- China

- /

- Marine and Shipping

- /

- SHSE:603162

Uncovering Hidden Gems In Asia Including Fujian Highton Development And Two More

Reviewed by Simply Wall St

Amid a backdrop of mixed performances in global markets, small-cap indexes have shown resilience by posting gains for the fifth consecutive week, highlighting their potential as investors navigate hopes for de-escalation in trade tensions. In this environment, identifying promising stocks becomes crucial, and characteristics such as strong fundamentals and growth potential can set apart undiscovered gems like Fujian Highton Development and others in Asia's vibrant market landscape.

Top 10 Undiscovered Gems With Strong Fundamentals In Asia

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Shangri-La Hotel | NA | 15.26% | 23.20% | ★★★★★★ |

| Luyin Investment GroupLtd | 40.20% | 6.14% | 18.68% | ★★★★★★ |

| Hiconics Eco-energy Technology | NA | 30.59% | 27.60% | ★★★★★★ |

| Suzhou Longjie Special Fiber | 1.49% | 12.26% | -16.14% | ★★★★★☆ |

| Nikko | 44.54% | 5.86% | -5.45% | ★★★★★☆ |

| Uju Holding | 33.18% | 8.01% | -15.93% | ★★★★★☆ |

| Jiangxi Jiangnan New Material Technology | 65.40% | 18.89% | 17.99% | ★★★★★☆ |

| Ningbo Kangqiang Electronics | 43.28% | 3.45% | -5.24% | ★★★★★☆ |

| Mr Max Holdings | 48.68% | 1.03% | 0.97% | ★★★★☆☆ |

| iMarketKorea | 30.43% | 4.91% | 1.88% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Fujian Highton Development (SHSE:603162)

Simply Wall St Value Rating: ★★★★★★

Overview: Fujian Highton Development Co., Ltd. operates in the coastal and international ocean dry bulk transportation sector, with a market cap of CN¥8.16 billion.

Operations: The company generates revenue primarily from coastal and international ocean dry bulk transportation. It has a market cap of CN¥8.16 billion.

Fujian Highton Development, a smaller player in the market, has demonstrated notable progress with its net debt to equity ratio at a satisfactory 2%, indicating strong financial health. The company's interest payments are well-covered by EBIT at 14.1 times coverage, suggesting robust earnings quality. Over the past year, earnings surged by 165.7%, outpacing the shipping industry's growth of 33.3%. However, recent quarterly results showed sales of CNY 805.9 million and net income of CNY 67.64 million compared to CNY 89.94 million last year, reflecting some challenges in maintaining profitability amidst rising revenue figures.

Maruichi Steel Tube (TSE:5463)

Simply Wall St Value Rating: ★★★★★★

Overview: Maruichi Steel Tube Ltd., along with its subsidiaries, is engaged in the manufacturing and sale of steel tubes, surface treated steel sheets, and poles across Japan, North America, and Asia with a market capitalization of ¥283.50 billion.

Operations: Maruichi generates revenue primarily from the sale of steel tubes, surface-treated steel sheets, and poles across various regions. The company's financial performance is reflected in its market capitalization of ¥283.50 billion.

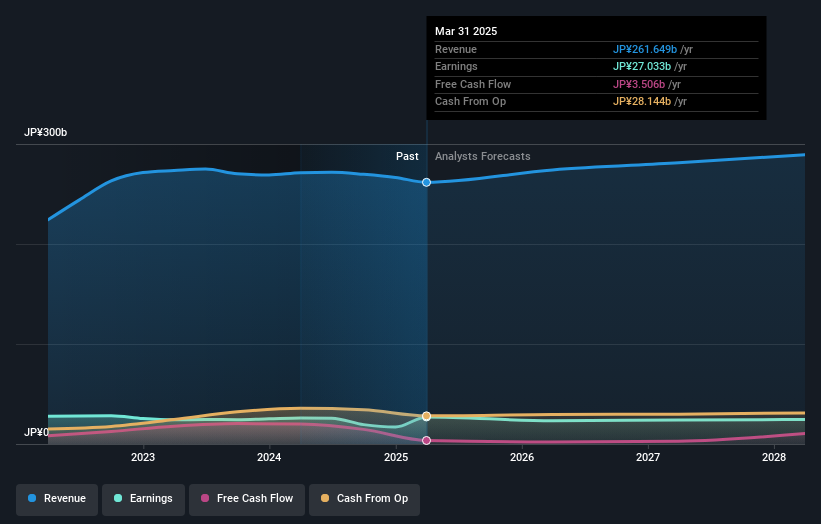

Maruichi Steel Tube, a notable player in the Asian market, has shown promising financial health with earnings growth of 3.5% over the past year, surpassing the industry average of 1.7%. The company is trading at a significant discount of 63.7% below its estimated fair value and maintains more cash than total debt, highlighting strong fiscal management. Additionally, its debt-to-equity ratio improved from 2.8 to 1.4 over five years, indicating reduced leverage risk. Recently announced share repurchase plans totaling ¥12 billion further underline strategic capital management efforts aimed at enhancing shareholder value through flexible policy implementation amidst evolving business conditions.

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Value Rating: ★★★★★☆

Overview: Chugin Financial Group, Inc., with a market cap of ¥285.99 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual clients in Japan.

Operations: Chugin Financial Group, Inc. generates revenue primarily through its subsidiary, The Chugoku Bank, Limited, by providing a variety of financial services to both corporate and individual clients in Japan. The company has a market cap of ¥285.99 billion.

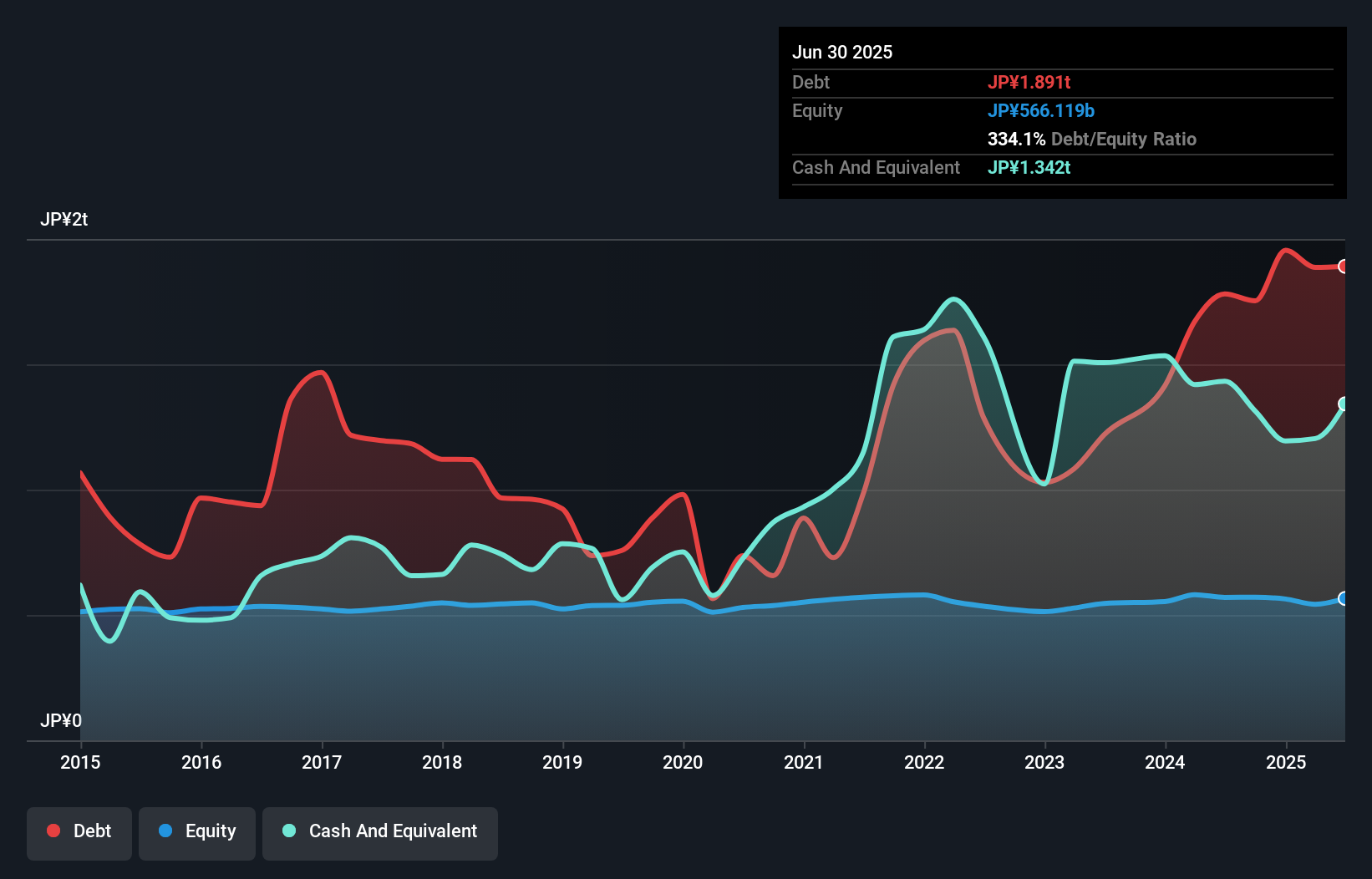

Chugin Financial Group, with total assets of ¥11,069.6 billion and equity standing at ¥563.8 billion, operates in a niche space that seems to offer both stability and growth potential. The bank's total deposits amount to ¥8,322.6 billion against loans of ¥6,774.6 billion; however, it has an insufficient allowance for bad loans at 1.7% of total loans despite having appropriate non-performing loan levels below 2%. While earnings have seen a robust annual growth rate of 13.8% over five years, the stock trades at nearly 25% below estimated fair value amid high share price volatility recently observed in the market.

Summing It All Up

- Unlock more gems! Our Asian Undiscovered Gems With Strong Fundamentals screener has unearthed 2650 more companies for you to explore.Click here to unveil our expertly curated list of 2653 Asian Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Fujian Highton Development, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:603162

Fujian Highton Development

Engages in the coastal and international ocean dry bulk transportation business in China and internationally.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives