Navigating Japan's Dividend Landscape With 3 Stocks Yielding From 3% To 3.3%

Reviewed by Simply Wall St

As Japan's Nikkei 225 and TOPIX indices experienced marginal weekly losses amidst hints of potential interest rate hikes by the Bank of Japan, investors are closely monitoring the evolving economic landscape. In this context, dividend stocks can offer a compelling opportunity for those seeking steady income streams, particularly when navigating through periods of market uncertainty and monetary policy adjustments.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 3.48% | ★★★★★★ |

| AiphoneLtd (TSE:6718) | 3.44% | ★★★★★★ |

| Mitsubishi Shokuhin (TSE:7451) | 3.38% | ★★★★★★ |

| Ryoyu Systems (TSE:4685) | 3.44% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.05% | ★★★★★★ |

| HITO-Communications HoldingsInc (TSE:4433) | 3.27% | ★★★★★★ |

| Toyo Kanetsu K.K (TSE:6369) | 3.61% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.34% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.31% | ★★★★★★ |

| Innotech (TSE:9880) | 4.04% | ★★★★★★ |

Click here to see the full list of 305 stocks from our Top Dividend Stocks screener.

We'll examine a selection from our screener results.

Daicel (TSE:4202)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daicel Corporation operates in various sectors including materials, medical/healthcare, smart technologies, safety systems, and engineering plastics across Japan, China, and other international markets with a market capitalization of approximately ¥449.03 billion.

Operations: Daicel Corporation generates revenue from diverse sectors such as materials, medical/healthcare, smart technologies, safety systems, and engineering plastics across multiple geographical markets.

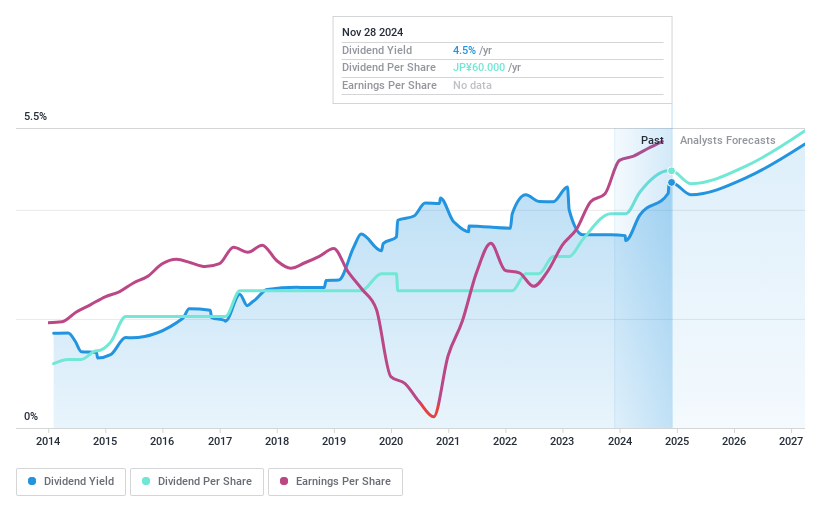

Dividend Yield: 3.1%

Daicel has shown a consistent dividend increase over the past decade, with recent announcements indicating further growth to JPY 28.00 per share for the fiscal year ending March 31, 2025. Despite a stable history of dividend payments, these are not well-supported by cash flows, as indicated by a high cash payout ratio of 183.4%. The company's earnings have grown significantly over the past year and are expected to continue growing modestly. However, Daicel's dividends remain low compared to top Japanese dividend payers and its financial leverage is high.

- Navigate through the intricacies of Daicel with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Daicel shares in the market.

Iyogin HoldingsInc (TSE:5830)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iyogin HoldingsInc, operating through its subsidiaries, offers banking and financial services with a market capitalization of approximately ¥396.97 billion.

Operations: Iyogin HoldingsInc generates its revenue primarily through banking and financial services.

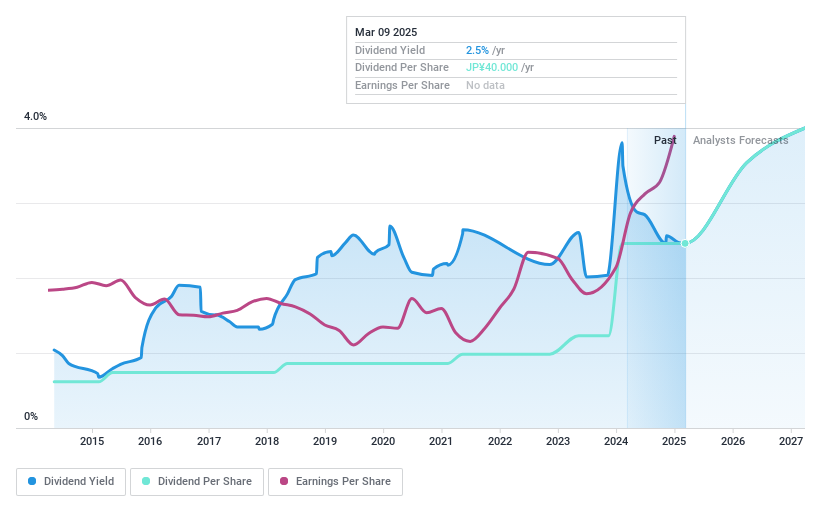

Dividend Yield: 3.1%

Iyogin HoldingsInc recently announced a share repurchase program, committing to buy back up to ¥5 billion worth of shares by July 31, 2024. This move aims to enhance shareholder value through improved capital efficiency. Financially, the company is trading below its estimated fair value and maintains a low allowance for bad loans at 35%. Over the past year, earnings surged by 41.5% and are projected to grow annually by 2.84%. Iyogin has consistently paid dividends over the last decade with an annual yield of 3.05%, supported by a low payout ratio of 18.7%, indicating stability and reliability in its dividend payments despite being slightly lower than top market payers.

- Click here and access our complete dividend analysis report to understand the dynamics of Iyogin HoldingsInc.

- According our valuation report, there's an indication that Iyogin HoldingsInc's share price might be on the cheaper side.

Nippon Yusen Kabushiki Kaisha (TSE:9101)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Yusen Kabushiki Kaisha operates globally, offering a range of logistics services with a market capitalization of approximately ¥2.19 trillion.

Operations: Nippon Yusen Kabushiki Kaisha generates revenue primarily through its Liner & Logistics segment, which includes Liner Trade (¥192.35 billion), Logistics Business (¥702.30 billion), and Air Transport Business (¥161.19 billion), as well as its Irregular Private Ship Business, which contributes ¥1.23 billion.

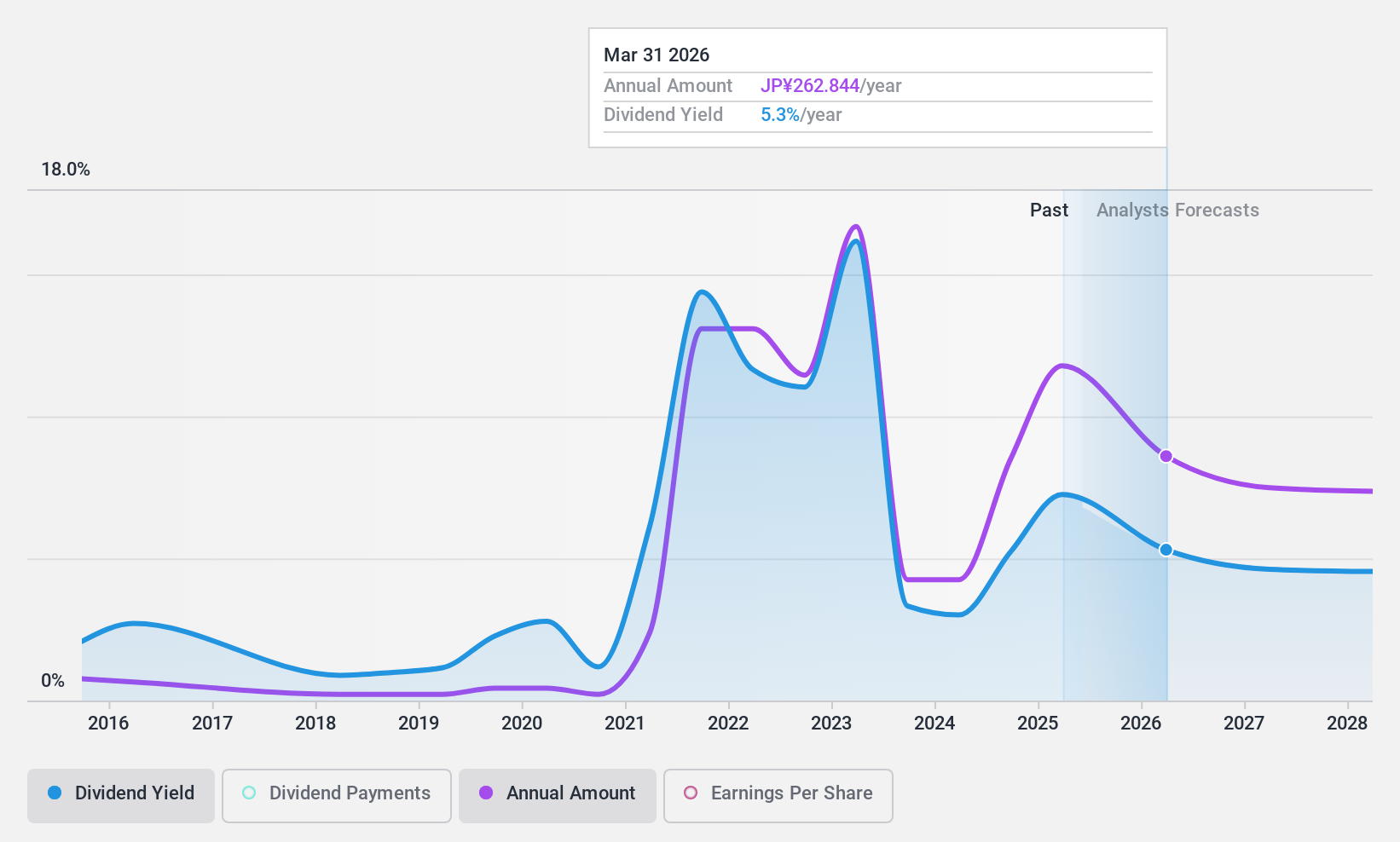

Dividend Yield: 3.4%

Nippon Yusen Kabushiki Kaisha has recently increased its dividend forecast to ¥80.00 per share, up from previous projections, indicating a positive adjustment in shareholder returns. Concurrently, the company announced a significant share repurchase program valued at ¥100 billion aiming to cancel 7.62% of its issued capital by April 2025, potentially enhancing earnings per share and shareholder value. However, despite these shareholder-friendly initiatives, the sustainability of dividends is under scrutiny due to coverage concerns with both earnings and cash flows being stretched to meet payouts.

- Click to explore a detailed breakdown of our findings in Nippon Yusen Kabushiki Kaisha's dividend report.

- According our valuation report, there's an indication that Nippon Yusen Kabushiki Kaisha's share price might be on the expensive side.

Seize The Opportunity

- Explore the 305 names from our Top Dividend Stocks screener here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Iyogin HoldingsInc, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5830

Undervalued with solid track record and pays a dividend.