- Taiwan

- /

- Semiconductors

- /

- TWSE:6531

Undiscovered Gems To Explore This January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, with major U.S. stock indexes climbing higher amid easing inflation and strong earnings reports, the focus on small-cap stocks is gaining traction. In this dynamic environment, identifying promising small-cap companies can be crucial for investors looking to capitalize on potential growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Ryoyu Systems | NA | 2.05% | 10.66% | ★★★★★★ |

| Lungteh Shipbuilding | 60.46% | 29.56% | 44.51% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Wuxi Chemical Equipment | NA | 12.26% | -0.74% | ★★★★★★ |

| Ningbo Sinyuan Zm Technology | NA | 18.08% | 9.75% | ★★★★★★ |

| All E Technologies | NA | 27.05% | 31.58% | ★★★★★★ |

| Tureks Turizm Tasimacilik Anonim Sirketi | 4.71% | 50.82% | 59.08% | ★★★★★★ |

| ZHEJIANG DIBAY ELECTRICLtd | 24.08% | 7.75% | 1.96% | ★★★★★☆ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

Anhui Xinke New MaterialsLtd (SHSE:600255)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Anhui Xinke New Materials Co., Ltd focuses on the research, development, production, and sales of copper alloy strip products in China with a market capitalization of approximately CN¥5.98 billion.

Operations: Xinke's primary revenue stream is from its processing and manufacturing segment, generating CN¥3.81 billion.

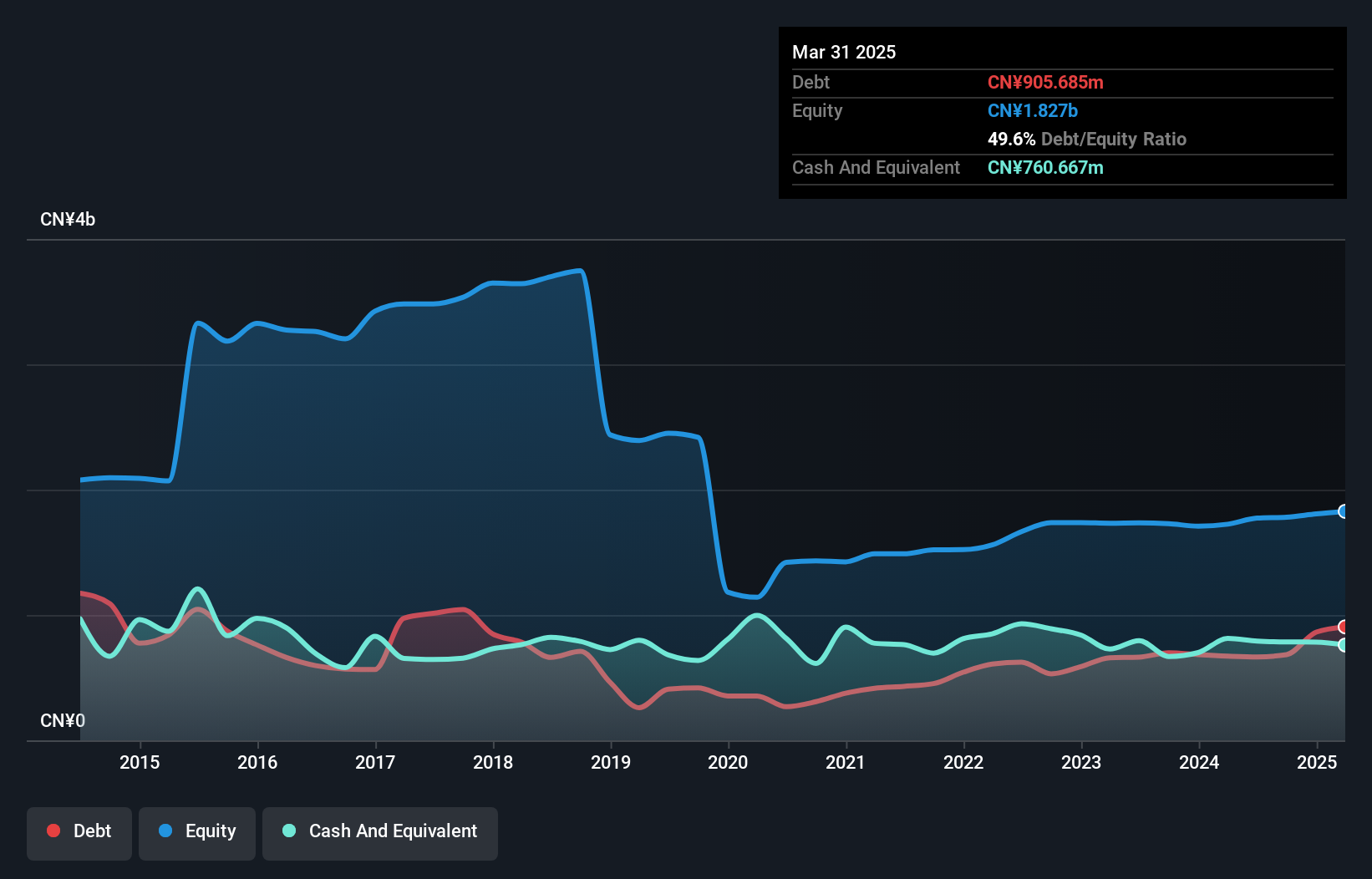

Anhui Xinke, a small player in the metals and mining sector, has turned profitable recently with a net income of CNY 39.81 million for the first nine months of 2024, contrasting last year's loss of CNY 35.09 million. Sales climbed to CNY 2.87 billion from CNY 2.26 billion year-on-year, showcasing robust growth despite its volatile share price in recent months. However, interest payments are not well covered by EBIT at just twice coverage; this could pose challenges if not addressed. The debt-to-equity ratio has risen significantly over five years from 17% to nearly double that figure at 38%.

- Unlock comprehensive insights into our analysis of Anhui Xinke New MaterialsLtd stock in this health report.

Understand Anhui Xinke New MaterialsLtd's track record by examining our Past report.

Streamax Technology (SZSE:002970)

Simply Wall St Value Rating: ★★★★★☆

Overview: Streamax Technology Co., Ltd. focuses on the research, development, manufacture, and sale of AI-powered mobile safety and industrial management solutions for commercial vehicles globally, with a market cap of CN¥8.36 billion.

Operations: Streamax Technology generates revenue primarily through the sale of AI-powered mobile safety and industrial management solutions for commercial vehicles. The company has a market capitalization of CN¥8.36 billion, reflecting its scale in the industry.

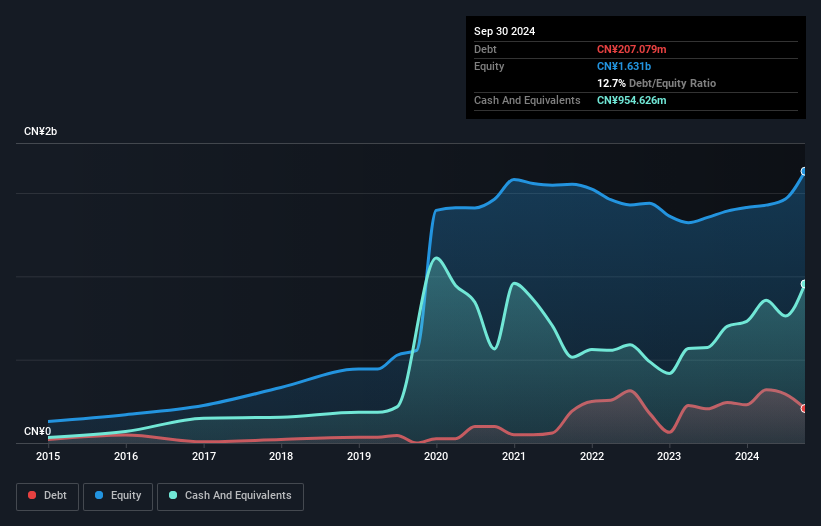

With a remarkable earnings growth of 1145.4% over the past year, Streamax Technology is making waves in the auto components industry, outpacing its peers significantly. The company’s debt to equity ratio has shifted from 0% to 12.7% over five years, yet it maintains more cash than total debt, ensuring financial stability. Recent financials highlight net income at CNY 220 million for the first nine months of 2024 compared to CNY 81 million last year, with basic earnings per share rising from CNY 0.47 to CNY 1.27, reflecting strong operational performance and profitability enhancements amidst strategic corporate changes and shareholder meetings focused on future growth prospects.

AP Memory Technology (TWSE:6531)

Simply Wall St Value Rating: ★★★★★★

Overview: AP Memory Technology Corporation is involved in the design, development, licensing, manufacturing, and sale of customized memory-related integrated circuit products and technologies across various international markets with a market cap of NT$45.92 billion.

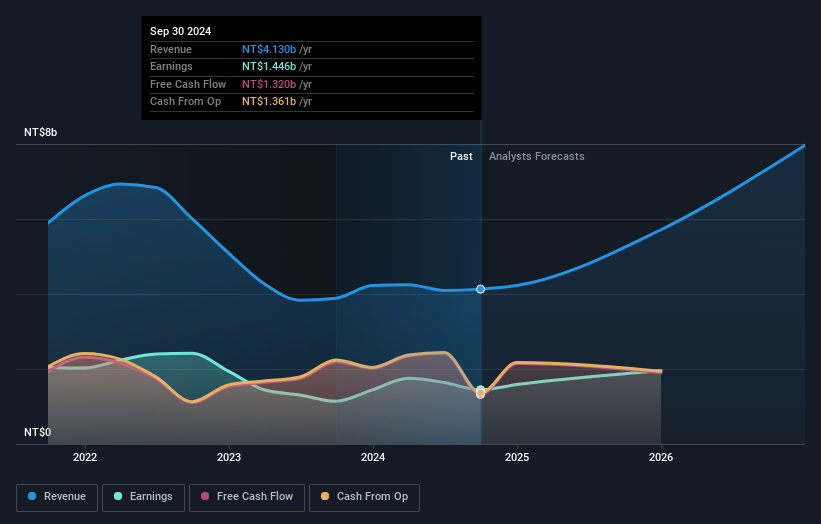

Operations: The company's revenue is primarily derived from its IoT Division, contributing NT$3.56 billion, while the AI Division adds NT$569.91 million.

AP Memory Technology, a nimble player in the semiconductor space, has demonstrated impressive financial agility. Over the past year, earnings surged by 26.9%, outpacing the industry average of 5.9%. The company boasts a healthy balance sheet with its debt-to-equity ratio plummeting from 11.7% to just 0.4% over five years, and it holds more cash than total debt, indicating prudent fiscal management. A notable one-off gain of NT$435 million recently impacted results but doesn't overshadow its overall profitability and positive free cash flow position. Recent leadership changes may influence strategic directions as they navigate future growth prospects confidently.

Key Takeaways

- Dive into all 4644 of the Undiscovered Gems With Strong Fundamentals we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6531

AP Memory Technology

Engages in designing, development, licensing, manufacturing, and selling customized memory-related integrated circuit (IC) chip products and technologies in China, Japan, Taiwan, Europe, America, and internationally.

Flawless balance sheet with high growth potential.