The Bull Case For Toyota Motor (TSE:7203) Could Change Following Surge in North American Electrified Sales

Reviewed by Sasha Jovanovic

- Toyota Motor Corporation recently reported a near 16% increase in North American vehicle sales for the third quarter, with electrified models comprising almost half of U.S. sales in September 2025.

- This performance highlights Toyota's growing traction in the electrified vehicle market and the effectiveness of its ongoing electric and hybrid vehicle strategy.

- We'll explore how surging demand for Toyota's electrified vehicles could reshape the company’s investment outlook and long-term growth prospects.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Toyota Motor Investment Narrative Recap

To be a shareholder in Toyota Motor, you need to believe in its ability to capitalize on the rising demand for electrified vehicles while managing risks in key markets like North America and China. The reported 16% rise in North American vehicle sales and the boost in electrified model volumes will likely ease immediate concerns about declining sales mix, though competitive and currency risks remain significant and unchanged by this news.

Among Toyota’s recent announcements, the push to accelerate high-speed EV charger deployment in Japan directly echoes the brand’s ongoing electrification efforts. While this move aligns with catalysts such as reinforcing Toyota’s position in the electric and hybrid sectors, shorter-term success still hinges on sustaining sales momentum in established markets and managing operational risks.

Yet, investors should also keep in mind that, should North American sales volumes waver in upcoming quarters, …

Read the full narrative on Toyota Motor (it's free!)

Toyota Motor's outlook suggests ¥52,446.5 billion in revenue and ¥3,866.3 billion in earnings by 2028. This implies a 3.0% annual revenue growth rate but an earnings decrease of ¥898.8 billion from the current earnings of ¥4,765.1 billion.

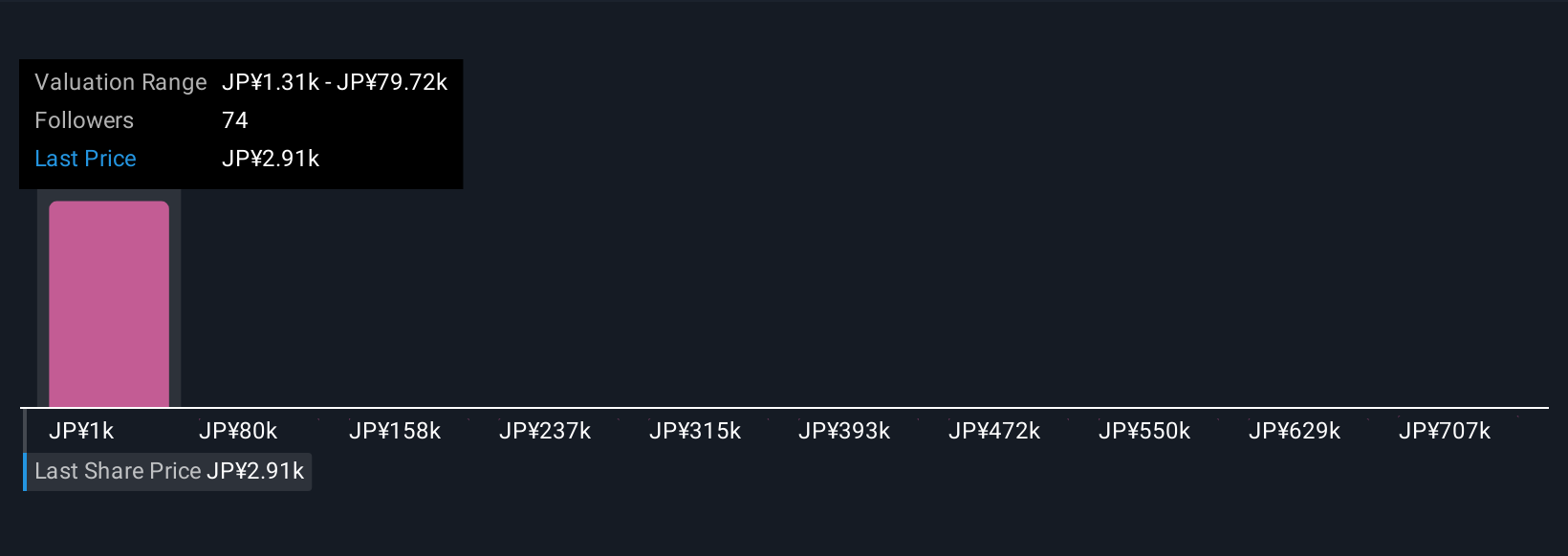

Uncover how Toyota Motor's forecasts yield a ¥3158 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Seven Community members’ fair value estimates for Toyota span from ¥1,309.71 to an outlier of ¥785,455, highlighting wildly varying growth expectations. Some see opportunity in Toyota’s efforts to restore lost production volume, which could influence future performance in the eyes of many market participants.

Explore 7 other fair value estimates on Toyota Motor - why the stock might be worth less than half the current price!

Build Your Own Toyota Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toyota Motor research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

- Our free Toyota Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toyota Motor's overall financial health at a glance.

Curious About Other Options?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- This technology could replace computers: discover 26 stocks that are working to make quantum computing a reality.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Rare earth metals are the new gold rush. Find out which 32 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toyota Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7203

Toyota Motor

Designs, manufactures, assembles, and sells passenger vehicles, minivans and commercial vehicles, and related parts and accessories in Japan, North America, Europe, Asia, Central and South America, Oceania, Africa, and the Middle East.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives