- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3019

Exploring Undiscovered Gems In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by mixed performances among major indices and significant economic indicators, small-cap stocks have been particularly impacted, with the Russell 2000 Index experiencing a decline after outperforming larger-cap peers in previous weeks. Amidst this backdrop of fluctuating market sentiment and economic data, identifying promising small-cap opportunities requires a keen eye for companies that exhibit strong fundamentals, resilience to macroeconomic shifts, and potential for growth within their niche sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| SHL Consolidated Bhd | NA | 16.14% | 19.01% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| African Rainbow Capital Investments | NA | 37.52% | 38.29% | ★★★★★★ |

| Segar Kumala Indonesia | NA | 21.81% | 18.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Steamships Trading | 33.60% | 4.17% | 3.90% | ★★★★★☆ |

| Societe de Limonaderies et de Boissons Rafraichissantes d'Afrique | 39.37% | 4.38% | -14.46% | ★★★★★☆ |

| Transcorp Power | 46.33% | 114.79% | 152.92% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.65% | 21.96% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Ningbo Sunrise Elc TechnologyLtd (SZSE:002937)

Simply Wall St Value Rating: ★★★★★☆

Overview: Ningbo Sunrise Elc Technology Co., Ltd specializes in the manufacturing and sale of precision components, with a market cap of CN¥5.53 billion.

Operations: The company generates revenue primarily through the sale of precision components. It has a market capitalization of CN¥5.53 billion.

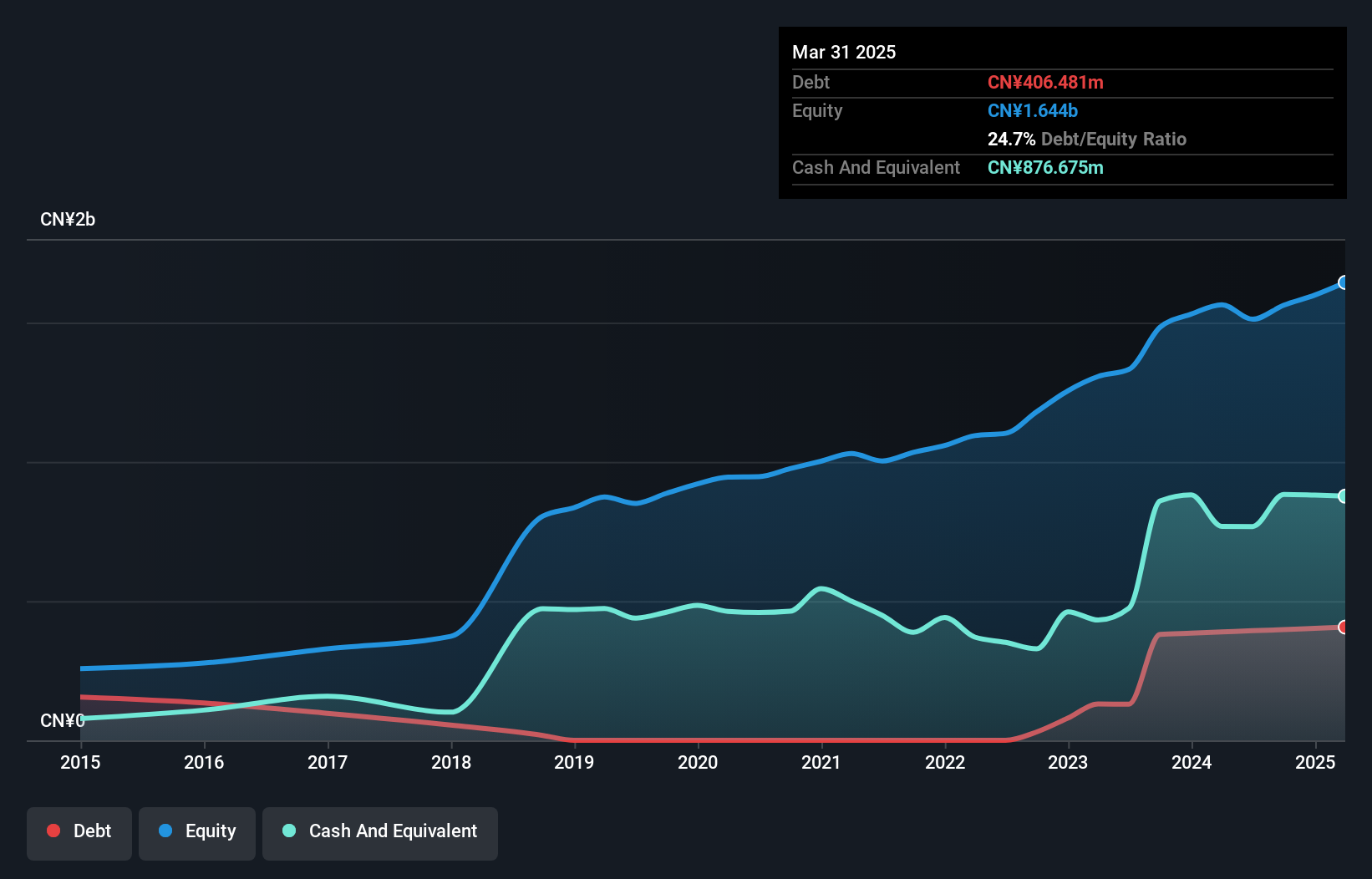

Ningbo Sunrise Elc Technology, a small cap player in the electronics industry, has shown consistent earnings growth of 21% annually over the past five years. Despite not outpacing its industry peers last year with a 1.6% increase, it remains profitable and boasts high-quality earnings. The company’s debt-to-equity ratio has risen to 25%, yet it still holds more cash than total debt, ensuring financial stability. Trading at a price-to-earnings ratio of 20x below the CN market average suggests good value potential. Recent reports indicate steady net income at CNY 192 million for nine months ending September 2024.

Mitsubishi Pencil (TSE:7976)

Simply Wall St Value Rating: ★★★★★☆

Overview: Mitsubishi Pencil Co., Ltd. manufactures and supplies writing instruments in Japan, with a market cap of ¥137.73 billion.

Operations: The company generates revenue primarily from the sale of writing instruments in Japan. It has a market capitalization of ¥137.73 billion, indicating its substantial presence in the industry.

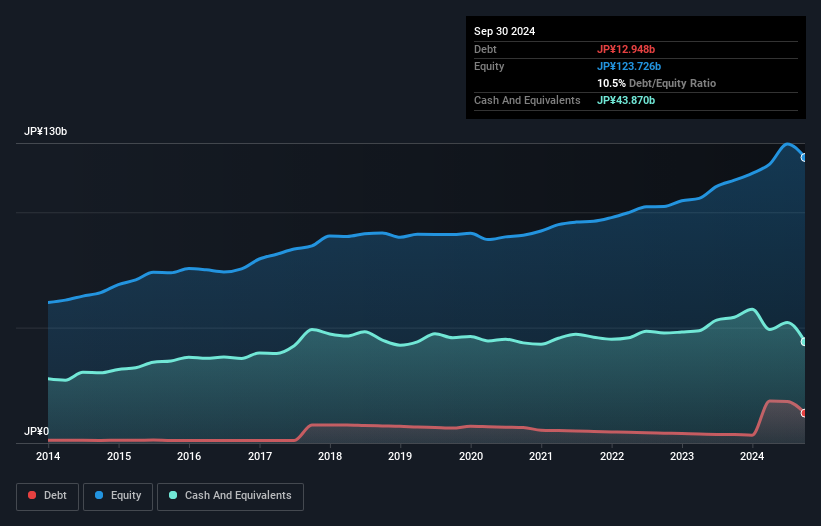

With a market presence often overshadowed by larger players, Mitsubishi Pencil shines through its strategic maneuvers and financial resilience. Recently, the company repurchased 643,700 shares for ¥1.54 billion and increased dividends to JPY 22 per share. Despite revising down its profit forecast due to costs from acquiring Lamy as a subsidiary, earnings surged by 44% last year, outpacing industry growth of 9%. The joint venture with Linc Limited aims to leverage Mitsubishi's technology in India, potentially enhancing future value despite near-term profit pressures from restructuring expenses and goodwill amortization.

- Dive into the specifics of Mitsubishi Pencil here with our thorough health report.

Explore historical data to track Mitsubishi Pencil's performance over time in our Past section.

Asia Optical (TWSE:3019)

Simply Wall St Value Rating: ★★★★★★

Overview: Asia Optical Co., Inc. is a Taiwanese company that manufactures and sells cameras and optical lenses for various devices both domestically and internationally, with a market cap of NT$33.51 billion.

Operations: The company's revenue streams are primarily derived from the Optical Components Division and the Image Sensing Components Business, contributing NT$10.66 billion and NT$4.10 billion respectively. The Digital Camera Division generates NT$2.77 billion, while the Plastic Photoelectric Component Business Department adds NT$3.46 billion to the total revenue mix.

Asia Optical has been making waves with impressive earnings growth, outpacing the electronics industry by a significant margin. Over the past year, earnings have surged 149.4%, showcasing the company's robust performance in a competitive market. The recent quarterly results highlight sales of TWD 6.83 billion and net income of TWD 684.71 million, marking substantial increases from last year’s figures of TWD 4.72 billion and TWD 181.76 million respectively. With a price-to-earnings ratio at 22x, below the industry average, Asia Optical presents an attractive valuation for investors seeking opportunities in this sector's dynamic landscape.

- Click here and access our complete health analysis report to understand the dynamics of Asia Optical.

Assess Asia Optical's past performance with our detailed historical performance reports.

Seize The Opportunity

- Click through to start exploring the rest of the 4625 Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3019

Asia Optical

Manufactures, produces and sells cameras, optical lenses for distance meters, video cameras, copiers, fax machines, optical sights, and CD players in Taiwan and internationally.

Flawless balance sheet with solid track record.