Upward Earnings Revision Might Change The Case For Investing In Takeuchi Mfg (TSE:6432)

Reviewed by Sasha Jovanovic

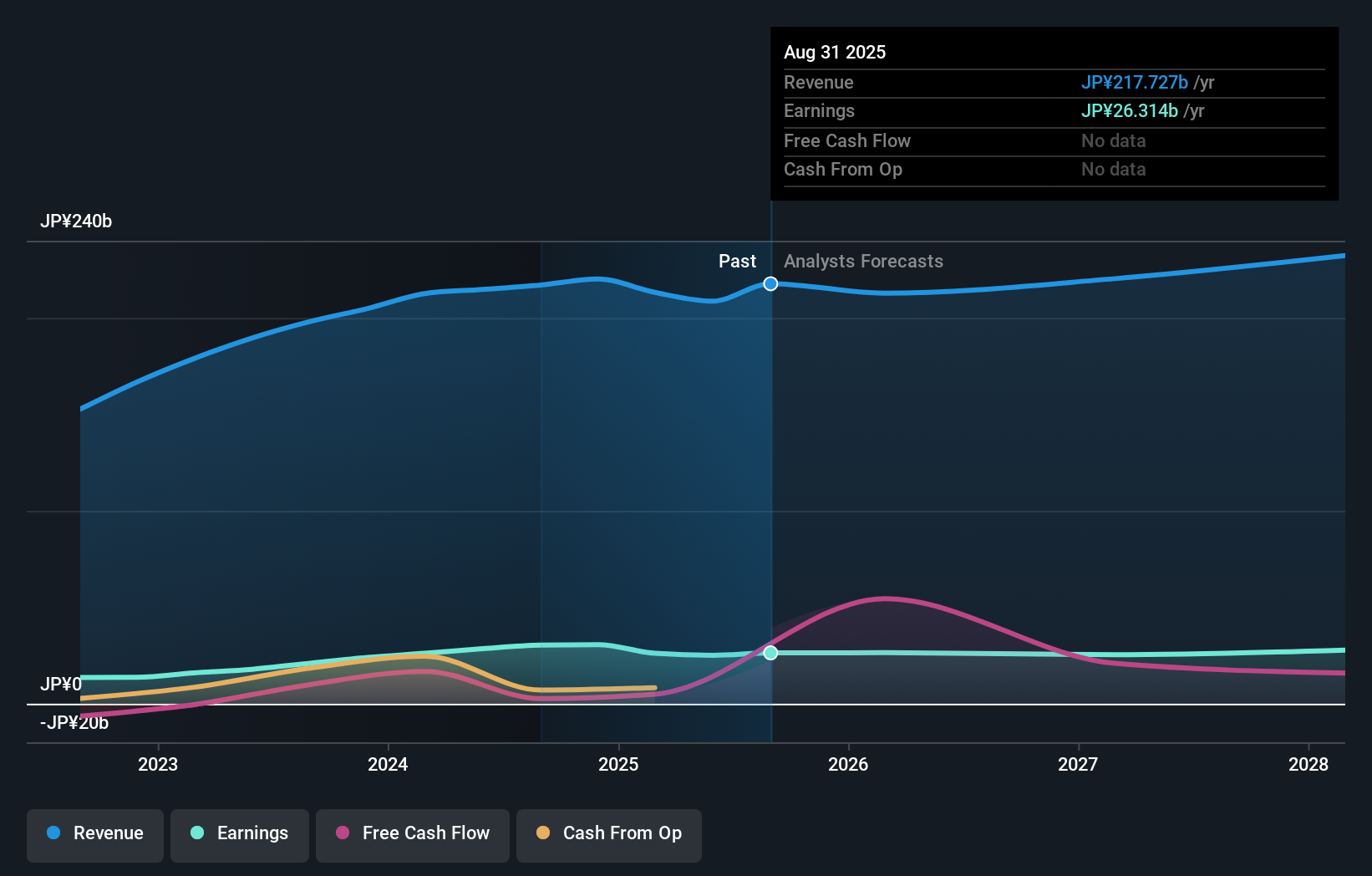

- Takeuchi Mfg. Co., Ltd. recently reported its consolidated financial results for the six months ended August 31, 2025, highlighting a 4.1% increase in net sales, a 5.9% decline in operating profit, and upward revisions to its earnings and dividend forecasts for the full year.

- Stronger-than-expected sales in North America and Europe prompted the company to raise its fiscal year outlook, underscoring the significance of international markets in offsetting regional challenges.

- We'll explore how Takeuchi Mfg's improved forecasts and emphasis on overseas growth may influence its overall investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

What Is Takeuchi Mfg's Investment Narrative?

To get behind Takeuchi Mfg., you need to believe in its ability to expand internationally and drive revenue despite short-term margin swings. The company’s revised guidance, fueled by robust North American and European sales, suggests overseas demand is outweighing mixed results in markets like France and Asia/Oceania. This upward revision to both earnings and dividends shifts the spotlight to export performance as the key near-term catalyst, potentially outweighing earlier concerns about slower domestic growth and operating margin compression. With the expansion of production capacity underway and expected dividend hikes, confidence in Takeuchi’s global positioning could now boost sentiment more significantly than previously anticipated. However, risks remain around sustaining margins and the pace of international growth, especially if input costs or overseas demand falter, which could quickly change the company's performance narrative.

But while sales momentum is promising, margin pressures are still a risk that investors should be aware of. Takeuchi Mfg's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

Explore 2 other fair value estimates on Takeuchi Mfg - why the stock might be worth over 2x more than the current price!

Build Your Own Takeuchi Mfg Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Takeuchi Mfg research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Takeuchi Mfg research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Takeuchi Mfg's overall financial health at a glance.

Searching For A Fresh Perspective?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Takeuchi Mfg might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6432

Takeuchi Mfg

Manufactures and sells construction machinery in Japan and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives