- Taiwan

- /

- Tech Hardware

- /

- TPEX:3213

3 High-Quality Dividend Stocks Yielding 3.2%

Reviewed by Simply Wall St

As global markets show resilience with U.S. indexes nearing record highs and broad-based gains across sectors, investors are navigating a complex economic landscape marked by geopolitical tensions and fluctuating interest rates. In this environment, high-quality dividend stocks yielding 3.2% can offer stability and income potential, making them an attractive option for those seeking to balance growth with reliable returns.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.78% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.20% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.61% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.58% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.30% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.78% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.79% | ★★★★★★ |

Click here to see the full list of 1960 stocks from our Top Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

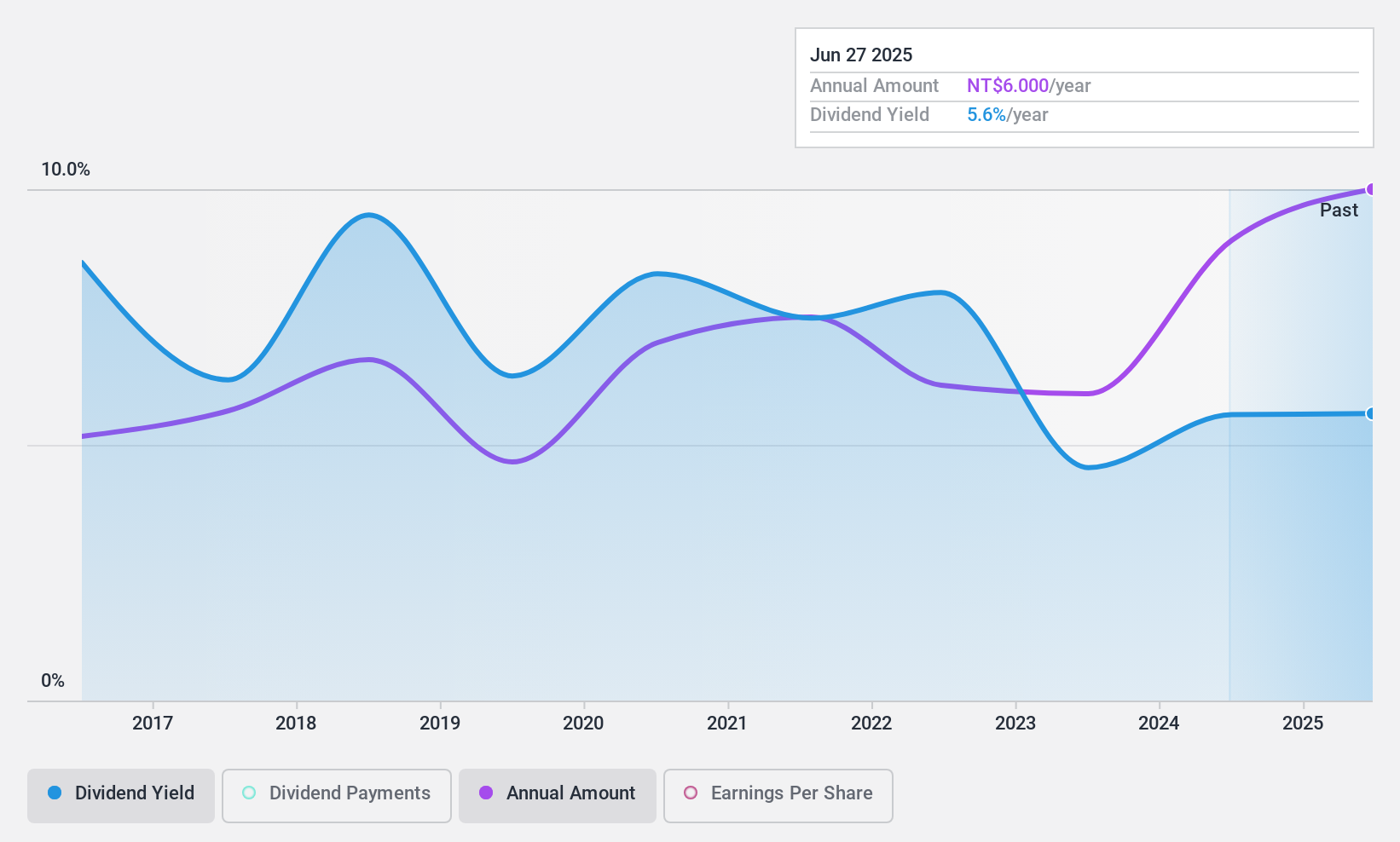

Mildef Crete (TPEX:3213)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mildef Crete Inc. develops, manufactures, and sells computer systems worldwide with a market capitalization of NT$5.13 billion.

Operations: Mildef Crete Inc.'s revenue is derived from its global operations in developing, manufacturing, and selling computer systems.

Dividend Yield: 6.2%

Mildef Crete's dividend yield of 6.17% ranks in the top 25% within the TW market. However, despite a reasonable payout ratio of 56.4%, dividends are not well-covered by cash flows, with a high cash payout ratio of 112.5%. Dividends have been volatile and unreliable over the past decade, though they have grown overall during this period. Recent earnings show decreased quarterly net income but increased year-to-date figures compared to last year.

- Unlock comprehensive insights into our analysis of Mildef Crete stock in this dividend report.

- Our valuation report unveils the possibility Mildef Crete's shares may be trading at a discount.

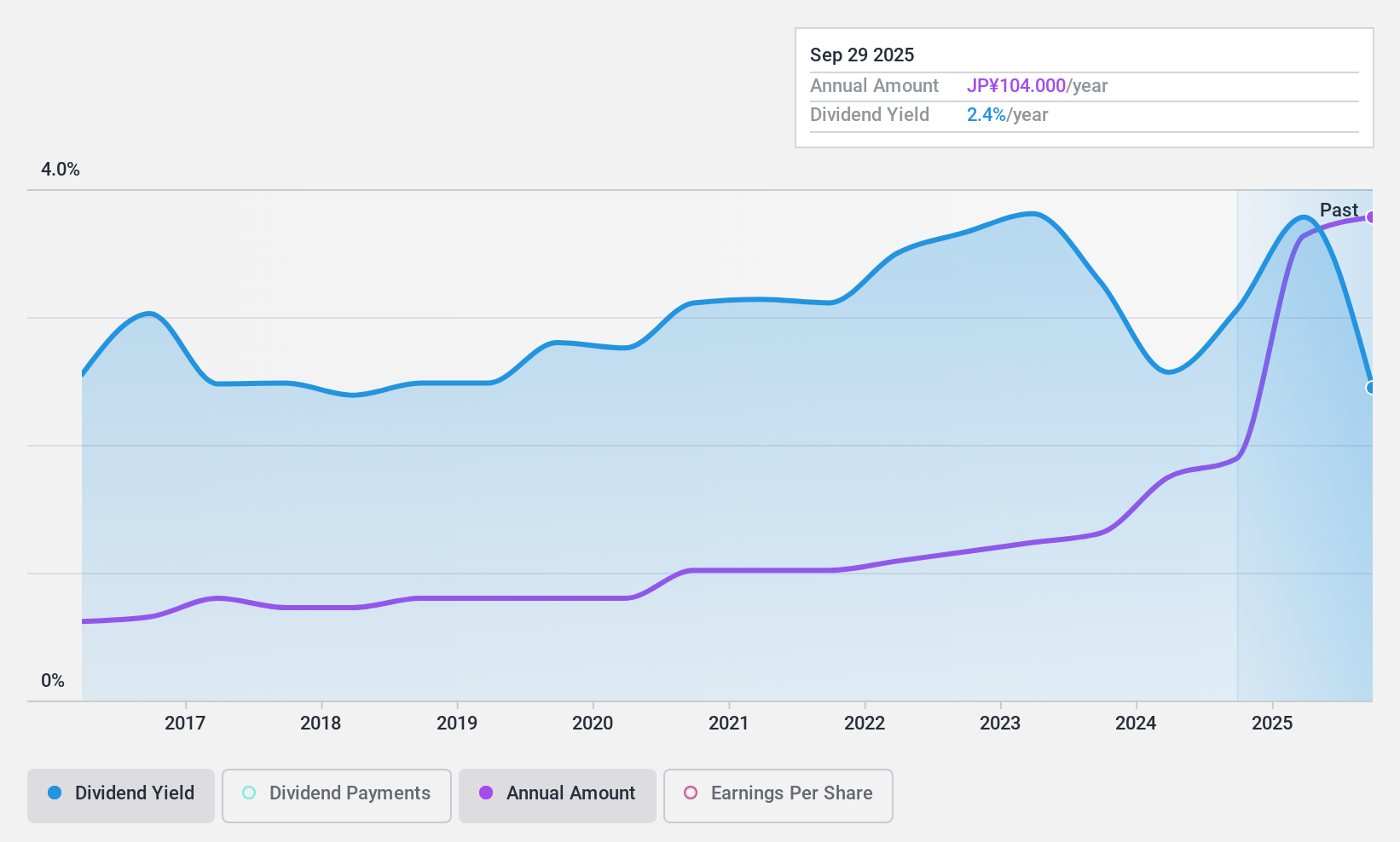

Techno Ryowa (TSE:1965)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Techno Ryowa Ltd. specializes in the design, construction, and maintenance of environmental control systems primarily in Japan, with a market cap of ¥49.59 billion.

Operations: Techno Ryowa Ltd.'s revenue is primarily derived from its Air Conditioning Sanitary Equipment Construction Business at ¥48.01 billion, followed by General Building Equipment Work at ¥25.11 billion, Electrical Equipment Construction Business at ¥2.62 billion, and Cooling and Heating Equipment Sales Segment at ¥1.20 billion.

Dividend Yield: 4.2%

Techno Ryowa's dividend yield of 4.24% is among the top 25% in Japan, yet it's not covered by free cash flows despite a low payout ratio of 13.7%. Earnings surged by 77.5% last year, but dividends have been volatile and unreliable over the past decade. The company's price-to-earnings ratio is favorable at 10x compared to the market average of 13.6x, though its share price has been highly volatile recently.

- Click here and access our complete dividend analysis report to understand the dynamics of Techno Ryowa.

- Our valuation report here indicates Techno Ryowa may be overvalued.

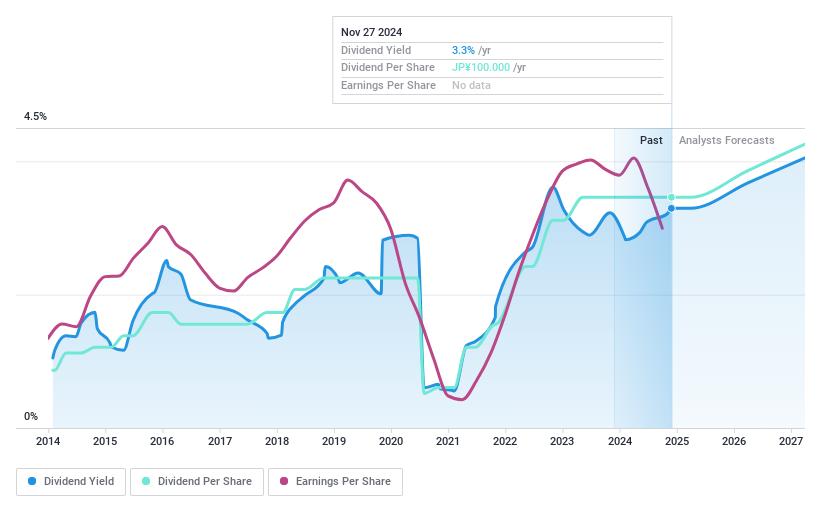

Okuma (TSE:6103)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Okuma Corporation is a manufacturer and seller of machine tools, NC controllers, FA products, and servo motors across Japan, the United States, the rest of the Americas, Europe, China, and the Asia Pacific with a market cap of ¥188.16 billion.

Operations: Revenue Segments (in millions of ¥): Machine Tools: ¥200,000; NC Controllers: ¥50,000; FA Products: ¥30,000; Servo Motors: ¥20,000.

Dividend Yield: 3.2%

Okuma Corporation's dividend yield is modest compared to the top 25% of Japanese dividend payers, yet its dividends are well-covered by earnings and cash flow, with payout ratios of 42.9% and 37.1%, respectively. Despite a volatile dividend history over the past decade, recent affirmations maintain payouts at ¥100 per share. However, lowered earnings guidance due to weaker-than-expected sales might impact future dividend stability despite current coverage adequacy.

- Take a closer look at Okuma's potential here in our dividend report.

- According our valuation report, there's an indication that Okuma's share price might be on the cheaper side.

Turning Ideas Into Actions

- Explore the 1960 names from our Top Dividend Stocks screener here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3213

Mildef Crete

Research, designs, plans, manufactures, sell, imports, and exports computer software, hardware, and components in Taiwan, Germany, the United Kingdom, Sweden, the United States, and internationally.

Flawless balance sheet with solid track record and pays a dividend.