- Japan

- /

- Specialty Stores

- /

- TSE:7545

Spotlighting December 2024's Undiscovered Gems with Promising Potential

Reviewed by Simply Wall St

As global markets navigate a cautious economic landscape marked by the Federal Reserve's recent rate cuts and political uncertainties, smaller-cap indexes have felt the brunt of investor trepidation, with notable declines in key benchmarks like the Russell 2000. In this environment, identifying stocks with strong fundamentals and resilience to macroeconomic shifts becomes crucial for uncovering potential opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Mandiri Herindo Adiperkasa | NA | 20.72% | 11.08% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Arab Insurance Group (B.S.C.) | NA | -59.20% | 20.33% | ★★★★★☆ |

| Eclatorq Technology | 37.47% | 8.43% | 18.41% | ★★★★★☆ |

| Chita Kogyo | 8.34% | 2.84% | 8.49% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Yuan Cheng CableLtd | 112.32% | 6.17% | 58.39% | ★★★★☆☆ |

Let's dive into some prime choices out of from the screener.

Tsubakimoto Chain (TSE:6371)

Simply Wall St Value Rating: ★★★★★★

Overview: Tsubakimoto Chain Co. is a Japanese company that manufactures and sells chains, motion control, mobility, and materials handling systems components with a market capitalization of ¥194.53 billion.

Operations: The primary revenue streams for Tsubakimoto Chain Co. are from its Chain and Mobility segments, generating ¥94.51 billion and ¥88.71 billion respectively. The Material Handling segment also contributes significantly with ¥68.28 billion in revenue, while the Motion Control segment adds ¥22.93 billion to the total revenue mix.

Tsubakimoto Chain, a notable player in the machinery sector, has seen its earnings grow by 48.9% over the past year, outpacing industry growth of just 0.8%. The company has successfully reduced its debt to equity ratio from 25.1% to 11.2% over five years and trades at a value significantly below estimated fair value by 41.2%. Recently, Tsubakimoto completed a substantial share buyback program, repurchasing approximately 5 million shares for ¥9.99 billion while also increasing dividends to JPY 99 per share from JPY 60 last year despite revising down their earnings guidance due to slower sales in Japan's Materials Handling Systems Operations.

Nishimatsuya Chain (TSE:7545)

Simply Wall St Value Rating: ★★★★★★

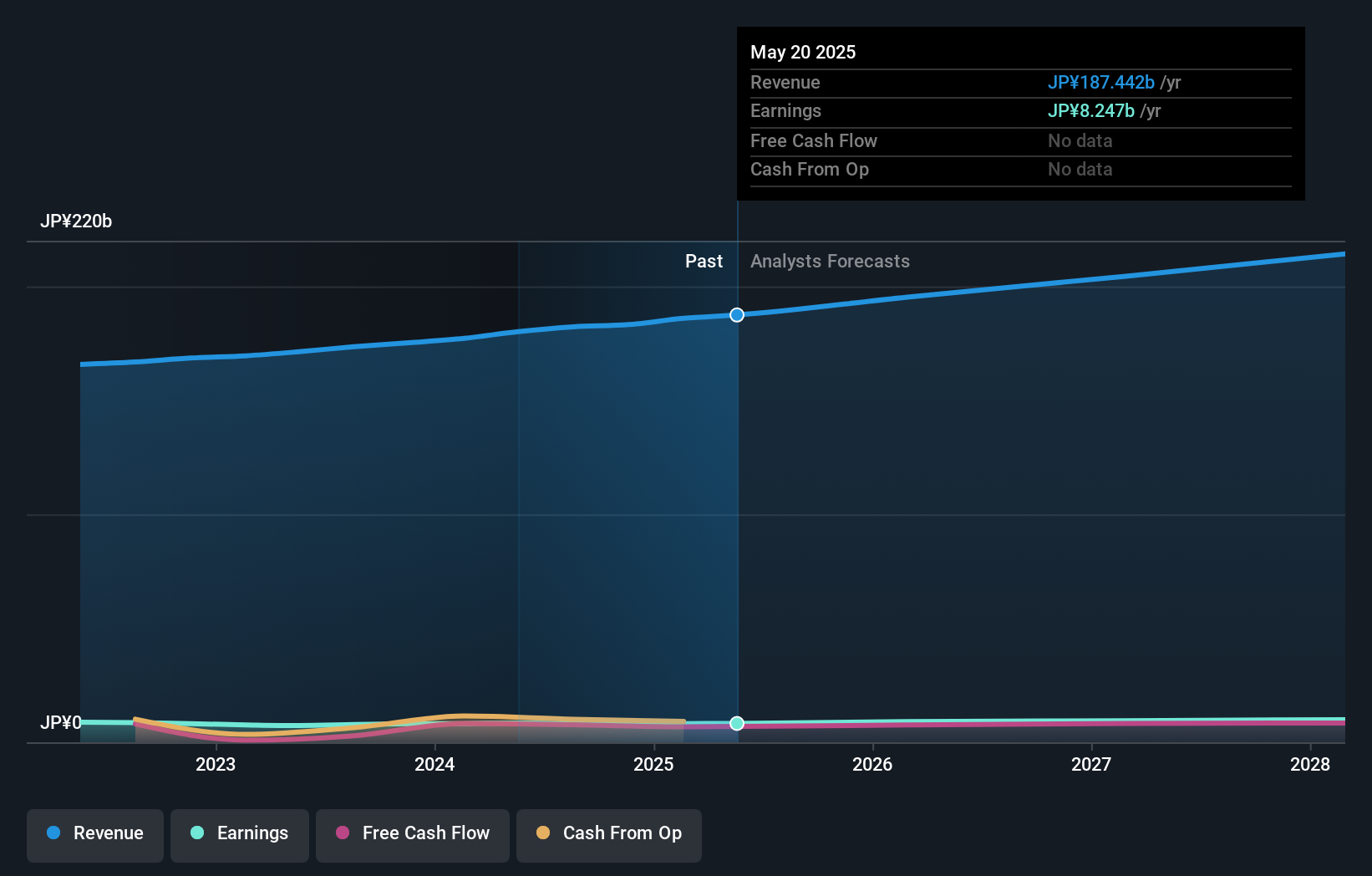

Overview: Nishimatsuya Chain Co., Ltd. operates a chain of specialty stores for baby and children's living goods in Japan, with a market cap of ¥135.70 billion.

Operations: The company's revenue primarily comes from its chain of specialty stores focused on baby and children's living goods in Japan. It is important to note that the market cap stands at ¥135.70 billion.

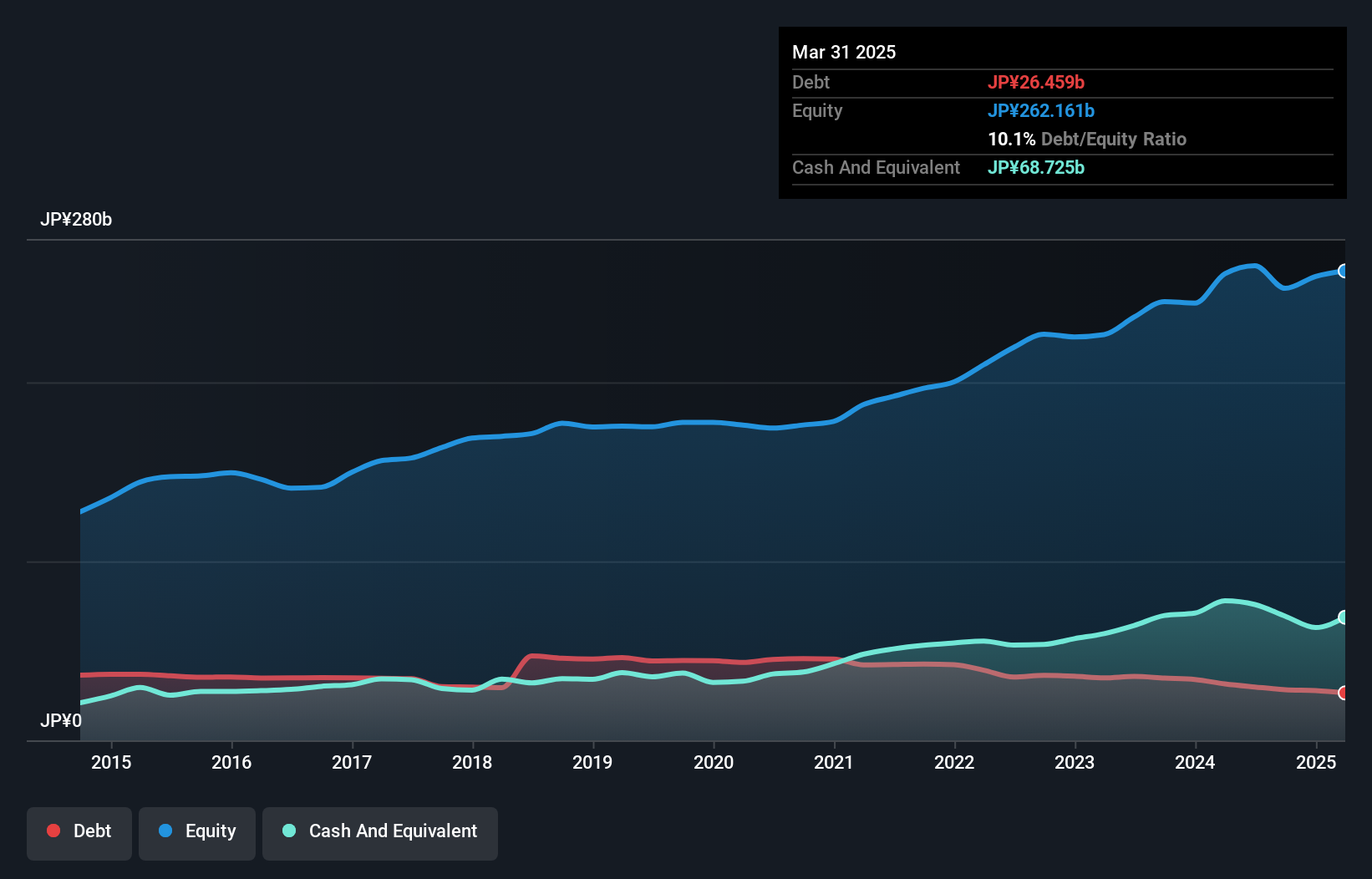

Nishimatsuya Chain, a notable player in specialty retail, exhibits strong financial health with earnings growing 17.6% annually over the past five years, despite recent growth of 5.6% not matching the industry's 10.5%. The company has more cash than total debt and trades at a value 20.1% below its estimated fair worth, suggesting potential undervaluation. Recently, it completed a share buyback of 200,100 shares for ¥499.78 million to enhance shareholder value and flexibility in capital policies amidst changing business conditions. This strategic move aligns with their consistent dividend policy of JPY 15 per share for fiscal year-end February 2025.

Chicony Power Technology (TWSE:6412)

Simply Wall St Value Rating: ★★★★★★

Overview: Chicony Power Technology Co., Ltd. is a Taiwanese company that develops, manufactures, and sells switching power supplies, electronic components and LED lighting modules, and smart building solutions with a market capitalization of approximately NT$47.49 billion.

Operations: Chicony Power Technology generates revenue primarily from its operations in Asia and domestic markets, with NT$31.32 billion and NT$35.12 billion respectively. The company faces a deduction of NT$31.18 billion due to internal segment activities, impacting its overall financial results.

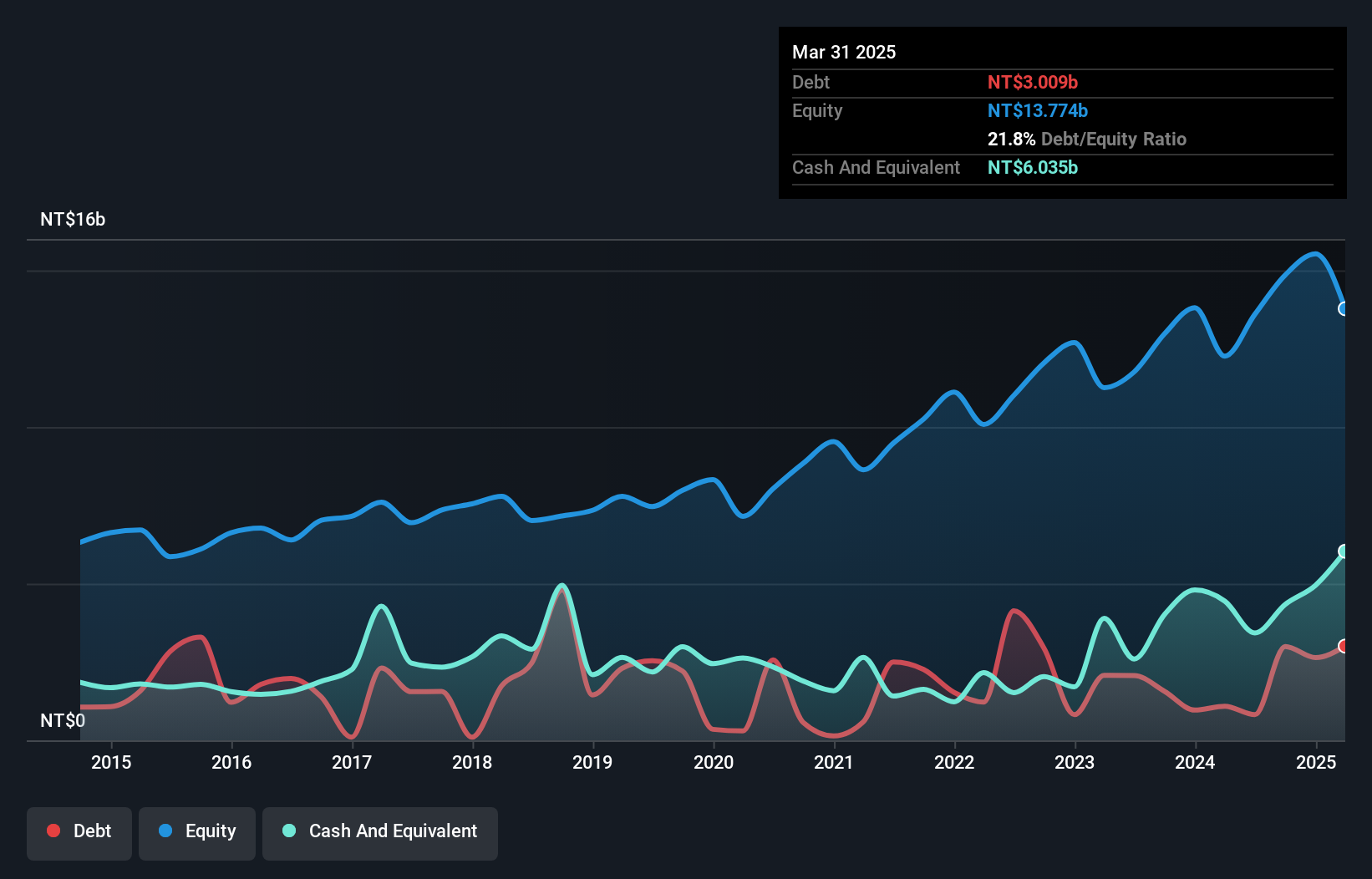

Chicony Power Technology, a dynamic player in the electrical industry, showcases a promising profile with its price-to-earnings ratio of 13.7x, which is attractively below the Taiwan market average of 20.8x. Over the past five years, it has successfully reduced its debt to equity ratio from 27.7% to 20.2%, reflecting prudent financial management. The company reported third-quarter sales of TWD 10 billion and net income slightly dipped to TWD 887 million compared to last year’s TWD 942 million; however, earnings per share for nine months improved from TWD 5.81 to TWD 6.19, indicating robust operational performance amidst challenging conditions.

- Click to explore a detailed breakdown of our findings in Chicony Power Technology's health report.

Gain insights into Chicony Power Technology's past trends and performance with our Past report.

Where To Now?

- Get an in-depth perspective on all 4625 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nishimatsuya Chain might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7545

Nishimatsuya Chain

Operates a chain of specialty stores for baby/children's living goods in Japan.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives