Will Cerence AI Partnership Transform Suzuki Motor's (TSE:7269) Position in the Electric Vehicle Market?

Reviewed by Sasha Jovanovic

- On September 30, 2025, Cerence AI announced a collaboration with Suzuki Motor Corporation to build an in-car conversational AI assistant for Suzuki's first battery electric vehicle, the e VITARA, which will launch globally.

- This partnership highlights Suzuki's move to enhance its competitive edge in electric vehicles by incorporating advanced voice technology and a more personalized driving experience.

- We'll explore how the integration of AI-powered user experiences could influence Suzuki Motor's long-term position in the electric vehicle segment.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

What Is Suzuki Motor's Investment Narrative?

To be a Suzuki Motor shareholder, you have to believe in the company's ability to compete in a rapidly evolving auto sector, particularly as electric vehicles gain worldwide traction. The recent Cerence AI collaboration for the e VITARA marks a shift toward next-generation user experiences and could be an important near-term catalyst as Suzuki rolls out its first mass-market BEV. While this news positions Suzuki closer to technology leaders, the actual financial impact will depend on how well consumers respond to the e VITARA's AI-enhanced features. Risks remain, especially around the company's relatively inexperienced board and the challenge of accelerating growth in a slower market segment. If the Cerence partnership sparks meaningful differentiation and sales momentum, some risks may ease; if not, sluggish growth forecasts and board renewal could weigh more heavily than before.

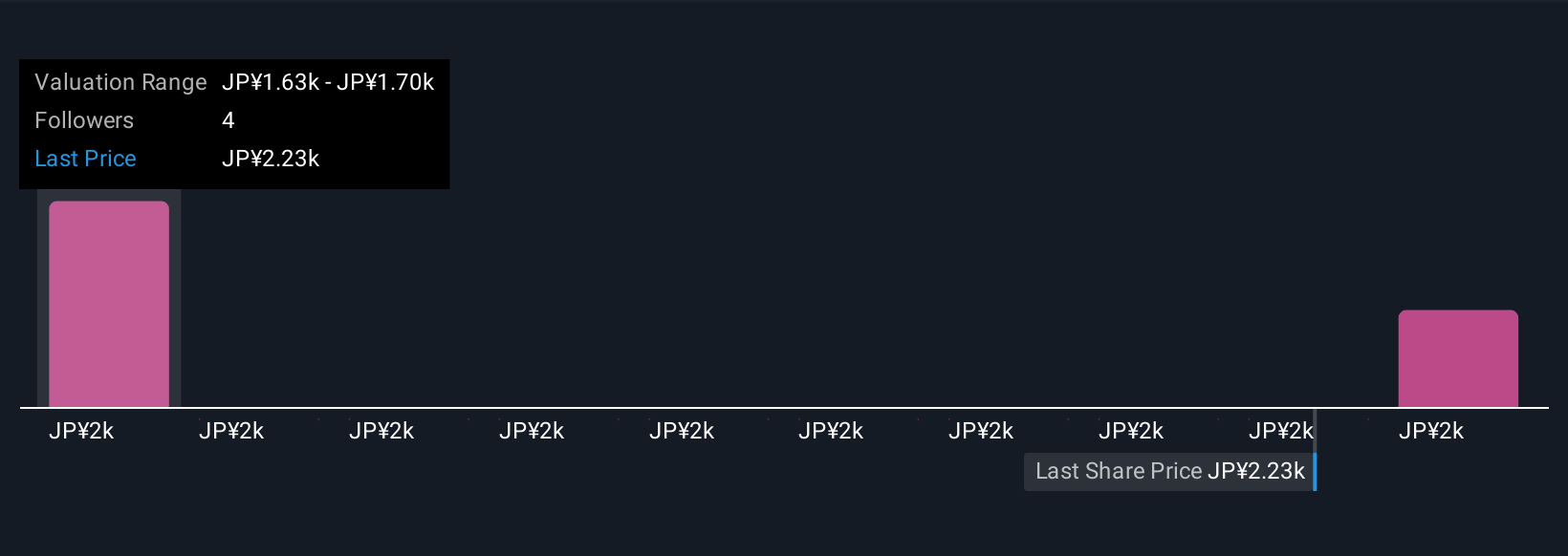

But the youthful board's decision-making is something investors shouldn't overlook. Suzuki Motor's share price has been on the slide but might be up to 37% below fair value. Find out if it's a bargain.Exploring Other Perspectives

Explore 2 other fair value estimates on Suzuki Motor - why the stock might be worth 27% less than the current price!

Build Your Own Suzuki Motor Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Suzuki Motor research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Suzuki Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Suzuki Motor's overall financial health at a glance.

Looking For Alternative Opportunities?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- The latest GPUs need a type of rare earth metal called Dysprosium and there are only 36 companies in the world exploring or producing it. Find the list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

- These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7269

Suzuki Motor

Engages in the manufacture and sale of automobiles, motorcycles, outboard motors, electric wheelchairs, and other products in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives