- Japan

- /

- Consumer Services

- /

- TSE:7366

Japanese Exchange Growth Companies With High Insider Ownership August 2024

Reviewed by Simply Wall St

Japan's stock markets have experienced significant volatility recently, driven by a rebounding yen and concerns over global growth. Despite this, the Nikkei 225 Index and the broader TOPIX Index managed to recoup much of their initial losses by the end of last week. In such a fluctuating environment, stocks with high insider ownership can be particularly appealing. These companies often exhibit strong alignment between management and shareholder interests, which can be crucial for navigating market uncertainties.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Hottolink (TSE:3680) | 27% | 59.7% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.8% | 43.3% |

| Micronics Japan (TSE:6871) | 15.3% | 39.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.9% |

| Medley (TSE:4480) | 34% | 28.7% |

| SHIFT (TSE:3697) | 35.4% | 32.8% |

| ExaWizards (TSE:4259) | 21.8% | 91.1% |

| Money Forward (TSE:3994) | 21.4% | 66.9% |

| Astroscale Holdings (TSE:186A) | 20.9% | 90% |

| AeroEdge (TSE:7409) | 10.7% | 28.5% |

Underneath we present a selection of stocks filtered out by our screen.

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market cap of ¥329.74 billion.

Operations: Visional's revenue segments are primarily derived from its human resources platform solutions in Japan.

Insider Ownership: 39.5%

Earnings Growth Forecast: 11.2% p.a.

Visional, Inc. demonstrates strong growth potential with earnings forecasted to grow 11.2% annually and revenue expected to increase by 12.5% per year, outpacing the Japanese market average of 4.3%. The company is trading at a significant discount of 51.7% below its estimated fair value and has shown substantial profit growth of 74.3% over the past year. Additionally, Visional's Return on Equity is projected to reach a high level of 25.4% within three years, reflecting robust future profitability prospects without recent insider trading activity impacting confidence levels.

- Dive into the specifics of Visional here with our thorough growth forecast report.

- Our valuation report unveils the possibility Visional's shares may be trading at a discount.

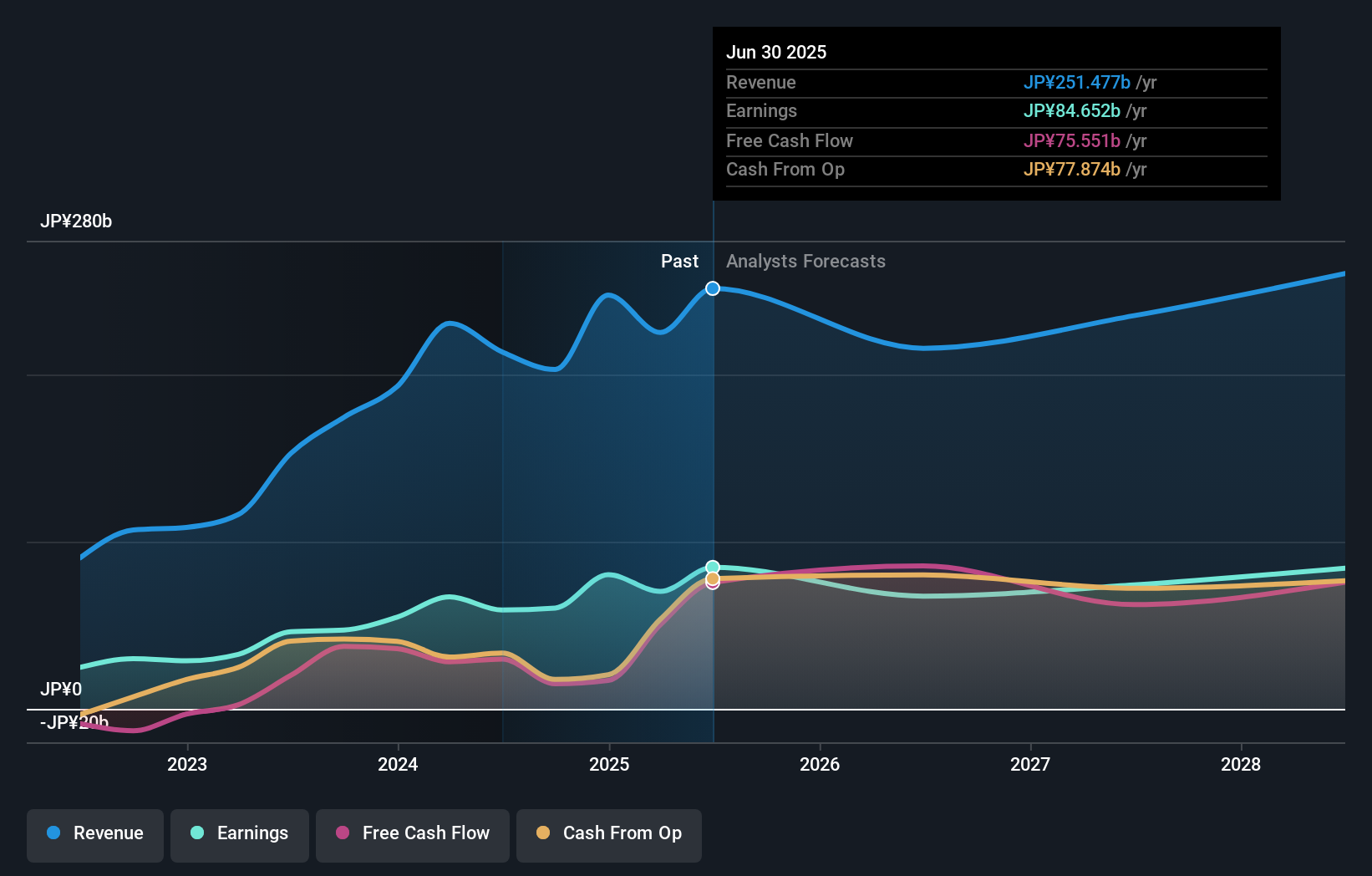

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment in Japan and internationally, with a market cap of ¥2.43 trillion.

Operations: The primary revenue segment for Lasertec Corporation is the design, manufacture, and sale of inspection and measurement equipment, generating ¥213.51 billion.

Insider Ownership: 12.1%

Earnings Growth Forecast: 19.4% p.a.

Lasertec Corporation has demonstrated robust growth, with earnings increasing by 28% over the past year and forecasted to grow at 19.4% per year, outpacing the Japanese market average of 8.7%. Despite a highly volatile share price recently, its revenue is expected to grow at 15.7% annually, faster than the market's 4.3%. Recent sales figures show significant performance improvements, particularly in the ACTIS Series. No substantial insider trading activity was reported in the last three months.

- Click to explore a detailed breakdown of our findings in Lasertec's earnings growth report.

- Our valuation report here indicates Lasertec may be overvalued.

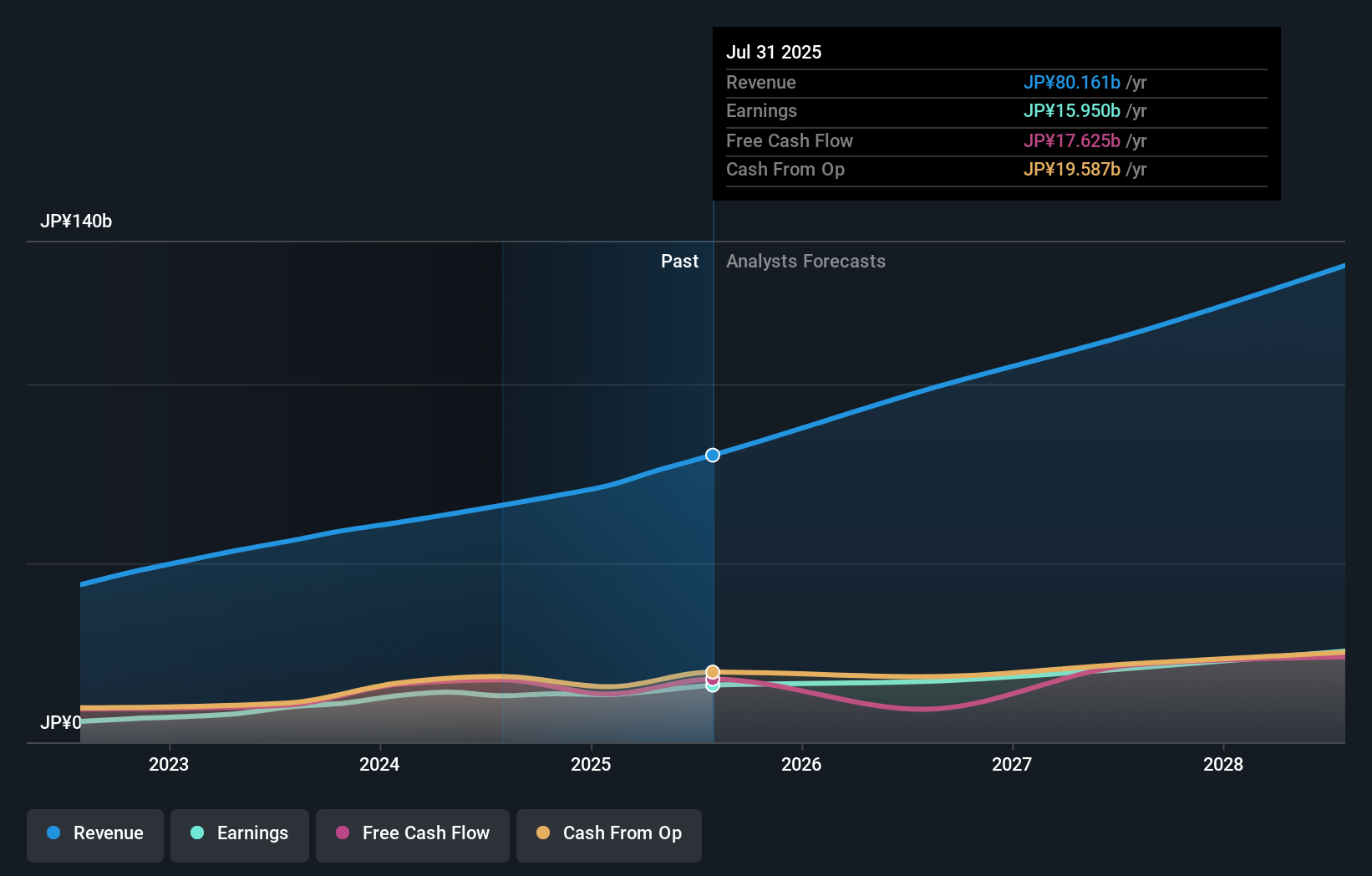

LITALICO (TSE:7366)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: LITALICO Inc. operates schools for learning and preschools in Japan with a market cap of ¥37.85 billion.

Operations: LITALICO generates revenue through its educational institutions focused on learning and preschool services in Japan.

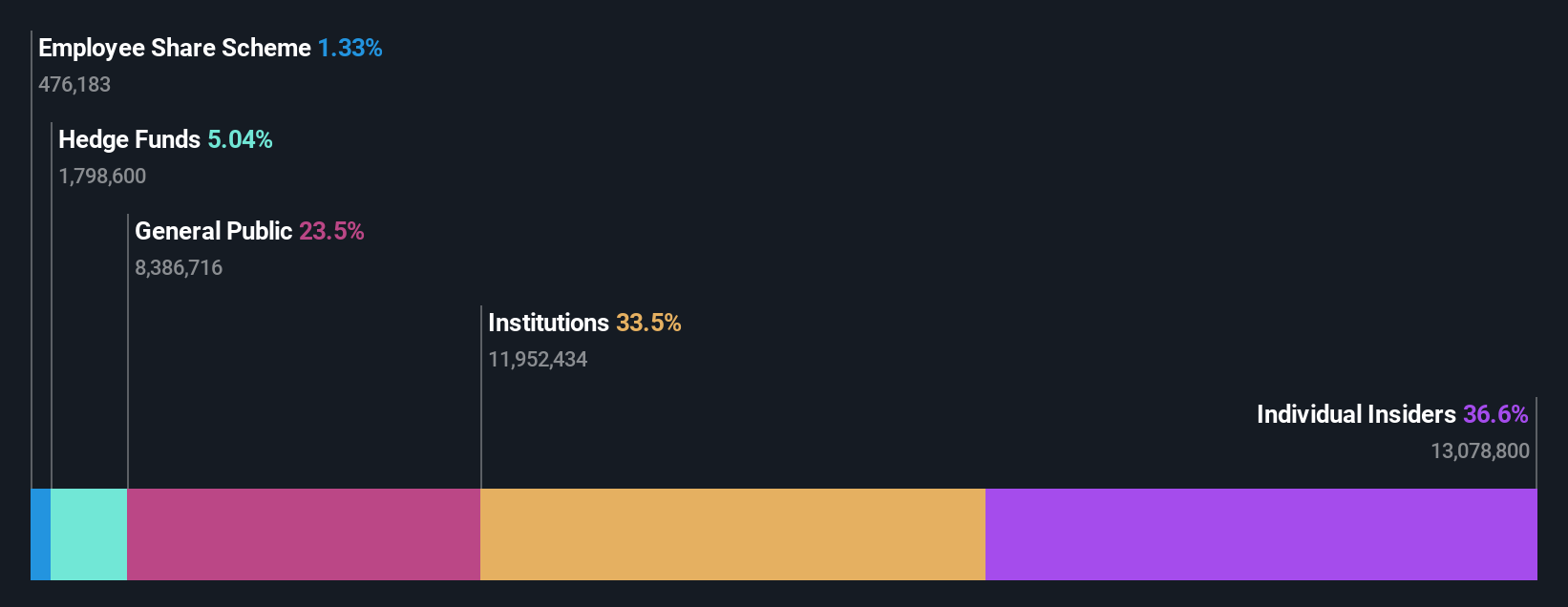

Insider Ownership: 37.2%

Earnings Growth Forecast: 16.8% p.a.

LITALICO Inc. is forecasted to see revenue growth of 13.9% per year, outpacing the Japanese market average of 4.3%. Earnings are expected to grow at 16.8% annually, also above market averages, though profit margins have decreased from 10.6% last year to 7.4%. The company recently announced a private placement with UBS A London Branch for ¥26,572,650 and has a high level of debt alongside significant share price volatility over the past three months.

- Click here to discover the nuances of LITALICO with our detailed analytical future growth report.

- Our valuation report here indicates LITALICO may be undervalued.

Make It Happen

- Reveal the 100 hidden gems among our Fast Growing Japanese Companies With High Insider Ownership screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7366

Undervalued slight.