- Japan

- /

- Consumer Durables

- /

- TSE:6794

3 Reliable Dividend Stocks Offering At Least 4% Yield

Reviewed by Simply Wall St

As global markets navigate a landscape marked by declining major stock indexes and expectations for further interest rate cuts, investors are seeking stability amidst economic uncertainties. With the Nasdaq reaching record highs while other indices falter, dividend stocks offering yields of at least 4% present an attractive option for those looking to balance risk and income in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.25% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.25% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.63% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.21% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

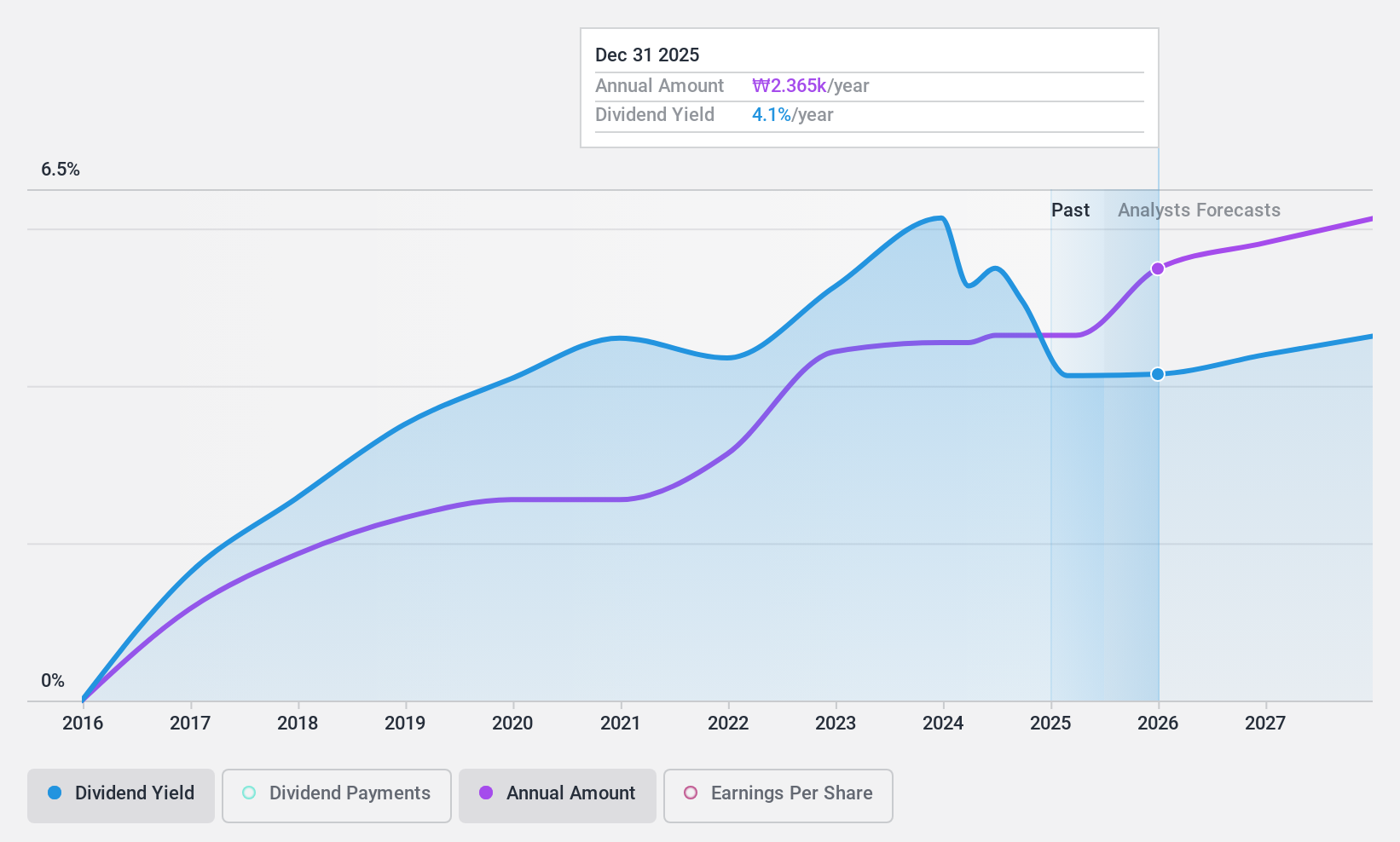

KT (KOSE:A030200)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: KT Corporation offers integrated telecommunications and platform services both in Korea and internationally, with a market cap of ₩11.05 trillion.

Operations: KT Corporation's revenue segments consist of ICT services generating ₩18.93 trillion, Finance contributing ₩3.60 trillion, Real Estate at ₩540.28 million, and Satellite Broadcasting bringing in ₩705.65 million.

Dividend Yield: 4.4%

KT's dividend payments are backed by a 73% payout ratio and a low 26.4% cash payout ratio, indicating strong coverage. However, dividends have been volatile over the past decade, affecting reliability despite recent growth. The company's dividend yield is among the top in Korea's market. Recent earnings show improved net income, and KT's strategic partnership with Microsoft could bolster future revenue streams, potentially supporting more stable dividends going forward.

- Get an in-depth perspective on KT's performance by reading our dividend report here.

- Our valuation report here indicates KT may be undervalued.

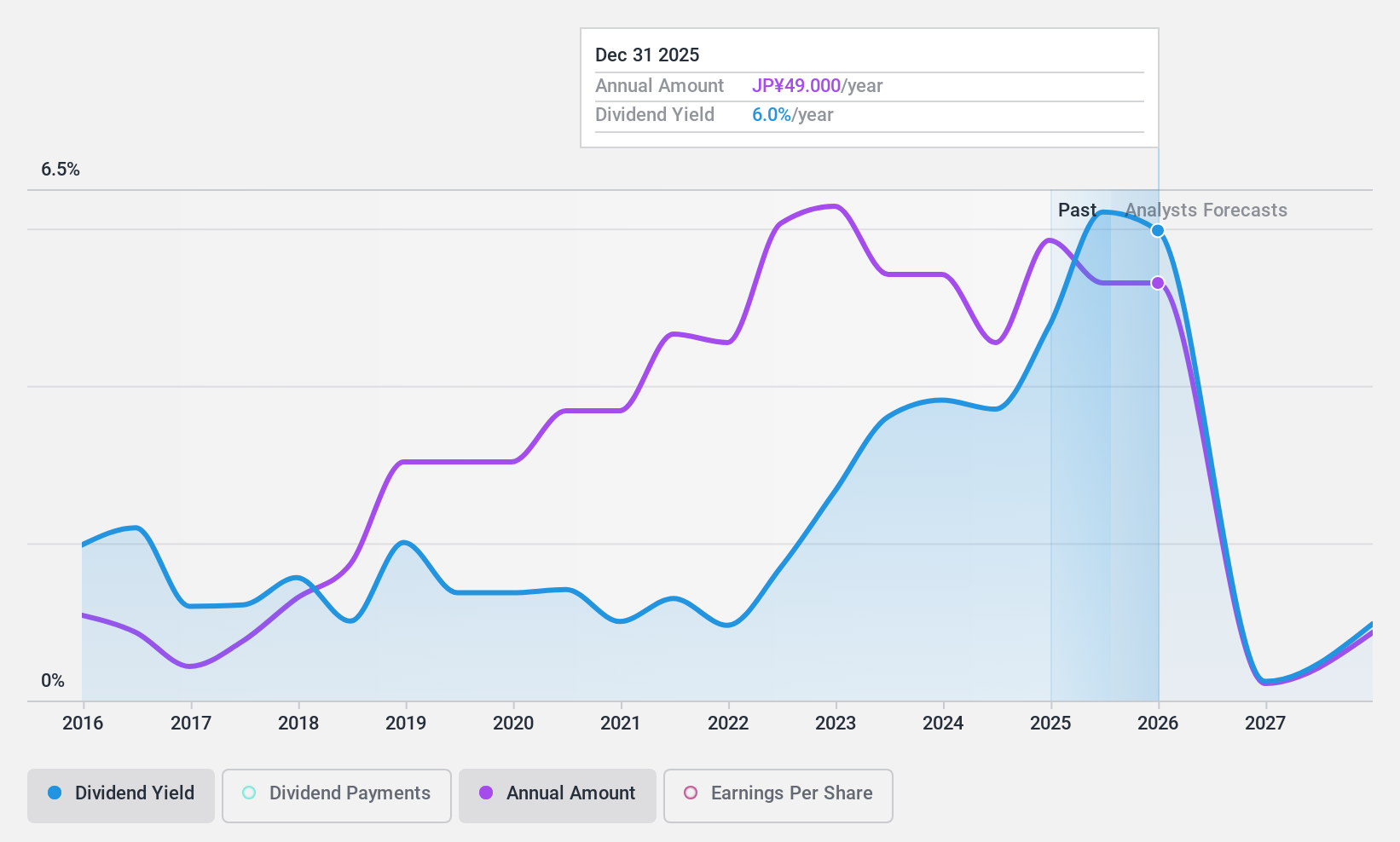

ValueCommerce (TSE:2491)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: ValueCommerce Co., Ltd. offers marketing solutions both in Japan and internationally, with a market cap of ¥25.80 billion.

Operations: ValueCommerce Co., Ltd. generates revenue through its EC Solutions segment, which accounts for ¥17.76 billion, and its Marketing Solutions segment, contributing ¥12.12 billion.

Dividend Yield: 4.5%

ValueCommerce's dividends are well-covered by earnings with a 51.7% payout ratio and a low cash payout ratio of 33.3%, ensuring sustainability. Despite offering a competitive dividend yield in Japan, its dividend history is marred by volatility over the past decade, impacting reliability. The stock trades significantly below its estimated fair value, presenting potential for capital appreciation alongside income generation from dividends. Earnings growth forecasts further support the prospect of future dividend stability.

- Click here and access our complete dividend analysis report to understand the dynamics of ValueCommerce.

- The analysis detailed in our ValueCommerce valuation report hints at an deflated share price compared to its estimated value.

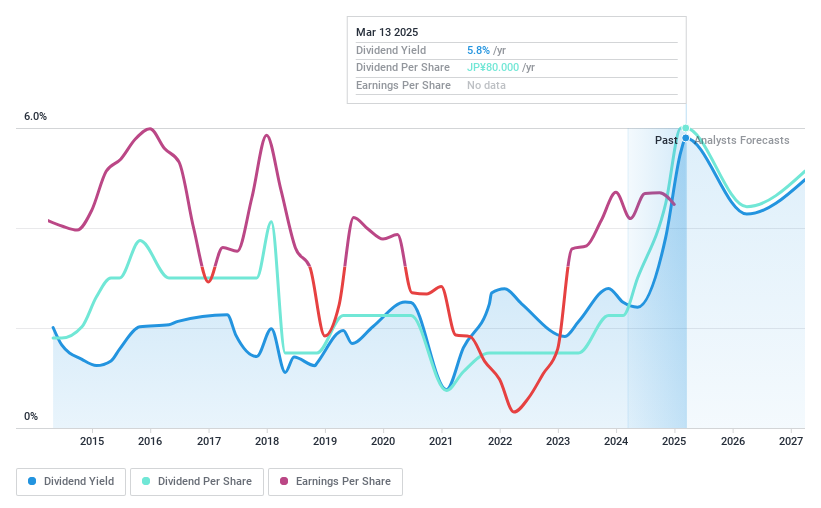

Foster Electric Company (TSE:6794)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Foster Electric Company, Limited produces and sells loudspeakers, audio equipment, and electronic equipment in Japan and internationally, with a market cap of ¥33.20 billion.

Operations: Foster Electric Company's revenue primarily comes from its Speaker Business, generating ¥106.08 billion, and its Mobile Audio Business, contributing ¥13.50 billion.

Dividend Yield: 4%

Foster Electric Company offers a competitive dividend yield in Japan, supported by a low payout ratio of 21.9% and reasonable cash flow coverage at 70.1%. However, its dividend history is marked by volatility over the past decade, impacting reliability. Recent guidance indicates significant earnings growth with dividends doubling year-on-year to JPY 30 per share for fiscal 2025. Despite high share price volatility, it trades below estimated fair value, suggesting potential for capital appreciation alongside dividends.

- Dive into the specifics of Foster Electric Company here with our thorough dividend report.

- Our expertly prepared valuation report Foster Electric Company implies its share price may be lower than expected.

Where To Now?

- Delve into our full catalog of 1972 Top Dividend Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6794

Foster Electric Company

Engages in the production and sale of loudspeakers, audio equipment, and electronical equipment in Japan and internationally.

Undervalued with solid track record and pays a dividend.