- Japan

- /

- Construction

- /

- TSE:1888

DB Insurance And 2 Other Reliable Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets navigate the early days of President Trump's administration, U.S. stocks have been buoyed by optimism surrounding potential trade deals and AI investments, with major indices like the S&P 500 reaching new record highs. In this environment of cautious optimism and economic shifts, dividend stocks such as DB Insurance offer investors a potential source of steady income and stability amidst market fluctuations.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.19% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 5.94% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.52% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 3.90% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.34% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.93% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.52% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.12% | ★★★★☆☆ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

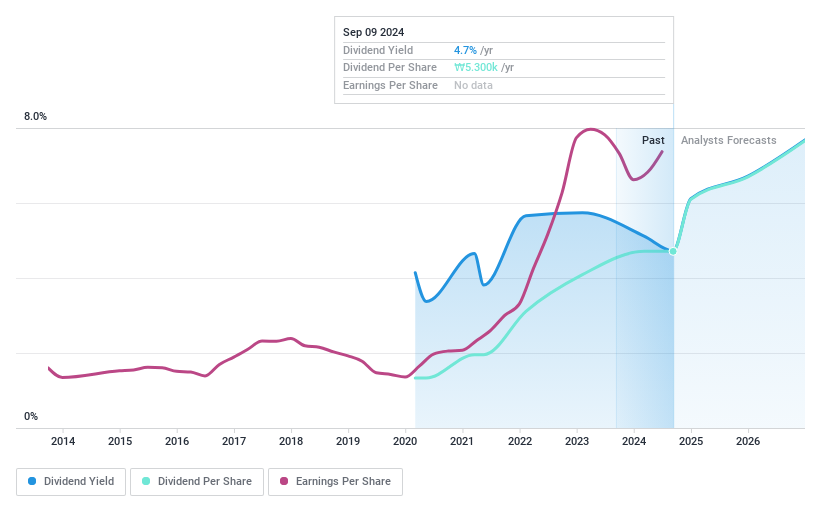

DB Insurance (KOSE:A005830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: DB Insurance Co., Ltd. offers a range of insurance products and services in South Korea, with a market cap of ₩5.50 trillion.

Operations: DB Insurance Co., Ltd.'s revenue is primarily derived from its Non-Life Insurance Sector at ₩19.44 billion, followed by the Life Insurance Sector at ₩1.49 billion and the Installment Finance Sector at ₩39.43 million.

Dividend Yield: 5.5%

DB Insurance offers a compelling dividend profile, trading significantly below its estimated fair value and analyst price targets. With a cash payout ratio of 7.9% and an earnings payout ratio of 15.9%, dividends are well-covered by both cash flows and earnings, ensuring sustainability. Although it has only been paying dividends for five years, the payments have been reliable and growing steadily. Its dividend yield is among the top 25% in the Korean market.

- Click here to discover the nuances of DB Insurance with our detailed analytical dividend report.

- Our expertly prepared valuation report DB Insurance implies its share price may be lower than expected.

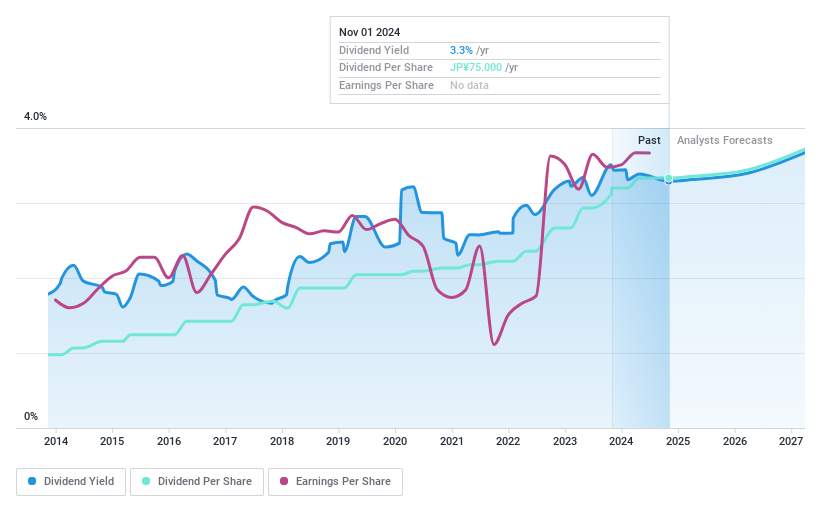

Wakachiku Construction (TSE:1888)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Wakachiku Construction Co., Ltd. operates in the construction and real estate sectors, with a market cap of ¥46.25 billion.

Operations: Wakachiku Construction Co., Ltd. generates revenue primarily from its construction business, which accounts for ¥82.49 billion, and its real estate segment, contributing ¥446 million.

Dividend Yield: 3.3%

Wakachiku Construction's dividend profile is characterized by a decade of reliable, stable growth, supported by a low cash payout ratio of 16.9%, ensuring coverage by cash flows and earnings. The dividend yield stands at 3.27%, which is below the top quartile in Japan but remains attractive due to sustainability factors like a modest payout ratio of 49.9%. Trading significantly below estimated fair value enhances its appeal despite declining profit margins from last year.

- Navigate through the intricacies of Wakachiku Construction with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Wakachiku Construction's share price might be too pessimistic.

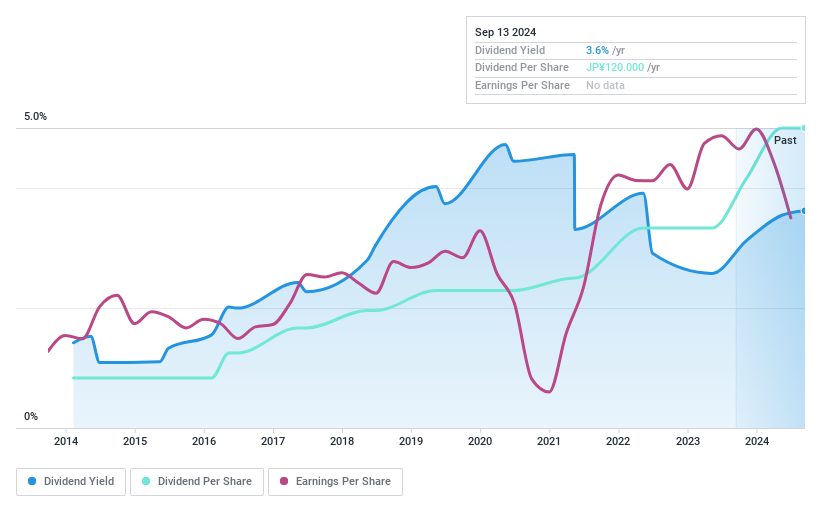

Sekisui Chemical (TSE:4204)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sekisui Chemical Co., Ltd. operates in the housing, urban infrastructure and environmental products, high performance plastics, and medical sectors with a market cap of ¥1.02 trillion.

Operations: Sekisui Chemical Co., Ltd. generates revenue from its Housing segment at ¥518.52 billion, High Performance Plastics at ¥433.73 billion, Environment and Lifelines at ¥238.56 billion, and Medical segment at ¥96.82 billion.

Dividend Yield: 2.9%

Sekisui Chemical's dividend profile is mixed, with recent guidance increasing the year-end dividend to ¥40.00. However, its dividends have been volatile over the past decade, despite being covered by earnings and cash flows with payout ratios of 41.9% and 57.9%, respectively. The current yield of 2.94% is below Japan's top quartile payers but reflects a growing trend in payments over ten years, supported by moderate earnings growth forecasts and strategic business expansions in solar technology.

- Get an in-depth perspective on Sekisui Chemical's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Sekisui Chemical is trading behind its estimated value.

Seize The Opportunity

- Click this link to deep-dive into the 1938 companies within our Top Dividend Stocks screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Wakachiku Construction, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Wakachiku Construction might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1888

Wakachiku Construction

Engages in construction and real estate businesses.

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives