors with a market cap of CN¥27.92 billion.

Operations: Orbbec Inc. generates revenue through the design, manufacturing, and sale of 3D vision sensors.

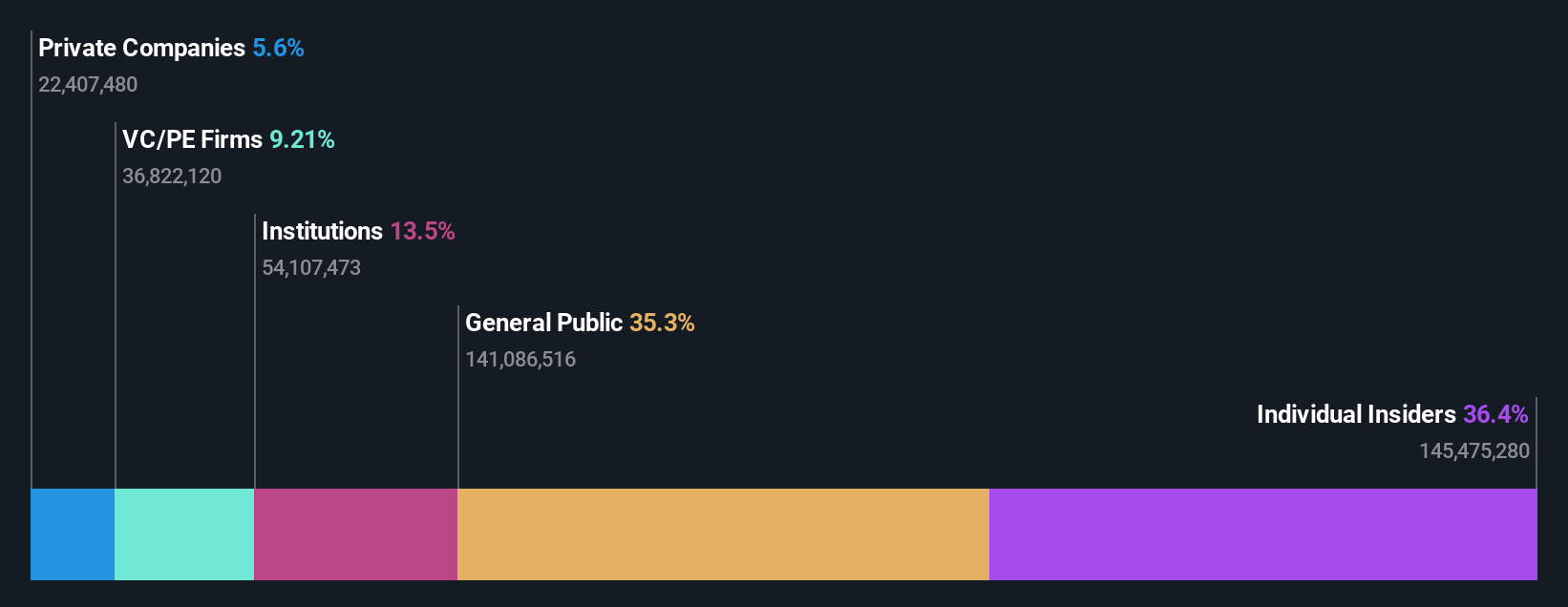

Insider Ownership: 36.5%

Earnings Growth Forecast: 127.9% p.a.

Orbbec's recent earnings report shows significant revenue growth to CNY 562.19 million, reducing its net loss from CNY 275.88 million to CNY 59.99 million year-over-year. Despite a volatile share price, the company forecasts robust annual revenue growth of 34.8%, outpacing the market, with expected profitability within three years. Insider ownership remains high without recent substantial insider trading activity; however, return on equity is projected to remain low at 6% in three years.

- Click to explore a detailed breakdown of our findings in Orbbec's earnings growth report.

- According our valuation report, there's an indication that Orbbec's share price might be on the expensive side.

Trial Holdings (TSE:141A)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Trial Holdings Inc. is a diversified company engaged in retail, logistics, financial/payment services, and retail tech businesses with a market cap of ¥224.71 billion.

Operations: The company's revenue is primarily driven by its Distribution and Retail segment, which accounts for ¥754.69 billion, while the Retail AI segment contributes ¥4.51 billion.

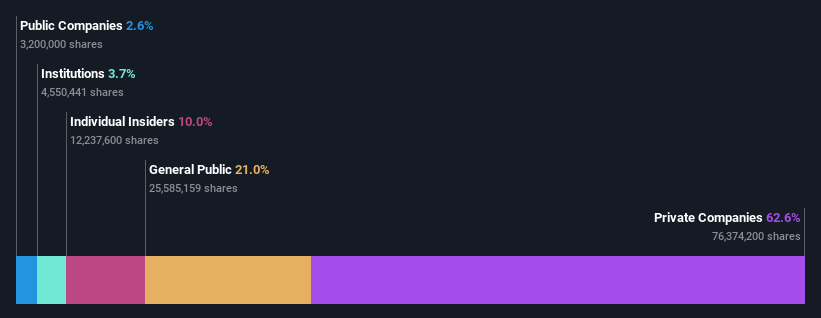

Insider Ownership: 10%

Earnings Growth Forecast: 21.4% p.a.

Trial Holdings has shown impressive sales growth, with recent reports indicating all store sales increased by over 110% year-over-year. The stock trades at a significant discount to its estimated fair value, although it experiences high volatility. Earnings are forecast to grow significantly at 21.37% annually, surpassing market expectations. Despite no substantial insider trading activity recently, the company maintains strong insider ownership, aligning management interests with shareholders amid slower revenue growth projections compared to earnings.

- Navigate through the intricacies of Trial Holdings with our comprehensive analyst estimates report here.

- Our valuation report here indicates Trial Holdings may be undervalued.

PARK24 (TSE:4666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PARK24 Co., Ltd. operates and manages parking facilities in Japan and internationally, with a market cap of ¥345.02 billion.

Operations: The company's revenue segments include the Mobility Business at ¥112.06 billion, Parking Lot Business Japan at ¥182.30 billion, and Parking Lot Business Overseas at ¥82.41 billion.

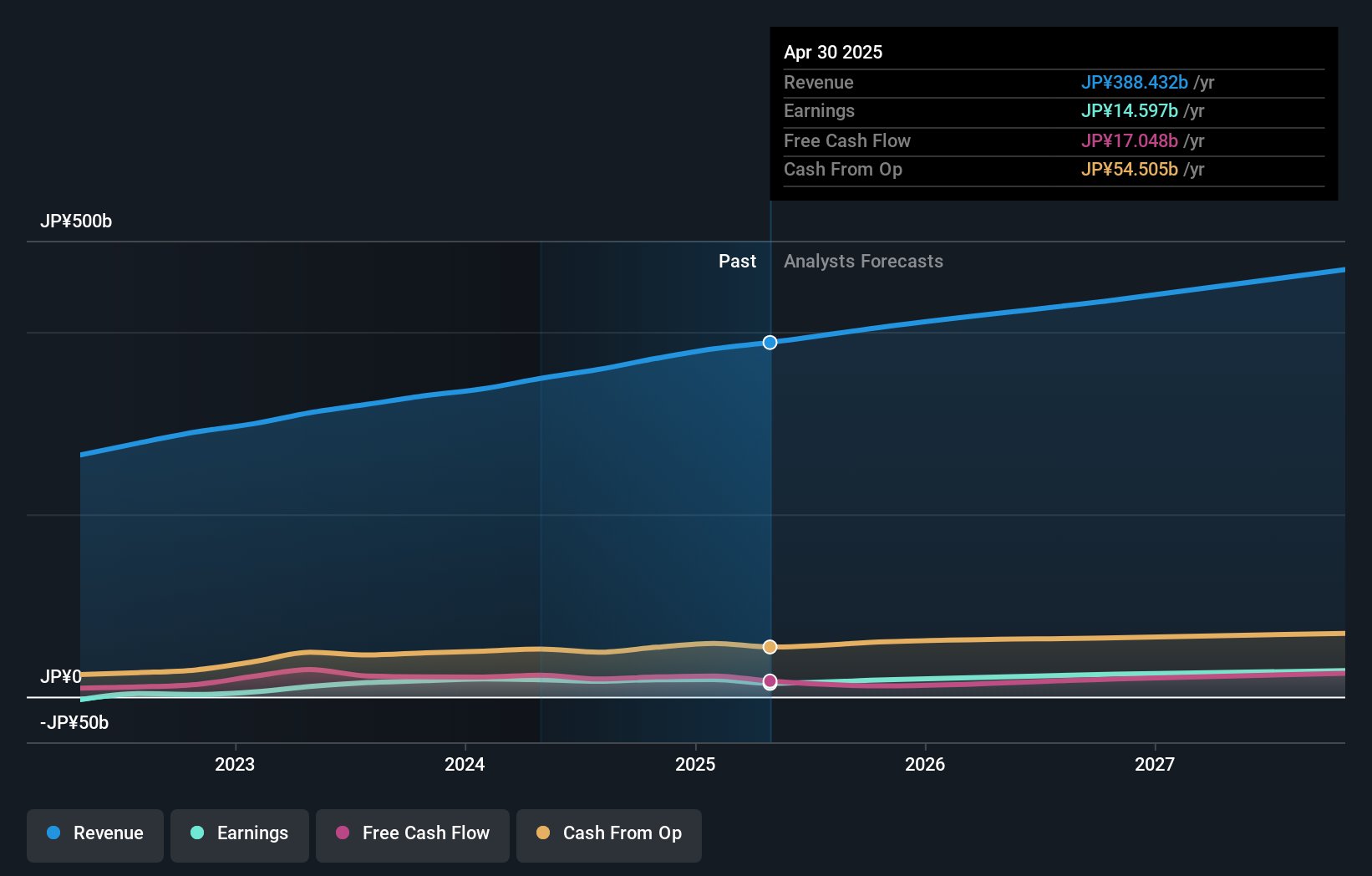

Insider Ownership: 10.5%

Earnings Growth Forecast: 12.2% p.a.

PARK24 demonstrates a solid growth trajectory with earnings projected to increase by 12.2% annually, outpacing the Japanese market average of 8%. Despite high debt levels, its revenue is expected to grow at 6.8% per year, surpassing the market rate of 4.2%. Analysts predict a stock price rise of 32.5%, indicating potential upside. Recent board meetings focused on structural and personnel changes could align management more closely with shareholders' interests, enhancing governance and strategic direction.

- Get an in-depth perspective on PARK24's performance by reading our analyst estimates report here.

- Our expertly prepared valuation report PARK24 implies its share price may be lower than expected.

Where To Now?

- Delve into our full catalog of 880 Fast Growing Global Companies With High Insider Ownership here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688322

High growth potential with excellent balance sheet.