Exploring Global Opportunities With 3 Promising Undiscovered Gems

Reviewed by Simply Wall St

As global markets navigate a landscape marked by mixed performances and trade negotiations, small- and mid-cap indexes have shown resilience, posting gains for the fifth consecutive week amid hopes for tariff de-escalation. In this dynamic environment, identifying promising stocks often involves looking beyond headline-grabbing giants to uncover lesser-known companies with strong fundamentals and growth potential.

Top 10 Undiscovered Gems With Strong Fundamentals Globally

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| ManpowerGroup Greater China | NA | 15.01% | 0.09% | ★★★★★★ |

| Thai Steel Cable | NA | 3.84% | 18.67% | ★★★★★★ |

| Taiyo KagakuLtd | 0.69% | 5.32% | -0.36% | ★★★★★☆ |

| Eclatorq Technology | 20.08% | 12.22% | 22.98% | ★★★★★☆ |

| Shanghai Pioneer Holding | 5.59% | 4.81% | 18.60% | ★★★★★☆ |

| Union Coop | 3.73% | -4.15% | -13.19% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Billion Industrial Holdings | 7.13% | 18.54% | -14.41% | ★★★★★☆ |

| VCREDIT Holdings | 115.47% | 25.47% | 30.34% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

We'll examine a selection from our screener results.

Ningbo Ocean Shipping (SHSE:601022)

Simply Wall St Value Rating: ★★★★★★

Overview: Ningbo Ocean Shipping Co., Ltd. offers shipping services across Japan, South Korea, Taiwan, and Southeast Asia with a market cap of CN¥10.93 billion.

Operations: Ningbo Ocean Shipping generates revenue primarily from its shipping services in East Asia. The company's net profit margin was 15.2% in the most recent financial period.

Ningbo Ocean Shipping, a relatively small player in the shipping industry, showcases promising financials with earnings growing 2.7% annually over five years. The company has effectively reduced its debt-to-equity ratio from 34.2% to 11.9%, indicating prudent financial management. Despite not outpacing the industry's recent growth of 33.3%, Ningbo's net income rose to CNY 175 million for Q1 2025 from CNY 167 million a year prior, reflecting steady performance amidst industry challenges. With a price-to-earnings ratio of 21x below the market average and more cash than total debt, it appears well-positioned for future opportunities in its sector.

- Dive into the specifics of Ningbo Ocean Shipping here with our thorough health report.

Gain insights into Ningbo Ocean Shipping's past trends and performance with our Past report.

Toshiba Tec (TSE:6588)

Simply Wall St Value Rating: ★★★★★☆

Overview: Toshiba Tec Corporation provides retail and workplace solutions both in Japan and internationally, with a market cap of ¥146.99 billion.

Operations: The company generates revenue primarily through its retail and workplace solutions. Recent financial data indicates a net profit margin of 3.5%. With a market cap of ¥146.99 billion, the business operates on an international scale, focusing on these core segments for income generation.

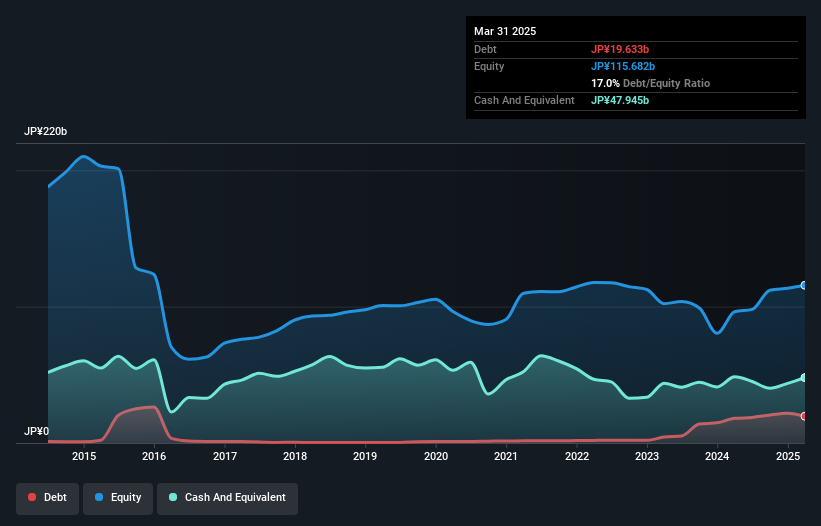

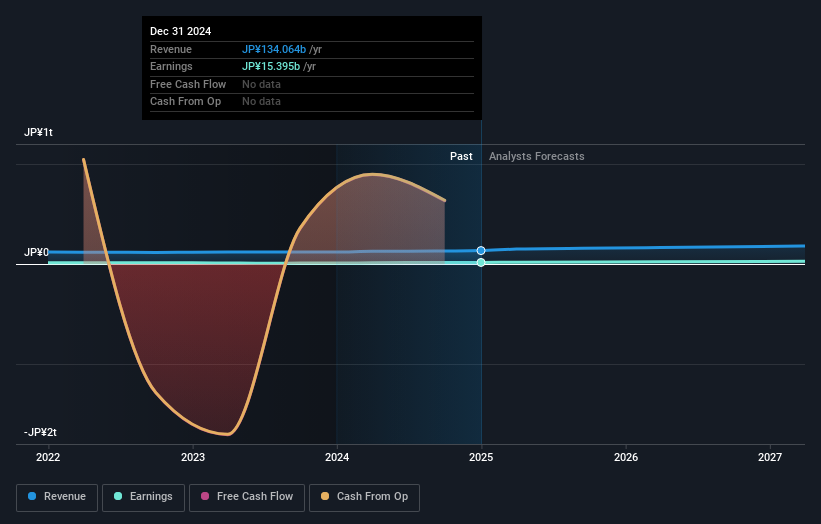

Toshiba Tec, a notable player in the tech space, has recently turned profitable, outperforming the industry's 7.2% growth rate. However, its debt-to-equity ratio has risen from 1.2% to 17% over five years, though it holds more cash than total debt. A significant one-off gain of ¥24 billion impacted its financials for the year ending March 2025. Trading at a discount of nearly 29% below estimated fair value and with strong interest coverage (29x EBIT), Toshiba Tec's structural reforms aim to boost sustainable growth in overseas retail solutions despite forecasted earnings declines of about 16.5% annually over three years.

- Click to explore a detailed breakdown of our findings in Toshiba Tec's health report.

Examine Toshiba Tec's past performance report to understand how it has performed in the past.

North Pacific BankLtd (TSE:8524)

Simply Wall St Value Rating: ★★★★☆☆

Overview: North Pacific Bank, Ltd. offers a range of banking products and services to individuals and corporations in Japan, with a market cap of ¥194.67 billion.

Operations: North Pacific Bank, Ltd. generates revenue primarily through interest income from loans and advances to customers, along with fees and commissions from various banking services. The bank's cost structure includes interest expenses on deposits and borrowings as well as operational costs associated with providing its services. A notable financial metric is the net profit margin, which reflects the bank's efficiency in converting revenue into profit after accounting for all expenses.

North Pacific Bank has seen a robust earnings growth of 71.8% over the past year, outpacing the industry average of 31.4%. With total assets at ¥13,175.9 billion and equity standing at ¥416.1 billion, it demonstrates a solid financial foundation. The bank's non-performing loans are maintained at an appropriate level of 1.1%, though its allowance for bad loans is low at 53%. Recent share repurchases amounted to 6,178,500 shares for ¥3,199.97 million, reflecting efforts to enhance shareholder returns and improve capital efficiency amidst volatile share prices in recent months.

Key Takeaways

- Unlock our comprehensive list of 3240 Global Undiscovered Gems With Strong Fundamentals by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade North Pacific BankLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if North Pacific BankLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8524

North Pacific BankLtd

Provides various banking products and services for individuals and corporations in Japan.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives