- Japan

- /

- Professional Services

- /

- TSE:2170

3 Japanese Stocks That Could Be Trading Up To 49.8% Below Intrinsic Value

Reviewed by Simply Wall St

Japan's stock markets have recently experienced notable declines, with the Nikkei 225 Index down 5.8% and the broader TOPIX Index registering a 4.2% loss, driven by a U.S.-led sell-off in semiconductor stocks and yen strength impacting export-oriented companies. Despite these challenges, opportunities may exist for discerning investors to identify undervalued stocks that are trading below their intrinsic value. In such market conditions, identifying good stocks involves looking for companies with strong fundamentals that are temporarily overlooked or undervalued by the market.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3505.00 | ¥6826.41 | 48.7% |

| Kotobuki Spirits (TSE:2222) | ¥1750.50 | ¥3434.73 | 49% |

| Avant Group (TSE:3836) | ¥2013.00 | ¥4008.95 | 49.8% |

| Taiyo Yuden (TSE:6976) | ¥3112.00 | ¥6137.29 | 49.3% |

| Infomart (TSE:2492) | ¥322.00 | ¥619.66 | 48% |

| Ohara (TSE:5218) | ¥1363.00 | ¥2617.91 | 47.9% |

| KeePer Technical Laboratory (TSE:6036) | ¥4060.00 | ¥7903.27 | 48.6% |

| SHIFT (TSE:3697) | ¥11825.00 | ¥23405.30 | 49.5% |

| CIRCULATIONLtd (TSE:7379) | ¥661.00 | ¥1285.45 | 48.6% |

| TORIDOLL Holdings (TSE:3397) | ¥3534.00 | ¥6680.22 | 47.1% |

Below we spotlight a couple of our favorites from our exclusive screener.

JAC Recruitment (TSE:2124)

Overview: JAC Recruitment Co., Ltd. operates as a recruitment consultancy business in Japan and has a market cap of ¥126.11 billion.

Operations: JAC Recruitment Co., Ltd. generates revenue primarily through its recruitment consultancy services in Japan, with a market cap of ¥126.11 billion.

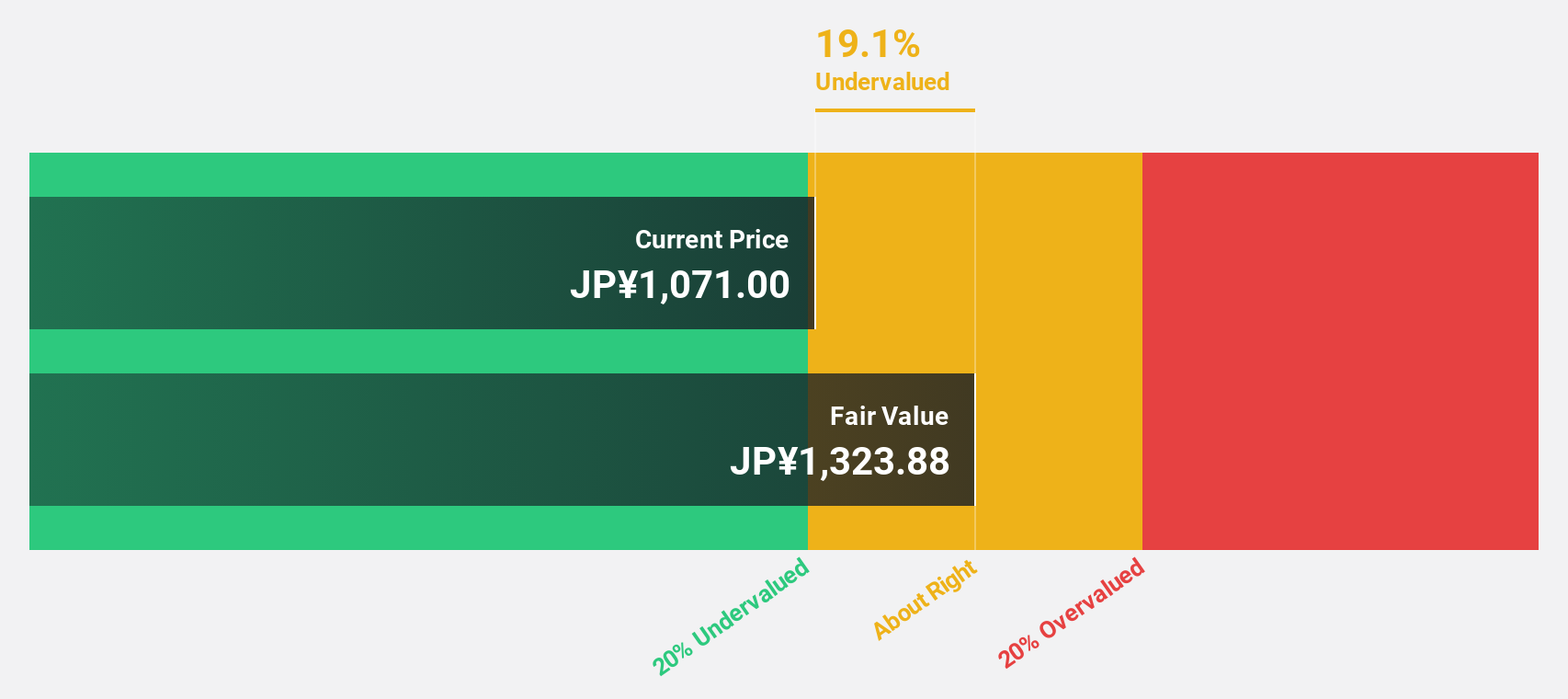

Estimated Discount To Fair Value: 35%

JAC Recruitment is trading at 35% below its estimated fair value of ¥1214.95, making it an attractive option for those seeking undervalued stocks based on cash flows. Earnings are forecast to grow by 18.1% annually, outpacing the JP market's 8.6%. Despite recent lowered earnings guidance and a share repurchase program worth ¥2 billion, the company maintains a reliable dividend yield of 3.29%.

- In light of our recent growth report, it seems possible that JAC Recruitment's financial performance will exceed current levels.

- Get an in-depth perspective on JAC Recruitment's balance sheet by reading our health report here.

Link and Motivation (TSE:2170)

Overview: Link and Motivation Inc., with a market cap of ¥61.33 billion, provides consulting and cloud services in Japan.

Operations: The company's revenue segments include the Matching Division with ¥15.92 billion, Individual Development Division generating ¥6.48 billion, and Organization Development Division contributing ¥13.49 billion.

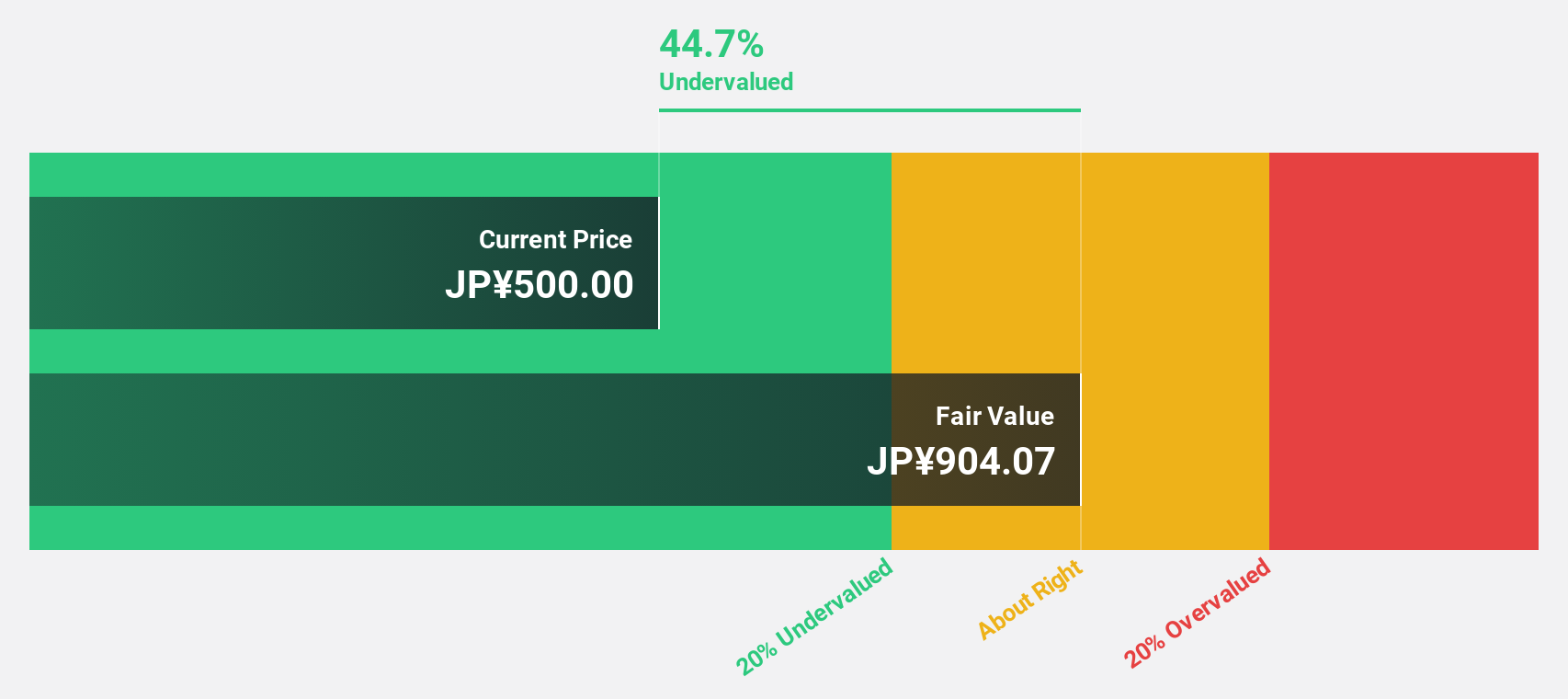

Estimated Discount To Fair Value: 45.9%

Link and Motivation is trading at ¥576, approximately 46% below its estimated fair value of ¥1064.75, indicating significant undervaluation based on cash flows. Earnings are projected to grow by 17% annually, outpacing the JP market's 8.6%, with a high forecasted return on equity of 28.8%. Despite recent share buybacks totaling ¥796.83 million and dividend affirmations, the stock has shown high volatility over the past three months.

- The analysis detailed in our Link and Motivation growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Link and Motivation.

Avant Group (TSE:3836)

Overview: Avant Group Corporation, with a market cap of ¥73.23 billion, operates through its subsidiaries to offer accounting, business intelligence, and outsourcing services.

Operations: The company's revenue segments are Management Solutions Business (¥8.52 billion), Digital Transformation Promotion Business (¥8.85 billion), and Consolidated Financial Statements Disclosure Business (¥7.54 billion).

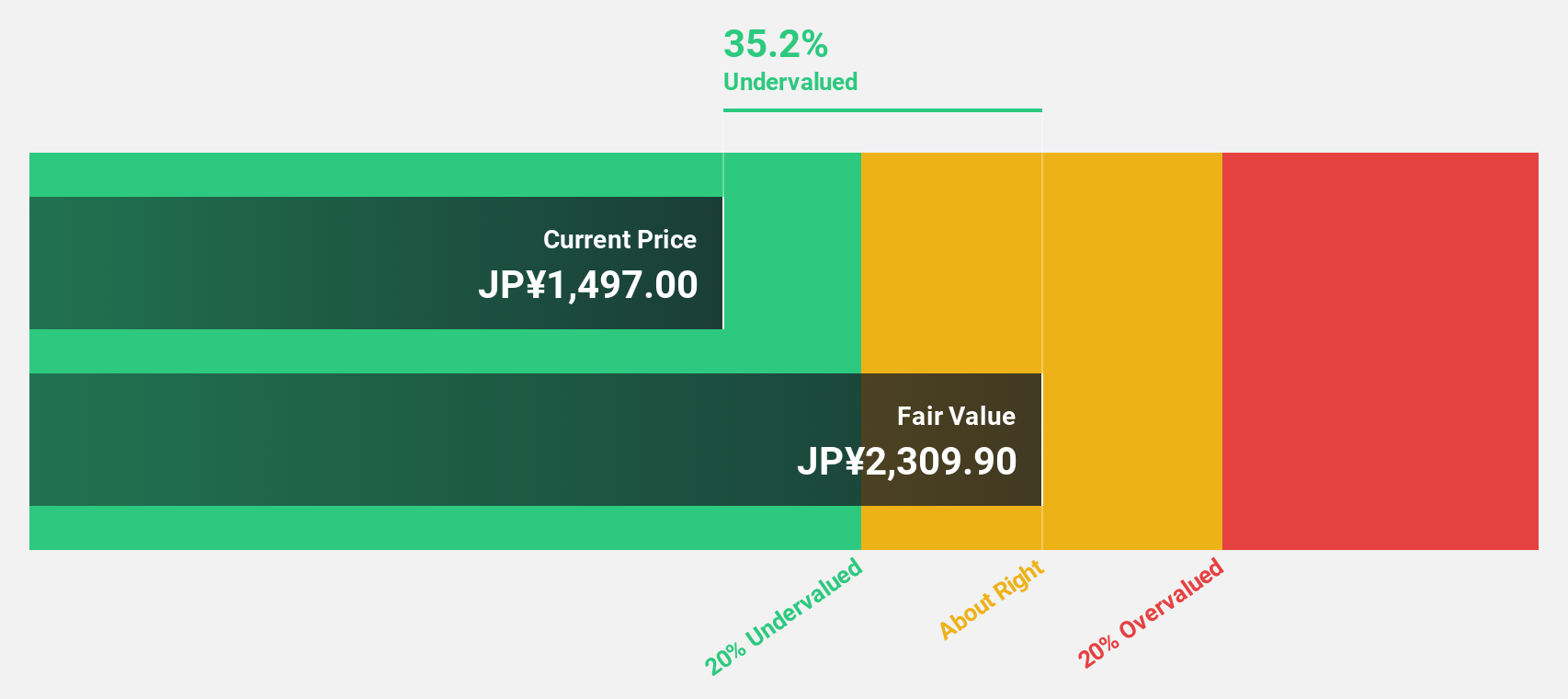

Estimated Discount To Fair Value: 49.8%

Avant Group is trading at ¥2013, significantly below its estimated fair value of ¥4008.95, indicating substantial undervaluation based on cash flows. The company forecasts robust revenue growth of 15.8% per year and earnings growth of 17.87% annually, both outpacing the JP market averages. Recent corporate actions include a dividend increase to ¥19.00 per share and a share buyback totaling ¥477.64 million, enhancing shareholder value amidst strong financial performance projections for FY2025.

- Our earnings growth report unveils the potential for significant increases in Avant Group's future results.

- Dive into the specifics of Avant Group here with our thorough financial health report.

Summing It All Up

- Access the full spectrum of 86 Undervalued Japanese Stocks Based On Cash Flows by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2170

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives