As global markets reach new highs, driven by optimism around potential trade deals and advancements in artificial intelligence, small-cap stocks have lagged behind their larger counterparts. This divergence presents an intriguing opportunity to explore companies with robust fundamentals that may be overlooked amidst the broader market enthusiasm. Identifying such stocks involves focusing on solid financial health and growth potential, which can offer resilience amid economic shifts and policy changes.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Miwon Chemicals | 0.22% | 11.24% | 14.59% | ★★★★★★ |

| Cita Mineral Investindo | NA | -3.08% | 16.56% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Oriental Precision & EngineeringLtd | 45.47% | 3.47% | -1.67% | ★★★★★☆ |

| iMarketKorea | 29.86% | 5.28% | 1.62% | ★★★★★☆ |

| Bakrie & Brothers | 22.66% | 7.78% | 13.50% | ★★★★★☆ |

| TBS Energi Utama | 77.67% | 4.11% | -2.54% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Fiera Milano (BIT:FM)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Fiera Milano SpA, along with its subsidiaries, specializes in organizing and hosting international events and fairs both in Italy and abroad, with a market capitalization of €329.39 million.

Operations: Fiera Milano generates revenue primarily from its Italian Exhibitions Business, contributing €245.29 million, and Congresses, adding €49.15 million. The Foreign Exhibitions Business adds a smaller portion with €5.13 million in revenue.

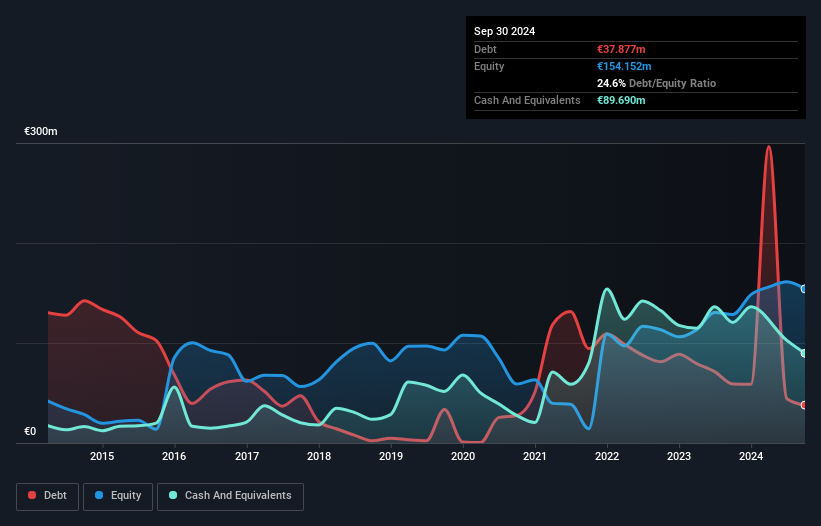

Fiera Milano, a smaller player in the market, has shown impressive earnings growth of 4699.7% over the past year, significantly outpacing the Media industry's 15.6%. Its price-to-earnings ratio stands at 9x, which is attractive compared to Italy's market average of 14.1x. The company's debt management appears solid with a reduced debt-to-equity ratio from 36.1% to 24.6% over five years and interest payments well covered by EBIT at 4.9x coverage. However, recent reports highlighted challenges with a net loss of €7 million for Q3 and declining earnings projected at an average rate of 3% annually over the next three years.

- Navigate through the intricacies of Fiera Milano with our comprehensive health report here.

Explore historical data to track Fiera Milano's performance over time in our Past section.

JAC Recruitment (TSE:2124)

Simply Wall St Value Rating: ★★★★★★

Overview: JAC Recruitment Co., Ltd. is a company that offers recruitment consultancy services in Japan with a market capitalization of ¥110.38 billion.

Operations: The company's primary revenue streams are derived from its Domestic Recruitment Business, generating ¥33.46 billion, and Overseas Business, contributing ¥3.74 billion. The Domestic Job Offer Advertising Business adds an additional ¥390 million to the overall revenue structure.

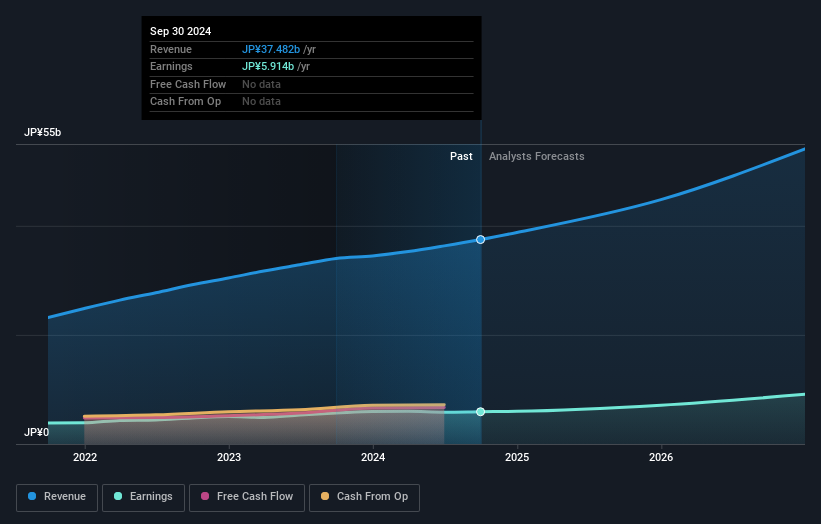

JAC Recruitment, a nimble player in the recruitment sector, has shown impressive financial health with earnings growing at 15% annually over the past five years. Their debt-free status eliminates concerns over interest coverage, highlighting robust financial management. Despite a modest 4% earnings growth last year compared to the industry’s 10%, JAC remains appealing as it trades at nearly 35% below its estimated fair value. Free cash flow is positive, and high-quality earnings further bolster its profile. With forecasts predicting a nearly 19% annual growth rate, JAC seems poised for continued expansion in its niche market.

Genky DrugStores (TSE:9267)

Simply Wall St Value Rating: ★★★★★☆

Overview: Genky DrugStores Co., Ltd. operates a chain of drug stores and has a market capitalization of ¥94.68 billion.

Operations: Genky DrugStores generates its revenue primarily from its chain of drug stores. The company reported a market capitalization of ¥94.68 billion, reflecting its scale in the retail sector. Its financial performance is characterized by a focus on optimizing cost structures to enhance profitability, with particular attention to managing operating expenses and cost of goods sold.

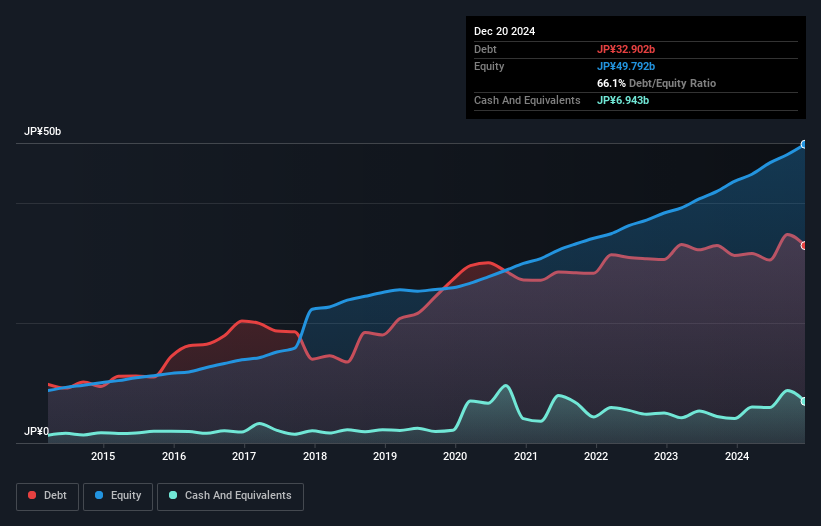

Genky DrugStores, a promising player in the retail sector, has shown robust financial performance with earnings growth of 26.6% over the past year, outpacing the industry average of 11.5%. Despite a high net debt to equity ratio at 54.1%, interest payments are comfortably covered by EBIT at 59.8 times, signaling strong operational efficiency. The company is free cash flow positive and has reduced its debt to equity ratio from 95.3% to 72.3% over five years, reflecting improved financial health. Recent sales reports indicate steady growth with all store net sales up by approximately 111% in January compared to last year’s figures.

- Get an in-depth perspective on Genky DrugStores' performance by reading our health report here.

Review our historical performance report to gain insights into Genky DrugStores''s past performance.

Next Steps

- Reveal the 4670 hidden gems among our Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:FM

Fiera Milano

Engages in hosting exhibitions, fairs, and other events in Italy and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)