- Japan

- /

- Electrical

- /

- TSE:6594

December 2024's Top Stock Picks Estimated To Be Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a complex landscape of interest rate adjustments and political uncertainties, investors are carefully assessing the implications for their portfolios. With U.S. stocks experiencing volatility amid cautious Federal Reserve commentary and looming government shutdown fears, the search for undervalued opportunities becomes increasingly pertinent. In such an environment, identifying stocks that are estimated to be below fair value can offer potential advantages by providing a margin of safety against market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hainan Jinpan Smart Technology (SHSE:688676) | CN¥43.72 | CN¥86.45 | 49.4% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1129.95 | ₹2250.68 | 49.8% |

| Sandy Spring Bancorp (NasdaqGS:SASR) | US$34.58 | US$68.97 | 49.9% |

| Lindab International (OM:LIAB) | SEK226.40 | SEK451.04 | 49.8% |

| Absolent Air Care Group (OM:ABSO) | SEK255.00 | SEK509.82 | 50% |

| STIF Société anonyme (ENXTPA:ALSTI) | €24.60 | €49.13 | 49.9% |

| Surgical Science Sweden (OM:SUS) | SEK159.10 | SEK317.00 | 49.8% |

| RENK Group (DB:R3NK) | €18.342 | €36.45 | 49.7% |

| Salmones Camanchaca (SNSE:SALMOCAM) | CLP2400.00 | CLP4798.13 | 50% |

| Paycor HCM (NasdaqGS:PYCR) | US$19.33 | US$38.52 | 49.8% |

Let's take a closer look at a couple of our picks from the screened companies.

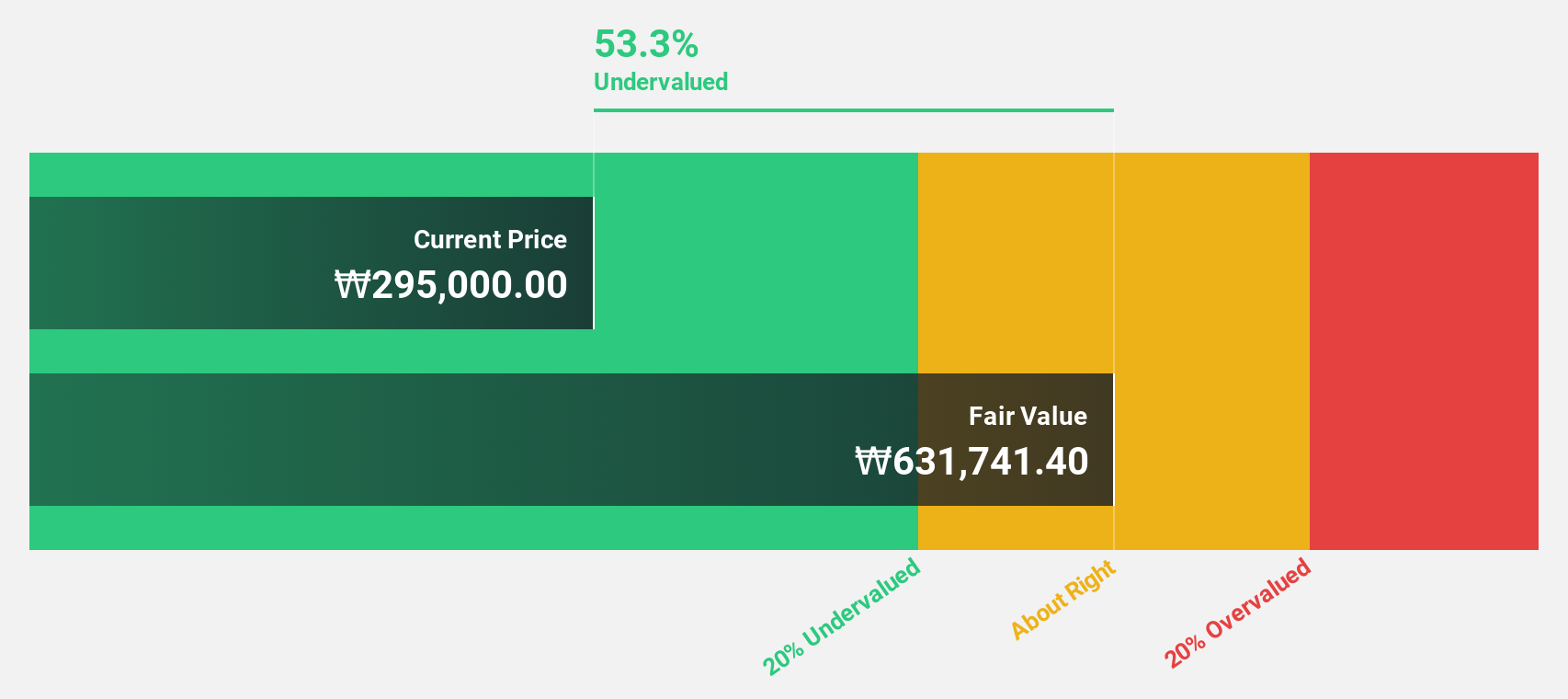

SK hynix (KOSE:A000660)

Overview: SK hynix Inc. is involved in the manufacture, distribution, and sale of semiconductor products across Korea, China, the rest of Asia, the United States, and Europe, with a market cap of approximately ₩117.21 trillion.

Operations: The company's revenue is primarily derived from the manufacture and sale of semiconductor products, amounting to approximately ₩57.73 billion.

Estimated Discount To Fair Value: 18.4%

SK hynix's recent developments in high-capacity SSDs and NAND technologies align with the growing AI market, potentially boosting future cash flows. The company reported a significant turnaround in profitability, with net income of KRW 5.75 trillion for Q3 2024, compared to a loss last year. Trading at approximately 18% below its fair value estimate of ₩214049.27, SK hynix appears undervalued based on discounted cash flow analysis despite moderate revenue growth forecasts.

- The analysis detailed in our SK hynix growth report hints at robust future financial performance.

- Navigate through the intricacies of SK hynix with our comprehensive financial health report here.

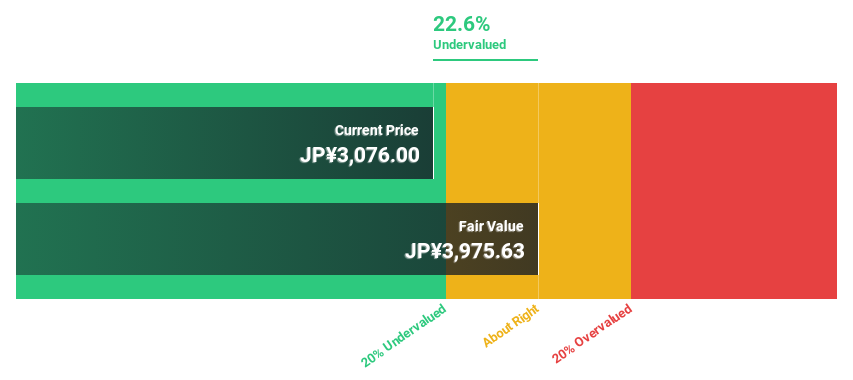

Nidec (TSE:6594)

Overview: Nidec Corporation, along with its subsidiaries, is engaged in the development, manufacturing, and sale of motors, electronics and optical components, and related products both in Japan and globally; it has a market capitalization of approximately ¥3.14 trillion.

Operations: Nidec's revenue segments include the development, manufacturing, and sale of motors, electronics and optical components, and related products both domestically in Japan and internationally.

Estimated Discount To Fair Value: 21.5%

Nidec is trading 21.5% below its estimated fair value of ¥3616.68, suggesting it may be undervalued based on cash flows. Earnings are forecast to grow significantly at 21% annually, outpacing the Japanese market's average growth rate. Recent collaboration with Renesas Electronics on an innovative E-Axle system for electric vehicles could enhance future cash flows by reducing costs and component size, potentially strengthening Nidec's position in the EV market.

- According our earnings growth report, there's an indication that Nidec might be ready to expand.

- Click here to discover the nuances of Nidec with our detailed financial health report.

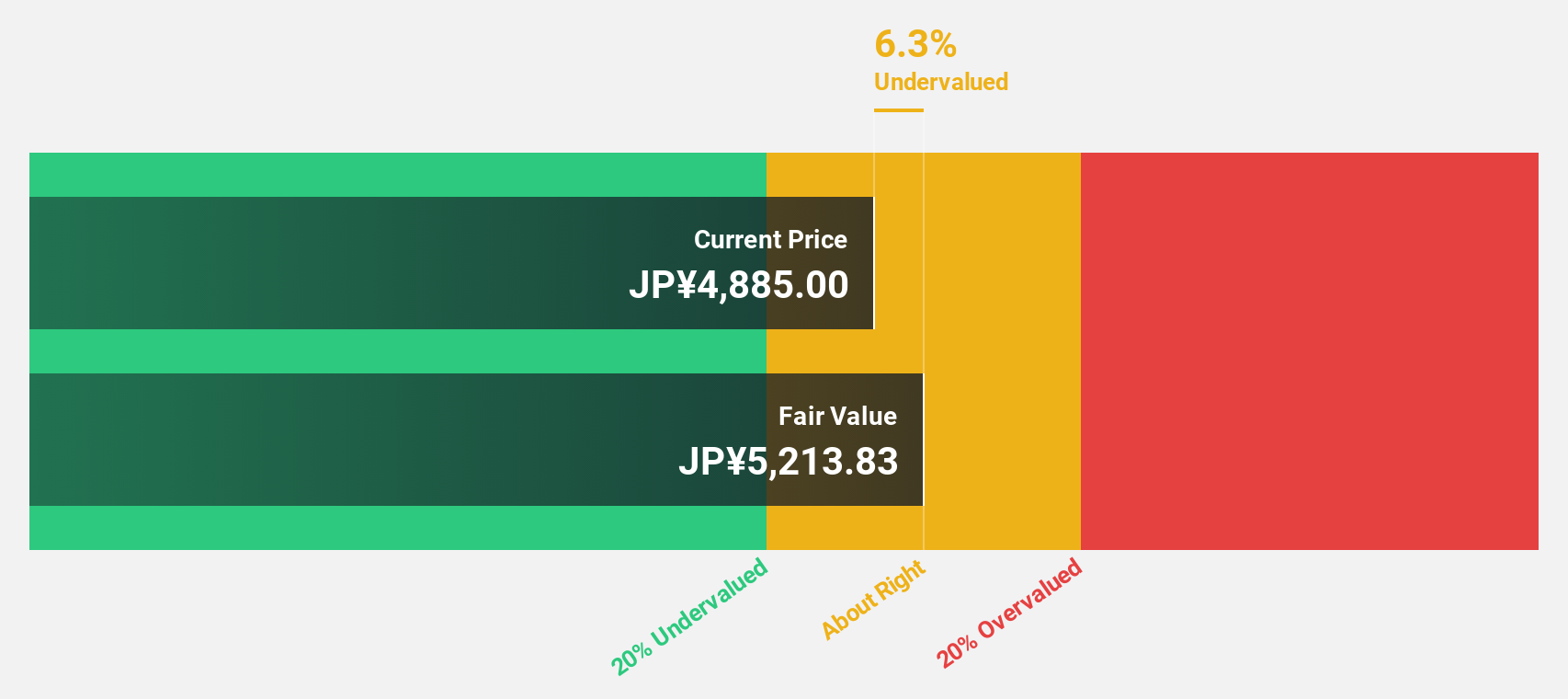

SBI Sumishin Net Bank (TSE:7163)

Overview: SBI Sumishin Net Bank, Ltd. offers a range of banking products and services to both individual and corporate clients in Japan, with a market cap of ¥583.53 billion.

Operations: The company's revenue is primarily derived from its Digital Bank Business, which accounts for ¥69.21 billion, and the THEMIX Business, contributing ¥266 million.

Estimated Discount To Fair Value: 17.5%

SBI Sumishin Net Bank's current share price of ¥3860 is 17.5% below its estimated fair value of ¥4676.41, indicating potential undervaluation based on cash flows. Earnings are projected to grow significantly at 24.2% annually over the next three years, surpassing the Japanese market's average growth rate. However, the bank maintains a low allowance for bad loans at 71%, and recent share price volatility could impact investor sentiment despite strong revenue forecasts.

- Our expertly prepared growth report on SBI Sumishin Net Bank implies its future financial outlook may be stronger than recent results.

- Unlock comprehensive insights into our analysis of SBI Sumishin Net Bank stock in this financial health report.

Make It Happen

- Click through to start exploring the rest of the 868 Undervalued Stocks Based On Cash Flows now.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nidec might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6594

Nidec

Develops, manufactures, and sells motors, electronics and optical components, and other related products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.