Humanoid Robotics Momentum Might Change The Case For Investing In Harmonic Drive Systems (TSE:6324)

Reviewed by Sasha Jovanovic

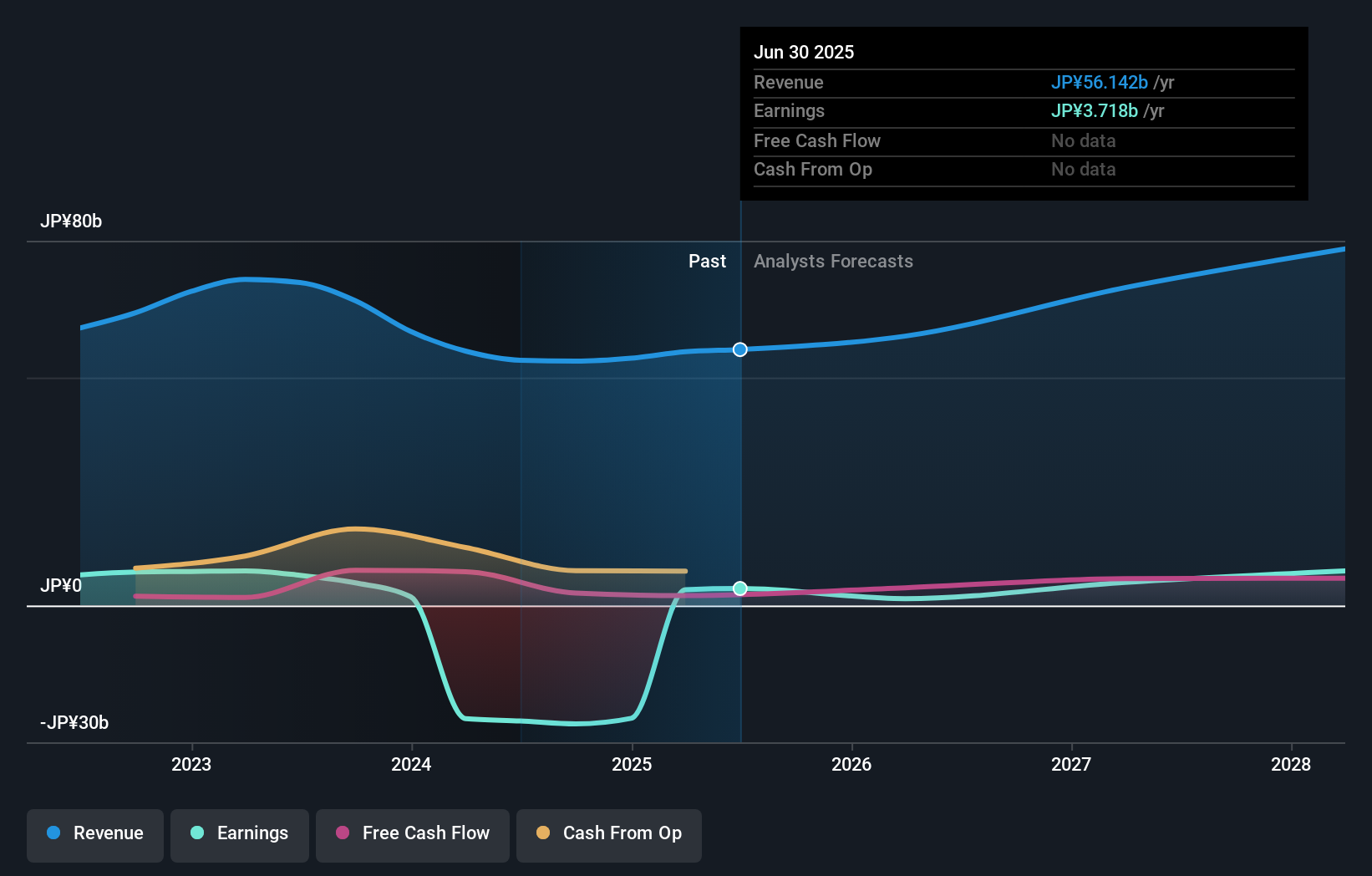

- Harmonic Drive Systems has been recognized as a strong contender in the humanoid robot market, maintaining investment in industrial robot facilities despite ongoing challenges in the automotive sector linked to a key customer, Nissan Motor.

- An important insight is that the company's expertise in precision control reducers continues to drive its relevance in robotics and automation, helping counterbalance difficulties in the automotive industry.

- To better understand Harmonic Drive Systems' investment positioning, we will explore how expectations for growth in humanoid robotics factor into its outlook.

The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

What Is Harmonic Drive Systems' Investment Narrative?

For investors considering Harmonic Drive Systems, the big-picture thesis hinges on the company’s niche in robotic precision components and its potential to ride the wave of humanoid automation. The recent news about ongoing investment in robot facilities, despite setbacks with Nissan, offers a measured boost to short-term optimism, aligning with hopes for robotics-driven growth. However, much of the company's expected momentum still depends on the broader adoption and scaling of humanoid robots, a catalyst that remains uncertain in near-term forecasts. The continued stability in dividends signals management’s confidence, yet the combination of high valuation multiples, recent share price volatility, and reliance on significant one-off earnings sets a complex scene. While the latest update underscores resilience, the material risks, especially concentrated customer exposure and expensive earnings ratios, deserve closer scrutiny in light of these new developments. On the flip side, risk tied to a single automotive customer is information investors should not overlook.

Harmonic Drive Systems' shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

Explore another fair value estimate on Harmonic Drive Systems - why the stock might be worth just ¥3651!

Build Your Own Harmonic Drive Systems Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Harmonic Drive Systems research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Harmonic Drive Systems research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Harmonic Drive Systems' overall financial health at a glance.

Seeking Other Investments?

Markets shift fast. These stocks won't stay hidden for long. Get the list while it matters:

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 32 best rare earth metal stocks of the very few that mine this essential strategic resource.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Harmonic Drive Systems might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6324

Harmonic Drive Systems

Produces and sells precision control equipment and components worldwide.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)