- Japan

- /

- Electrical

- /

- TSE:5816

Onamba Leads Three Key Dividend Stocks In Japan

Reviewed by Simply Wall St

As global markets exhibit mixed signals with the Nikkei 225 and TOPIX indices slightly down amid robust manufacturing data, Japan's economic landscape presents a complex yet intriguing opportunity for dividend investors. In this context, understanding the resilience and potential of key dividend-paying stocks like Onamba becomes crucial in navigating through fluctuating market conditions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.64% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.63% | ★★★★★★ |

| Business Brain Showa-Ota (TSE:9658) | 3.74% | ★★★★★★ |

| Globeride (TSE:7990) | 3.98% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.63% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.47% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 3.51% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.19% | ★★★★★★ |

| Innotech (TSE:9880) | 4.15% | ★★★★★★ |

Click here to see the full list of 389 stocks from our Top Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Onamba (TSE:5816)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Onamba Co., Ltd., operating both domestically and internationally, specializes in the manufacturing and distribution of wires and components for household electronic appliances, business equipment, and industrial electronic devices, with a market capitalization of ¥16.11 billion.

Operations: Onamba Co., Ltd. generates its revenue from the production and sale of wiring solutions and components, primarily for electronic devices used in homes, businesses, and industry sectors.

Dividend Yield: 3.2%

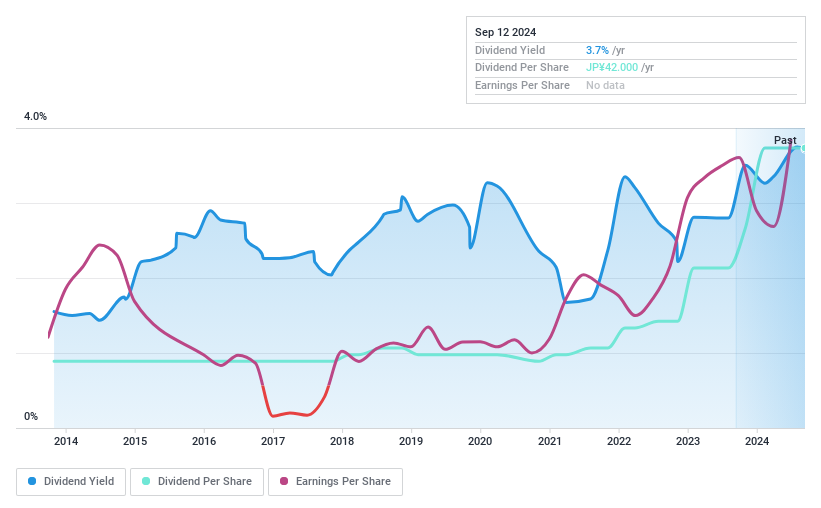

Onamba's dividend yield of 3.18% is modest compared to Japan's top dividend payers. Despite a history of volatility in its dividend payments over the past decade, both earnings and cash flows provide good coverage for current dividends, with a payout ratio of 27.7% and a cash payout ratio of 14.7%. However, trading at 71.4% below estimated fair value suggests potential undervaluation or underlying issues not reflected in dividend stability or growth metrics.

- Get an in-depth perspective on Onamba's performance by reading our dividend report here.

- According our valuation report, there's an indication that Onamba's share price might be on the cheaper side.

Tenma (TSE:7958)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tenma Corporation, specializing in the manufacture and sale of plastic products both domestically and internationally, has a market capitalization of approximately ¥51.22 billion.

Operations: Tenma Corporation generates its revenue primarily from the manufacture and sale of plastic products across global markets.

Dividend Yield: 3.4%

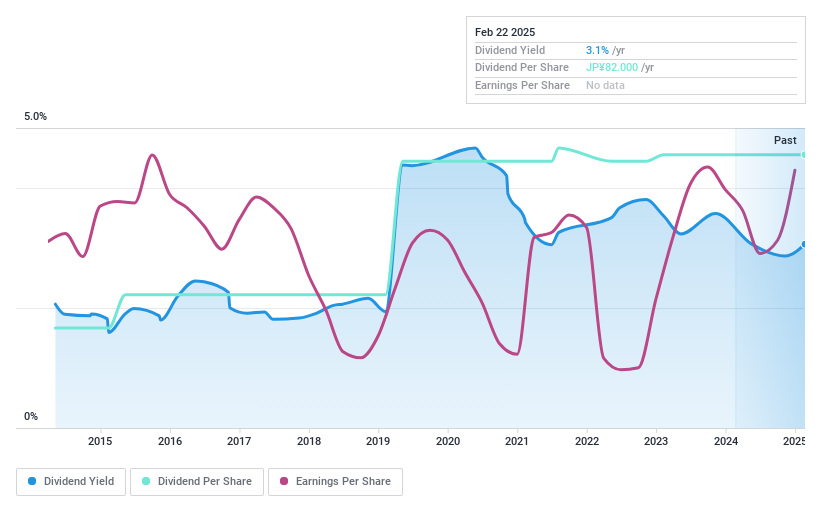

Tenma's dividend yield of 3.35% slightly trails the top quartile of Japanese dividend stocks. While dividends have grown over the past decade, current payouts aren't well supported by earnings or cash flows, with payout ratios at 76.8% and cash payout ratios significantly high at 453.1%. Recent shareholder activism challenges proposed surplus fund allocations and remuneration disclosures, reflecting concerns about governance and financial strategies that may impact future dividend reliability and growth.

- Click here to discover the nuances of Tenma with our detailed analytical dividend report.

- The valuation report we've compiled suggests that Tenma's current price could be inflated.

Mitsubishi UFJ Financial Group (TSE:8306)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitsubishi UFJ Financial Group, Inc. serves as the bank holding company for MUFG Bank, Ltd., with a market capitalization of approximately ¥19.20 trillion.

Operations: Mitsubishi UFJ Financial Group's revenue is derived from various segments including ¥3.23 billion from Global Markets, ¥7.83 billion from Digital Services, ¥4.32 billion from Trust Property, ¥10.14 billion from Corporate Banking, ¥6.85 billion from Global Commercial Banking, ¥8.63 billion from Global Corporate & Investment Banking, and ¥7.09 billion from Retail & Commercial Banking (excluding Digital Services).

Dividend Yield: 3.1%

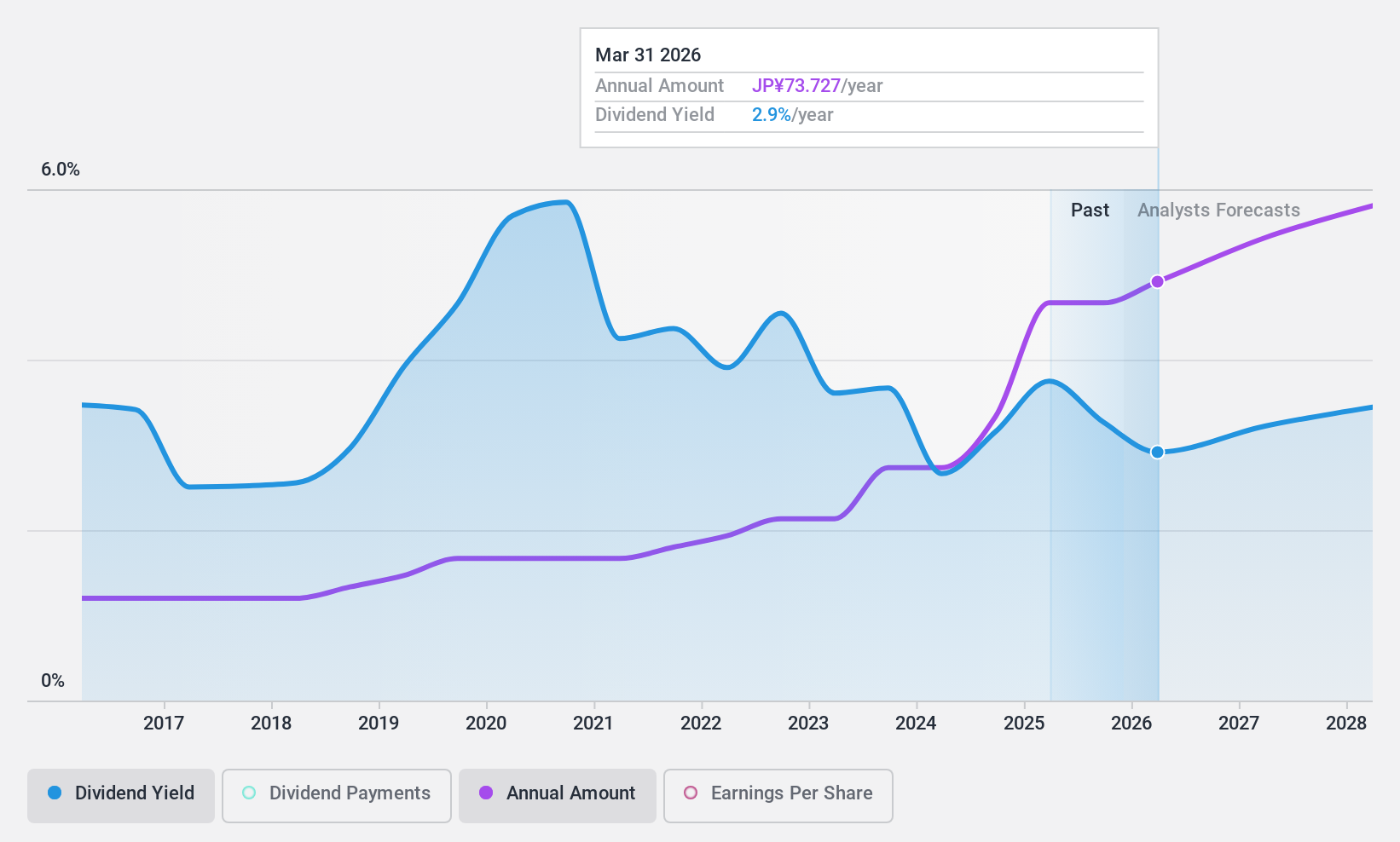

Mitsubishi UFJ Financial Group has demonstrated a consistent dividend increase over the past decade, with recent announcements indicating further rises for FY 2024 and projections into 2025. Despite a modest yield of 3.05%, which is below the top quartile for Japanese dividend stocks, its dividends are well-supported by earnings, evidenced by a sustainable payout ratio of 32.9%. The company's strategic share repurchase program aims to enhance capital efficiency and shareholder returns, reinforcing its commitment to delivering value despite some challenges in covering future dividends with current earnings forecasts.

- Click here and access our complete dividend analysis report to understand the dynamics of Mitsubishi UFJ Financial Group.

- Insights from our recent valuation report point to the potential undervaluation of Mitsubishi UFJ Financial Group shares in the market.

Taking Advantage

- Click through to start exploring the rest of the 386 Top Dividend Stocks now.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5816

Onamba

Manufactures and sells electronic components, general-purpose electric wires, and communication cables for consumer electronic devices, information office equipment, and industrial electronic devices in Japan.

Flawless balance sheet with proven track record and pays a dividend.