In a week marked by cautious Federal Reserve commentary and political uncertainties, global markets have experienced notable declines, with U.S. stocks seeing broad-based losses despite a late-week rally. As investors navigate these turbulent waters, dividend stocks can offer a measure of stability and income through regular payouts, making them an attractive consideration for portfolios seeking resilience amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.17% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.26% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.77% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.24% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.22% | ★★★★★★ |

Click here to see the full list of 1953 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

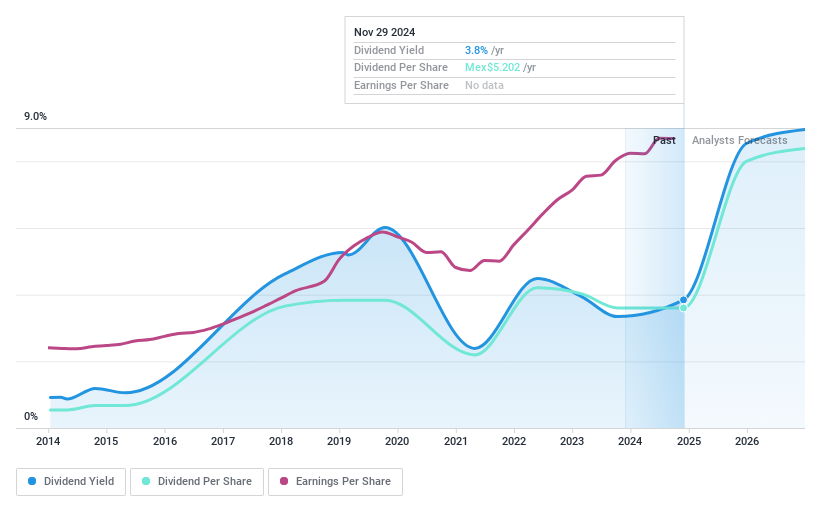

Grupo Financiero Banorte. de (BMV:GFNORTE O)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Grupo Financiero Banorte, S.A.B. de C.V. operates as a financial services company offering banking and financial products in Mexico and internationally, with a market cap of MX$388.92 billion.

Operations: Grupo Financiero Banorte, S.A.B. de C.V., through its subsidiaries, provides a range of banking and financial services both in Mexico and internationally.

Dividend Yield: 3.8%

Grupo Financiero Banorte's dividend payments, while historically volatile, are currently well covered by earnings with a payout ratio of 27%. Recent earnings growth and a strong net income of MXN 42.46 billion for the nine months ended September 2024 support this coverage. Despite trading below estimated fair value and offering good relative value compared to peers, its dividend yield of 3.83% is lower than top-tier payers in Mexico.

- Take a closer look at Grupo Financiero Banorte. de's potential here in our dividend report.

- The valuation report we've compiled suggests that Grupo Financiero Banorte. de's current price could be quite moderate.

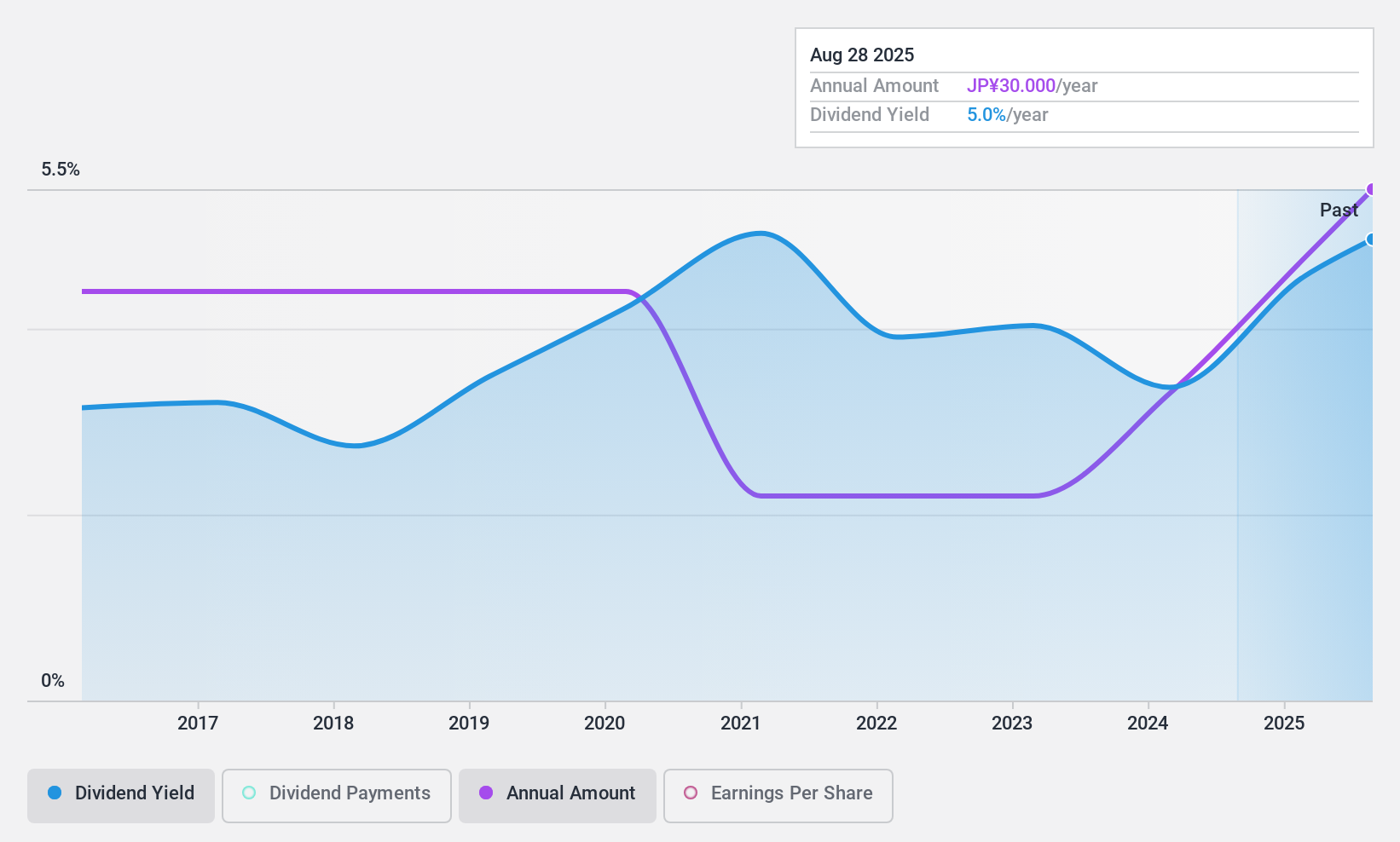

Onward Holdings (TSE:8016)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onward Holdings Co., Ltd. designs, manufactures, and sells men's, women's, and children's apparel across Japan, China, the United Kingdom, and the United States with a market cap of ¥78.05 billion.

Operations: Onward Holdings Co., Ltd. generates revenue through its subsidiaries by engaging in the design, manufacture, and sale of apparel for men, women, and children across Japan, China, the United Kingdom, and the United States.

Dividend Yield: 4.2%

Onward Holdings' dividend payments have been inconsistent over the past decade, lacking growth and experiencing volatility. However, with a payout ratio of 34.5%, dividends are well covered by earnings and cash flows (47.3% cash payout ratio). Recent sales growth—128.6% increase at all stores in November 2024—indicates potential for future stability. Despite trading below estimated fair value, its dividend yield of 4.17% ranks among the top in Japan's market, though earnings are impacted by one-off items.

- Unlock comprehensive insights into our analysis of Onward Holdings stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Onward Holdings shares in the market.

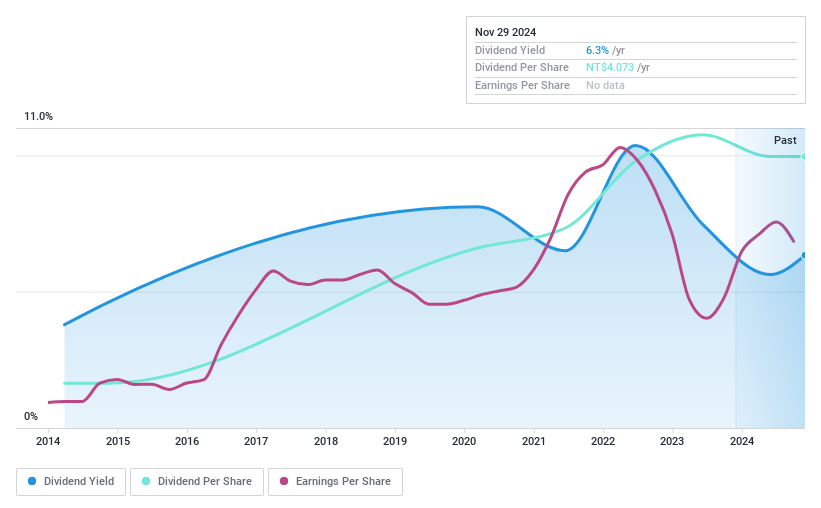

Supreme Electronics (TWSE:8112)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Supreme Electronics Co., Ltd. operates as an import and export dealer of electronic products and components across Taiwan, Hong Kong, China, the United States, and internationally, with a market cap of NT$32.34 billion.

Operations: Supreme Electronics Co., Ltd. generates revenue of NT$235.52 billion from its computer peripherals and electronic components segment.

Dividend Yield: 6.6%

Supreme Electronics' dividend yield of 6.57% ranks in the top 25% of Taiwan's market, though it is not well covered by free cash flows and relies on non-cash earnings. Despite stable dividends over the past decade, a high payout ratio of 81.8% raises sustainability concerns. Recent earnings growth and sales increases indicate potential strength, but debt coverage issues persist. The stock trades at a slight discount to its estimated fair value.

- Navigate through the intricacies of Supreme Electronics with our comprehensive dividend report here.

- According our valuation report, there's an indication that Supreme Electronics' share price might be on the cheaper side.

Next Steps

- Click through to start exploring the rest of the 1950 Top Dividend Stocks now.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8016

Onward Holdings

Through its subsidiaries, engages in the design, manufacture, and sale of men’s, women’s, and children’s apparel in Japan, China, the United Kingdom, and the United States.

Good value average dividend payer.