- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:3533

Exploring High Growth Tech Stocks Including Delta Electronics

Reviewed by Simply Wall St

In recent weeks, global markets have experienced a mix of trends, with the Nasdaq Composite reaching a new milestone while small-cap indices like the Russell 2000 have struggled to keep pace with larger counterparts. Amidst these fluctuations and expectations for monetary policy adjustments, growth stocks continue to capture investor interest due to their potential for substantial returns in dynamic sectors such as technology. In this context, identifying high-growth tech stocks involves assessing companies that demonstrate strong innovation capabilities and adaptability within evolving economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1314 stocks from our High Growth Tech and AI Stocks screener.

Let's dive into some prime choices out of from the screener.

Delta Electronics (TWSE:2308)

Simply Wall St Growth Rating: ★★★★☆☆

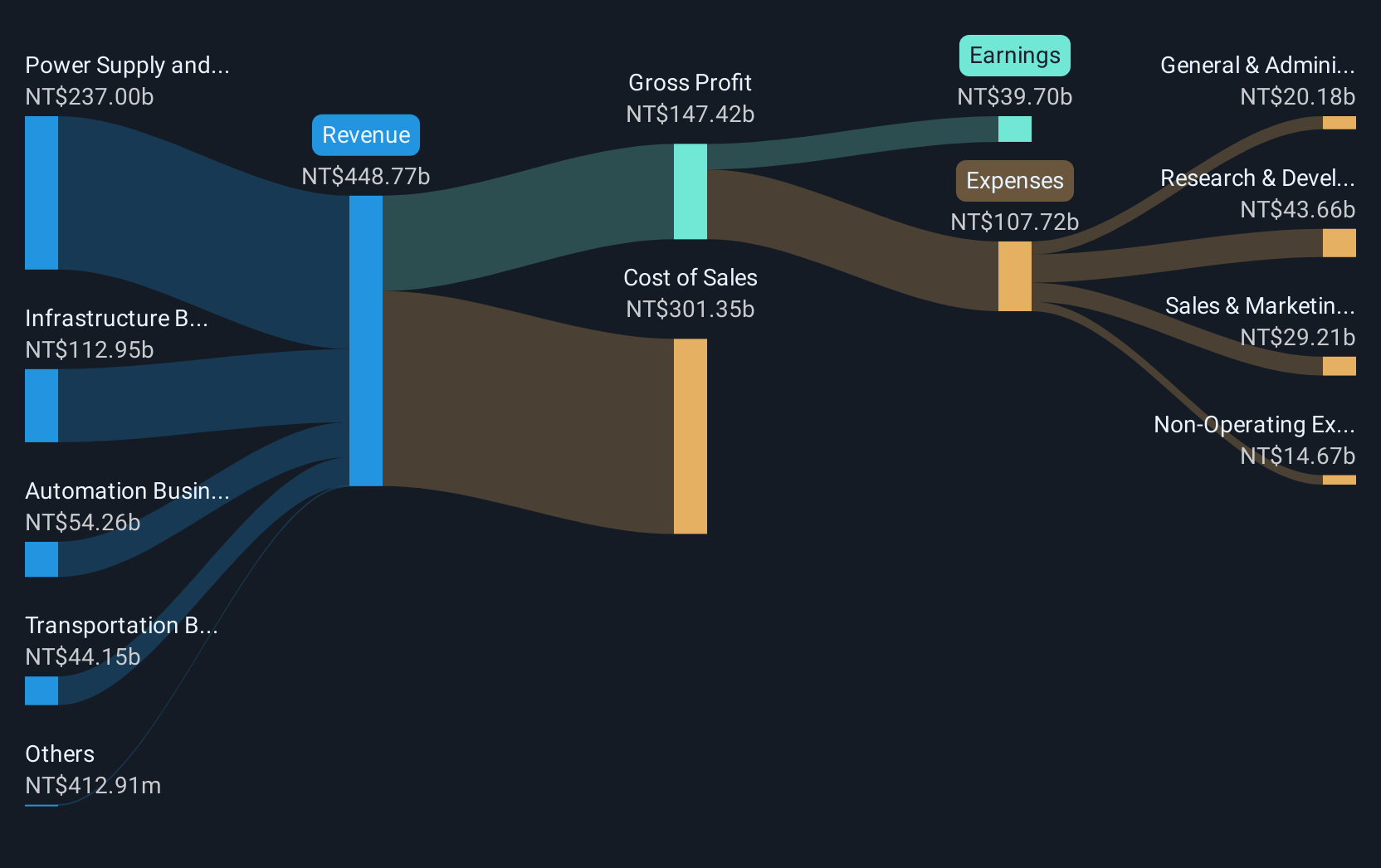

Overview: Delta Electronics, Inc. and its subsidiaries offer power and thermal management solutions across various regions including Mainland China, the United States, Taiwan, Thailand, and internationally, with a market capitalization of NT$1.11 trillion.

Operations: Delta Electronics operates through three primary business segments: Power Supply and Spare Parts, Infrastructure, and Automation. The Power Supply and Spare Parts Business Group is the largest revenue contributor with NT$259.73 billion, followed by the Infrastructure Business Group at NT$95.28 billion.

Delta Electronics has demonstrated robust growth and strategic agility, especially in the burgeoning sectors of AI and energy solutions. With a notable 11.6% annual revenue increase and an earnings growth of 15.4%, the company is outpacing both its industry and broader market benchmarks significantly. Recent expansions into Indonesia highlight Delta's commitment to tailored, sustainable solutions across diverse industries such as data centers and renewable energy, positioning it well for future technological demands. The firm's R&D dedication is evident from its consistent investment in innovation, ensuring it remains at the forefront of technological advancements in power electronics and automation crucial for smart cities development globally.

- Click here to discover the nuances of Delta Electronics with our detailed analytical health report.

Understand Delta Electronics' track record by examining our Past report.

Chicony Electronics (TWSE:2385)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Chicony Electronics Co., Ltd. is involved in the manufacture and sale of electronic parts and components both in Taiwan and internationally, with a market cap of NT$107.70 billion.

Operations: Chicony Electronics generates revenue primarily from the sale of computer peripherals, amounting to NT$99.67 billion. The company operates in both domestic and international markets, focusing on electronic parts and components manufacturing.

Chicony Electronics has shown a commendable trajectory in tech innovation, recently reporting a year-over-year sales increase to TWD 27.72 billion and net income growth to TWD 2.4 billion for Q3 2024. These figures underscore a consistent upward financial trend with earnings per share rising from TWD 2.93 to TWD 3.29 over the same period last year. The company's aggressive approach in R&D investments is pivotal, especially as it leverages recent technological shifts to enhance its product offerings, evidenced by its presentations at significant industry forums like Citi's Taiwan Corporate Day and the Investment Forum in Taipei, which likely play crucial roles in maintaining its competitive edge and market relevance.

- Navigate through the intricacies of Chicony Electronics with our comprehensive health report here.

Gain insights into Chicony Electronics' past trends and performance with our Past report.

Lotes (TWSE:3533)

Simply Wall St Growth Rating: ★★★★★☆

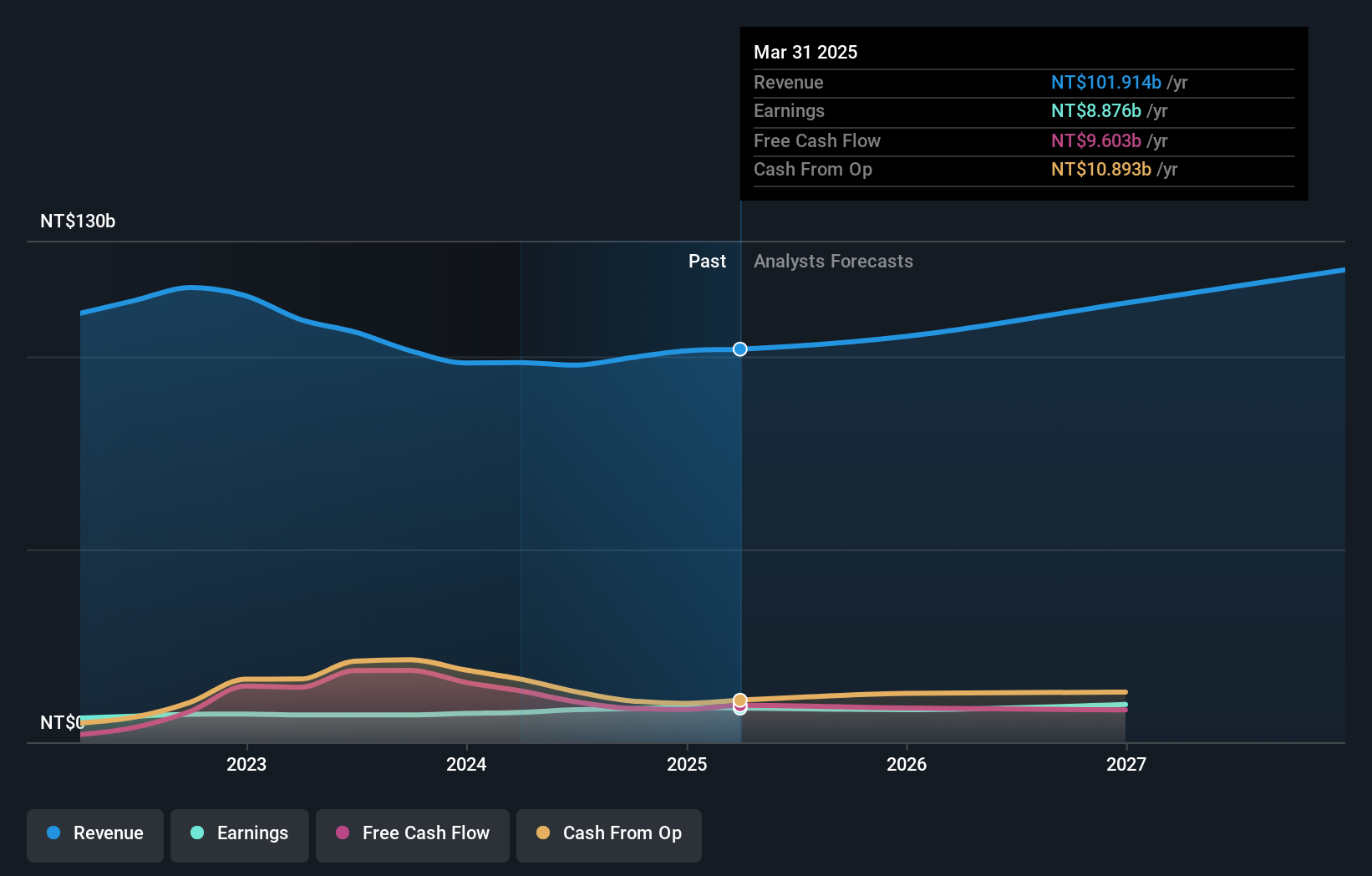

Overview: Lotes Co., Ltd designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally with a market cap of NT$219.44 billion.

Operations: Lotes generates revenue primarily from its electronic components and parts segment, which reported NT$28.36 billion in sales. The company is involved in the design, manufacturing, and sale of these products across various regions including Taiwan and Mainland China.

Lotes Co., Ltd has demonstrated robust growth, with Q3 2024 sales surging to TWD 8.07 billion from TWD 6.46 billion the previous year, alongside a net income increase to TWD 2.06 billion from TWD 1.87 billion. This performance is part of a broader trend where annual revenue and earnings are expected to grow by 16.2% and 20.3%, respectively, outpacing the Taiwanese market averages significantly. The company's commitment to innovation is evident in its R&D investments, aligning with industry shifts towards advanced tech solutions showcased at major conferences like Tech and Beyond in Taipei, enhancing its competitive stance in a rapidly evolving sector.

- Dive into the specifics of Lotes here with our thorough health report.

Explore historical data to track Lotes' performance over time in our Past section.

Seize The Opportunity

- Delve into our full catalog of 1314 High Growth Tech and AI Stocks here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:3533

Lotes

Designs, manufactures, and sells electronic interconnect and hardware components in Taiwan, Mainland China, and internationally.

Very undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives