- Japan

- /

- Consumer Durables

- /

- TSE:6952

Where Does Casio Stand After Its 1.2% Weekly Gain and Mixed 2025 Valuations?

Reviewed by Bailey Pemberton

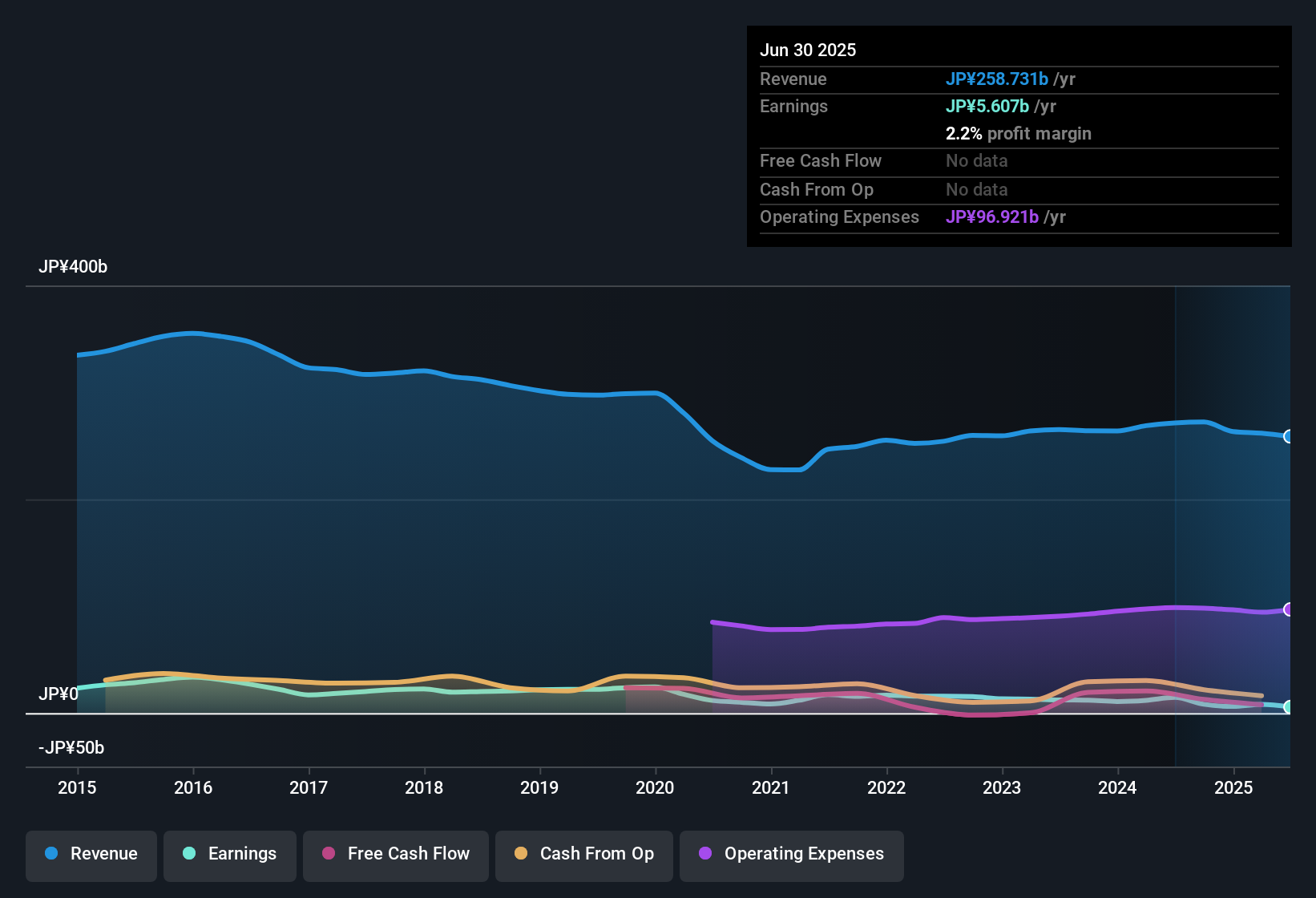

If you have been tracking Casio ComputerLtd, you are probably wondering whether now is the right moment to take action or hold off. The stock has delivered an interesting mix of signals for investors this year. Over the past week, it inched up 1.2%, putting a little spring back into its step after a more challenging month that saw shares slip 3.8%. Year-to-date, Casio is still down 2.5%, but look further out and you will spot a 7.0% gain over the last twelve months. This suggests that longer-term holders have seen some rewards. However, not all of the news is positive, with a 5-year performance still lagging behind at -8.3%.

These shifts in price have come at a time of steady changes across the broader electronics market, with shifting risk perceptions and global demand trends influencing how investors view Casio and its peers. It is also worth noting that Casio’s latest valuation score stands at just 1 out of 6, meaning it only checks the box for being undervalued in one of the main ways analysts look for bargains.

Diving deeper, the real question becomes: what do these numbers say about Casio’s true value, both through traditional methods and more forward-thinking approaches? Let us walk through the main valuation techniques first, then we will reveal a more insightful way to think about what Casio is truly worth.

Casio ComputerLtd scores just 1/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Casio ComputerLtd Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model is a widely used valuation technique that estimates what a company is worth today based on its projected future cash flows, which are then discounted back to present value. This method helps investors determine whether a stock is trading at a fair price compared to its intrinsic value.

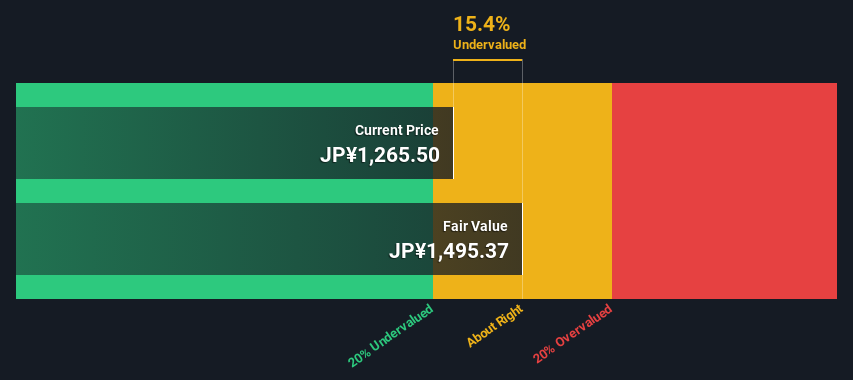

For Casio ComputerLtd, the DCF analysis starts with its latest twelve-month Free Cash Flow (FCF), reported at about ¥6.5 Billion. Analysts project steady growth in coming years, with estimates reaching approximately ¥21.95 Billion by 2030. Beyond the initial five years, where analyst input is available, further forecast data is extended using long-term growth assumptions from Simply Wall St. These projections are run through a 2 Stage Free Cash Flow to Equity model. This approach takes into account the evolving cash flow profile of the business over time.

The conclusion of this DCF assessment values Casio at an intrinsic fair value of ¥1,519 per share. This figure is currently about 18.9% higher than the actual market price, signaling the stock is notably undervalued based on cash flow fundamentals.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Casio ComputerLtd is undervalued by 18.9%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Casio ComputerLtd Price vs Earnings

The Price-to-Earnings (PE) ratio is a classic, widely-used tool for valuing profitable companies because it relates a company’s current share price to its per-share earnings. For businesses like Casio ComputerLtd, which have a long track record of generating consistent profits, the PE ratio gives investors a quick sense of how much the market is willing to pay for those earnings. Generally, growth expectations and risk play a big part in what counts as a normal or fair PE. If a company is expected to grow earnings faster than average, investors may be willing to pay a higher PE. On the flip side, if risks are elevated or growth prospects dim, a lower PE is typically justified.

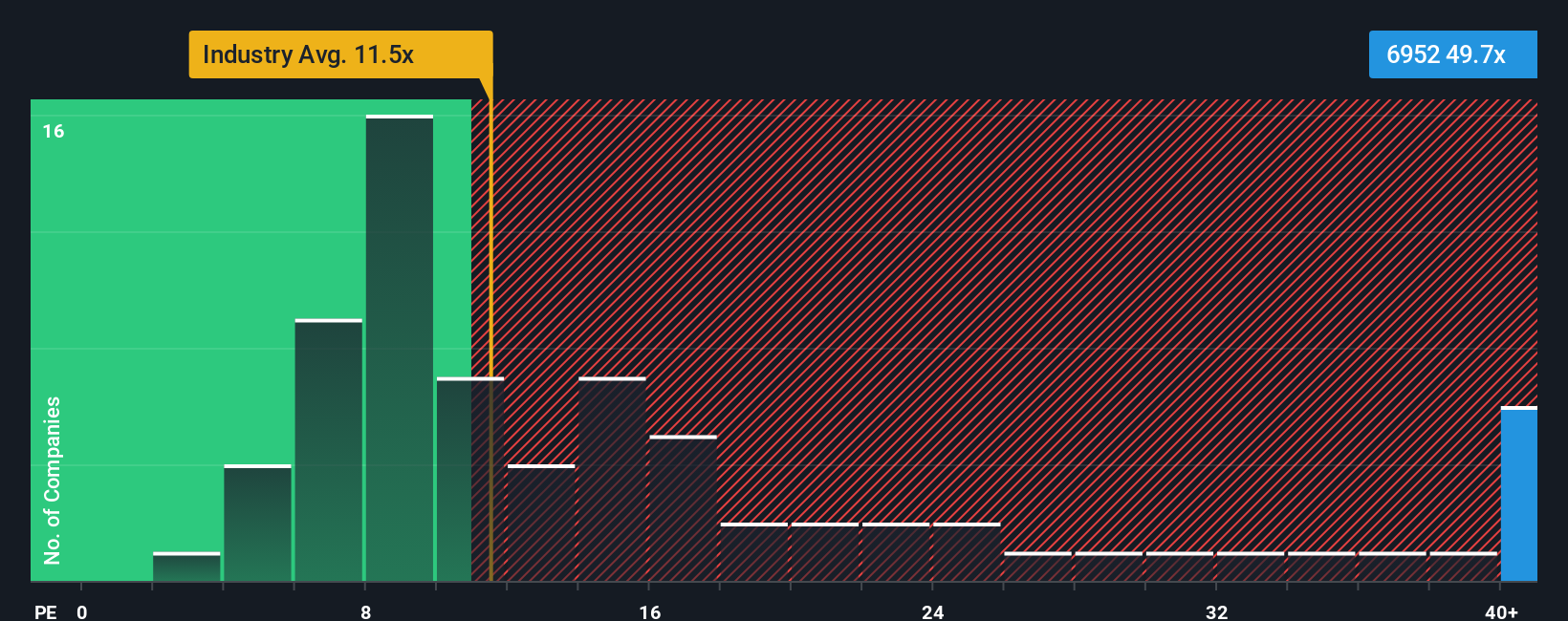

Currently, Casio is trading at a PE ratio of 50.07x. This is well above the Consumer Durables industry average of 11.63x and also higher than the peer average of 19.80x. At first glance, this could suggest the stock is expensive relative to its sector.

However, Simply Wall St’s proprietary “Fair Ratio” goes deeper. It estimates a fair PE for Casio at 20.91x, calculated by blending growth opportunities, profit margins, risk profile, industry context, and market cap. This makes it a more tailored valuation yardstick for a company’s unique fingerprint rather than relying on broad, one-size-fits-all comparisons. In this case, Casio’s actual PE of 50.07x is significantly higher than its Fair Ratio of 20.91x, suggesting the market is currently assigning a premium beyond what is justified by fundamentals.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Casio ComputerLtd Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply the story you build around a company, connecting your own perspective about where the business is heading with the numbers, such as your assumed fair value or forecasts for revenue and profit margins. By tying the company’s story to an actual financial forecast and then to a fair value, Narratives help bring context to the market price and allow you to see what drives your investment view.

Narratives are available directly on Simply Wall St’s Community page, used by millions of investors, making them an easy, accessible tool for anyone. They allow you to put your own outlook into the platform, quickly compare your fair value estimate to the current market price, and decide when you think Casio might be undervalued or overpriced with clarity and confidence. The best part is that Narratives are dynamic. Whenever new info like news or earnings is released, your Narrative updates as well, so your view always stays relevant.

For Casio ComputerLtd, different Narratives can lead to very different target prices: some investors, focused on Casio’s expansion in global watches and EdTech, might expect a price as high as ¥1,700, while others, concerned about competition and market risks, set their fair value as low as ¥1,100.

Do you think there's more to the story for Casio ComputerLtd? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Develops, produces, and sells consumer, system equipment, and other products.

Flawless balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives