- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6834

Undiscovered Gems And 2 Other Hidden Small Caps With Strong Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate cuts from major central banks and mixed performance in key indices, small-cap stocks have faced headwinds, with the Russell 2000 Index underperforming against larger counterparts. Amidst this backdrop of economic shifts and market volatility, identifying promising small-cap stocks requires a keen eye for companies that demonstrate resilience and potential for growth despite broader challenges.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| SALUS Ljubljana d. d | 13.55% | 13.11% | 9.95% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MAPFRE Middlesea | NA | 14.56% | 1.77% | ★★★★★☆ |

| Compañía Electro Metalúrgica | 71.27% | 12.50% | 19.90% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Ashot Ashkelon Industries (TASE:ASHO)

Simply Wall St Value Rating: ★★★★★☆

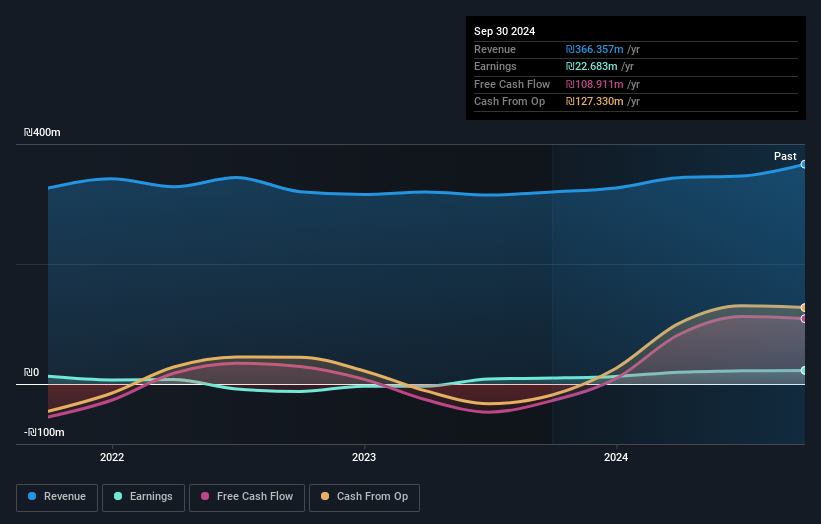

Overview: Ashot Ashkelon Industries Ltd. is an Israeli company that manufactures and sells systems and components for the aerospace and defense sectors both domestically and internationally, with a market capitalization of ₪1.26 billion.

Operations: Ashot Ashkelon Industries generates revenue primarily from its military segment, contributing ₪250.03 million, and its aviation and complex assemblies segment, which adds ₪100.23 million. The subsidiary in the USA accounts for an additional ₪67.39 million in revenue.

Ashot Ashkelon Industries shines with impressive earnings growth of 128.6% over the past year, outpacing its Aerospace & Defense peers. The company's net debt to equity ratio is a satisfactory 10.4%, and its interest payments are well-covered by EBIT at 18.4 times coverage, showcasing financial resilience. Despite a volatile share price recently, Ashot trades at an attractive valuation—85.6% below estimated fair value—and boasts high-quality earnings. Recent results highlight robust performance with third-quarter sales reaching ILS 100 million and net income climbing to ILS 11 million, reflecting strong operational momentum in this niche player.

SEIKOH GIKEN (TSE:6834)

Simply Wall St Value Rating: ★★★★★★

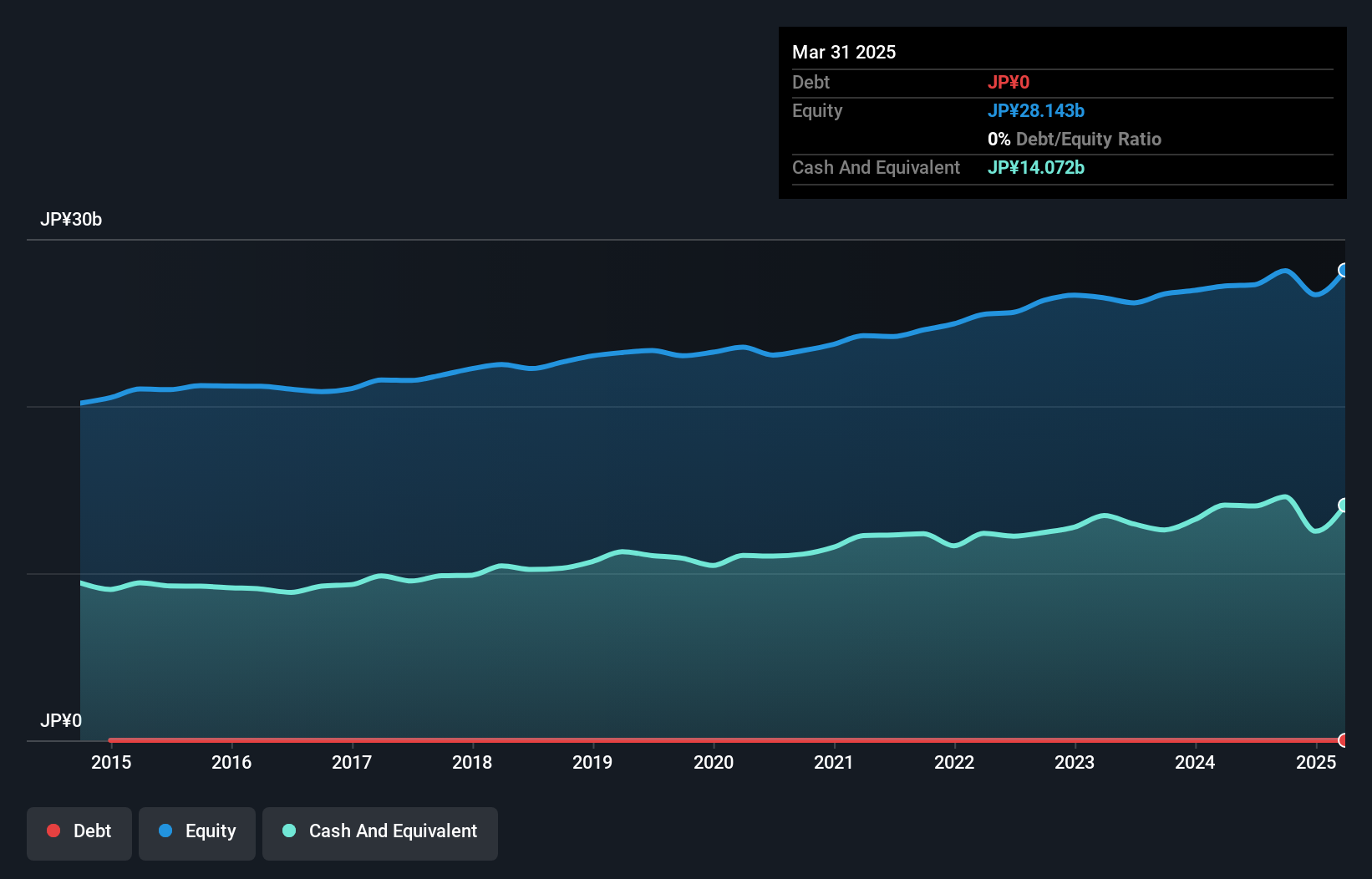

Overview: SEIKOH GIKEN Co., Ltd. is involved in the design, manufacture, and sale of optical components, lenses, and radio over fiber products both in Japan and internationally, with a market cap of ¥57.15 billion.

Operations: SEIKOH GIKEN generates revenue primarily through its Optical Products and Precision Machine segments, with ¥8.23 billion and ¥8.78 billion respectively.

With no debt over the past five years, SEIKOH GIKEN exhibits strong financial stability, and its earnings growth of 67.8% last year outpaced the electronic industry’s -1.6%. The company is trading at a 24% discount to its estimated fair value, offering potential upside for investors. Recently, it completed a share buyback program worth ¥1.32 billion, repurchasing 250,000 shares to enhance capital efficiency. Despite a volatile share price in recent months, future earnings are forecasted to grow by an impressive 25.1% annually, suggesting promising prospects ahead for this nimble player in the market.

- Dive into the specifics of SEIKOH GIKEN here with our thorough health report.

Gain insights into SEIKOH GIKEN's past trends and performance with our Past report.

Cyber_Folks (WSE:CBF)

Simply Wall St Value Rating: ★★★★★★

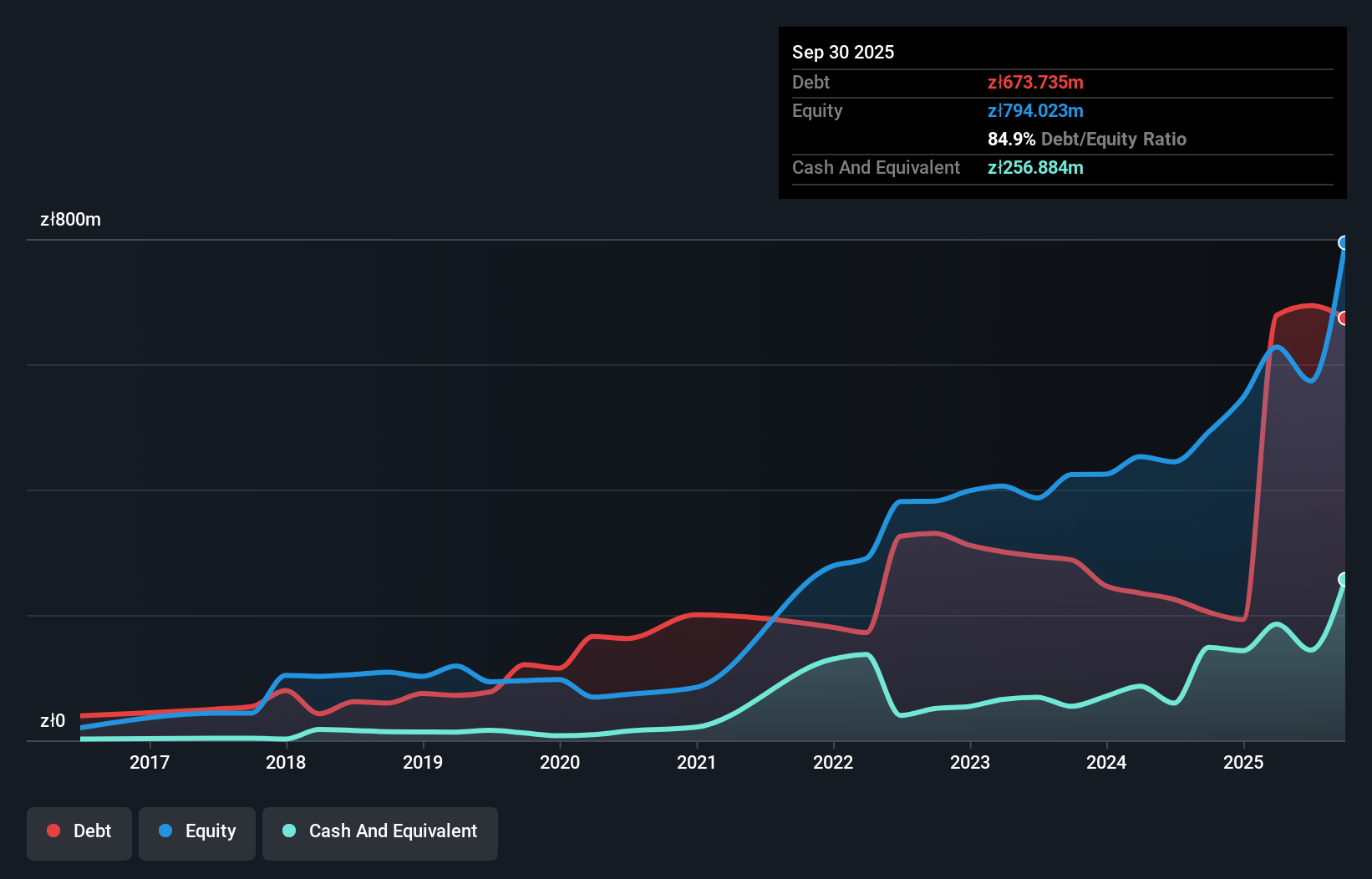

Overview: Cyber_Folks S.A. is a technology company focused on business digitization and enterprise support, operating both in Poland and internationally, with a market capitalization of PLN1.99 billion.

Operations: Cyber_Folks generates revenue primarily from its VERCOM segment, contributing PLN 462.11 million, and Cyber Folks segment, with PLN 151.63 million. The SaaS and Corporate segments add smaller amounts of PLN 2.34 million and PLN 2.36 million respectively.

Cyber_Folks has shown impressive financial performance, with its debt to equity ratio dropping from 126.4% to 41.6% over five years, indicating improved financial health. The company's earnings have surged by 203.8% in the past year, significantly outpacing the Telecom industry's growth of 7.5%. Trading at a substantial discount of 56.5% below estimated fair value suggests potential undervaluation opportunities for investors. Recent earnings reports highlight strong results with third-quarter sales hitting PLN 185 million and net income reaching PLN 62 million, compared to PLN 120 million and PLN 10 million respectively from a year ago, showcasing robust growth momentum despite share price volatility concerns.

- Delve into the full analysis health report here for a deeper understanding of Cyber_Folks.

Evaluate Cyber_Folks' historical performance by accessing our past performance report.

Key Takeaways

- Dive into all 4621 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6834

SEIKOH GIKEN

Engages in design, manufacture, and sale of optical components and lens, and radio over fiber products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.