Resona Holdings (TSE:8308) Eyes Growth with Earnings Surge and Corporate Lending Expansion

Reviewed by Simply Wall St

Resona Holdings (TSE:8308) has recently demonstrated strong financial performance, achieving a consolidated bottom line of ¥114.2 billion and prompting an upward revision of earnings targets to ¥175 billion, with a potential target of ¥190 billion. This success is attributed to strategic expansions in top-line income and fee income growth, alongside a noteworthy improvement in the cost/income ratio. However, challenges such as a relatively low Return on Equity and anticipated revenue declines pose growth hurdles. The following report examines Resona's unique capabilities, internal limitations, growth avenues, and the external market volatility affecting its position.

Click here to discover the nuances of Resona Holdings with our detailed analytical report.

Unique Capabilities Enhancing Resona Holdings's Market Position

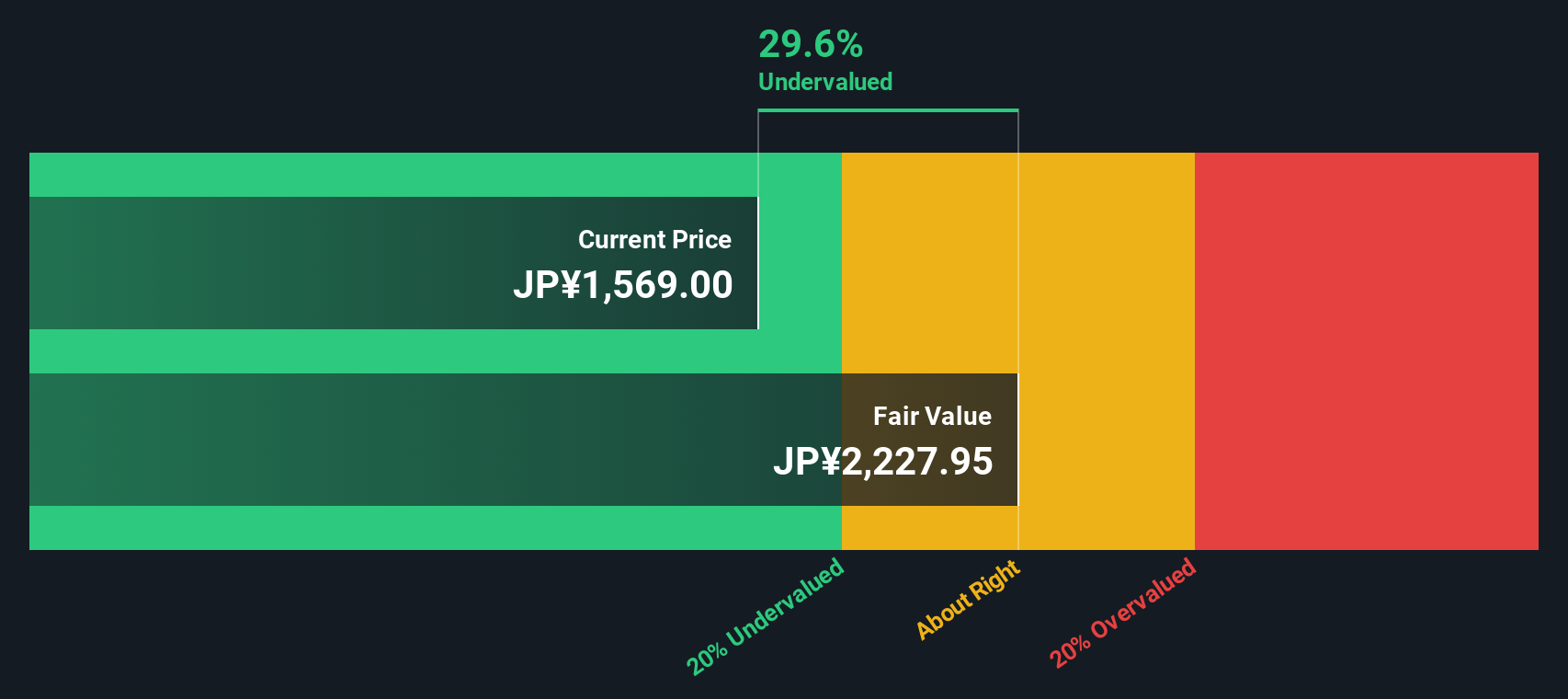

Resona Holdings has showcased its financial performance by achieving a consolidated bottom line of ¥114.2 billion, marking 69.2% progress against its initial full-year guidance. This success has prompted an upward revision of earnings targets to ¥175 billion, with an actual target of ¥190 billion, excluding one-off expenses. CEO Masahiro Minami highlighted this achievement, underscoring the company's strategic acumen. Additionally, Resona Holdings has improved its cost/income ratio to 63.9%, aligning with its medium-term management plan goals. This improvement is attributed to the expansion of top-line income, which has also supported fee income growth, increasing by ¥6.4 billion or 6% year-on-year. These strengths are further complemented by the company's trading position below its estimated fair value of ¥1775.12, suggesting potential undervaluation based on discounted cash flow analysis.

Internal Limitations Hindering Resona Holdings's Growth

While Resona Holdings has demonstrated financial prowess, certain weaknesses persist. The company's Return on Equity (ROE) is relatively low at 6.8%, falling short of the 20% benchmark and indicating room for improvement in shareholder returns. Additionally, the earnings growth over the past year, although impressive at 19%, did not surpass the Banks industry average of 22.6%. Furthermore, revenue is anticipated to decrease by 1.4% annually over the next three years, posing a challenge to sustaining growth momentum. Operating expenses have risen by ¥14.9 billion, which, although within planned limits, could strain financial resources if not managed effectively.

Growth Avenues Awaiting Resona Holdings

Resona Holdings is poised to capitalize on several growth opportunities. The company plans to expand its top-line income through net interest income and fee income, with a particular focus on the corporate lending business. This strategy is expected to drive future growth and enhance market presence. Furthermore, strategic investments in human capital and IT, including the integration of Minato Bank's operations, are anticipated to bolster future earnings. The company's commitment to shareholder value is evident in its announcement of a ¥20 billion share buyback, aiming for a total shareholder return ratio of 53.3% for the fiscal year.

Market Volatility Affecting Resona Holdings's Position

Resona Holdings faces several external threats that could impact its market position. The interest rate environment presents potential risks, with uncertainties surrounding the deposit beta and time deposit rates despite the positive outlook from the removal of negative interest rates. Inflation-related increases in expenses and credit costs, though deemed controllable, require careful management to avoid eroding profitability. Additionally, the company must navigate regulatory changes and competitive pressures in the financial sector, which could challenge its strategic initiatives and growth plans. The recent volatility in share price over the past three months further underscores the need for vigilance in managing these external factors.

Conclusion

Resona Holdings' impressive financial performance, marked by a significant increase in earnings and a strategic focus on cost efficiency, positions the company well for future growth. Challenges such as a lower-than-industry-average Return on Equity and anticipated revenue declines remain, but the company's strategic initiatives, including corporate lending expansion and investments in technology and human capital, are expected to drive long-term growth. The company's current trading price below its estimated fair value of ¥1775.12 suggests potential for price appreciation as these strategies unfold. However, Resona Holdings must remain vigilant against external threats such as interest rate fluctuations and regulatory changes to maintain its competitive edge and achieve its ambitious earnings targets.

Turning Ideas Into Actions

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

If you're looking to trade Resona Holdings, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About TSE:8308

Resona Holdings

Through its subsidiaries, provides retail and commercial banking products and services in Japan and internationally.

Solid track record with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives