- Taiwan

- /

- Semiconductors

- /

- TPEX:6147

Top 3 Dividend Stocks For Your Investment Portfolio

Reviewed by Simply Wall St

As global markets navigate the uncertainties of incoming political administrations and fluctuating economic indicators, investors are keenly observing shifts in policy that could impact corporate earnings and sector performance. Amidst this backdrop, dividend stocks remain a compelling option for those seeking steady income streams; these stocks can provide a buffer against market volatility while offering potential for growth aligned with robust financial fundamentals.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

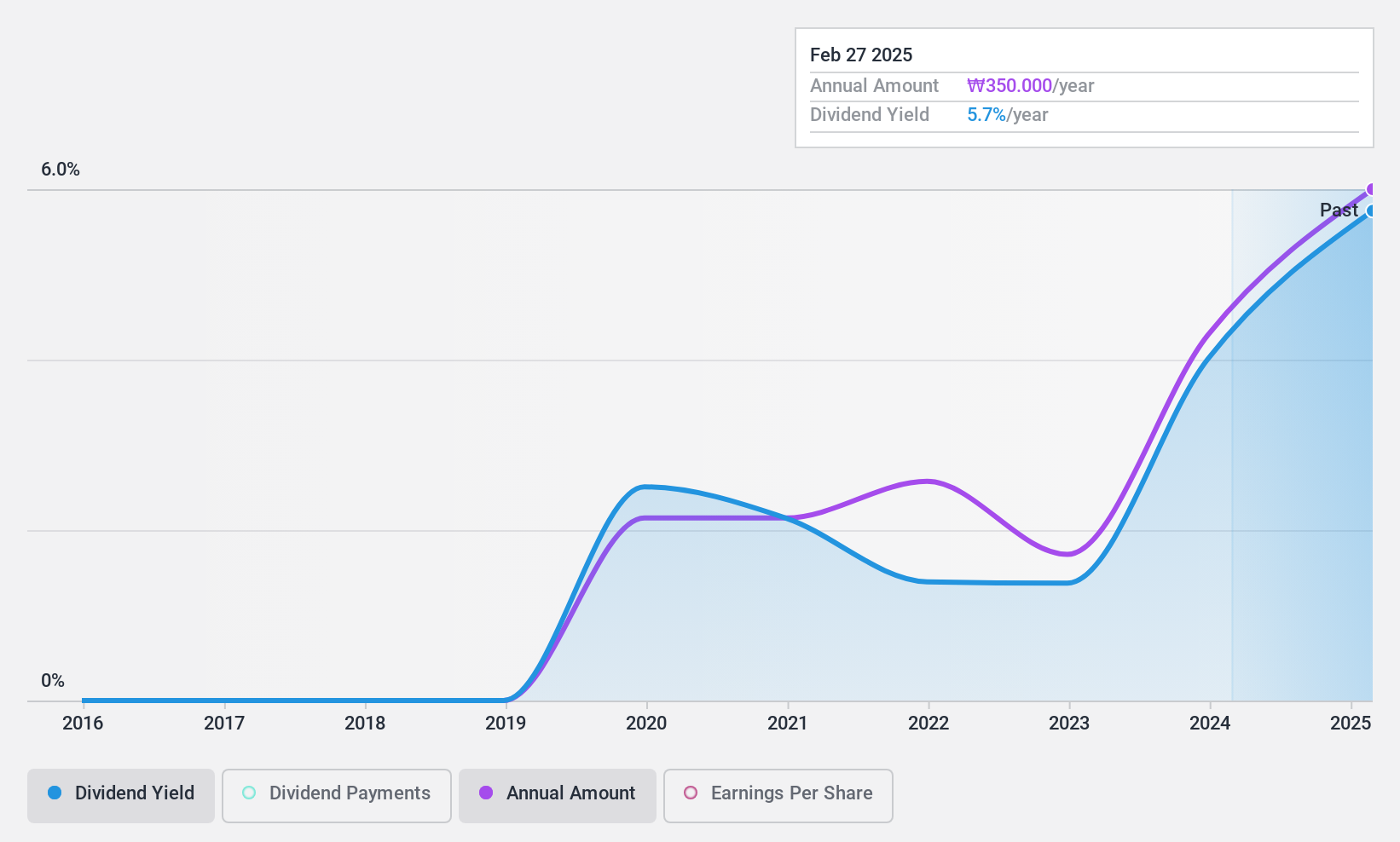

Samhwa Paints Industrial (KOSE:A000390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Samhwa Paints Industrial Co., Ltd. manufactures and sells a range of paints both in South Korea and internationally, with a market cap of ₩151.92 billion.

Operations: Samhwa Paints Industrial Co., Ltd. generates revenue primarily from its Paints and Chemicals segment, which accounts for ₩657.78 billion, alongside a smaller contribution from its IT segment at ₩8.73 billion.

Dividend Yield: 6.2%

Samhwa Paints Industrial offers a compelling dividend yield of 6.21%, ranking in the top 25% of the KR market, supported by a sustainable payout ratio of 47.5% and cash payout ratio of 29.9%. While earnings have grown significantly by 209% over the past year, its dividend track record is unstable with only five years of payments and volatility exceeding annual drops over 20%. The stock's P/E ratio is attractively below the market average.

- Click here and access our complete dividend analysis report to understand the dynamics of Samhwa Paints Industrial.

- Upon reviewing our latest valuation report, Samhwa Paints Industrial's share price might be too optimistic.

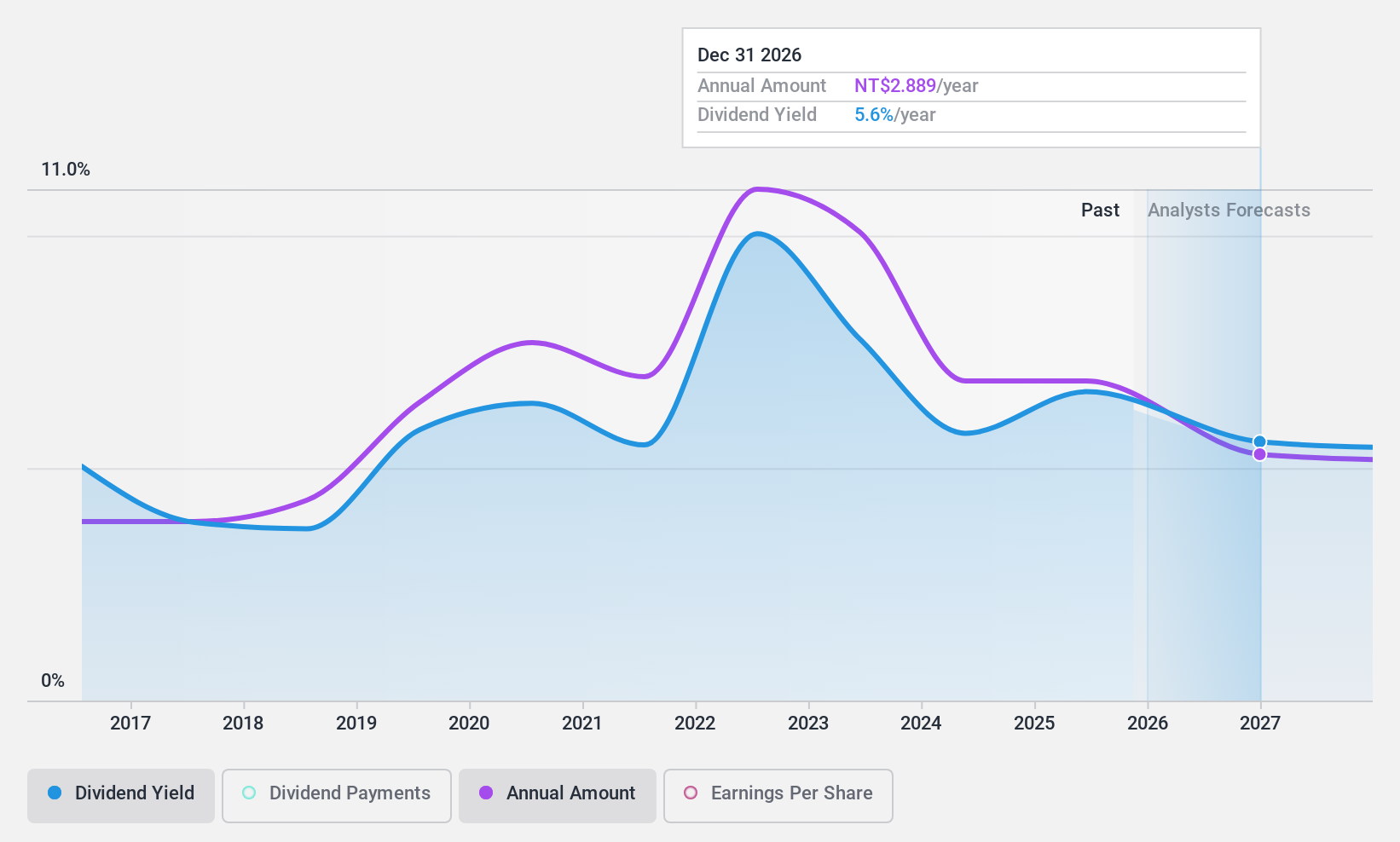

Chipbond Technology (TPEX:6147)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Chipbond Technology Corporation, along with its subsidiaries, focuses on the research, development, manufacture, and sale of driver IC and non-driver IC packaging and testing services in Taiwan and Mainland China with a market cap of NT$47.44 billion.

Operations: Chipbond Technology Corporation generates revenue from its semiconductors segment, amounting to NT$19.79 billion.

Dividend Yield: 5.9%

Chipbond Technology's dividend yield of 5.89% ranks in the top 25% of Taiwan's market, with a payout ratio of 70% and cash payout ratio at 78.1%, indicating sustainability from earnings and cash flows. However, its dividend history is marked by volatility over the past decade despite some growth. Recent earnings showed a slight decline in net income for Q3 compared to last year, but sales increased to TWD 5.55 billion from TWD 5.18 billion.

- Take a closer look at Chipbond Technology's potential here in our dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Chipbond Technology shares in the market.

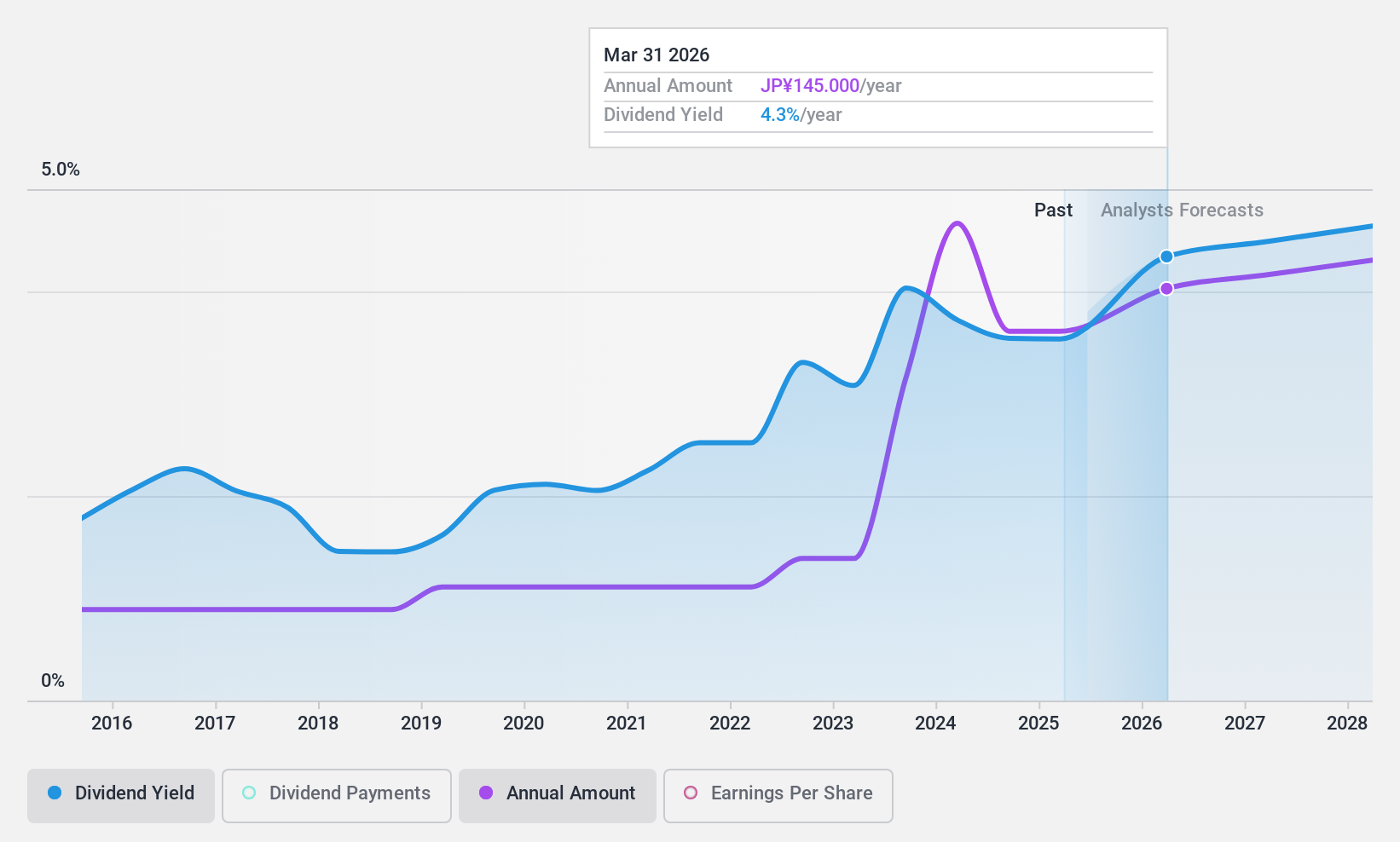

Mirai IndustryLtd (TSE:7931)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mirai Industry Co., Ltd., with a market cap of ¥60 billion, manufactures and sells electrical and pipe materials as well as wiring devices in Japan.

Operations: Mirai Industry Co., Ltd. generates revenue from its segments, with Electrical Materials and Pipe Materials contributing ¥34.80 billion and Wiring Accessories adding ¥7.08 billion.

Dividend Yield: 3.5%

Mirai Industry's dividend stability is challenged by a volatile history, with recent guidance indicating a decrease from JPY 100 to JPY 80 per share for the year ending March 2025. Despite this, dividends are well-covered by earnings and cash flows, with payout ratios of 30.9% and 47.4%, respectively. Trading significantly below estimated fair value, the stock offers potential value but remains less attractive in yield compared to top-tier JP market payers.

- Delve into the full analysis dividend report here for a deeper understanding of Mirai IndustryLtd.

- The valuation report we've compiled suggests that Mirai IndustryLtd's current price could be quite moderate.

Next Steps

- Dive into all 1969 of the Top Dividend Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6147

Chipbond Technology

Engages in the research, development, manufacture, and sale of driver IC and non-driver IC packaging and testing services in Taiwan and Mainland China.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives