- Japan

- /

- Consumer Durables

- /

- TSE:6952

Can Casio's (TSE:6952) Latest G-SHOCK Collaboration Reveal Shifts in Its Brand Strategy?

Reviewed by Sasha Jovanovic

- Casio America Inc. recently introduced the DW5600PDP-1, a limited-edition G-SHOCK watch created in collaboration with PLEASURES and inspired by Daft Punk, featuring unique helmet-themed artwork and a custom backlight tribute.

- This release highlights Casio's ongoing strategy of partnering with culturally influential brands to create collectible products that resonate with both new audiences and dedicated enthusiasts.

- We'll now assess how this high-profile, music-inspired collaboration could impact Casio's global brand positioning and product demand outlook.

Find companies with promising cash flow potential yet trading below their fair value.

Casio ComputerLtd Investment Narrative Recap

To invest in Casio Computer Ltd., you need to believe in its ability to revitalize its traditional product lines and reach younger, culturally engaged buyers through creative global collaborations. The Daft Punk-inspired G-SHOCK launch is a bold example of this marketing push, but given persistent declines in core financial metrics and ongoing profitability headwinds, its near-term impact may be limited unless it fuels broader, sustained demand and brand reappraisal; vulnerability in key markets and margin pressure remain particularly acute risks that may outweigh short-term attention from such releases.

One recent announcement most relevant to this news is Casio’s multiple high-profile collaborations, notably the League of Legends partnership in September 2025, which further underscores efforts to engage niche global audiences. Like the Daft Punk launch, these cross-sector initiatives aim to reinvigorate Casio’s image and enhance demand for premium products, yet their effect must be measured against the sizable challenge of offsetting sales stagnation and margin compression across major consumer markets.

By contrast, investors should also be aware that persistent underperformance in China and ongoing price competition in traditional segments could mean...

Read the full narrative on Casio ComputerLtd (it's free!)

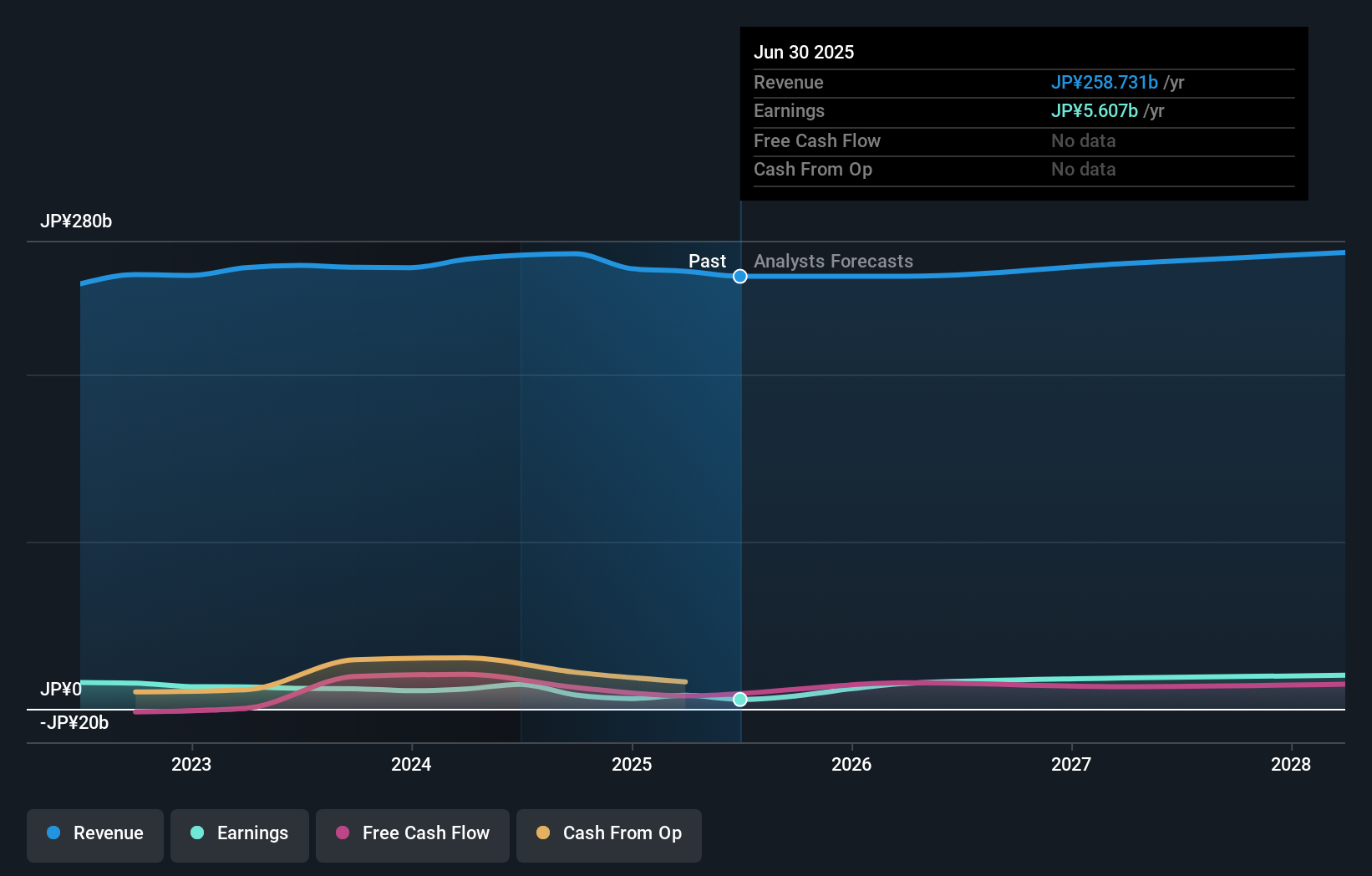

Casio ComputerLtd's narrative projects ¥275.8 billion revenue and ¥20.2 billion earnings by 2028. This requires 2.2% yearly revenue growth and a ¥14.6 billion earnings increase from ¥5.6 billion today.

Uncover how Casio ComputerLtd's forecasts yield a ¥1291 fair value, a 5% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members have shared two fair value estimates for Casio from ¥1,291.25 to ¥1,527.68. Alongside these varied views, financial risks tied to shrinking profit margins may influence your assessment of future opportunities.

Explore 2 other fair value estimates on Casio ComputerLtd - why the stock might be worth as much as 25% more than the current price!

Build Your Own Casio ComputerLtd Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Casio ComputerLtd research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Casio ComputerLtd research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Casio ComputerLtd's overall financial health at a glance.

Searching For A Fresh Perspective?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6952

Casio ComputerLtd

Develops, produces, and sells consumer, system equipment, and other products.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives