- Japan

- /

- Electronic Equipment and Components

- /

- TSE:5208

Discover Arisawa Mfg And Two Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate the complexities of trade policies and economic indicators, investors are keenly observing the impacts on major indices, with U.S. stocks experiencing slight declines amid tariff uncertainties and European markets showing resilience against growth concerns. In this environment, dividend stocks continue to attract attention for their potential to provide steady income streams, making them appealing options for those seeking stability in a fluctuating market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.55% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.89% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.49% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.03% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.30% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.98% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.87% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.85% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Arisawa Mfg (TSE:5208)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Arisawa Mfg. Co., Ltd. manufactures and sells electronic, optoelectronic, electrical insulating, display, and industrial structural materials both in Japan and internationally, with a market cap of ¥48.43 billion.

Operations: Arisawa Mfg. Co., Ltd.'s revenue segments include Electronic Materials at ¥30.50 billion, Industrial Application Structural Materials at ¥11.03 billion, Display Materials at ¥4.71 billion, and Electrical Insulation Material at ¥2.46 billion.

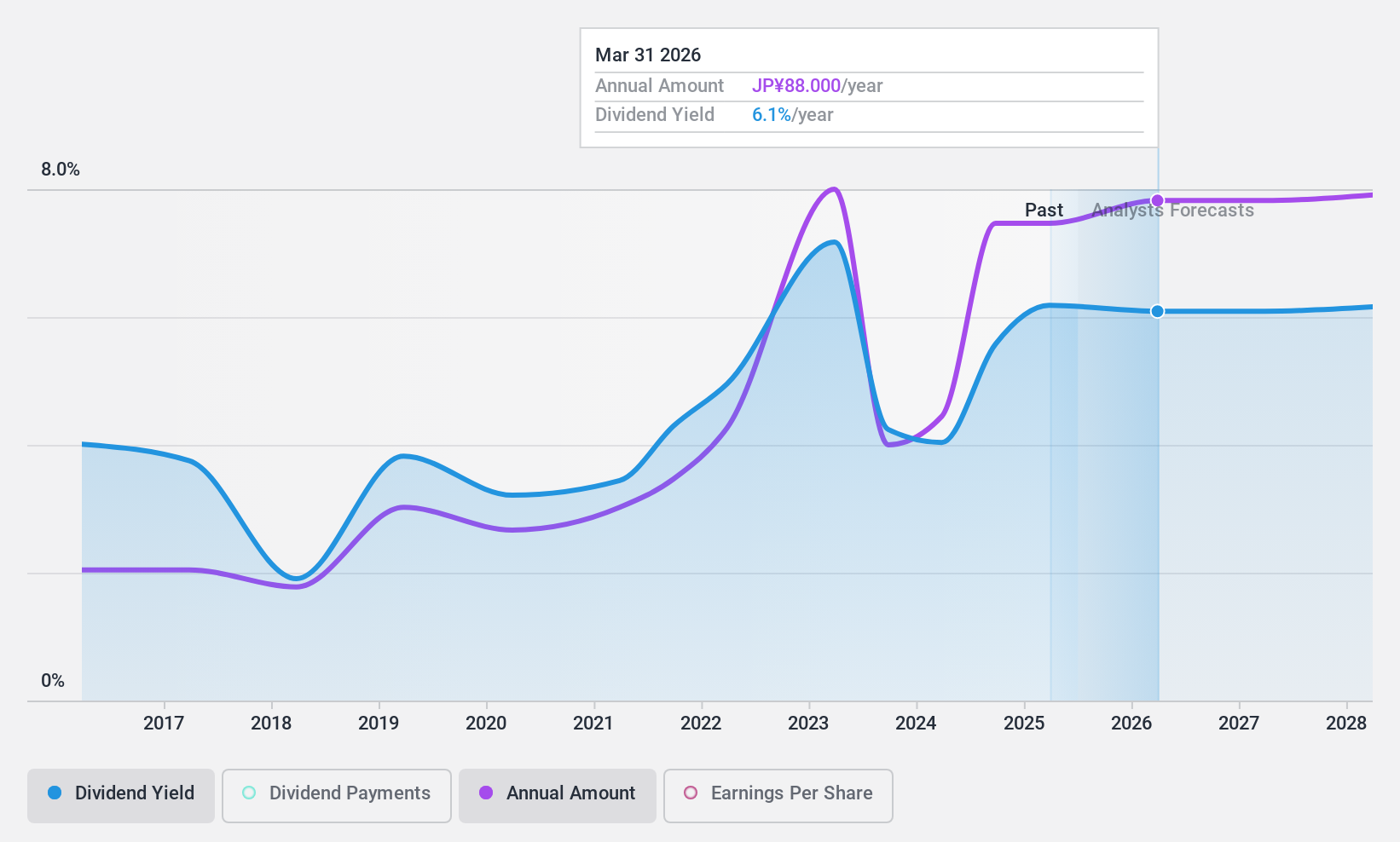

Dividend Yield: 5.8%

Arisawa Mfg. offers a high dividend yield of 5.76%, placing it in the top 25% of JP market payers, yet its dividends have been unreliable and volatile over the past decade. Despite a reasonable payout ratio of 74.4% covered by earnings, cash flows inadequately support dividends due to a high cash payout ratio of 136.2%. Earnings are forecasted to decline slightly, impacting future dividend sustainability despite revenue growth expectations of 5.18% annually.

- Get an in-depth perspective on Arisawa Mfg's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Arisawa Mfg is priced higher than what may be justified by its financials.

Cleanup (TSE:7955)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Cleanup Corporation operates in the equipment business for housing, stores, and business establishments both in Japan and internationally, with a market cap of ¥23.69 billion.

Operations: Cleanup Corporation generates revenue through its equipment business for housing, stores, and commercial establishments in both domestic and international markets.

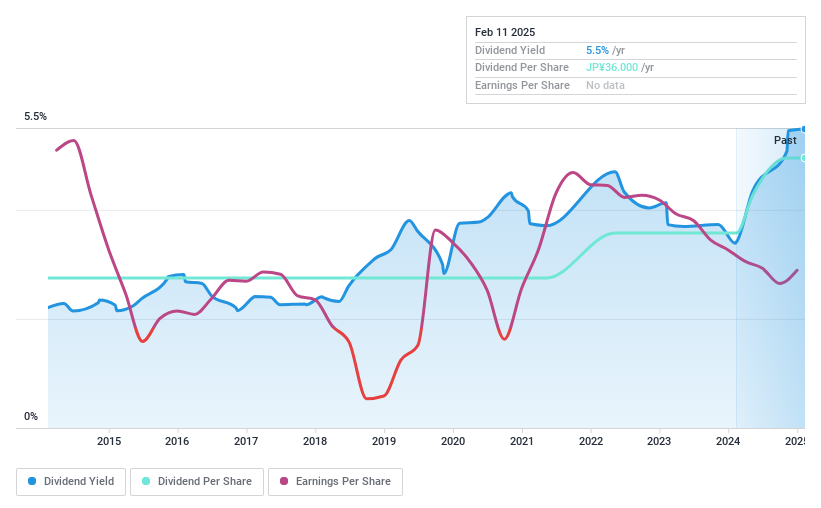

Dividend Yield: 5.5%

Cleanup's dividend yield of 5.48% ranks among the top 25% in the JP market, with stable and reliable growth over the past decade. However, dividends are not well covered by free cash flows or earnings, despite a low payout ratio of 37.6%. The lack of free cash flows raises concerns about long-term sustainability, especially given financial results impacted by large one-off items.

- Click here to discover the nuances of Cleanup with our detailed analytical dividend report.

- Our valuation report here indicates Cleanup may be overvalued.

FJ Next Holdings (TSE:8935)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: FJ NEXT Holdings Co., Ltd. is involved in the planning, development, sale, and brokerage of real estate properties in Japan with a market cap of ¥38.66 billion.

Operations: FJ NEXT Holdings Co., Ltd. generates revenue through its activities in real estate planning, development, sales, and brokerage within Japan.

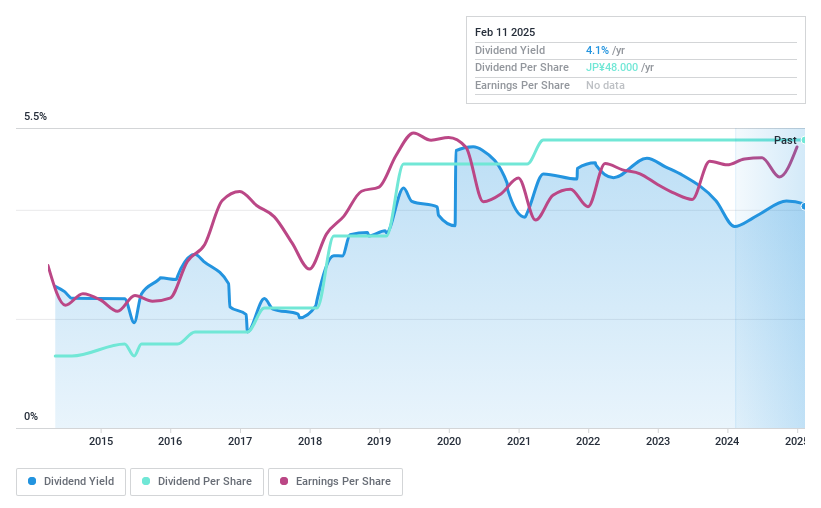

Dividend Yield: 4.1%

FJ Next Holdings' dividend yield of 4.06% places it in the top 25% of JP market payers, with stable growth over the past decade. Despite a low payout ratio of 11.6%, dividends are not supported by free cash flows, raising sustainability concerns. The Price-To-Earnings ratio is favorable at 5.7x compared to the market average of 13.3x, yet earnings alone do not cover dividend payments, indicating potential risk for future payouts without cash flow support.

- Navigate through the intricacies of FJ Next Holdings with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that FJ Next Holdings is trading beyond its estimated value.

Next Steps

- Investigate our full lineup of 1960 Top Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5208

Arisawa Mfg

Manufactures and sells electronic, display, electrical insulating, display, and industrial structural materials in Japan, China, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)