- Taiwan

- /

- Electronic Equipment and Components

- /

- TWSE:6213

High Growth Tech Stocks To Watch For Future Potential

Reviewed by Simply Wall St

As global markets navigate a landscape marked by rate cuts from the ECB and SNB, and anticipation of a Fed rate cut, the technology-heavy Nasdaq Composite has reached new heights, contrasting with the underperformance of small-cap stocks like those in the Russell 2000 Index. In this environment, identifying high growth tech stocks involves looking for companies that can capitalize on technological advancements and market trends while demonstrating resilience amid fluctuating economic conditions.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Pharma Mar | 25.43% | 56.19% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Waystream Holding | 22.09% | 113.25% | ★★★★★★ |

| Alnylam Pharmaceuticals | 22.34% | 70.30% | ★★★★★★ |

| Sarepta Therapeutics | 23.98% | 42.48% | ★★★★★★ |

| TG Therapeutics | 34.86% | 56.98% | ★★★★★★ |

| Alkami Technology | 21.94% | 98.60% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| Elliptic Laboratories | 70.09% | 111.37% | ★★★★★★ |

| Travere Therapeutics | 31.70% | 72.51% | ★★★★★★ |

Click here to see the full list of 1314 stocks from our High Growth Tech and AI Stocks screener.

Let's explore several standout options from the results in the screener.

Genomictree (KOSDAQ:A228760)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Genomictree Inc. is a biomarker-based molecular diagnostics company that develops and commercializes products for detecting cancer and infectious diseases, with a market cap of ₩548.17 billion.

Operations: The company generates revenue primarily from its Cancer Molecular Diagnosis Business, contributing ₩2.06 billion, while the Genomic Analysis segment adds ₩144 million.

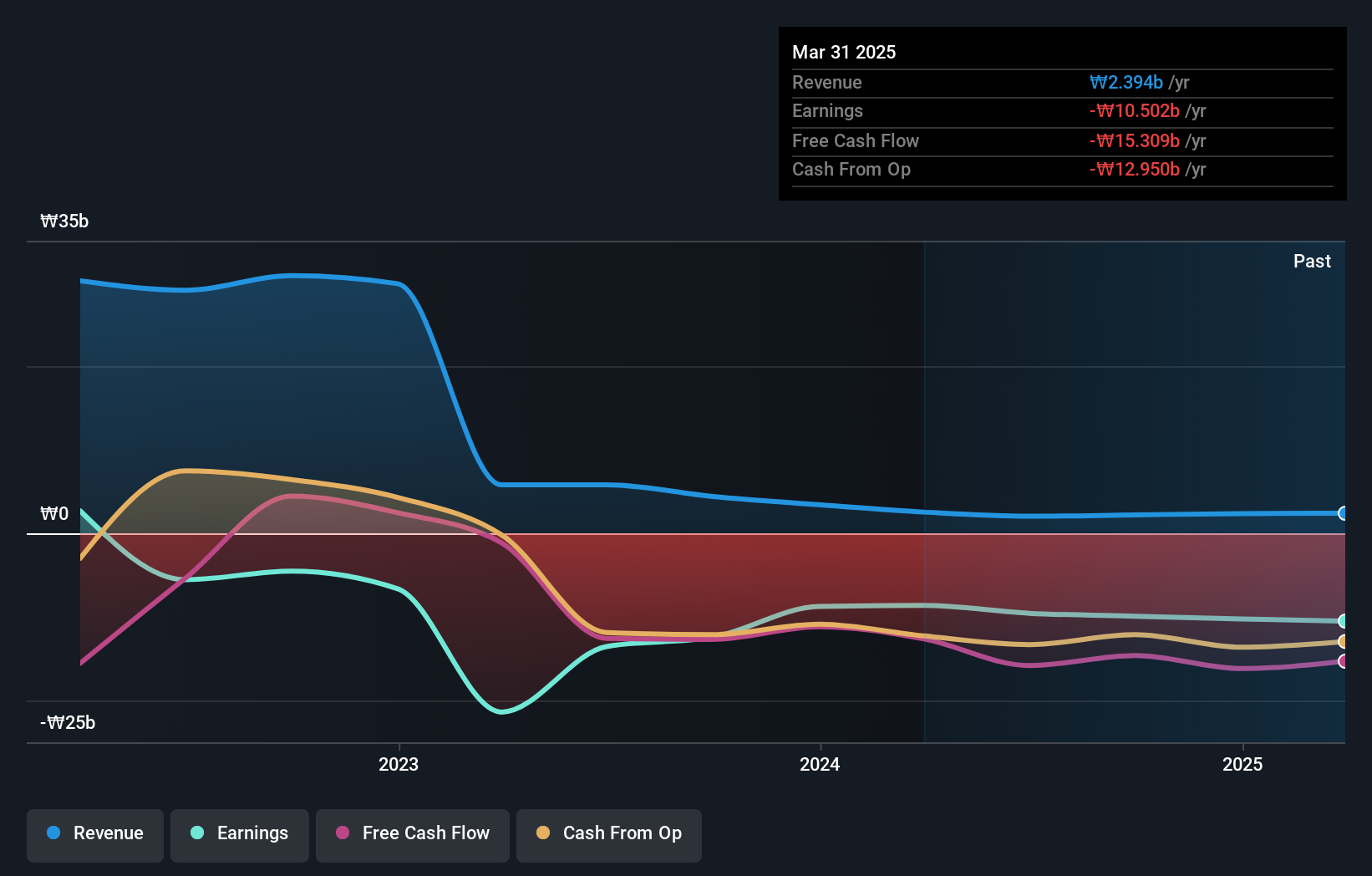

Genomictree, navigating the volatile biotech landscape, shows promise with an expected revenue growth rate of 97.8% per year, outpacing the South Korean market's average of 5.2%. Despite current unprofitability and a highly volatile share price over the past three months, projections indicate a significant uptick in profitability with earnings poised to surge by 115.9% annually over the next three years. The company's commitment to innovation is reflected in its strategic R&D investments aimed at pioneering advancements in biotechnology, although specific expenditure figures were not disclosed. This aggressive growth trajectory coupled with focused research efforts positions Genomictree to potentially reshape its sector dynamics if it successfully navigates the inherent risks of its development pipeline and market fluctuations.

Advantech (TWSE:2395)

Simply Wall St Growth Rating: ★★★★☆☆

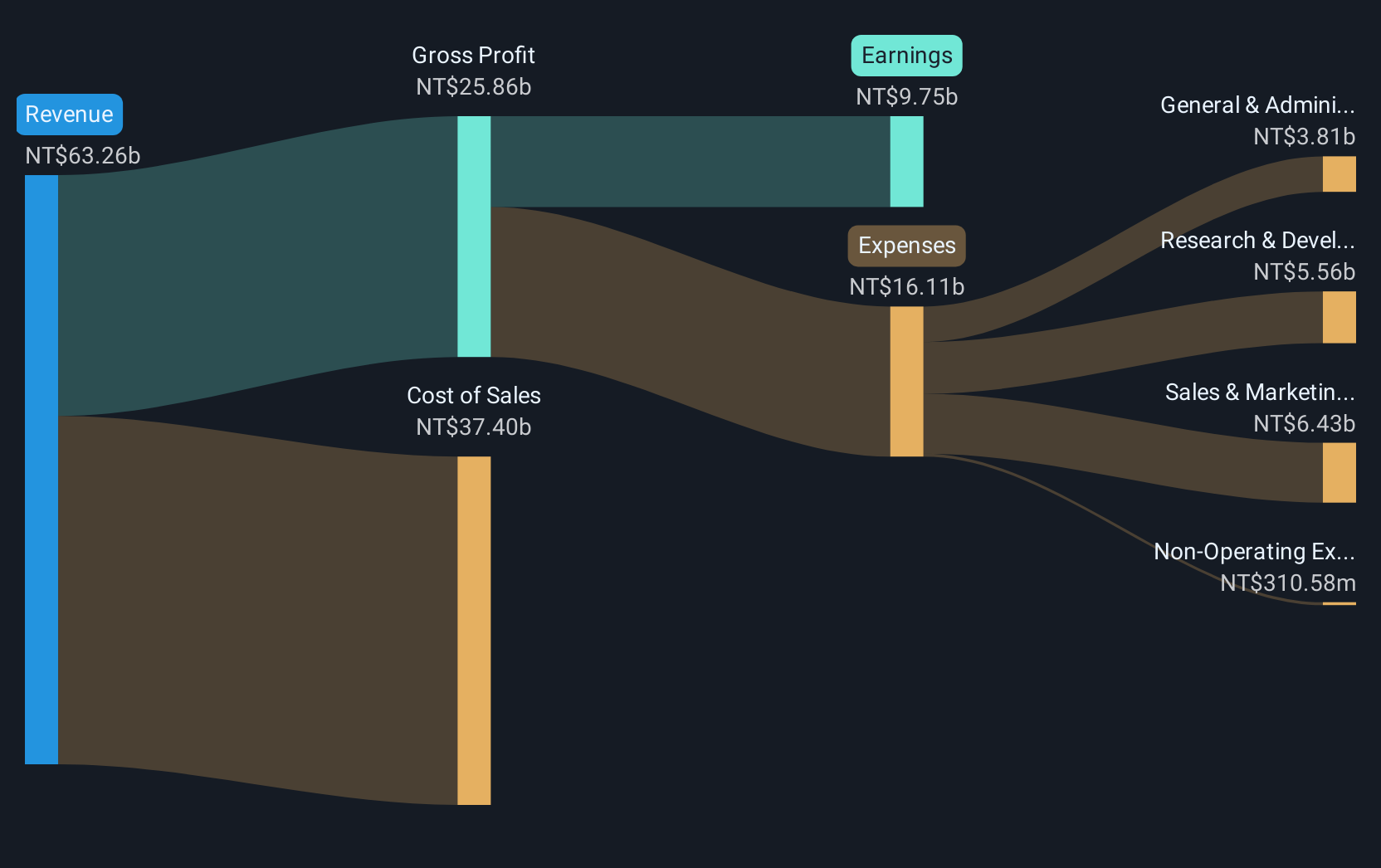

Overview: Advantech Co., Ltd. is a company that manufactures and sells embedded computing boards, industrial automation products, and applied and industrial computers, with a market capitalization of NT$309.97 billion.

Operations: Advantech generates revenue primarily through its Industrial IOT Group (IIoT), Embedded IOT Platform Group (EIoT), and Service IOT Group (SIoT), with the IIoT segment contributing NT$16.62 billion. The company's focus on industrial automation and IoT solutions positions it as a key player in these sectors.

Advantech's recent unveiling of the EAI-1200 and EAI-3300 AI acceleration modules, powered by Hailo-8™ processors, marks a significant stride in AI performance and efficiency. These innovations offer up to 52 TOPS of computing power with enhanced power efficiency, crucial for developers looking to upgrade existing systems with robust AI capabilities. Furthermore, the integration of AMD EPYC and Ryzen series processors across its x86 platforms underscores Advantech's commitment to powerful computing solutions tailored for diverse applications from edge to cloud. This strategic focus on high-performance AI and processing technologies not only caters to current market demands but also positions Advantech well within the competitive tech landscape.

- Dive into the specifics of Advantech here with our thorough health report.

Evaluate Advantech's historical performance by accessing our past performance report.

ITEQ (TWSE:6213)

Simply Wall St Growth Rating: ★★★★☆☆

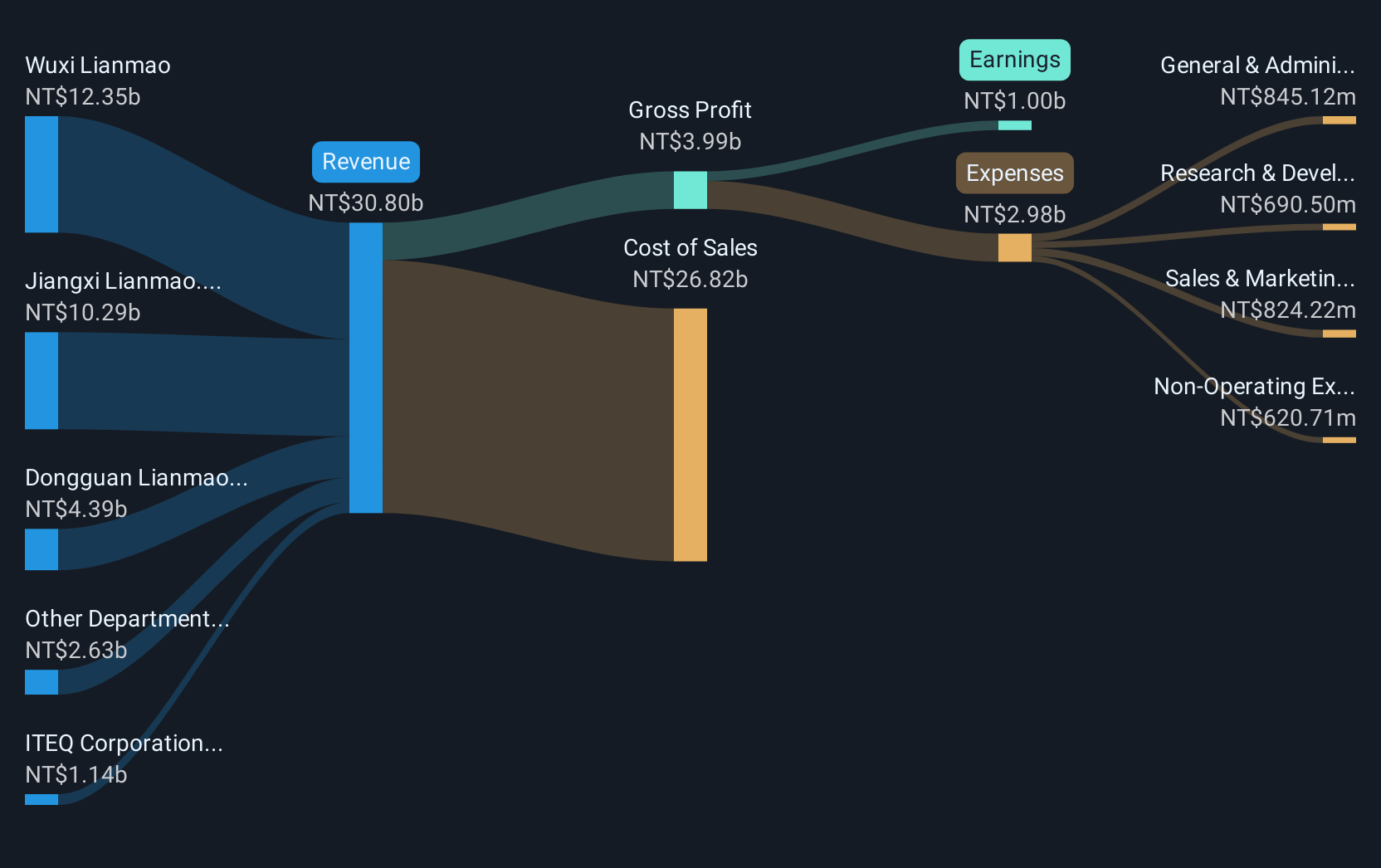

Overview: ITEQ Corporation is involved in the production and distribution of copper clad laminate materials for printed circuit boards across Taiwan, Asia, Europe, and other international markets, with a market capitalization of NT$28.49 billion.

Operations: The company generates revenue primarily from its subsidiaries, with Wuxi Lianmao contributing NT$11.46 billion and Jiangxi Lianmao adding NT$7.25 billion to the total revenue. Dongguan Lianmao also plays a significant role, bringing in NT$6.17 billion, while ITEQ Corporation itself accounts for NT$1.12 billion in sales.

ITEQ's robust performance is evident with a 35.9% surge in earnings over the past year, outpacing the electronics industry's growth of 5.3%. With revenue and earnings forecasted to grow annually at 11.3% and 37.1%, respectively, ITEQ significantly surpasses Taiwan's market projections of 2.3% for revenue and 6.6% for earnings growth. The company recently reported a third-quarter sales increase to TWD 7.96 billion from TWD 6.64 billion year-over-year, alongside an uptick in net income to TWD 249 million from TWD 234 million, reflecting its strong operational execution and market position.

- Take a closer look at ITEQ's potential here in our health report.

Gain insights into ITEQ's historical performance by reviewing our past performance report.

Taking Advantage

- Embark on your investment journey to our 1314 High Growth Tech and AI Stocks selection here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:6213

ITEQ

Engages in the manufacture and sale of copper clad laminate materials used for fabrication of printed circuit boards in Taiwan, Asia, Europe, and internationally.

Excellent balance sheet with proven track record.

Similar Companies

Market Insights

Community Narratives