- Taiwan

- /

- Basic Materials

- /

- TPEX:5520

Top Dividend Stocks To Consider In December 2024

Reviewed by Simply Wall St

As global markets grapple with economic shifts, rate cuts by the ECB and SNB, and anticipation of a Federal Reserve decision, investors are keenly observing how these developments affect stock indices. Amidst this backdrop, dividend stocks remain an attractive option for those seeking steady income streams, as they can offer stability in uncertain times.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.41% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.80% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

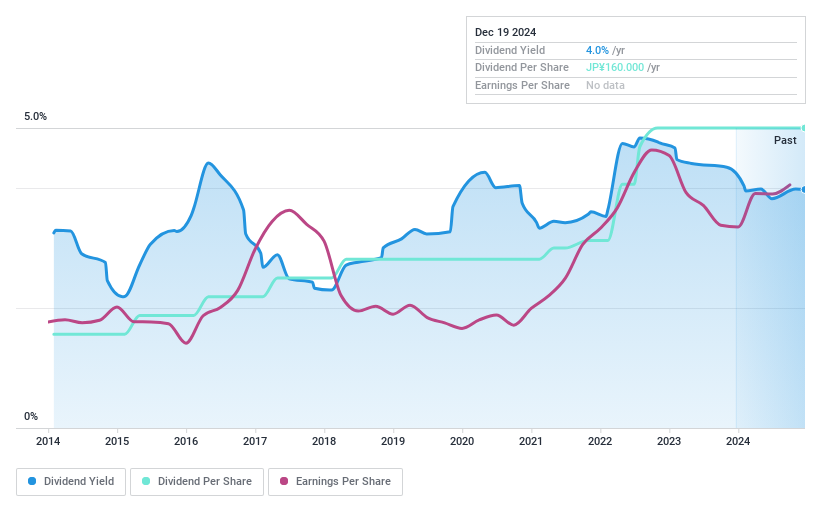

Aichi Electric (NSE:6623)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Aichi Electric Co., Ltd., along with its subsidiaries, manufactures and sells electric power products both in Japan and internationally, with a market cap of ¥37.81 billion.

Operations: Aichi Electric Co., Ltd.'s revenue is derived from the manufacture and sale of electric power products across various markets.

Dividend Yield: 4%

Aichi Electric's dividend payments, although reliable and stable over the past decade, are not well covered by free cash flows, with a high cash payout ratio of 142.3%. The company trades at 81.2% below its estimated fair value, offering potential upside for investors. Despite a low earnings payout ratio of 12.3%, sustainability concerns persist due to insufficient cash flow coverage. Its dividend yield of 3.98% ranks in the top quartile in Japan's market.

- Dive into the specifics of Aichi Electric here with our thorough dividend report.

- Upon reviewing our latest valuation report, Aichi Electric's share price might be too pessimistic.

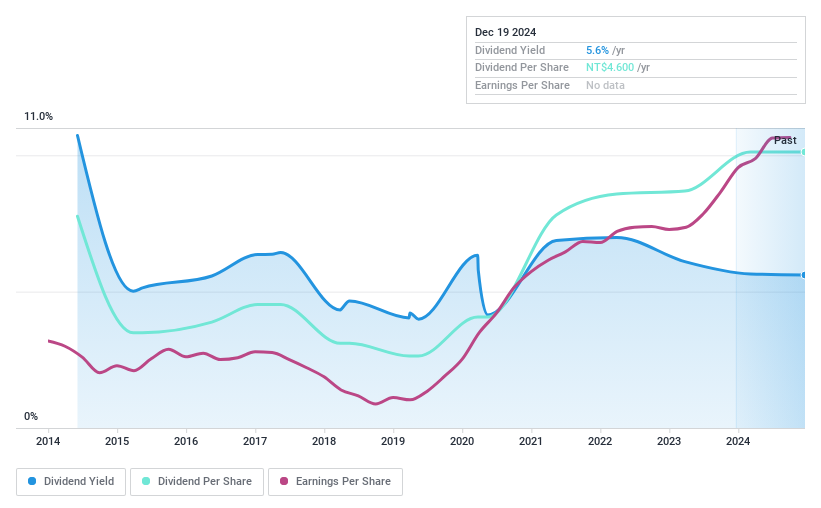

Lih Tai Construction Enterprise (TPEX:5520)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Lih Tai Construction Enterprise Co., Ltd. operates in the production and sale of ready-mixed concrete products, with a market capitalization of NT$4.92 billion.

Operations: Lih Tai Construction Enterprise Co., Ltd. generates revenue primarily from its Ready-Mix Concrete Segment, which accounts for NT$3.72 billion, complemented by its Transportation Division contributing NT$310.33 million.

Dividend Yield: 5.6%

Lih Tai Construction Enterprise's dividends are covered by earnings and cash flows, with payout ratios of 52.8% and 62.1%, respectively, indicating sustainability despite a volatile track record over the past decade. Its dividend yield of 5.61% ranks in Taiwan's top quartile, although reliability issues persist due to historical volatility. Recent financial performance shows growth, with nine-month sales reaching TWD 2.99 billion and net income at TWD 405.95 million, reflecting improved profitability year-over-year.

- Click to explore a detailed breakdown of our findings in Lih Tai Construction Enterprise's dividend report.

- Our comprehensive valuation report raises the possibility that Lih Tai Construction Enterprise is priced lower than what may be justified by its financials.

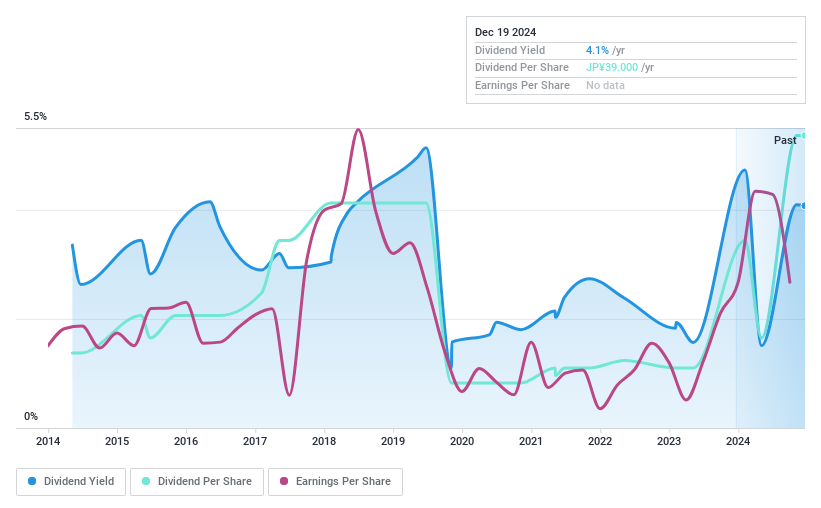

Helios Techno Holding (TSE:6927)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Helios Techno Holding Co., Ltd. operates in the lamp and manufacturing equipment sectors in Japan, with a market cap of ¥17.37 billion.

Operations: Helios Techno Holding Co., Ltd.'s revenue is primarily derived from its Lamp Business, which accounts for ¥2.23 billion, and its Manufacturing Equipment Business (including Inspecting Systems), contributing ¥10.01 billion.

Dividend Yield: 4.1%

Helios Techno Holding's dividend payments are well-covered by earnings and cash flows, with payout ratios of 45% and 28.4%, respectively, suggesting sustainability despite an unstable track record over the past decade. Its dividend yield of 4.08% ranks in Japan's top quartile. Recent inclusion in the S&P Global BMI Index highlights its growing market presence, supported by a significant earnings growth of 26.4% over the past year, enhancing its appeal to investors seeking value.

- Navigate through the intricacies of Helios Techno Holding with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Helios Techno Holding's current price could be quite moderate.

Where To Now?

- Embark on your investment journey to our 1967 Top Dividend Stocks selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:5520

Lih Tai Construction Enterprise

Produces and sells ready-mixed concrete products.

Flawless balance sheet with solid track record and pays a dividend.