- Taiwan

- /

- Tech Hardware

- /

- TWSE:2356

Exploring High Growth Tech Stocks for January 2025

Reviewed by Simply Wall St

As global markets react to easing core U.S. inflation and robust bank earnings, major indices like the S&P 500 and Nasdaq Composite have recorded significant gains, reflecting an optimistic market sentiment despite recent volatility. In this environment, high growth tech stocks that demonstrate strong fundamentals and adaptability to economic shifts can offer intriguing opportunities for investors seeking exposure to innovative sectors.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Exelixis | 62.05% | 20.47% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| CD Projekt | 23.11% | 30.61% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.97% | 27.22% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.02% | 61.89% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1225 stocks from our High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Lime Technologies (OM:LIME)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Lime Technologies AB (publ) offers SaaS-based CRM solutions in the Nordic region and has a market cap of SEK4.56 billion.

Operations: The company generates revenue primarily from selling and implementing CRM software, with this segment contributing SEK656.49 million.

Lime Technologies has demonstrated robust financial performance with a notable 23.5% annual earnings growth and a forecasted revenue increase of 13.6% per year, outpacing the Swedish market's average. This growth trajectory is supported by strategic executive changes aimed at enhancing governance and innovation, as evidenced by recent appointments to their nomination committee. Furthermore, their consistent R&D investment underscores a commitment to evolving within the competitive software industry, positioning them well for sustained advancements in technology solutions and customer engagement strategies.

- Click to explore a detailed breakdown of our findings in Lime Technologies' health report.

Gain insights into Lime Technologies' past trends and performance with our Past report.

Cathay Group Holdings (SEHK:1981)

Simply Wall St Growth Rating: ★★★★☆☆

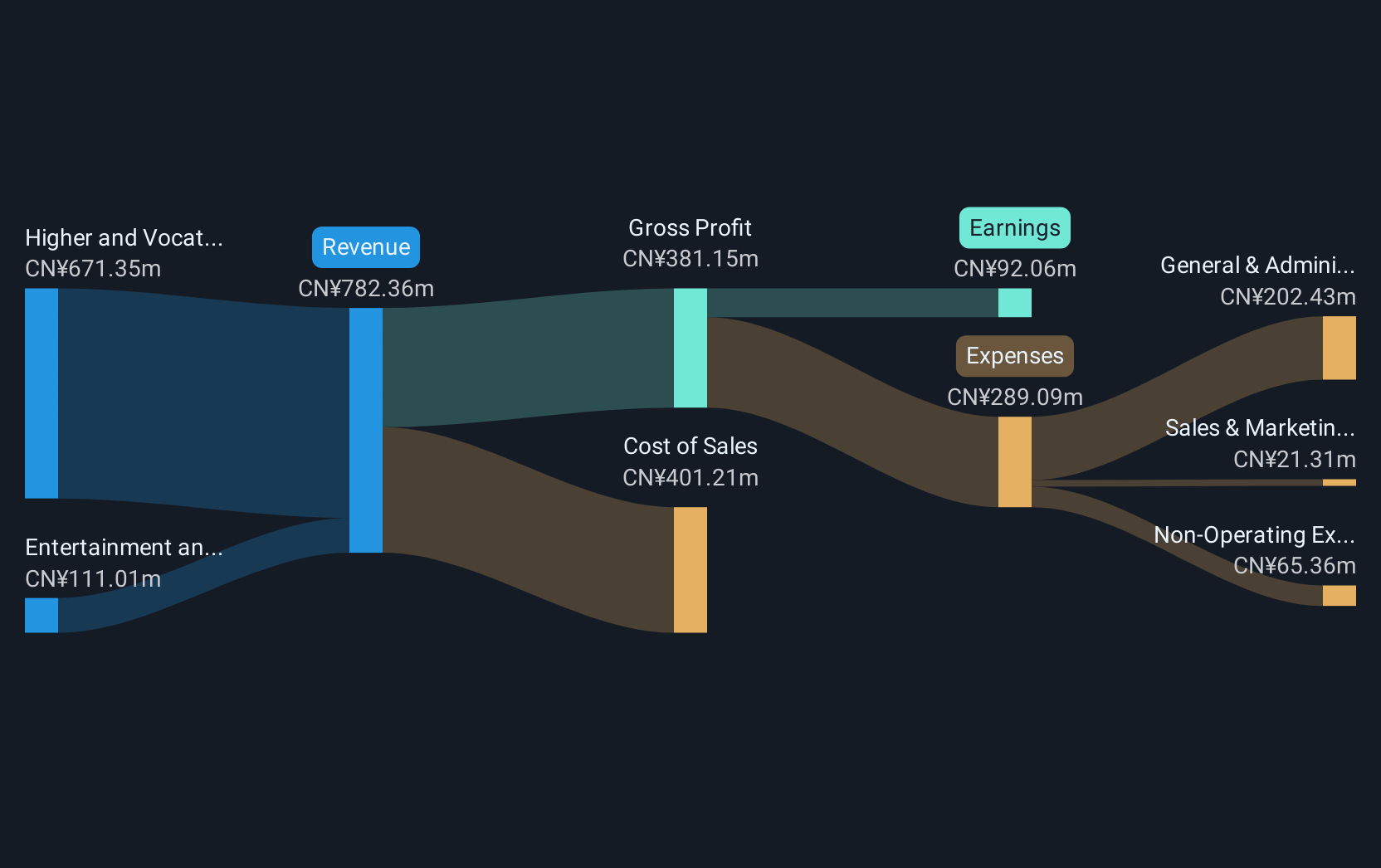

Overview: Cathay Group Holdings Inc. is an investment holding company involved in entertainment production and higher education, operating both in the People’s Republic of China and internationally, with a market cap of approximately HK$2.34 billion.

Operations: Cathay Group Holdings generates revenue through its higher and vocational education segment, contributing CN¥606.66 million, and its entertainment and livestreaming e-commerce segment, which adds CN¥162.17 million.

Cathay Group Holdings, amid its current unprofitability, is poised for significant transformation with expected revenue growth of 8.7% annually, outpacing the Hong Kong market's 7.6%. This growth is underpinned by a strategic shift in operations to a new business hub in Causeway Bay, effective from January 2025. Impressively, earnings are projected to surge by approximately 98.8% annually over the next three years as the company transitions towards profitability and sustains free cash flow positivity. These developments reflect Cathay's adaptability and potential resilience in navigating through its financial rejuvenation phase.

- Unlock comprehensive insights into our analysis of Cathay Group Holdings stock in this health report.

Understand Cathay Group Holdings' track record by examining our Past report.

Inventec (TWSE:2356)

Simply Wall St Growth Rating: ★★★★☆☆

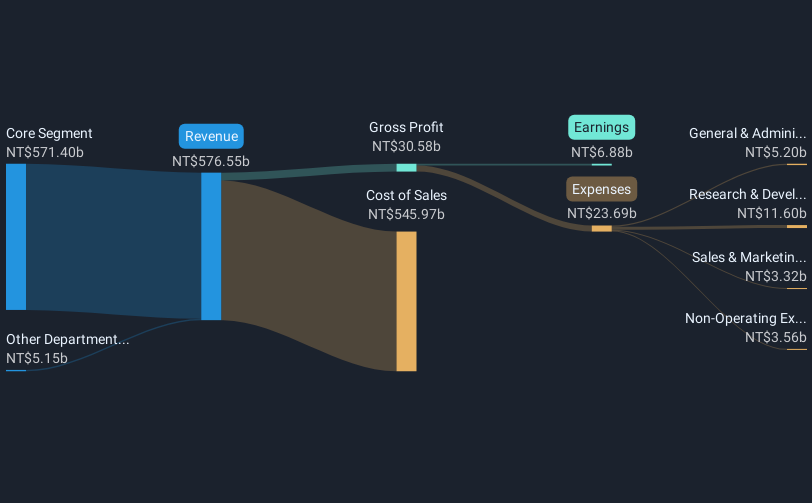

Overview: Inventec Corporation, along with its subsidiaries, is engaged in the development, manufacturing, processing, and trading of computers and related products across various regions including Taiwan, the United States, Japan, Hong Kong, Macao, Mainland China and other international markets; it has a market cap of NT$177.22 billion.

Operations: The core segment of Inventec Corporation generates NT$571.40 billion in revenue, significantly overshadowing its other department's contribution of NT$5.15 billion.

Inventec has demonstrated robust financial growth, with a notable increase in sales to TWD 448.48 billion and net income rising to TWD 4.90 billion over the first nine months of 2024, reflecting year-over-year growth rates of 16% and 18%, respectively. This performance is underpinned by strategic presentations at major global investment forums, signaling strong market confidence and expanding industry presence. Inventec's commitment to innovation is evident from its R&D investments, aligning with industry trends towards enhanced technological solutions and services. These factors collectively suggest a promising trajectory for Inventec in the evolving tech landscape.

- Delve into the full analysis health report here for a deeper understanding of Inventec.

Assess Inventec's past performance with our detailed historical performance reports.

Where To Now?

- Get an in-depth perspective on all 1225 High Growth Tech and AI Stocks by using our screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2356

Inventec

Develops, manufactures, processes, and trades in computers and related products in Taiwan, the United States, Japan, Hong Kong, Macao, Mainland China, and internationally.

Mediocre balance sheet low.

Similar Companies

Market Insights

Community Narratives