- Netherlands

- /

- Banks

- /

- ENXTAM:INGA

3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed landscape of rising U.S. Treasury yields, fluctuating consumer confidence, and geopolitical developments, investors are increasingly seeking stability amidst the volatility. In such an environment, dividend stocks can offer a reliable income stream and potential for long-term growth, making them an attractive consideration for those looking to bolster their portfolios with resilient investments.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.41% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.83% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.79% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.82% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.15% | ★★★★★★ |

Click here to see the full list of 1963 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

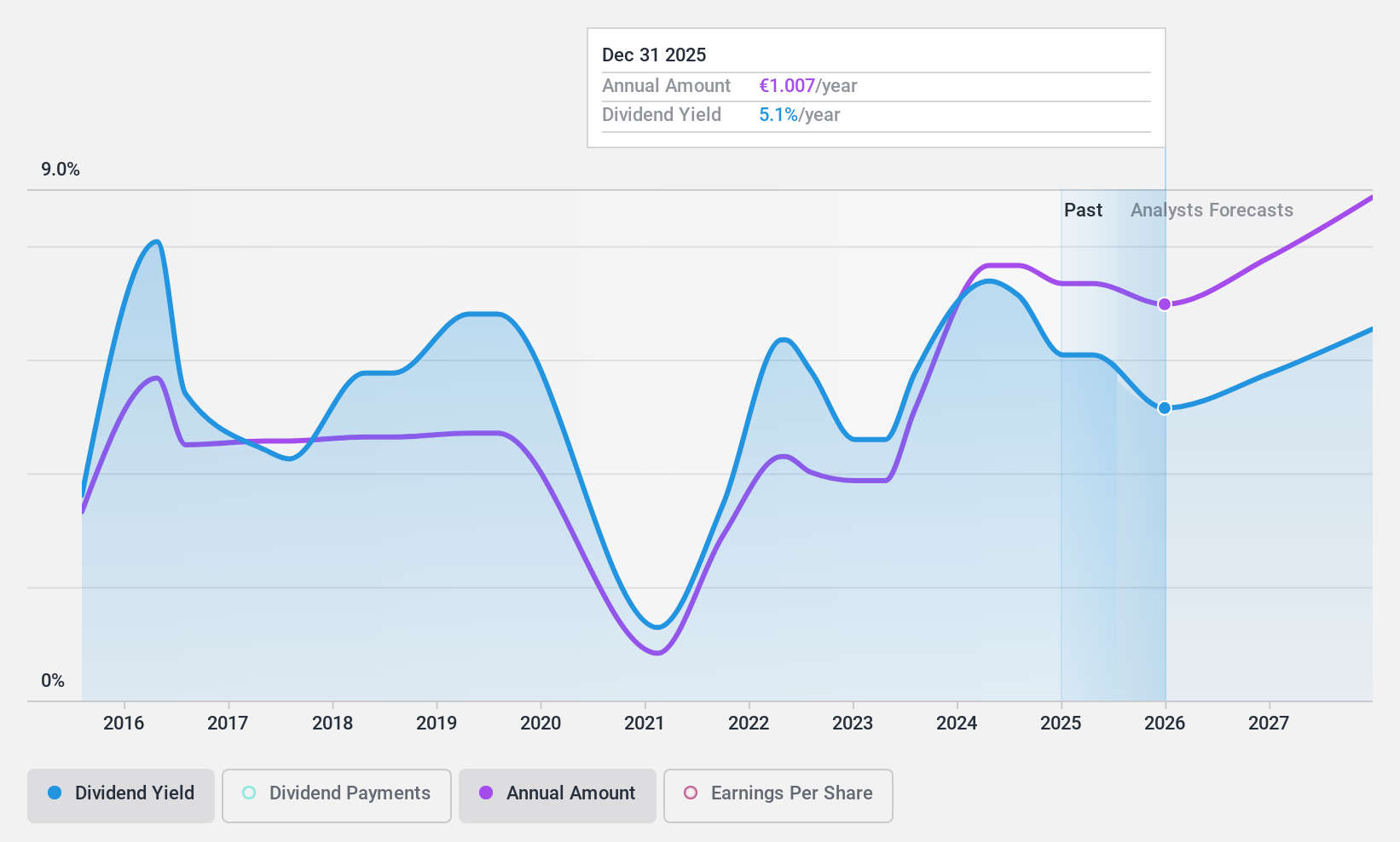

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, the rest of Europe, and internationally with a market cap of €47.31 billion.

Operations: ING Groep N.V. generates revenue through its diverse banking products and services across multiple regions, including the Netherlands, Belgium, Germany, the rest of Europe, and international markets.

Dividend Yield: 7.3%

ING Groep's dividend yield of 7.28% ranks in the top 25% of Dutch market payers, though it's not well covered by current earnings due to a high payout ratio of 99.8%. Despite volatile dividends over the past decade, ING has announced a €2.5 billion shareholder distribution, including a €500 million cash dividend payable on January 16, 2025. Recent earnings guidance expects total income of €22.5 billion for 2024, reflecting ongoing strategic initiatives and financial performance challenges.

- Delve into the full analysis dividend report here for a deeper understanding of ING Groep.

- Our expertly prepared valuation report ING Groep implies its share price may be lower than expected.

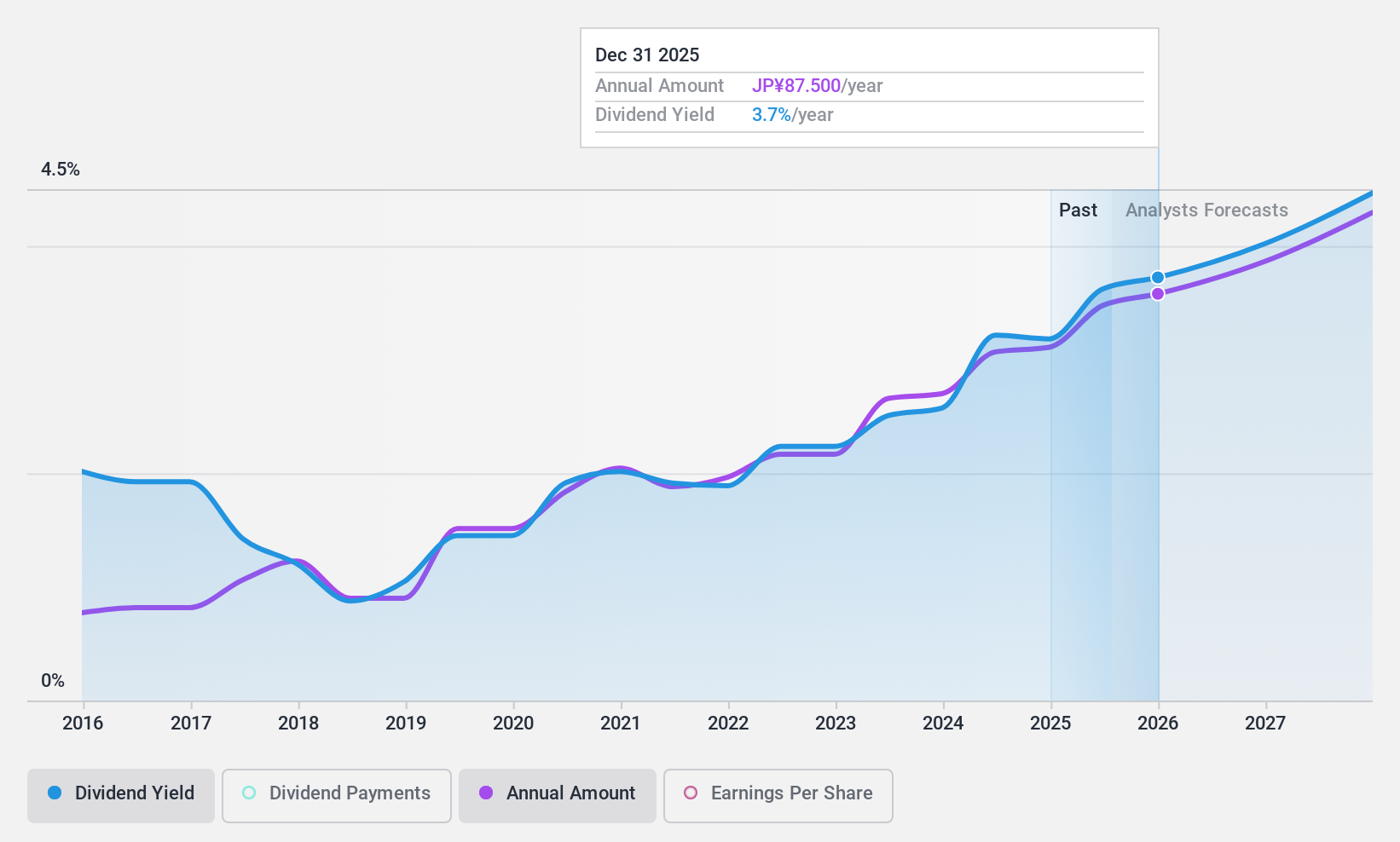

Funai Soken Holdings (TSE:9757)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Funai Soken Holdings Incorporated offers consulting services to manufacturing and retail businesses in Japan, with a market cap of ¥110.80 billion.

Operations: Funai Soken Holdings generates revenue through its segments: Consulting (¥22.51 billion), Digital Solutions (¥4.77 billion), and Logistics (¥4.63 billion).

Dividend Yield: 3.2%

Funai Soken Holdings' dividend yield of 3.18% is below the top 25% in Japan, and its dividends have been unreliable over the past decade, with volatility and lack of consistent growth. However, dividends are covered by earnings (57.1% payout ratio) and cash flows (68.6% cash payout ratio). Trading at a discount to fair value enhances its appeal despite an unstable dividend history. Earnings growth forecasts remain positive at 10.66% annually, supporting potential future payouts.

- Get an in-depth perspective on Funai Soken Holdings' performance by reading our dividend report here.

- The valuation report we've compiled suggests that Funai Soken Holdings' current price could be quite moderate.

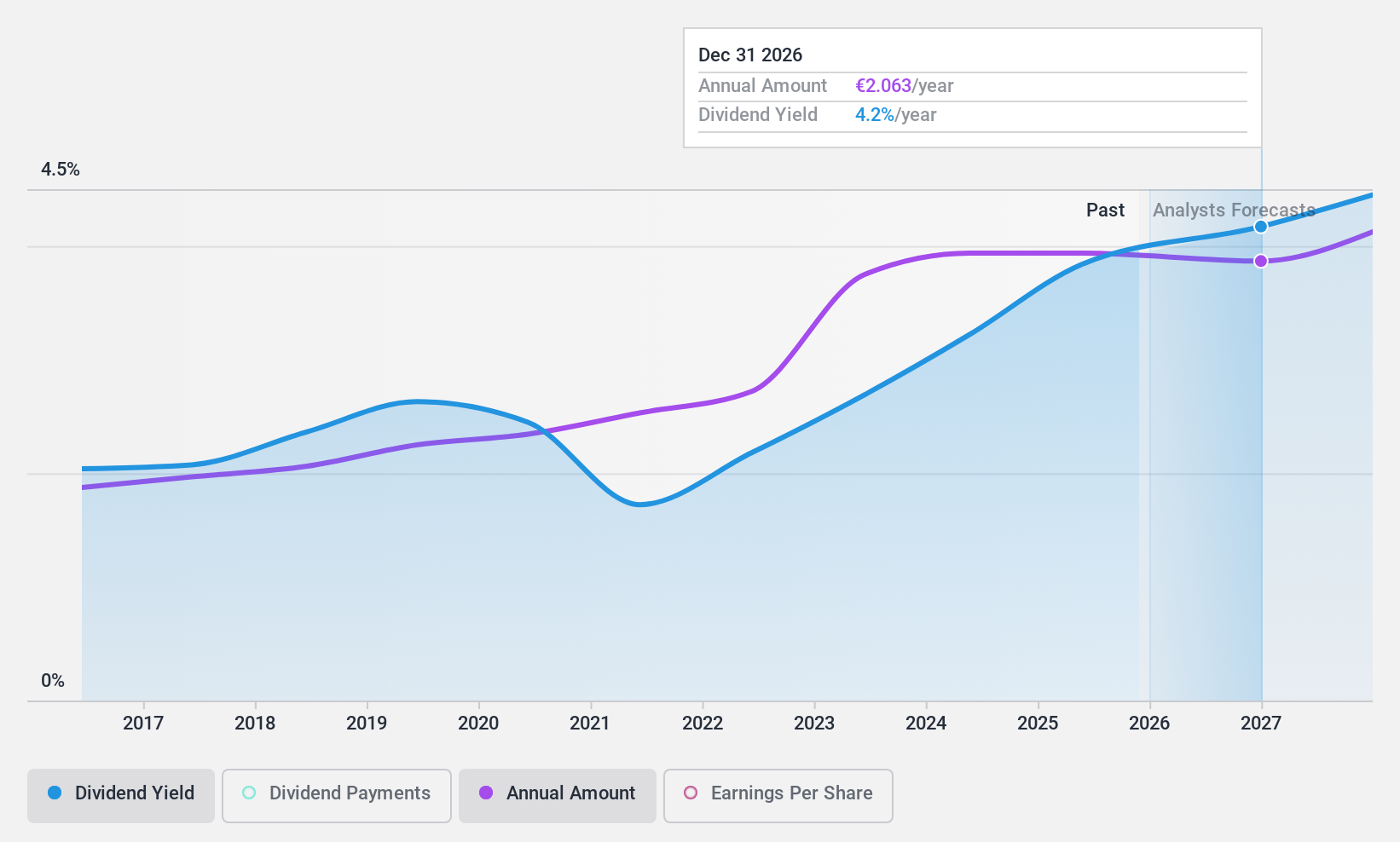

Brenntag (XTRA:BNR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Brenntag SE is a global distributor of industrial and specialty chemicals and ingredients, operating across Germany, Europe, the Middle East, Africa, the Americas, and the Asia Pacific with a market cap of approximately €8.46 billion.

Operations: Brenntag SE's revenue segments include Brenntag Essentials in Latin America (€665.50 million), North America (€4.28 billion), Asia Pacific (APAC) (€745.20 million), and Europe, Middle East & Africa (EMEA) (€3.35 billion).

Dividend Yield: 3.6%

Brenntag's dividend yield of 3.58% is lower than the top 25% in Germany, yet it offers reliable and stable payouts over the past decade, supported by a sustainable payout ratio of 56.1%. Dividends are well covered by cash flows with a cash payout ratio of 45.1%, despite high debt levels. Recent earnings showed a decline in net income but ongoing strategic partnerships, like with Aquaporin, may bolster future prospects and distribution reach.

- Click to explore a detailed breakdown of our findings in Brenntag's dividend report.

- In light of our recent valuation report, it seems possible that Brenntag is trading behind its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1960 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTAM:INGA

ING Groep

Provides various banking products and services in the Netherlands, Belgium, Germany, rest of Europe, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives