In the current global market landscape, solid corporate earnings are driving U.S. indices like the S&P 500 and Nasdaq Composite to new highs, while inflationary pressures and trade dynamics continue to shape economic outlooks across regions such as Europe and Asia. Amidst these developments, dividend stocks stand out as a compelling option for investors seeking steady income streams, providing a buffer against market volatility through regular payouts.

Top 10 Dividend Stocks Globally

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.29% | ★★★★★★ |

| NCD (TSE:4783) | 4.21% | ★★★★★★ |

| Japan Excellent (TSE:8987) | 4.26% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.47% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 4.16% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.48% | ★★★★★★ |

| Daicel (TSE:4202) | 4.65% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.96% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 4.56% | ★★★★★★ |

| Allianz (XTRA:ALV) | 4.52% | ★★★★★★ |

Click here to see the full list of 1492 stocks from our Top Global Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

Takeuchi Mfg (TSE:6432)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Takeuchi Mfg. Co., Ltd. manufactures and sells construction machinery both in Japan and internationally, with a market cap of ¥221.56 billion.

Operations: Takeuchi Mfg. Co., Ltd.'s revenue is primarily derived from its operations in Japan (¥197.29 billion), followed by the USA (¥114.62 billion), with additional contributions from the United Kingdom (¥15.05 billion), France (¥10.47 billion), and China (¥4.68 billion).

Dividend Yield: 3.7%

Takeuchi Mfg. maintains a stable dividend of JPY 200.00 per share, consistent with the previous year, reflecting reliability over the past decade. However, its dividend yield of 3.75% lags behind top-tier payers in Japan and is not well covered by free cash flows due to a high cash payout ratio of 187%. Despite this, dividends are well-covered by earnings with a low payout ratio of 37.4%, suggesting some sustainability concerns primarily linked to cash flow coverage rather than profitability metrics.

- Unlock comprehensive insights into our analysis of Takeuchi Mfg stock in this dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Takeuchi Mfg shares in the market.

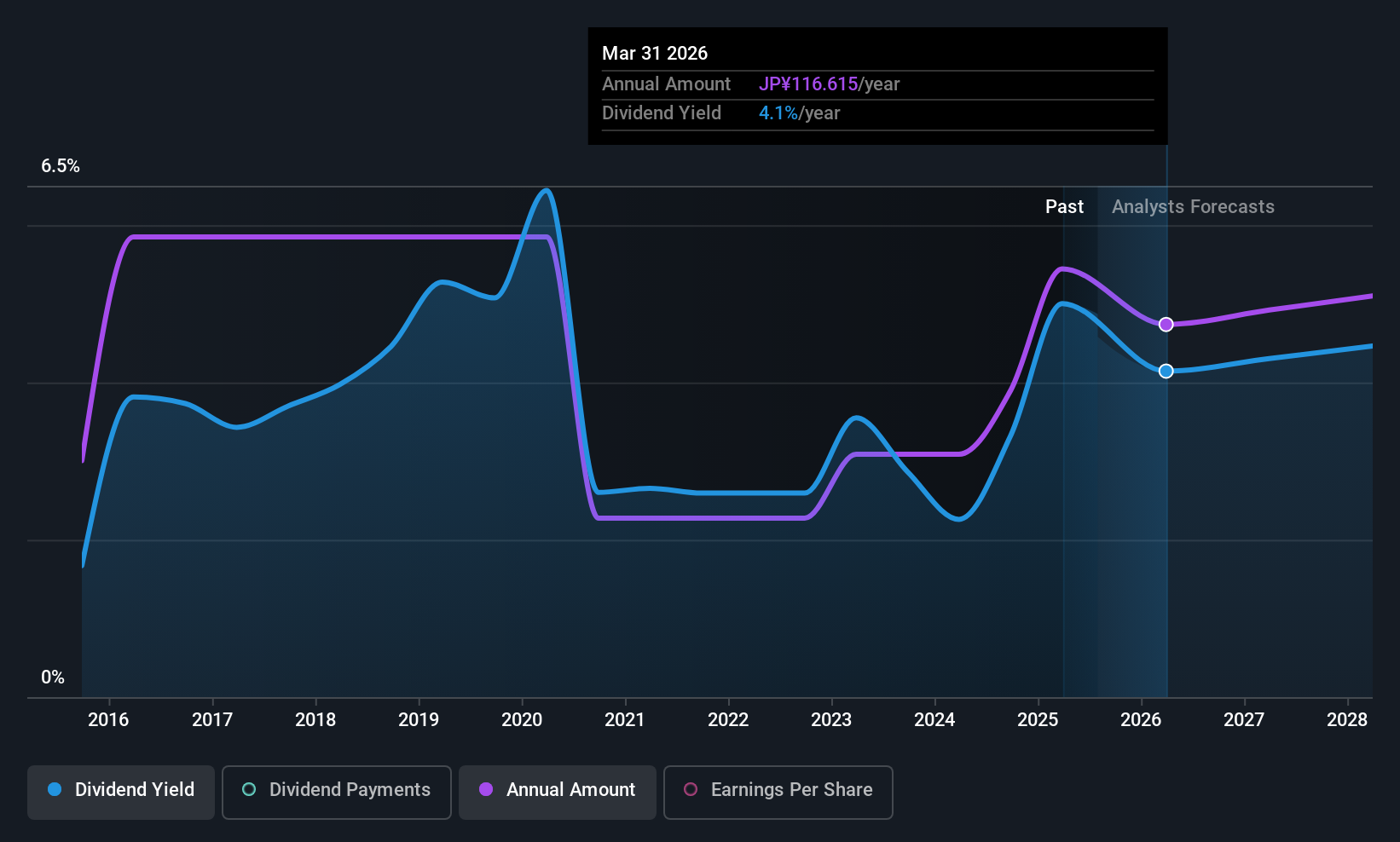

Mazda Motor (TSE:7261)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mazda Motor Corporation manufactures and sells passenger cars and commercial vehicles across Japan, the United States, North America, Europe, and other international markets with a market cap of ¥532.08 billion.

Operations: Mazda Motor Corporation's revenue segments consist of ¥3.73 billion from Japan, ¥0.77 billion from Europe, ¥3.29 billion from North America, and ¥0.65 billion from other regions.

Dividend Yield: 5.5%

Mazda Motor's dividend of JPY 30.00 per share remains unchanged from last year, supported by a low payout ratio of 30.4% and cash payout ratio of 19.5%, indicating strong coverage by earnings and cash flows. Despite being in the top 25% for dividend yield in Japan at 5.53%, its dividends have been volatile over the past decade with an unstable track record, reflecting potential reliability concerns despite trading below estimated fair value.

- Get an in-depth perspective on Mazda Motor's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Mazda Motor is priced lower than what may be justified by its financials.

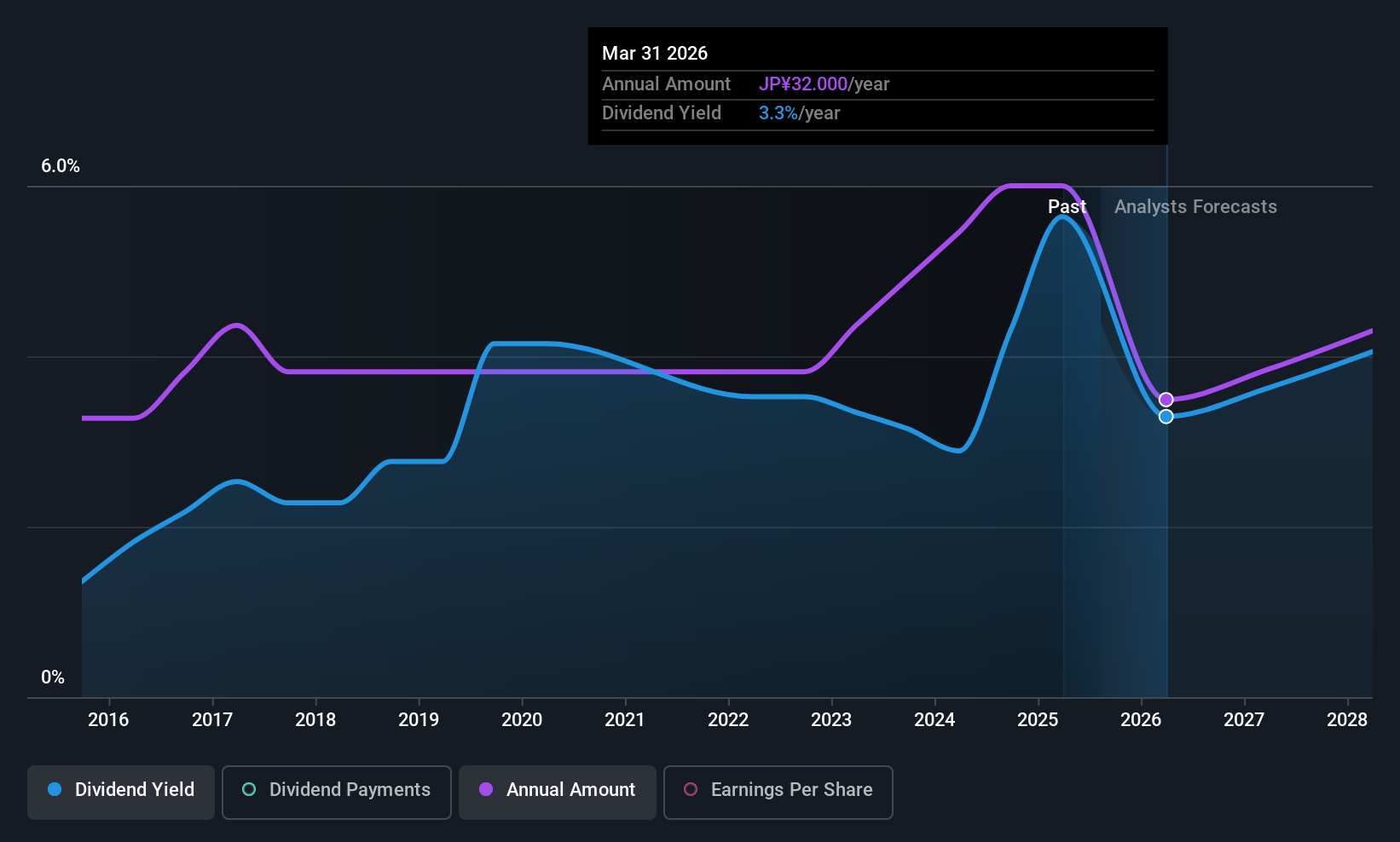

Subaru (TSE:7270)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Subaru Corporation is a manufacturer and seller of automobiles and aerospace products across Japan, Asia, North America, Europe, and other international markets with a market capitalization of ¥1.84 trillion.

Operations: Subaru Corporation's revenue is primarily derived from its Automobiles segment, which accounts for ¥4.57 billion, followed by its Aerospace segment at ¥111.58 million.

Dividend Yield: 3.9%

Subaru's dividend payments have been volatile over the past decade, with a recent decrease to JPY 58.00 per share expected for fiscal year ending March 2026. Despite this volatility, dividends are well covered by earnings (payout ratio: 25.1%) and cash flows (cash payout ratio: 37.1%). Trading at a discount to its estimated fair value, Subaru offers good relative value compared to peers, though earnings are forecasted to decline in the coming years.

- Click here to discover the nuances of Subaru with our detailed analytical dividend report.

- Our expertly prepared valuation report Subaru implies its share price may be lower than expected.

Key Takeaways

- Investigate our full lineup of 1492 Top Global Dividend Stocks right here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7270

Subaru

Manufactures and sells automobiles and aerospace products in Japan, rest of Asia, North America, Europe, Asia, and Internationally.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives