- Japan

- /

- Commercial Services

- /

- TSE:4384

3 Insider-Backed Growth Stocks To Watch

Reviewed by Simply Wall St

In a week where global markets experienced mixed performances, with the Nasdaq Composite reaching new heights while most major indexes declined, investors are closely watching growth stocks as they continue to outperform value stocks. Amidst this backdrop of economic uncertainty and shifting monetary policies, insider ownership in growth companies can serve as a strong indicator of confidence in their long-term potential.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| Propel Holdings (TSX:PRL) | 36.9% | 37.6% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.5% | 65.9% |

Let's review some notable picks from our screened stocks.

Shenzhen WOTE Advanced MaterialsLtd (SZSE:002886)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Shenzhen WOTE Advanced Materials Co., Ltd specializes in the research, development, production, and sale of polymer materials and engineering plastic products both in China and internationally, with a market cap of approximately CN¥4.80 billion.

Operations: The company generates revenue primarily from the New Material Industry segment, totaling CN¥1.72 billion.

Insider Ownership: 28.6%

Earnings Growth Forecast: 90.9% p.a.

Shenzhen WOTE Advanced Materials Ltd. has demonstrated robust growth, with net income rising from CNY 15.38 million to CNY 25.07 million over the past year, supported by significant revenue increases. Earnings are projected to grow at a substantial rate of 90.9% annually, outpacing the broader Chinese market's growth forecasts. Despite low forecasted return on equity and insufficient interest coverage by earnings, insider ownership remains high without recent insider trading activity, indicating confidence in future performance potential.

- Click here to discover the nuances of Shenzhen WOTE Advanced MaterialsLtd with our detailed analytical future growth report.

- The analysis detailed in our Shenzhen WOTE Advanced MaterialsLtd valuation report hints at an inflated share price compared to its estimated value.

Winall Hi-tech Seed (SZSE:300087)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Winall Hi-tech Seed Co., Ltd. focuses on the research, development, breeding, promotion, and service of various crop seeds in China and internationally, with a market cap of CN¥11.46 billion.

Operations: Winall Hi-tech Seed Co., Ltd. generates revenue through its activities in the research, development, breeding, promotion, and service of a diverse range of crop seeds both domestically and internationally.

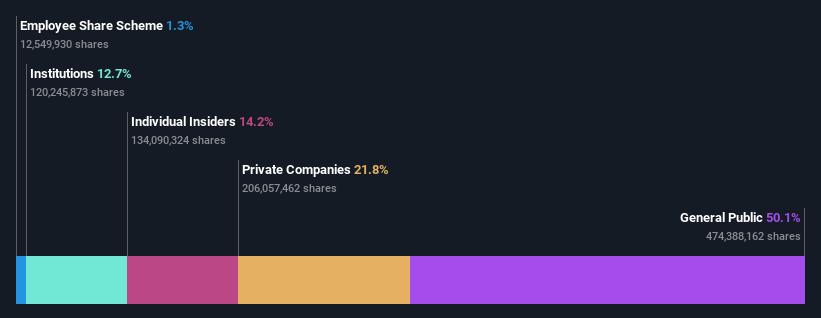

Insider Ownership: 14.2%

Earnings Growth Forecast: 37.4% p.a.

Winall Hi-tech Seed's revenue surged to CNY 2.06 billion for the first nine months of 2024, yet it faced a net loss of CNY 84.33 million, contrasting with last year's profit. Despite this setback, revenue is expected to grow by 23.3% annually, surpassing the market average. Earnings are also forecasted to rise significantly at 37.4% per year. The company has high insider ownership but no recent insider trading activity, suggesting management confidence amidst volatility and lower profit margins.

- Click to explore a detailed breakdown of our findings in Winall Hi-tech Seed's earnings growth report.

- Our valuation report unveils the possibility Winall Hi-tech Seed's shares may be trading at a premium.

Raksul (TSE:4384)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raksul Inc. is a company that offers printing services in Japan, with a market capitalization of approximately ¥77.65 billion.

Operations: Raksul Inc. generates revenue from its printing services in Japan.

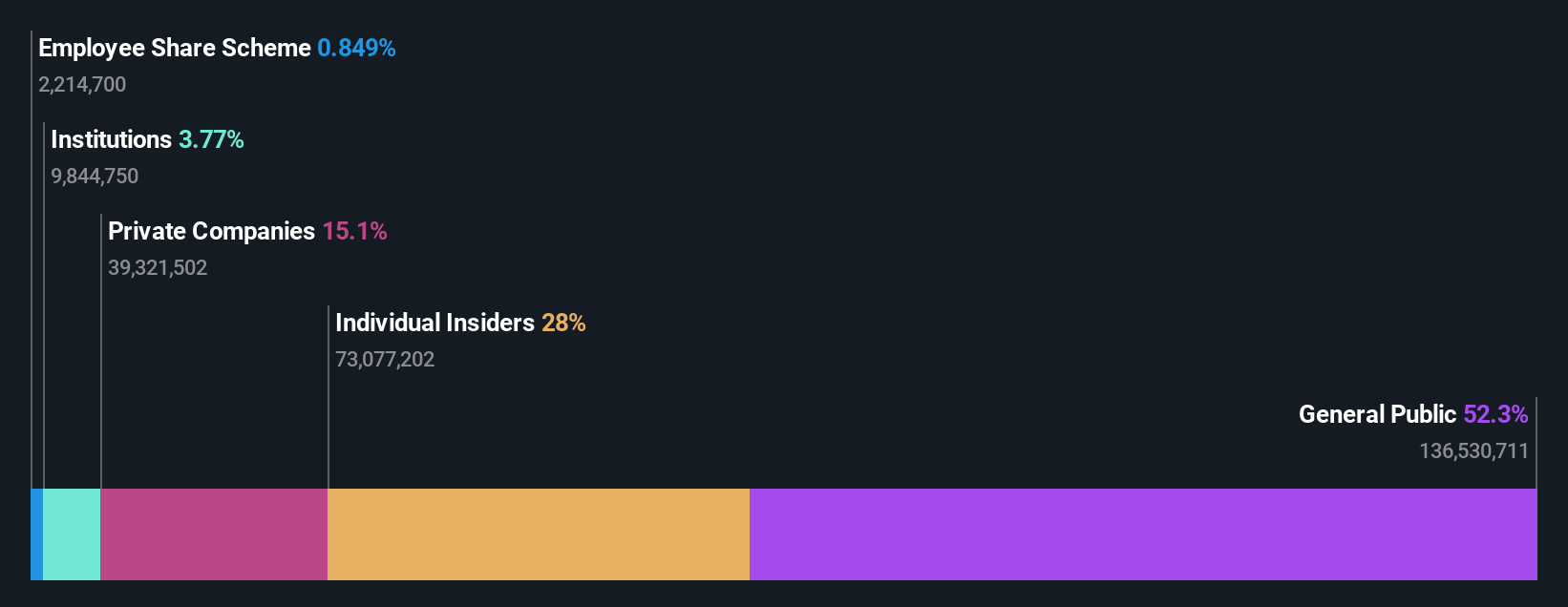

Insider Ownership: 14.2%

Earnings Growth Forecast: 25% p.a.

Raksul Inc. is set to grow its earnings significantly, with forecasts indicating a 25% annual increase, outpacing the Japanese market. Despite recent volatility and declining profit margins from 3.7% to 2.4%, it trades below estimated fair value and expects revenue growth of 10.2% annually, faster than the market average. A recent share buyback program aims to enhance profitability and capital efficiency, while a company split seeks to bolster expertise and competitiveness through Elastic Infra Inc.'s creation.

- Dive into the specifics of Raksul here with our thorough growth forecast report.

- Insights from our recent valuation report point to the potential overvaluation of Raksul shares in the market.

Turning Ideas Into Actions

- Navigate through the entire inventory of 1522 Fast Growing Companies With High Insider Ownership here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4384

Reasonable growth potential with adequate balance sheet.