Mitsubishi Heavy Industries (TSE:7011) Leverages AI Innovations for Growth Despite Valuation Concerns

Reviewed by Simply Wall St

Mitsubishi Heavy Industries (TSE:7011) continues to showcase its innovative prowess, evidenced by a remarkable 15% revenue growth and a significant 41% increase in earnings over the past year. The recent introduction of AI-driven solutions and strategic expansion in the Asia-Pacific region underscore the company's commitment to future growth, although challenges such as a lower-than-industry-average return on equity and competitive market pressures persist. This report examines key areas including financial performance, emerging market opportunities, and strategic initiatives aimed at enhancing operational efficiency and customer engagement.

Competitive Advantages That Elevate Mitsubishi Heavy Industries

Mitsubishi Heavy Industries has demonstrated a strong ability to innovate, as evidenced by a 15% year-over-year revenue growth driven by new product lines. This innovation is further underscored by a 41% increase in earnings over the past year, significantly outpacing the machinery industry average of 0.8%. The company's strategic expansion in the Asia-Pacific region, with a 10% market share increase, highlights its competitive positioning. Additionally, the net profit margin improvement from 3.8% to 4.9% reflects enhanced operational efficiency. The company's financial health is bolstered by a satisfactory net debt to equity ratio of 35.6% and strong interest coverage, indicating effective financial management.

Challenges Constraining Mitsubishi Heavy Industries's Potential

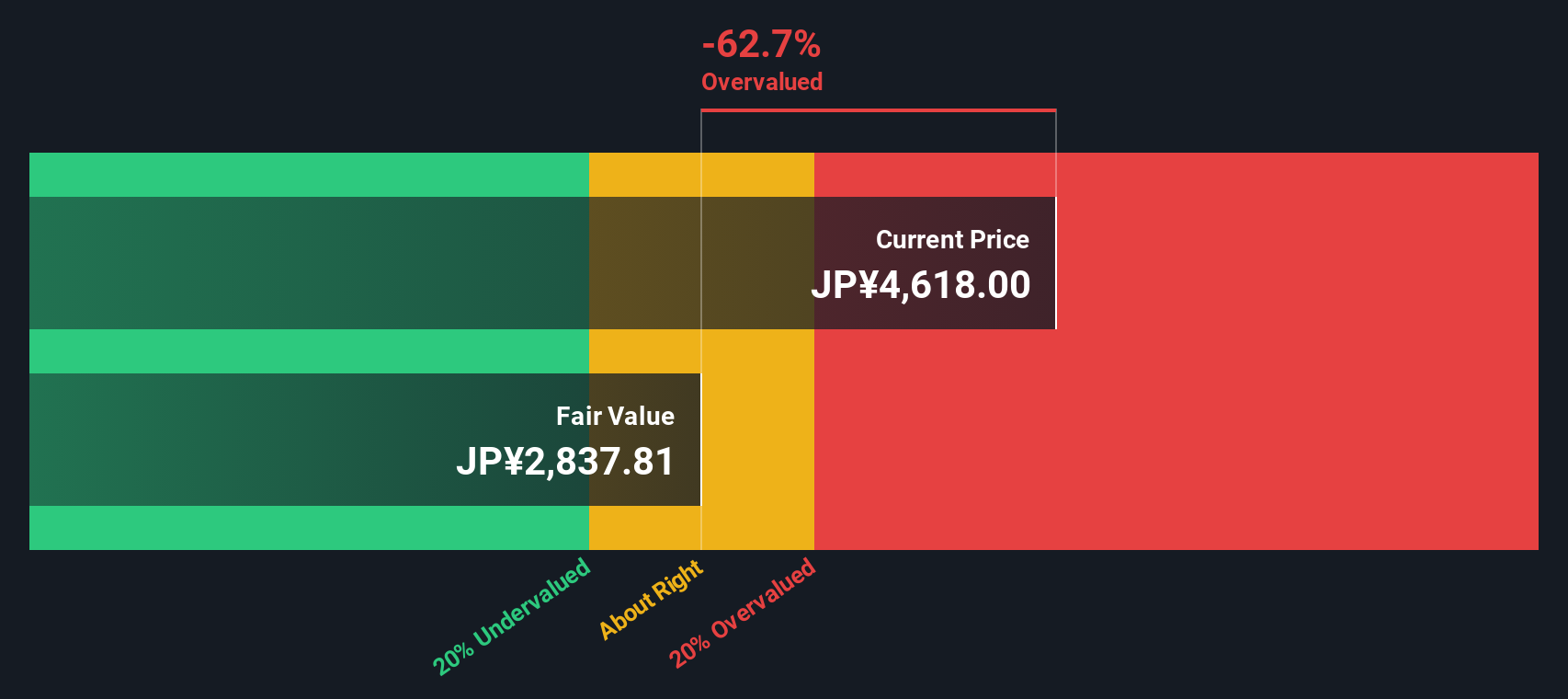

Despite strong earnings growth, Mitsubishi Heavy Industries faces challenges with a return on equity of 10.7%, which is below the industry threshold of 20%. The forecasted revenue growth of 6.3% per year also falls short of the desired 20% benchmark, potentially limiting investor appeal. Furthermore, the dividend yield of 0.94% is considerably lower than the top quartile of dividend payers in the Japanese market, raising concerns about dividend stability. The company's current share price, considered expensive with a Price-To-Earnings Ratio of 33x, suggests a disconnect between market valuation and financial performance metrics.

Emerging Markets Or Trends for Mitsubishi Heavy Industries

The company is poised to capitalize on emerging trends with the upcoming launch of AI-driven solutions, expected to create new revenue streams. Efforts to engage younger demographics through targeted marketing strategies have resulted in a 20% increase in engagement, indicating potential for customer base expansion. Investments in digital infrastructure are anticipated to enhance operational efficiencies and customer experiences, positioning the company favorably in the evolving technological environment. These initiatives suggest a promising trajectory for improved return on equity over the next three years.

Competitive Pressures and Market Risks Facing Mitsubishi Heavy Industries

Economic uncertainties pose a risk to consumer spending, potentially impacting revenue streams. The intensifying competitive environment requires agility and continuous innovation to maintain market position. Regulatory changes in key markets are closely monitored, as they could affect operational strategies. The company's share price volatility over the past three months highlights the need for strategic risk management to navigate these external pressures effectively.

Conclusion

Mitsubishi Heavy Industries showcases a commendable capacity for innovation, as seen in its impressive revenue and earnings growth, which outpaces industry norms. This positions the company well in the competitive Asia-Pacific market, though its current return on equity and forecasted growth rates suggest some limitations in investor appeal. The company's strategic focus on AI-driven solutions and digital infrastructure investments indicates a forward-thinking approach that could enhance future profitability and market engagement. However, the high Price-To-Earnings Ratio of 33x, compared to industry peers, suggests that the market may have priced in these growth prospects, potentially limiting short-term share price appreciation. As such, while Mitsubishi Heavy Industries is well-positioned for long-term growth, investors should be mindful of current market valuations and economic uncertainties that could impact future performance.

Summing It All Up

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Mitsubishi Heavy Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:7011

Mitsubishi Heavy Industries

Manufactures and sells heavy machinery worldwide.

Flawless balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives