- Taiwan

- /

- Electronic Equipment and Components

- /

- TPEX:3689

Unearthing February 2025 Undiscovered Gems on None

Reviewed by Simply Wall St

As global markets continue to react to heightened inflation and shifting economic policies, U.S. stock indexes are climbing toward record highs, with growth stocks outpacing their value counterparts. Despite small-cap stocks lagging behind larger indices like the S&P 500, the current market environment presents a unique opportunity for investors to identify undiscovered gems that may offer potential growth as conditions evolve. In this context, recognizing stocks with strong fundamentals and resilience in uncertain times can be crucial for uncovering promising investment opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Zona Franca de Iquique | NA | 7.94% | 12.83% | ★★★★★★ |

| Zambia Sugar | 1.04% | 20.60% | 44.34% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| ASA Gold and Precious Metals | NA | 7.47% | -26.86% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Watt's | 70.56% | 7.69% | -0.53% | ★★★★★☆ |

| National General Insurance (P.J.S.C.) | NA | 11.69% | 30.36% | ★★★★★☆ |

| Sociedad Matriz SAAM | 38.79% | -0.59% | -19.23% | ★★★★☆☆ |

| BOSQAR d.d | 94.35% | 39.11% | 23.56% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Shenzhen Honor Electronic (SZSE:300870)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Honor Electronic Co., Ltd. is a global manufacturer of switching power adapters with a market cap of CN¥12.25 billion.

Operations: Shenzhen Honor Electronic generates revenue primarily from the sale of switching power adapters. The company's net profit margin has shown an upward trend, increasing from 5% to 7% over recent periods.

Shenzhen Honor Electronic's recent performance showcases a dynamic yet challenging landscape. With earnings surging by 234% over the past year, it outpaced the electrical industry average of 1%. The company boasts high-quality earnings and maintains more cash than its total debt, reflecting financial prudence. However, its debt-to-equity ratio has climbed from 6.5 to 54.4 over five years, suggesting increased leverage. Despite this, free cash flow turned positive recently at US$13 million as of September 2024 after fluctuating significantly in prior periods. Earnings are projected to grow annually by nearly 16%, indicating potential for future expansion amidst market volatility.

- Get an in-depth perspective on Shenzhen Honor Electronic's performance by reading our health report here.

Gain insights into Shenzhen Honor Electronic's past trends and performance with our Past report.

U.D. Electronic (TPEX:3689)

Simply Wall St Value Rating: ★★★★★★

Overview: U.D. Electronic Corp. is engaged in the research, manufacturing, and sale of electronic components, materials, and connectors primarily in Taiwan and China, with a market capitalization of NT$8.59 billion.

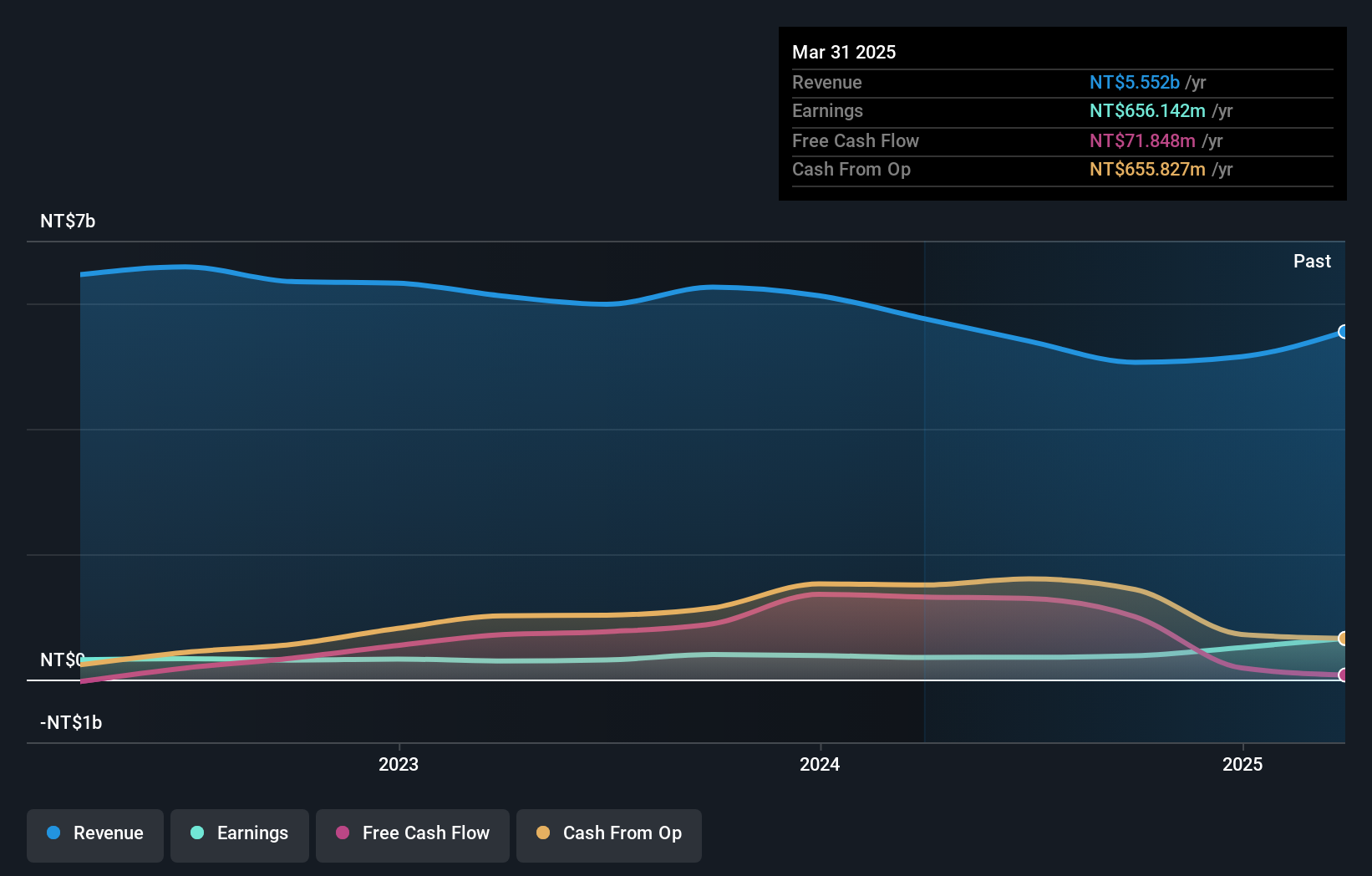

Operations: The company generates revenue primarily from the trading of signal connector manufacturing, amounting to NT$5.06 billion.

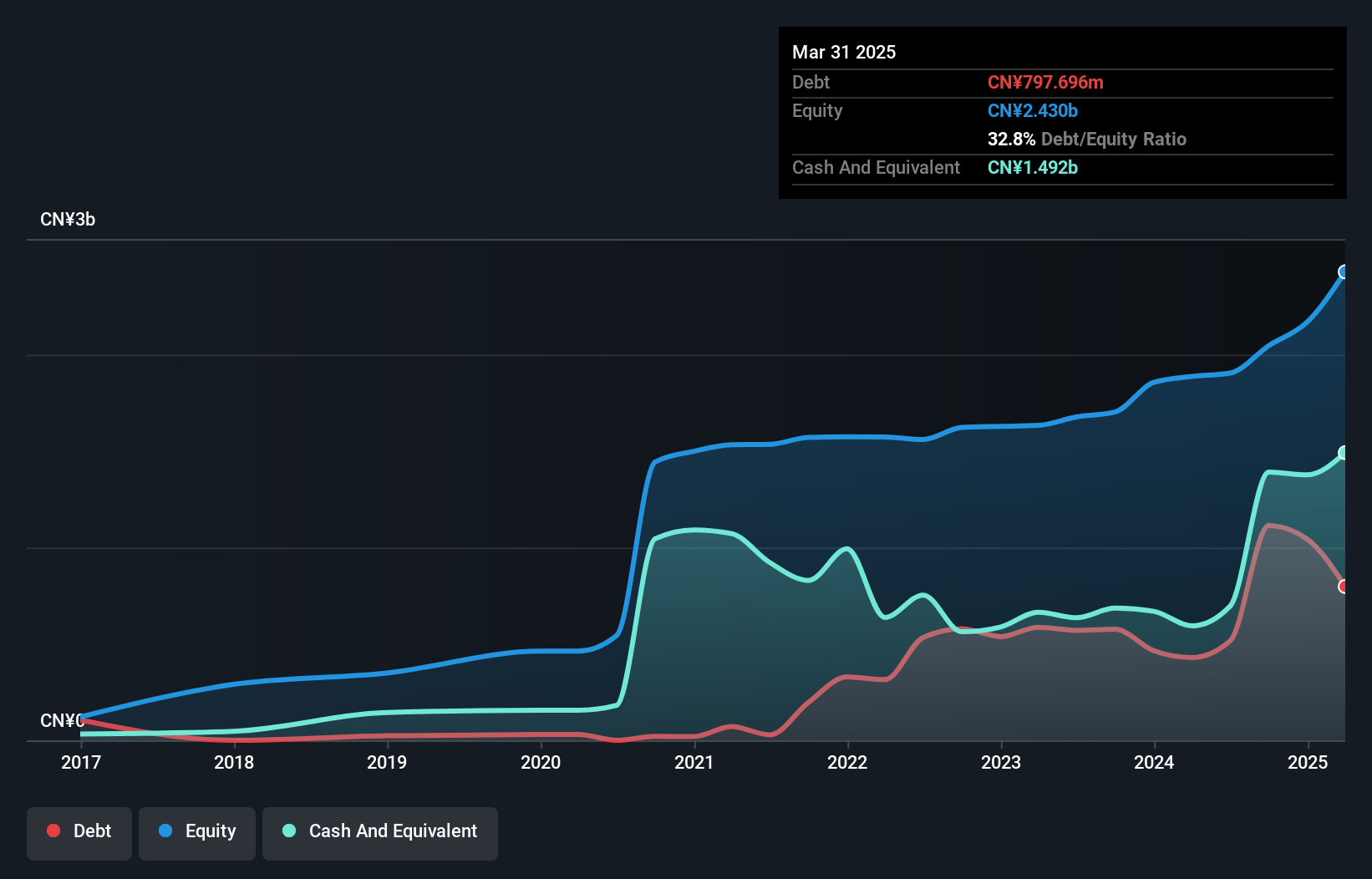

U.D. Electronic, a small player in the electronics sector, has been catching attention with its high-quality earnings and impressive debt management. Over the past five years, their debt-to-equity ratio has significantly improved from 74.3% to 13.6%, suggesting solid financial health. Despite negative earnings growth of -4.6% last year against an industry average of 7.8%, U.D.'s free cash flow remains positive at US$1 billion as of September 2024, highlighting robust cash generation capabilities. Trading at a substantial discount—77% below estimated fair value—it seems poised for potential upside if operational improvements align with market expectations amidst recent volatility in share price trends over the past three months.

- Click here and access our complete health analysis report to understand the dynamics of U.D. Electronic.

Examine U.D. Electronic's past performance report to understand how it has performed in the past.

Yamanashi Chuo BankLtd (TSE:8360)

Simply Wall St Value Rating: ★★★★☆☆

Overview: The Yamanashi Chuo Bank, Ltd., along with its subsidiaries, offers a range of banking services to individual and corporate clients in Japan and has a market capitalization of ¥68.68 billion.

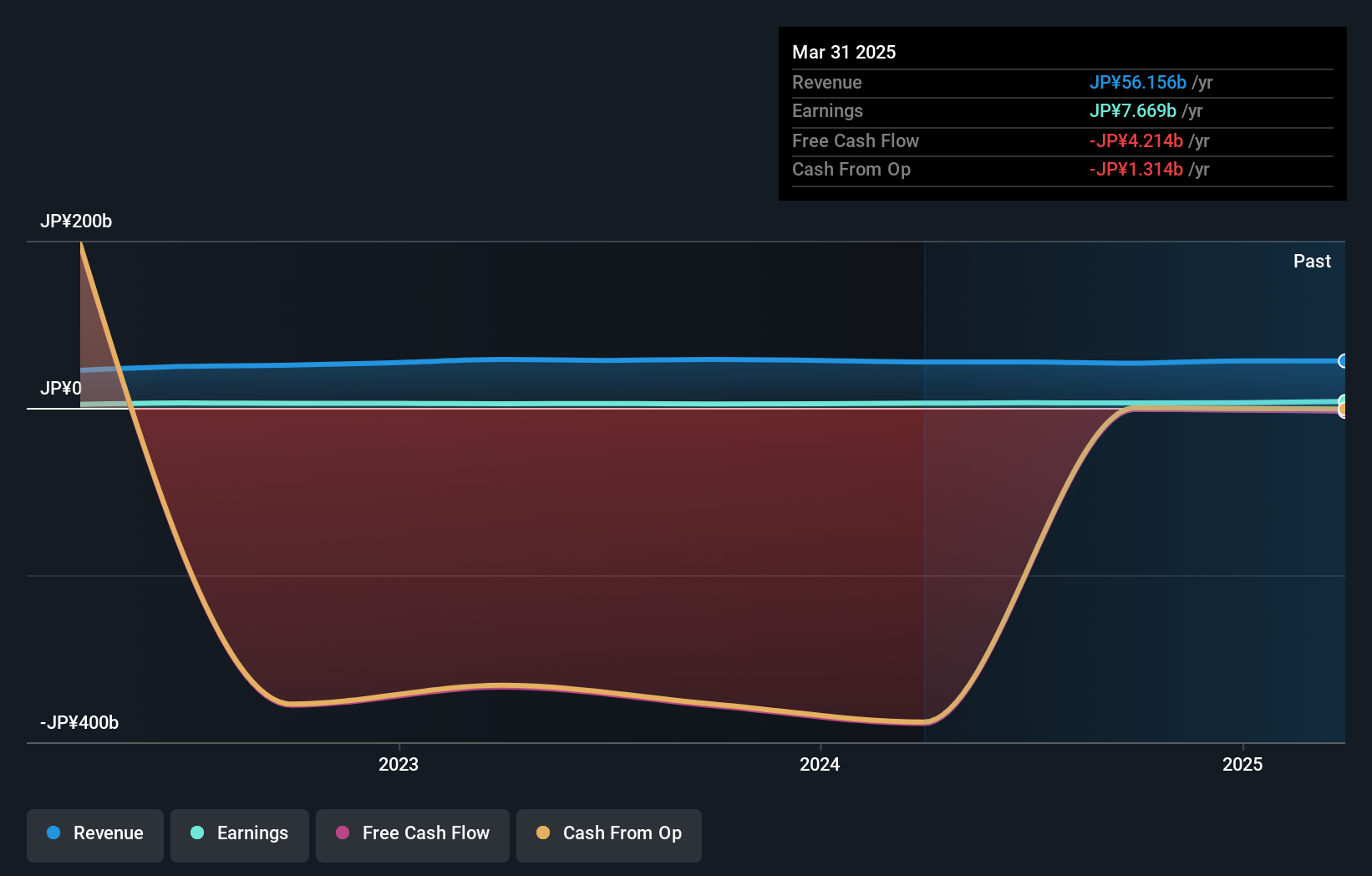

Operations: Yamanashi Chuo Bank generates revenue primarily through interest income from loans and securities. The bank's financial performance is influenced by its net profit margin, which has shown variability over recent periods.

With total assets of ¥4.56 trillion and equity of ¥214.1 billion, Yamanashi Chuo Bank is a notable player in the banking sector. The bank's deposits stand at ¥3.67 trillion, while loans are at ¥2.65 trillion, reflecting a net interest margin of 0.8%. Despite its high-quality earnings history, the allowance for bad loans is insufficient at 1% of total loans, which could be concerning for some investors. Trading at 17% below estimated fair value may present an opportunity; however, its earnings growth over the past year was slightly behind industry standards at 20.7%.

Summing It All Up

- Unlock our comprehensive list of 4710 Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TPEX:3689

U.D. Electronic

Researches, manufactures, and sells electronic components and materials, connectors, and products in Taiwan and China.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives