- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3038

January 2025's Leading Dividend Stocks

Reviewed by Simply Wall St

As we navigate the global markets in early 2025, cooling inflation and robust bank earnings have propelled U.S. stocks higher, with value stocks notably outperforming growth shares. Against this backdrop of economic optimism and strategic sector gains, dividend stocks stand out as a compelling choice for investors seeking steady income streams amidst fluctuating market conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.48% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.68% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.47% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.13% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.55% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.04% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.93% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.02% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.97% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

Academy of Environmental Planning and DesignLtd. Nanjing University (SZSE:300864)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Academy of Environmental Planning and Design Co., Ltd. (SZSE:300864) operates in the environmental planning and design sector, with a market cap of CN¥3.15 billion.

Operations: The company generates revenue from the service industry, amounting to CN¥815.11 million.

Dividend Yield: 3.9%

Academy of Environmental Planning and Design Ltd. Nanjing University offers a dividend yield in the top 25% of the CN market, with a payout ratio of 73.4%, indicating dividends are covered by earnings. Despite only four years of dividend history, payments have been stable and growing. Recent earnings growth supports sustainability, with net income rising to CNY 131.45 million for the nine months ended September 2024. However, large one-off items impact financial results reliability.

- Delve into the full analysis dividend report here for a deeper understanding of Academy of Environmental Planning and DesignLtd. Nanjing University.

- The analysis detailed in our Academy of Environmental Planning and DesignLtd. Nanjing University valuation report hints at an deflated share price compared to its estimated value.

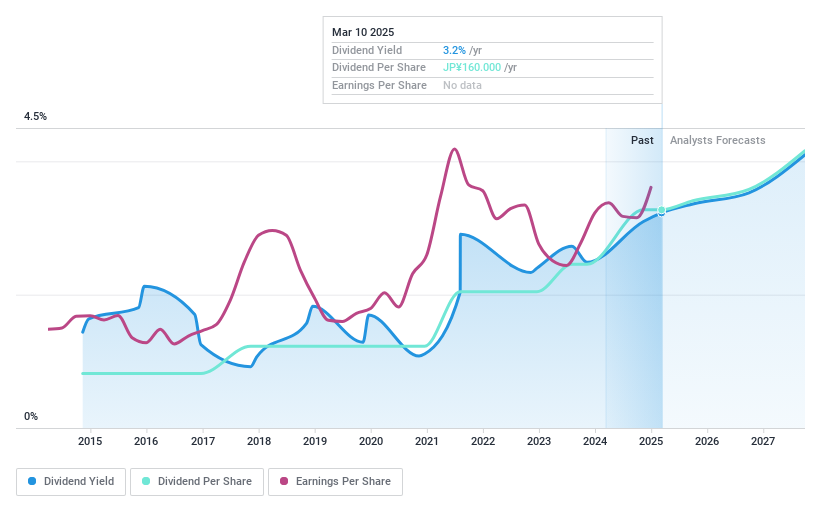

Nissei ASB Machine (TSE:6284)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nissei ASB Machine Co., Ltd. is involved in the planning, development, manufacturing, and sale of machines for producing PET and other plastic bottles globally, with a market cap of ¥76.45 billion.

Operations: Nissei ASB Machine Co., Ltd.'s revenue segments are composed of ¥7.56 billion from Europe, ¥12.36 billion from the Americas, ¥24.55 billion from East Asia, and ¥22.78 billion from South/West Asia.

Dividend Yield: 3%

Nissei ASB Machine offers a dividend yield of 3.02%, which is below the top quartile in Japan. However, its dividends are well-supported by earnings and cash flows, with payout ratios of 38.9% and 27.2%, respectively. The company has maintained stable and growing dividends over the past decade, supported by recent earnings growth of 13.6%. Additionally, it trades at a significant discount to its estimated fair value, enhancing its appeal for value-conscious investors.

- Click here to discover the nuances of Nissei ASB Machine with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Nissei ASB Machine shares in the market.

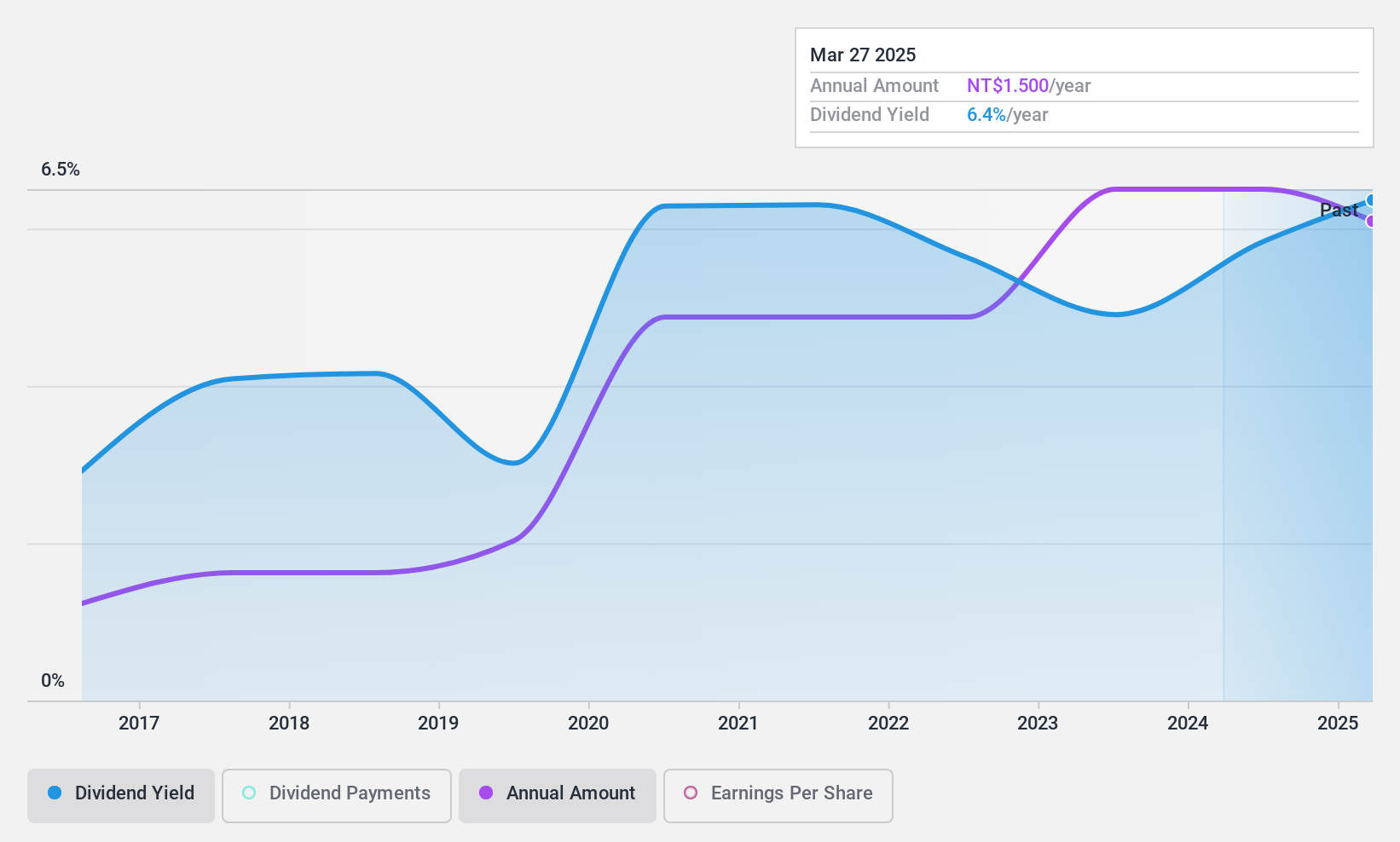

Emerging Display Technologies (TWSE:3038)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Emerging Display Technologies Corp. manufactures and distributes capacitive touch panels and liquid crystal displays (LCD) across Taiwan, Europe, the United States, and other international markets, with a market cap of approximately NT$4.01 billion.

Operations: Emerging Display Technologies Corp.'s revenue segments are comprised of NT$1.31 billion from the Americas Business Unit, NT$3.66 billion from the Taiwan Regional Division, and NT$433.08 million from the Mainland District Business Unit.

Dividend Yield: 5.9%

Emerging Display Technologies offers a high dividend yield of 5.9%, ranking in the top 25% of Taiwanese dividend payers. Its dividends have been stable and growing over the past decade, supported by a payout ratio of 69.8% and covered by cash flows at 62%. Despite recent declines in sales and net income, trading at 33.8% below estimated fair value may attract value-focused investors seeking reliable income streams amidst earnings challenges.

- Dive into the specifics of Emerging Display Technologies here with our thorough dividend report.

- Our comprehensive valuation report raises the possibility that Emerging Display Technologies is priced lower than what may be justified by its financials.

Make It Happen

- Take a closer look at our Top Dividend Stocks list of 1997 companies by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Emerging Display Technologies, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Emerging Display Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3038

Emerging Display Technologies

Produces and sells capacitive touch panels and liquid crystal displays (LCD) in Taiwan, Europe, the United States, and internationally.

Flawless balance sheet 6 star dividend payer.

Similar Companies

Market Insights

Community Narratives