- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:6121

Discover December 2024's Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate cuts from the ECB and SNB, and anticipation of a similar move by the Fed, investors are observing mixed performances across major indices. With inflationary pressures persisting and labor markets showing signs of cooling, dividend stocks have gained attention for their potential to provide steady income in uncertain times. In this context, selecting dividend stocks that demonstrate resilience and consistent payout histories becomes crucial for those seeking stability amid market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.85% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.02% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.43% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.76% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.12% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.43% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.95% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.77% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.23% | ★★★★★★ |

Click here to see the full list of 1967 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Simplo Technology (TPEX:6121)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Simplo Technology Co., Ltd. is a global producer and seller of battery packs with a market cap of NT$71.95 billion.

Operations: Simplo Technology Co., Ltd.'s revenue primarily comes from its Batteries / Battery Systems segment, which generated NT$82.29 billion.

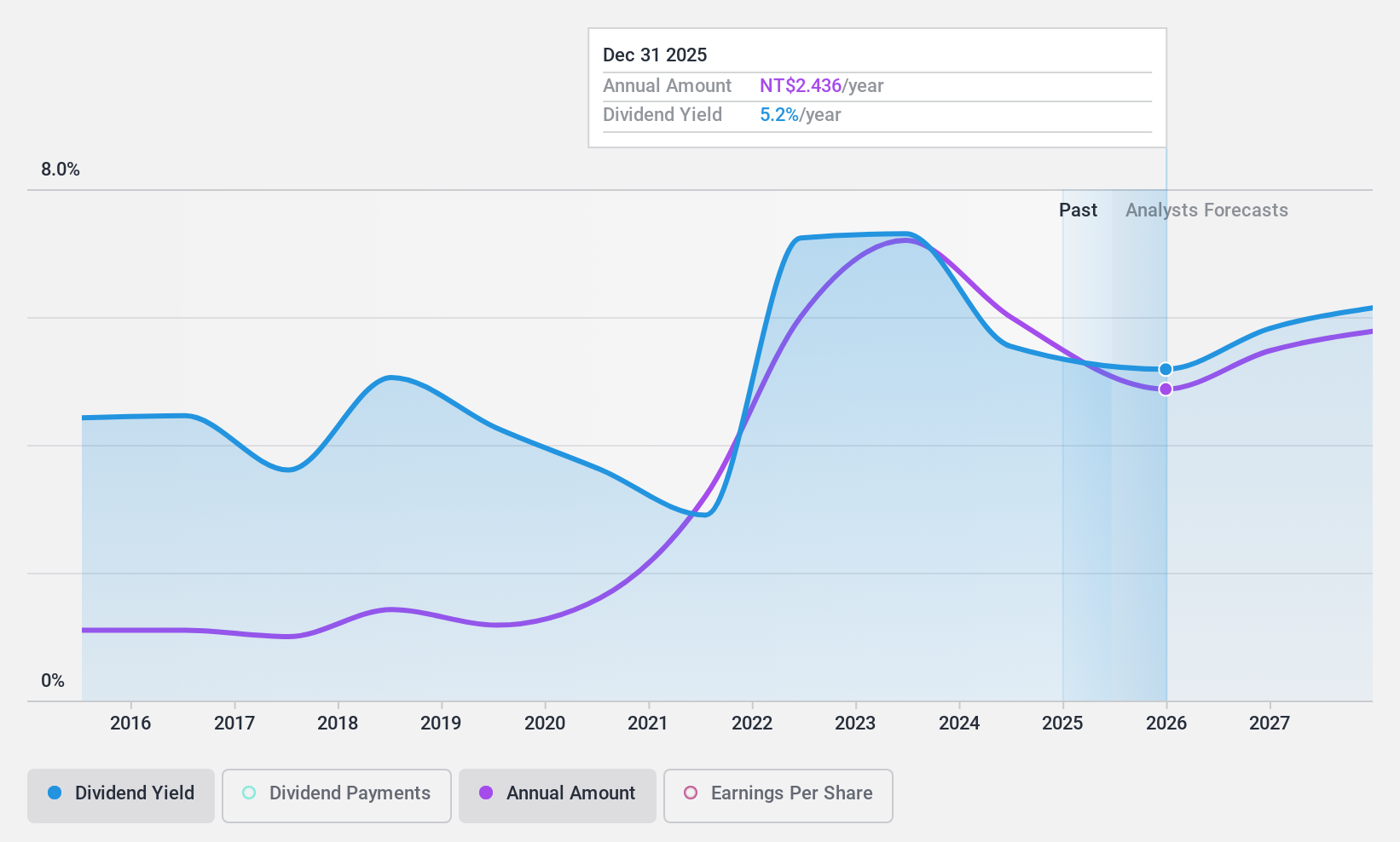

Dividend Yield: 5.3%

Simplo Technology's dividend yield is among the top 25% in Taiwan, but recent earnings reveal challenges. The company's Q3 2024 net income decreased to TWD 1.43 billion from TWD 1.59 billion a year ago, impacting its ability to sustain dividends, which are not covered by free cash flow due to a high cash payout ratio of 119.1%. Despite trading at good value and having increased dividends over the past decade, payments have been volatile and unreliable.

- Click to explore a detailed breakdown of our findings in Simplo Technology's dividend report.

- In light of our recent valuation report, it seems possible that Simplo Technology is trading behind its estimated value.

United Microelectronics (TWSE:2303)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: United Microelectronics Corporation is a semiconductor wafer foundry with operations in Taiwan, China, Hong Kong, Japan, Korea, the United States, Europe, and internationally; it has a market cap of NT$547.46 billion.

Operations: United Microelectronics Corporation generates revenue primarily from its Wafer Fabrication segment, which amounted to NT$226.87 billion.

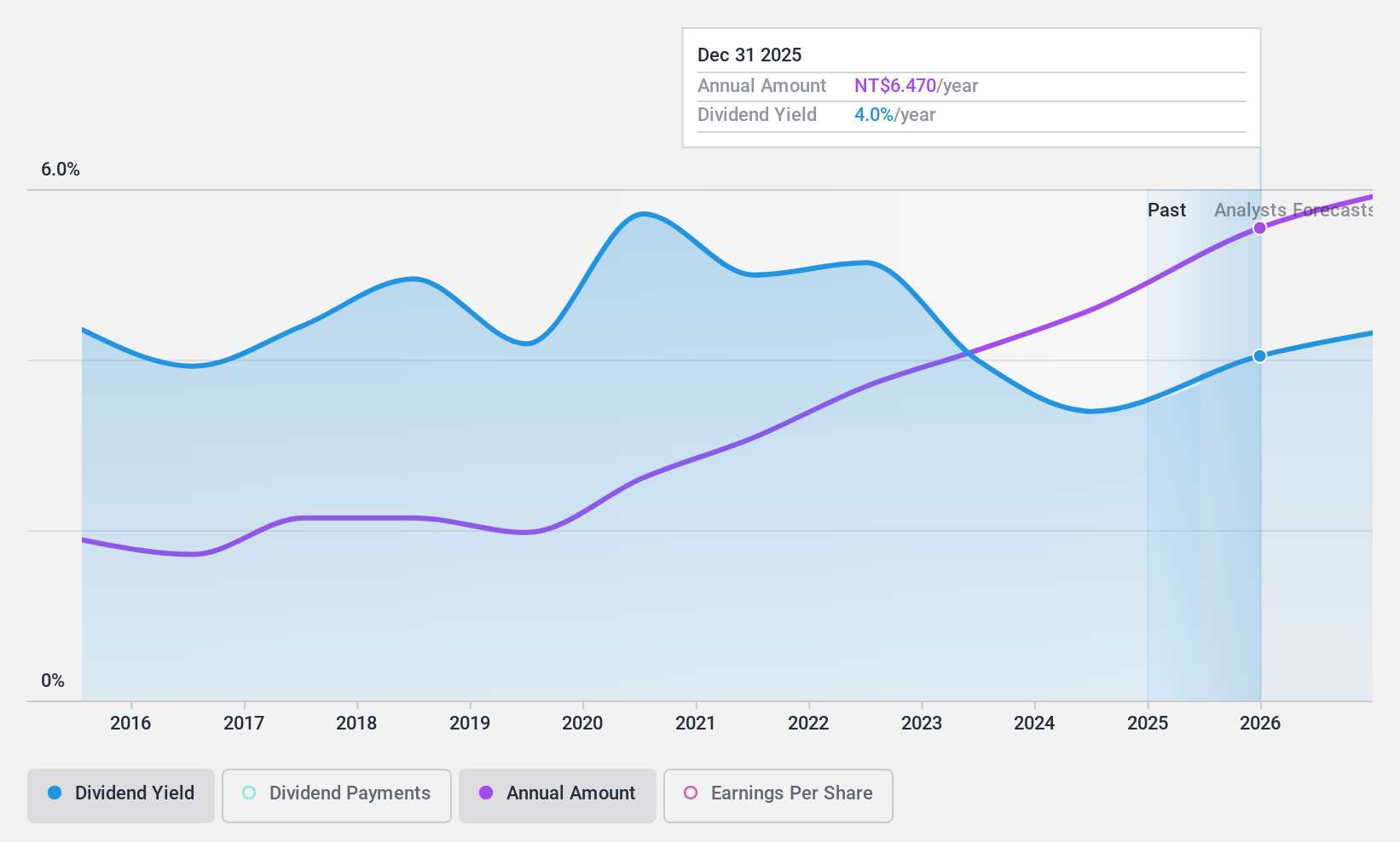

Dividend Yield: 7.0%

United Microelectronics offers a high dividend yield in Taiwan's top quartile, but its sustainability is questionable. The 6.97% dividend isn't backed by free cash flow and has been volatile over the past decade despite an increased payout ratio of 72.2%. Recent earnings show a decline in net income, with TWD 14.47 billion for Q3 2024 compared to TWD 15.97 billion last year, raising concerns about future dividend reliability amidst ongoing renewable energy investments.

- Take a closer look at United Microelectronics' potential here in our dividend report.

- Our comprehensive valuation report raises the possibility that United Microelectronics is priced lower than what may be justified by its financials.

Taiwan Hon Chuan Enterprise (TWSE:9939)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Taiwan Hon Chuan Enterprise Co., Ltd. manufactures and sells packaging materials for the food and beverage industries across Taiwan, Mainland China, Southeast Asia, and internationally, with a market cap of NT$41.73 billion.

Operations: Taiwan Hon Chuan Enterprise Co., Ltd.'s revenue is comprised of NT$10.09 billion from domestic sales and NT$17.65 billion from overseas markets.

Dividend Yield: 3.7%

Taiwan Hon Chuan Enterprise's dividend yield of 3.65% is below Taiwan's top quartile, and while dividends are covered by earnings with a 53.9% payout ratio, they aren't supported by free cash flows due to a high cash payout ratio of 831.7%. Despite stable and growing dividends over the past decade, the company's high debt level and recent private placement raise questions about future sustainability amidst strong earnings growth of 23.3% last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Taiwan Hon Chuan Enterprise.

- Our expertly prepared valuation report Taiwan Hon Chuan Enterprise implies its share price may be lower than expected.

Key Takeaways

- Embark on your investment journey to our 1967 Top Dividend Stocks selection here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:6121

Very undervalued with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives