- Saudi Arabia

- /

- Metals and Mining

- /

- SASE:1321

Undiscovered Gems With Potential To Explore This January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to the recent political developments and economic indicators, with major indices like the S&P 500 reaching new highs, small-cap stocks have remained somewhat overshadowed by their larger counterparts. In this dynamic environment, identifying promising small-cap stocks requires a keen eye for companies with strong fundamentals and growth potential that can capitalize on current trends such as AI advancements and manufacturing rebounds.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Yantai Ishikawa Sealing Technology | NA | 0.96% | -9.28% | ★★★★★★ |

| Göltas Göller Bölgesi Cimento Sanayi ve Ticaret | 18.55% | 49.85% | 71.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Maezawa Kasei Industries | 0.81% | 2.30% | 18.80% | ★★★★★★ |

| Shandong Boyuan Pharmaceutical & Chemical | NA | 28.20% | 32.92% | ★★★★★★ |

| Center International GroupLtd | 27.06% | 1.89% | -39.77% | ★★★★★★ |

| Master Trust | 33.35% | 28.01% | 41.50% | ★★★★★☆ |

| Poly Plastic Masterbatch (SuZhou)Ltd | 2.80% | 17.08% | -4.11% | ★★★★★☆ |

| Zhejiang E-P Equipment | 15.30% | 21.69% | 32.47% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

East Pipes Integrated Company for Industry (SASE:1321)

Simply Wall St Value Rating: ★★★★★★

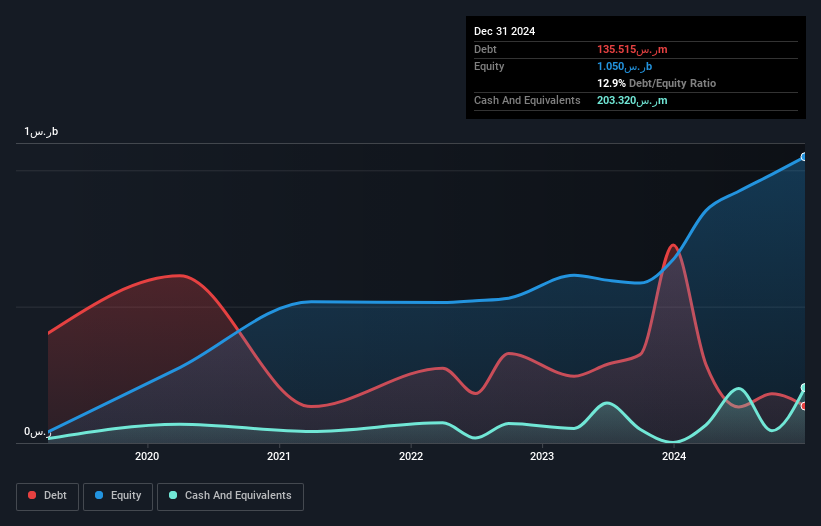

Overview: East Pipes Integrated Company for Industry manufactures and sells pipes, tubes, and hollow shapes from iron and steel in the Kingdom of Saudi Arabia, with a market capitalization of SAR5.07 billion.

Operations: East Pipes generates revenue primarily from its Machinery - Pumps segment, amounting to SAR2.18 billion.

East Pipes Integrated Company for Industry has made significant strides, showcasing robust growth in recent times. The company's earnings surged by 418%, outpacing the industry average of 114%. Over the past year, net income jumped to SAR 112.85 million from SAR 20.79 million, while sales climbed to SAR 540.15 million from SAR 230.27 million a year prior. A noteworthy contract valued at over SAR 57 million with Binyah and AI Rashid Trading is set to bolster future financials further, reflecting its strategic positioning in steel pipe manufacturing and supply within Saudi Arabia's infrastructure sector.

Guangdong Shunna Electric (SZSE:000533)

Simply Wall St Value Rating: ★★★★★★

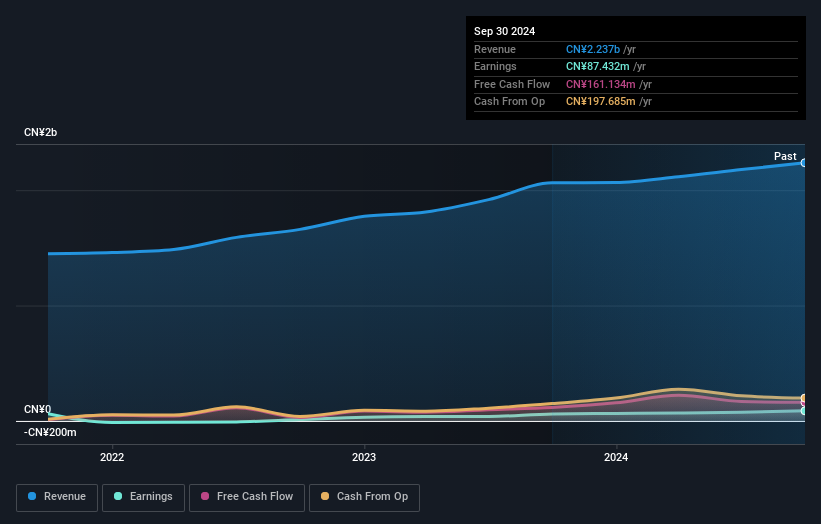

Overview: Guangdong Shunna Electric Co., Ltd. specializes in providing power transmission and distribution equipment in China, with a market cap of CN¥4.59 billion.

Operations: Guangdong Shunna Electric generates revenue primarily from the sale of power transmission and distribution equipment. The company focuses on optimizing its cost structure to enhance profitability, with particular attention to managing production costs. It has demonstrated a notable trend in its net profit margin, reflecting efficiency in converting revenue into actual profit.

Shunna Electric, a notable player in the electrical sector, has shown impressive earnings growth of 43.9% over the past year, outpacing its industry peers' 0.8%. This growth is supported by a significant reduction in its debt to equity ratio from 52.1% to 18.3% over five years, indicating improved financial health. The company's net debt to equity ratio stands at a satisfactory 4.7%, with interest payments well-covered by EBIT at 33 times coverage, reflecting strong operational efficiency. Despite recent share price volatility, Shunna trades at nearly 8% below estimated fair value and maintains high-quality earnings performance.

Tsubakimoto Chain (TSE:6371)

Simply Wall St Value Rating: ★★★★★★

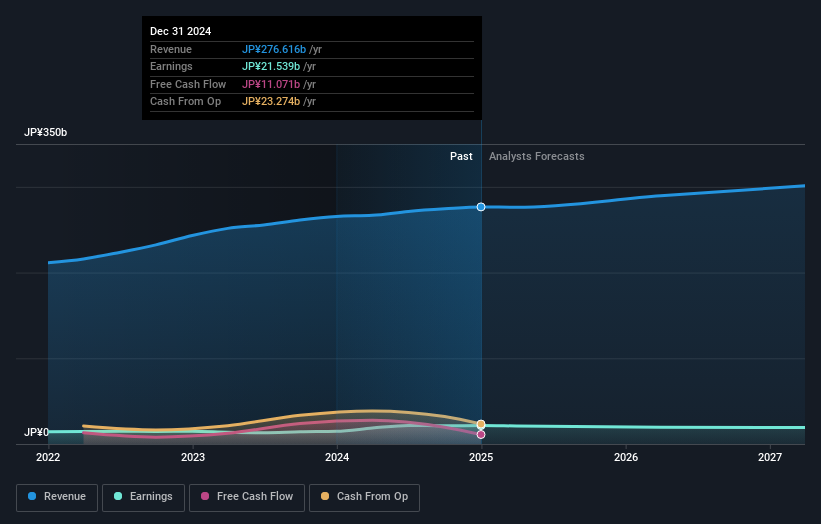

Overview: Tsubakimoto Chain Co. is a Japanese company that manufactures and sells components for chains, motion control, mobility, and materials handling systems with a market cap of ¥192.47 billion.

Operations: The company's primary revenue streams include Chain at ¥94.51 billion, Mobility at ¥88.71 billion, and Material Handling at ¥68.28 billion, with Motion Control contributing ¥22.93 billion.

Tsubakimoto Chain, a nimble player in the machinery sector, has seen its earnings surge by 48.9% over the past year, outpacing industry growth of 1.6%. The company is trading at a favorable value, with shares priced 42.1% below estimated fair value. Despite revising down its earnings guidance for fiscal year ending March 2025 due to challenges in Materials Handling Systems Operations and Motion Control Operations, Tsubakimoto remains financially sound with more cash than total debt and a reduced debt-to-equity ratio from 25.1% to 11.2% over five years. Recent share buybacks further indicate strategic financial management.

- Click here to discover the nuances of Tsubakimoto Chain with our detailed analytical health report.

Understand Tsubakimoto Chain's track record by examining our Past report.

Taking Advantage

- Get an in-depth perspective on all 4668 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East Pipes Integrated Company for Industry might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1321

East Pipes Integrated Company for Industry

Manufactures and sells pipes, tubes, and hollow shapes from iron and steel in the Kingdom of Saudi Arabia.

Outstanding track record with flawless balance sheet.

Market Insights

Community Narratives