3 Japanese Stocks That May Be Undervalued Based On Current Estimates

Reviewed by Simply Wall St

Japan’s stock markets have recently seen significant gains, with the Nikkei 225 Index rising 3.1% and the broader TOPIX Index up 2.8%, driven by a weaker yen following the U.S. Federal Reserve's decision to cut interest rates by 50 basis points. Amid this backdrop, identifying undervalued stocks becomes crucial as investors seek opportunities that may benefit from favorable economic conditions and market dynamics. In this context, a good stock is typically characterized by strong fundamentals, solid growth potential, and attractive valuations relative to its peers or historical performance.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Hagiwara Electric Holdings (TSE:7467) | ¥3575.00 | ¥6812.26 | 47.5% |

| Kotobuki Spirits (TSE:2222) | ¥1735.00 | ¥3434.73 | 49.5% |

| Shin Maint HoldingsLtd (TSE:6086) | ¥1542.00 | ¥2936.08 | 47.5% |

| Stella Chemifa (TSE:4109) | ¥4090.00 | ¥8099.17 | 49.5% |

| Hibino (TSE:2469) | ¥3475.00 | ¥6942.49 | 49.9% |

| Appier Group (TSE:4180) | ¥1777.00 | ¥3499.39 | 49.2% |

| SaizeriyaLtd (TSE:7581) | ¥5310.00 | ¥10076.65 | 47.3% |

| Visional (TSE:4194) | ¥8490.00 | ¥16914.40 | 49.8% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2853.00 | ¥5399.12 | 47.2% |

| Money Forward (TSE:3994) | ¥6004.00 | ¥11903.57 | 49.6% |

Here we highlight a subset of our preferred stocks from the screener.

Money Forward (TSE:3994)

Overview: Money Forward, Inc. offers financial solutions for individuals, financial institutions, and corporations mainly in Japan with a market cap of ¥327.37 billion.

Operations: The Platform Services Business segment generates ¥36.16 billion in revenue.

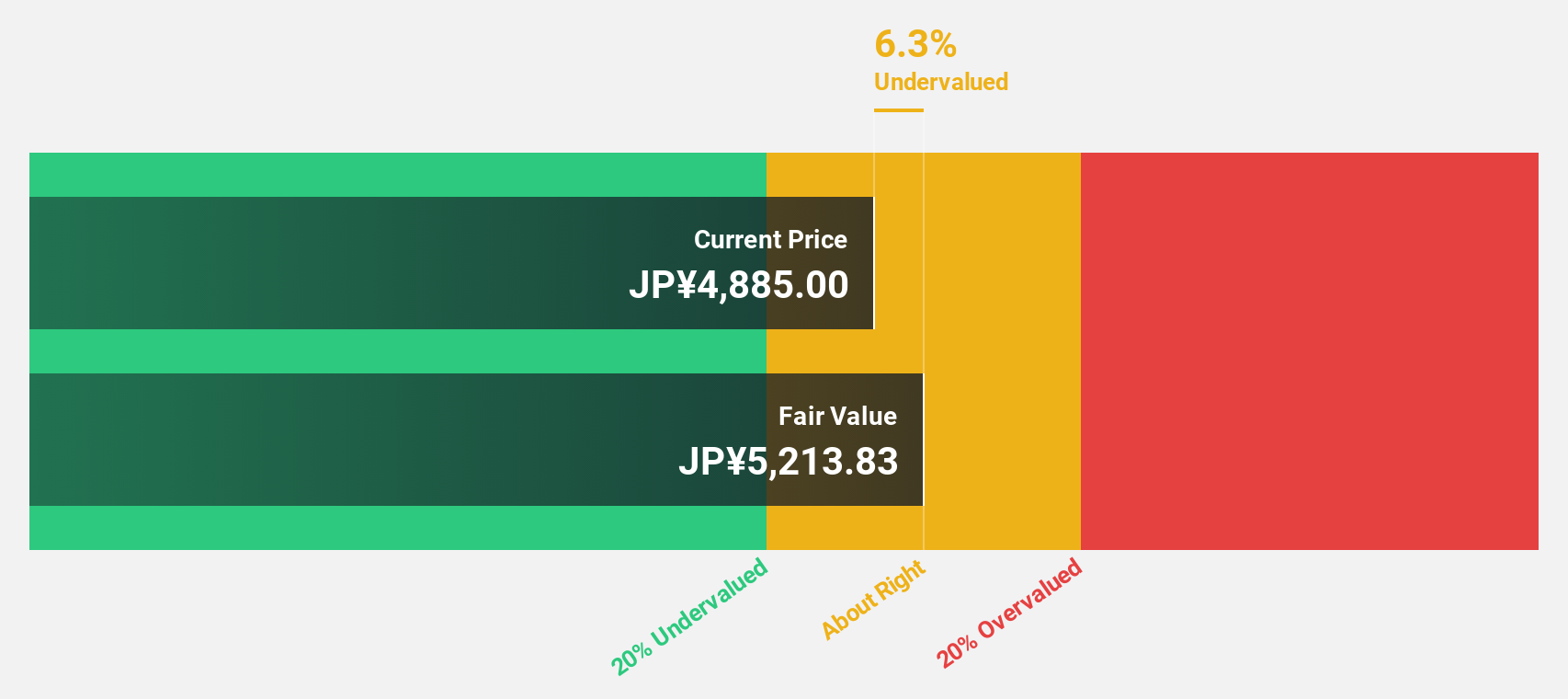

Estimated Discount To Fair Value: 49.6%

Money Forward, Inc. appears undervalued based on cash flows, trading at 49.6% below its estimated fair value of ¥11,903.57. Revenue is forecast to grow at 20.7% per year, significantly outpacing the Japanese market's 4.3%. Earnings are expected to grow by 68.12% annually and become profitable within three years, with a projected return on equity of 20.6%. Recent strategic moves include a joint venture with Sumitomo Mitsui Card Company and internal restructuring efforts to enhance focus on fintech services.

- Our growth report here indicates Money Forward may be poised for an improving outlook.

- Navigate through the intricacies of Money Forward with our comprehensive financial health report here.

Appier Group (TSE:4180)

Overview: Appier Group, Inc. is a software-as-a-service company offering AI platforms to help enterprises make data-driven decisions, with a market cap of ¥181.54 billion.

Operations: The AI SaaS Business segment generated ¥14.70 billion in revenue.

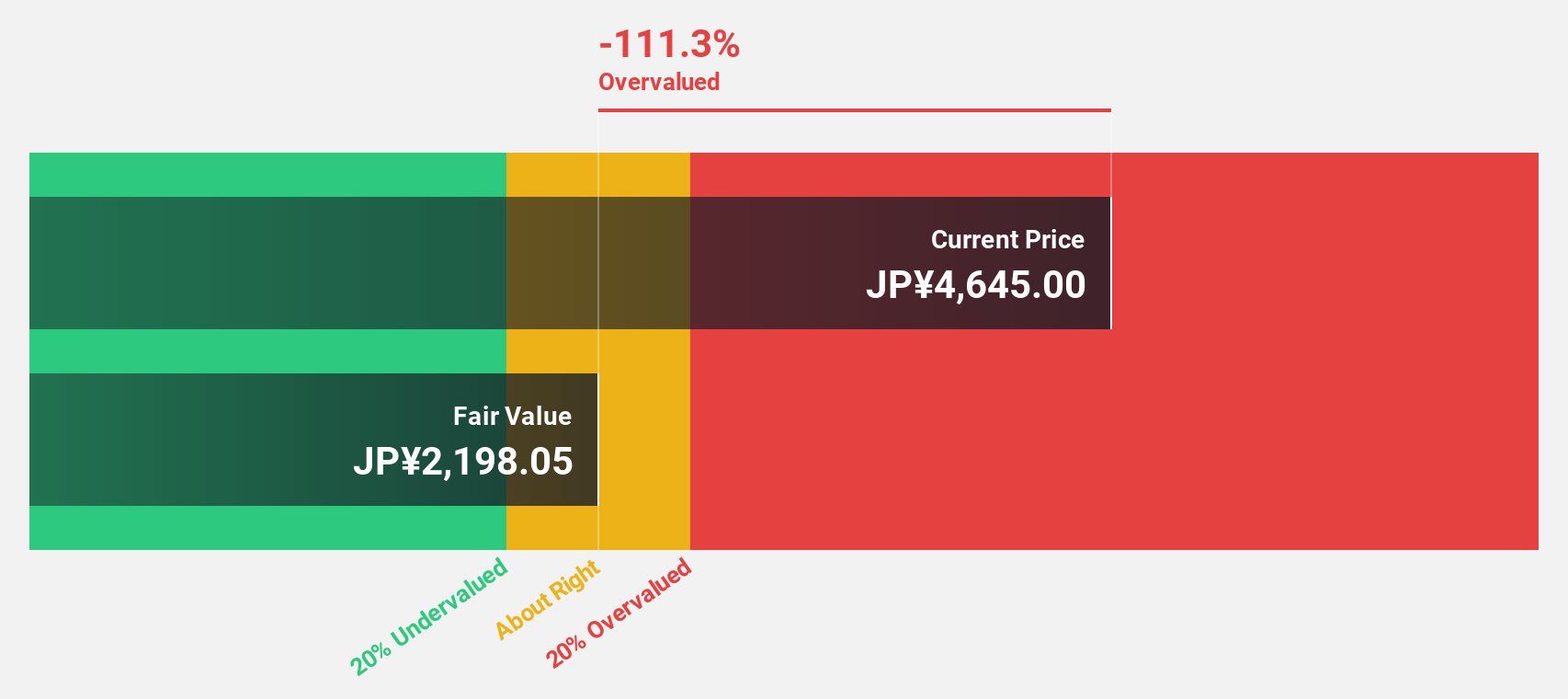

Estimated Discount To Fair Value: 49.2%

Appier Group is trading at ¥1777, significantly below its estimated fair value of ¥3499.39. Earnings are forecast to grow 38.6% annually, outpacing the Japanese market's 8.6%. Recent strategic moves include a share repurchase program worth ¥1 billion and a partnership with Huy Thanh Jewelry that boosted ROI sixfold using AI-driven personalization tools. Revenue is projected to grow at 19.9% per year, faster than the market average of 4.3%.

- Our comprehensive growth report raises the possibility that Appier Group is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Appier Group.

SBI Sumishin Net Bank (TSE:7163)

Overview: SBI Sumishin Net Bank, Ltd. offers a range of banking products and services to both individual and corporate clients in Japan, with a market cap of ¥430.07 billion.

Operations: The company generates revenue primarily from its Digital Bank Business segment, which accounts for ¥67.08 billion, and the THEMIX Business segment, contributing ¥0.22 billion.

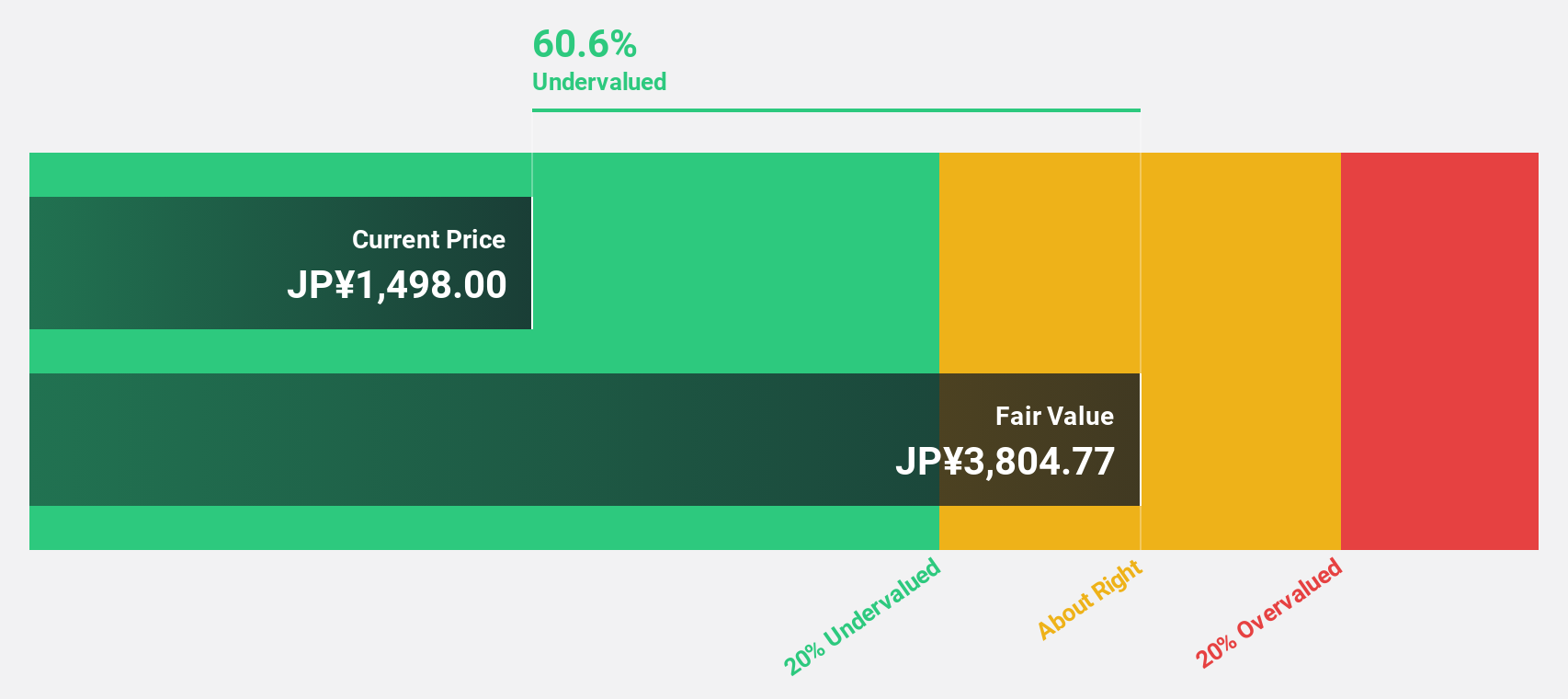

Estimated Discount To Fair Value: 47.2%

SBI Sumishin Net Bank is trading at ¥2853, significantly below its estimated fair value of ¥5399.12, presenting a compelling case for being undervalued based on cash flows. Earnings have grown 15.6% annually over the past five years and are forecast to grow 23.86% per year, outpacing the Japanese market's 8.6%. Recent inclusion in the FTSE All-World Index and dividend increases further highlight its strong financial position and growth potential.

- Upon reviewing our latest growth report, SBI Sumishin Net Bank's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of SBI Sumishin Net Bank stock in this financial health report.

Next Steps

- Gain an insight into the universe of 80 Undervalued Japanese Stocks Based On Cash Flows by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4180

Appier Group

A software-as-a-service company, provides artificial intelligence (AI) platforms for enterprises to make data-driven decisions in Japan and internationally.

Flawless balance sheet with solid track record.