Nissan Motor (TSE:7201) Shifts to Hybrid Production in US as EV Plans Stalled by Weak Demand

Reviewed by Sasha Jovanovic

- In recent days, Nissan Motor has decided to pause its plans to produce battery electric vehicles in the United States, shelving the launch of a new battery-powered SUV at its Canton, Mississippi facility due to slowing sales and discontinued tax incentives.

- This shift includes a potential revival of the discontinued Nissan Xterra model as a hybrid, with new production targeted to begin at the same U.S. plant in 2028, reflecting Nissan's adaptation to changing consumer demand and the evolving regulatory landscape in the automotive sector.

- We'll examine how Nissan’s pivot toward hybrid production in the U.S. could reshape its investment outlook and earnings assumptions.

AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

Nissan Motor Investment Narrative Recap

Being a shareholder in Nissan Motor today means believing in the company’s ability to recover margins and return to profitability through restructuring, cost-cutting, and competitive realignment, especially in key global markets. The latest news about pausing US battery EV production and pivoting to hybrids is a measured response to changing consumer trends and incentives, but does not appear to shift the most critical near-term catalyst, the execution and success of Nissan’s turnaround plan. Risks to cash flow and consistent margin recovery remain central for now.

Among recent company announcements, Nissan’s ongoing consideration to sell its 75% stake in the Yokohama F. Marinos soccer club stands out as most relevant to current events. While such a sale is unlikely to materially alter operational results, it sits within the context of Nissan’s larger restructuring efforts, which include addressing shortfalls in free cash flow and persistent operating losses, now under sharper focus as the company adapts its US product strategy.

However, with cash flow remaining under pressure and visibility on a turnaround still a key concern for investors, attention should remain on...

Read the full narrative on Nissan Motor (it's free!)

Nissan Motor's outlook anticipates ¥12,909.5 billion in revenue and ¥203.3 billion in earnings by 2028. This forecast requires 1.5% annual revenue growth and an earnings increase of ¥1,018.5 billion from current earnings of ¥-815.2 billion.

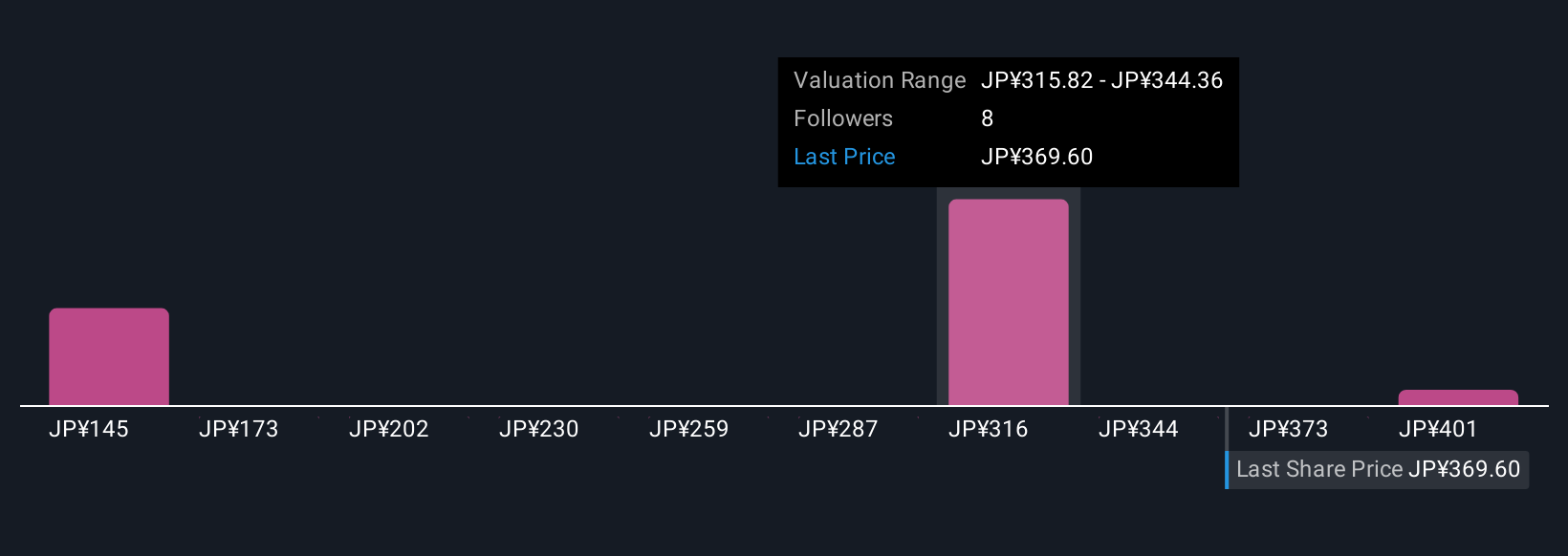

Uncover how Nissan Motor's forecasts yield a ¥336 fair value, a 10% downside to its current price.

Exploring Other Perspectives

The Simply Wall St Community shared three fair value estimates for Nissan, ranging widely from ¥111.04 to ¥430 per share. As these varied viewpoints highlight, ongoing challenges around persistent negative free cash flow may weigh heavily on future returns and margin stability, see what other investors are factoring in.

Explore 3 other fair value estimates on Nissan Motor - why the stock might be worth as much as 15% more than the current price!

Build Your Own Nissan Motor Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Nissan Motor research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Nissan Motor research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Nissan Motor's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The latest GPUs need a type of rare earth metal called Terbium and there are only 35 companies in the world exploring or producing it. Find the list for free.

- Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives