- Japan

- /

- Consumer Durables

- /

- TSE:1766

Token (TSE:1766): Examining Valuation After Recent Share Price Shifts

Reviewed by Simply Wall St

Price-to-Earnings of 12.5x: Is it justified?

Token currently trades at a Price-to-Earnings (P/E) ratio of 12.5x, which is higher than the JP Consumer Durables industry average of 11.4x but lower than the peer average of 31.9x. This places Token as more expensive than the industry as a whole, yet still valued below some of its direct competitors.

The P/E ratio is one of the most common tools for evaluating whether a company is fairly valued. It compares the current share price to per-share earnings. For companies in the consumer durables sector, it signals how much investors are willing to pay per yen of earnings and reflects expectations of future profitability and growth.

While Token's premium to the industry may suggest investor optimism, the company's robust revenue growth and recent acceleration in profits could be a reason the market is paying up. However, the below-average Return on Equity and only moderate forecasted earnings growth raise questions about whether this higher valuation multiple is fully justified by future prospects.

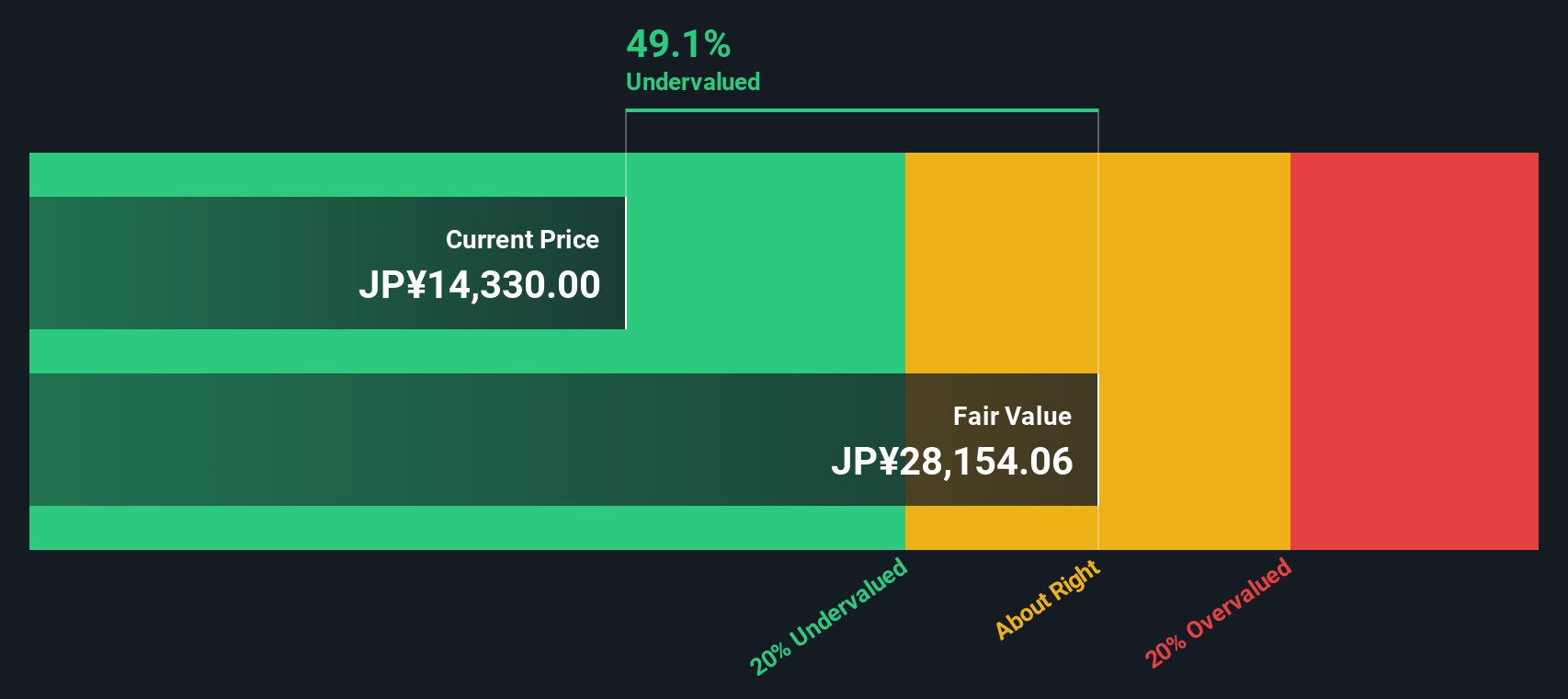

Result: Fair Value of ¥40,547.05 (UNDERVALUED)

See our latest analysis for Token.However, slowing net income growth and lingering industry competition could challenge Token’s valuation. This creates uncertainty around whether its recent momentum can be sustained.

Find out about the key risks to this Token narrative.Another View: SWS DCF Model Offers a Second Opinion

While a price-to-earnings approach suggests value, our SWS DCF model also points to undervaluation. This supports the earlier finding. However, every model makes different assumptions, so which is closer to reality?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Token Narrative

If you think there's more to the story or want to dig into the numbers yourself, you can explore the data and shape your own view in just a few minutes. Do it your way

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Token.

Looking for More Smart Investing Ideas?

Don’t let great opportunities slip by. With the right tools, you can spot standouts the crowd often misses. Take your investing up a notch today by opening the door to new growth stories and potential winners using the powerful Simply Wall Street screener.

- Tap into rapid shifts shaping healthcare by finding emerging medical technologies and innovation drivers with healthcare AI stocks.

- Supercharge your income potential by targeting stable companies with strong yields through dividend stocks with yields > 3%.

- Unlock tomorrow’s leaders trading at attractive valuations by zeroing in on hidden gems via undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Token might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1766

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026