Japan's stock markets have shown mixed performance recently, with the Nikkei 225 Index gaining 0.5% while the broader TOPIX Index fell by 1.0%. This comes amid a backdrop of economic uncertainty and currency fluctuations, as the yen strengthened against the USD. In this environment, growth companies with high insider ownership can offer unique advantages. Insider ownership often signals confidence in a company's future prospects and aligns management's interests with those of shareholders, making these stocks particularly compelling in uncertain times.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 32.7% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

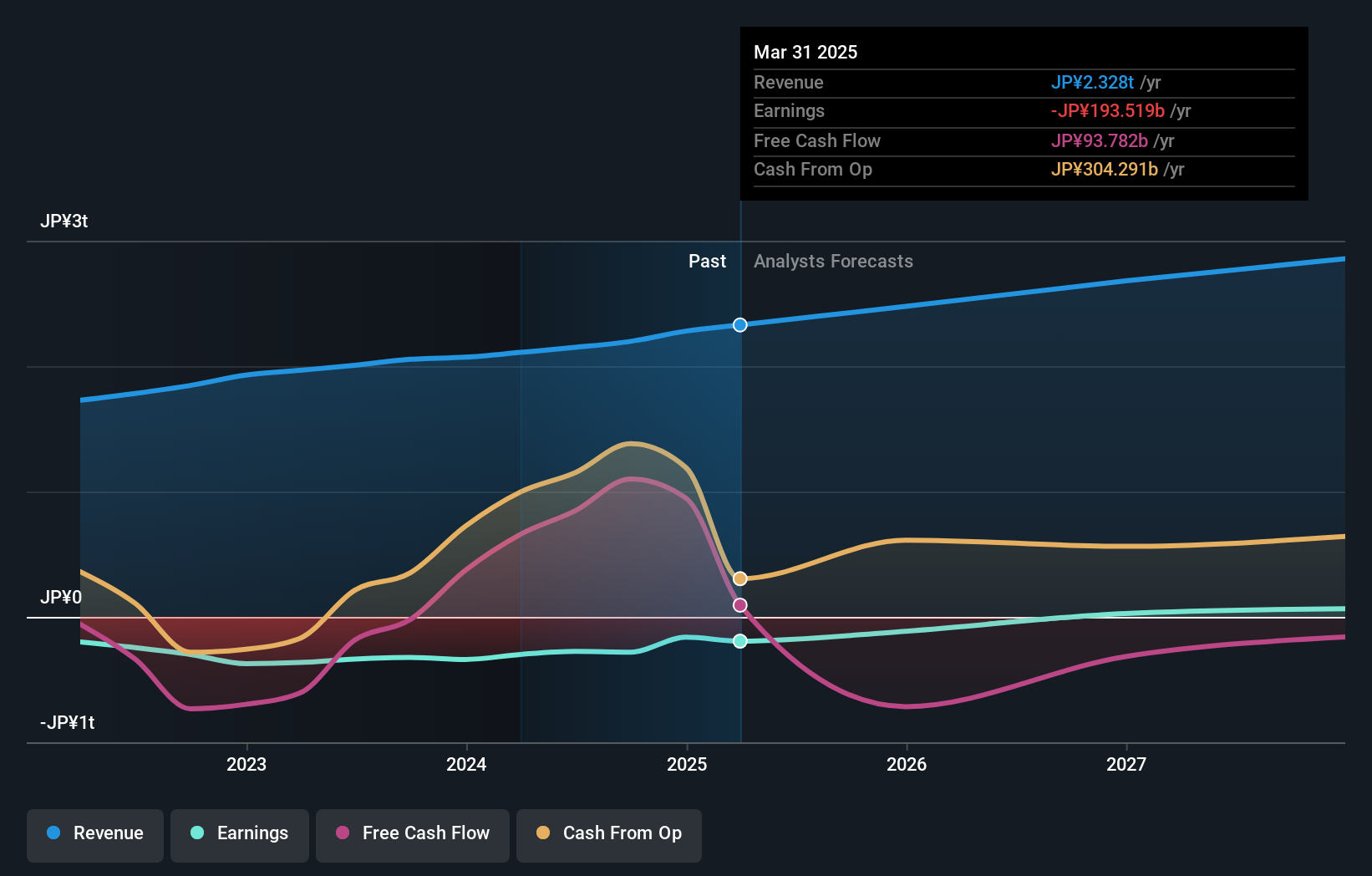

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors serving both Japanese and international markets with a market cap of ¥2.03 trillion.

Operations: Rakuten Group's revenue segments include Mobile at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

Insider Ownership: 17.3%

Earnings Growth Forecast: 82.3% p.a.

Rakuten Group, Inc. is forecast to experience significant earnings growth at 82.35% per year and become profitable within three years, outperforming the average market growth in Japan. Despite its volatile share price and low return on equity forecast of 9.6%, Rakuten's revenue is expected to grow at 7.6% per year, surpassing the broader JP market's rate of 4.2%. The stock trades at a substantial discount of 89.5% below estimated fair value as of recent analyses.

- Dive into the specifics of Rakuten Group here with our thorough growth forecast report.

- Our valuation report unveils the possibility Rakuten Group's shares may be trading at a discount.

JAPAN MATERIAL (TSE:6055)

Simply Wall St Growth Rating: ★★★★☆☆

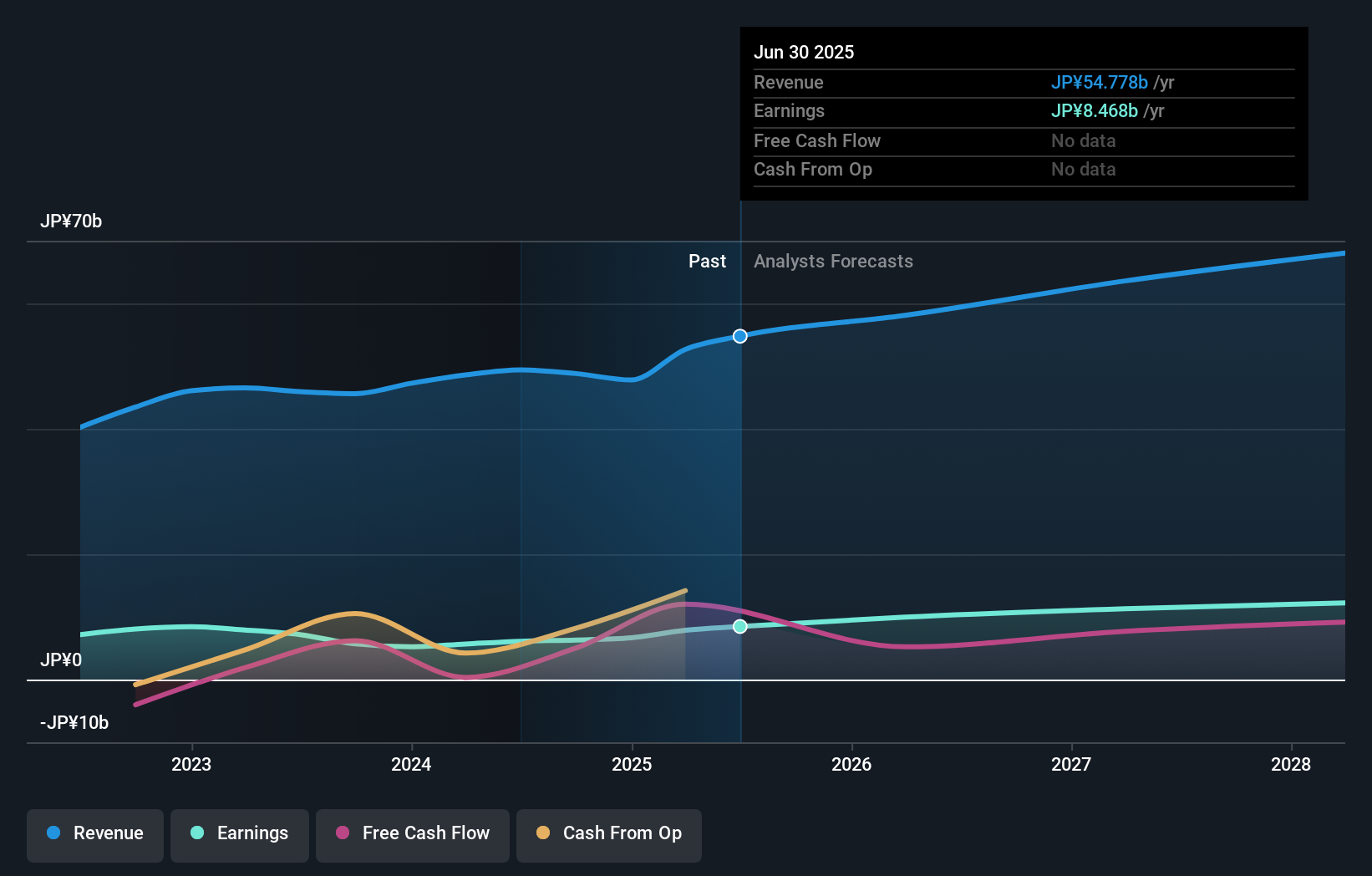

Overview: JAPAN MATERIAL Co., Ltd. operates in the electronics and graphics businesses in Japan with a market cap of ¥179.89 billion.

Operations: The company's revenue segments are comprised of ¥47.65 billion from Electronics, ¥1.56 billion from Graphics Solution Business, and ¥206 million from Solar Power Generation Business.

Insider Ownership: 35.3%

Earnings Growth Forecast: 24.4% p.a.

Japan Material is forecast to achieve annual earnings growth of 24.4%, outpacing the JP market's 8.5% per year, and revenue growth of 14.7%, also above the market's 4.2%. Despite a low return on equity forecast at 18.1% in three years and recent share price volatility, it trades at a significant discount—36.2% below its estimated fair value—highlighting potential undervaluation opportunities for investors focused on growth companies with high insider ownership in Japan.

- Navigate through the intricacies of JAPAN MATERIAL with our comprehensive analyst estimates report here.

- Our comprehensive valuation report raises the possibility that JAPAN MATERIAL is priced lower than what may be justified by its financials.

BayCurrent Consulting (TSE:6532)

Simply Wall St Growth Rating: ★★★★☆☆

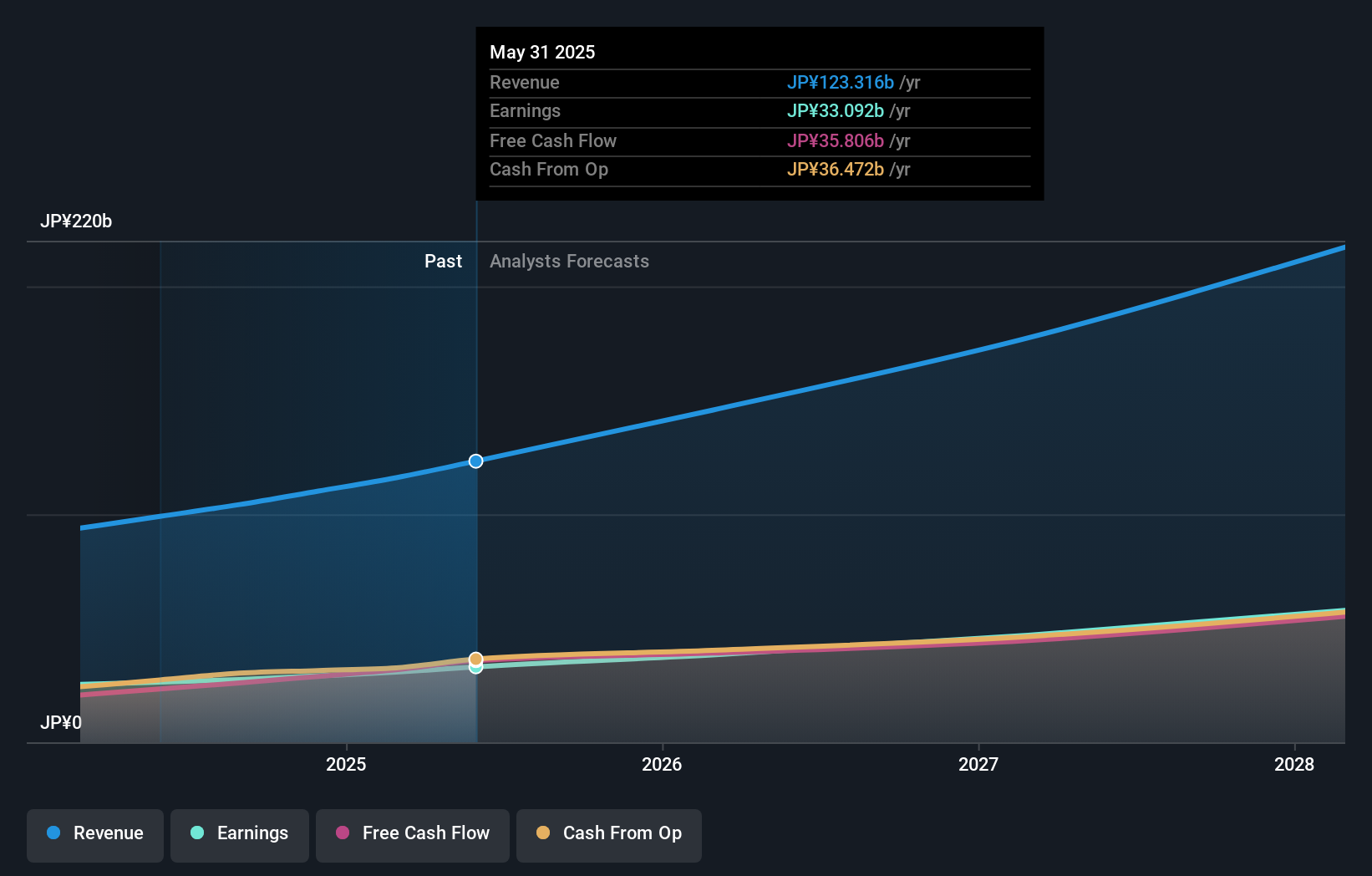

Overview: BayCurrent Consulting, Inc. provides consulting services in Japan and has a market cap of ¥781.06 billion.

Operations: BayCurrent Consulting generates revenue from its consulting services in Japan.

Insider Ownership: 13.9%

Earnings Growth Forecast: 18.8% p.a.

BayCurrent Consulting's earnings are forecast to grow 18.8% annually, outpacing the JP market's 8.5%, with revenue growth at 18.6% per year, also exceeding the market's 4.2%. Despite trading at a significant discount—45.8% below its estimated fair value—and having no substantial insider trading in the past three months, it has shown robust performance with a return on equity expected to reach 35.5% in three years and recent earnings growth of 16.8%.

- Click here and access our complete growth analysis report to understand the dynamics of BayCurrent Consulting.

- In light of our recent valuation report, it seems possible that BayCurrent Consulting is trading beyond its estimated value.

Where To Now?

- Investigate our full lineup of 95 Fast Growing Japanese Companies With High Insider Ownership right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.