Is Nissan a Value Opportunity After Recent EV Expansion and Mixed Valuation Signals?

Reviewed by Bailey Pemberton

- Wondering if Nissan Motor is quietly turning into a value opportunity, or if the market is cheap for a reason? This breakdown will help you decide whether the current price really stacks up.

- The stock has inched up 0.4% over the last week and 4.5% over the past month, but it is still down 22.3% year to date and only 1.7% higher over the last year. That makes the recent moves more intriguing than euphoric.

- Recent headlines have focused on Nissan Motor's intensified push into electric and hybrid vehicles, alongside expanded partnerships in key markets. This signals that management is still trying to reposition the business for long term competitiveness. At the same time, investors are debating whether ongoing restructuring efforts and changing global auto demand can meaningfully shift its growth trajectory.

- On our checks, Nissan Motor scores a 3/6 valuation score, suggesting the shares look undervalued on some metrics but not across the board. Below, we walk through the main valuation approaches and, by the end, explore a more holistic way to judge whether the stock really offers good value.

Find out why Nissan Motor's 1.7% return over the last year is lagging behind its peers.

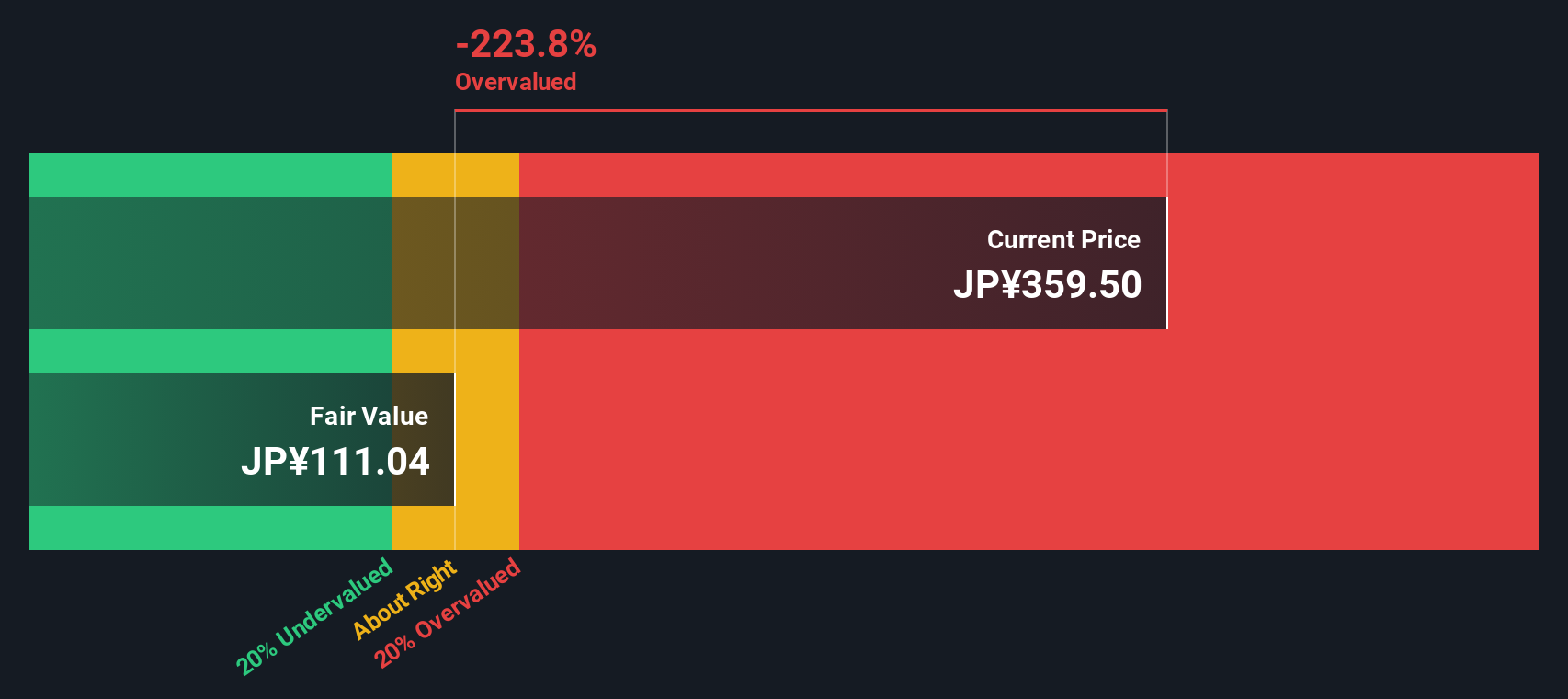

Approach 1: Nissan Motor Dividend Discount Model (DDM) Analysis

The Dividend Discount Model estimates what a stock is worth by projecting future dividends and discounting them back to today, assuming that dividends ultimately drive long term returns.

For Nissan Motor, the model uses a current annual dividend per share of about ¥2.70 and assumes very modest long run dividend growth of 0.60%, capped down from an initially higher estimate of 2.54%. This conservative growth rate reflects the reality that earnings and cash flows are still volatile, so dividend expansion is expected to be slow and steady rather than aggressive.

With an implied return on equity of roughly 2.94% and a low payout ratio of about 13.8%, the DDM framework suggests Nissan has room to maintain or gradually grow its dividend, but not at a pace that would justify the current share price. Based on these inputs, the intrinsic value comes out far below where the stock trades today, implying it is roughly 1195.8% overvalued rather than a hidden bargain.

Result: OVERVALUED

Our Dividend Discount Model (DDM) analysis suggests Nissan Motor may be overvalued by 1195.8%. Discover 935 undervalued stocks or create your own screener to find better value opportunities.

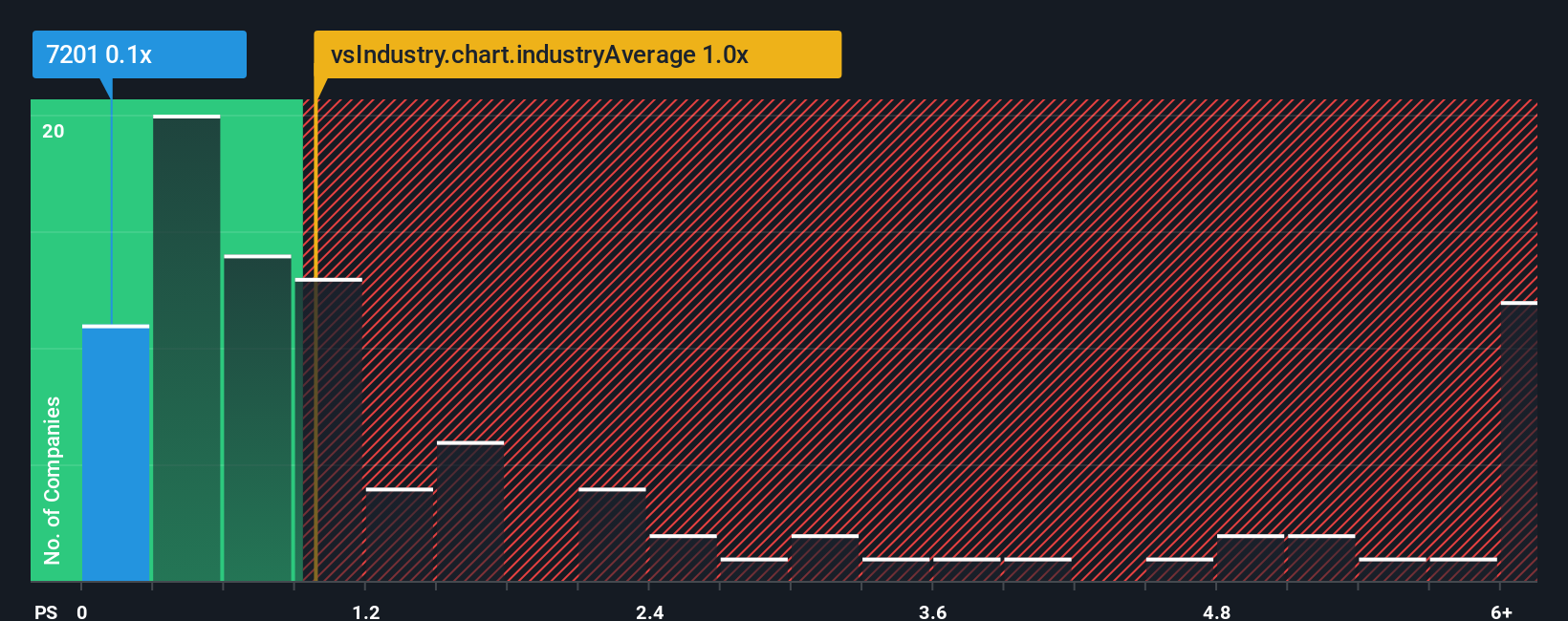

Approach 2: Nissan Motor Price vs Sales

For companies like Nissan Motor that are still working through volatile earnings and uneven profitability, the price to sales ratio is often a cleaner way to judge valuation. Sales tend to be more stable than earnings, so this multiple can provide a more reliable anchor when margins are cycling up and down.

In general, a higher multiple is considered reasonable when investors expect stronger growth and are comfortable with the risks. Slower growing or riskier businesses usually trade on a lower, more conservative multiple. Nissan Motor currently trades on a price to sales ratio of about 0.11x, which is well below both the Auto industry average of roughly 0.92x and the peer group average of around 0.33x. On the surface, that discount indicates the market is cautious about its outlook.

To go beyond simple comparisons, Simply Wall St uses a proprietary Fair Ratio, which estimates what Nissan’s price to sales multiple could be after taking into account its growth profile, profit margins, risk characteristics, industry and market cap. For Nissan, this fair price to sales ratio is 0.62x, indicating the stock appears materially undervalued relative to what those fundamentals would typically support.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

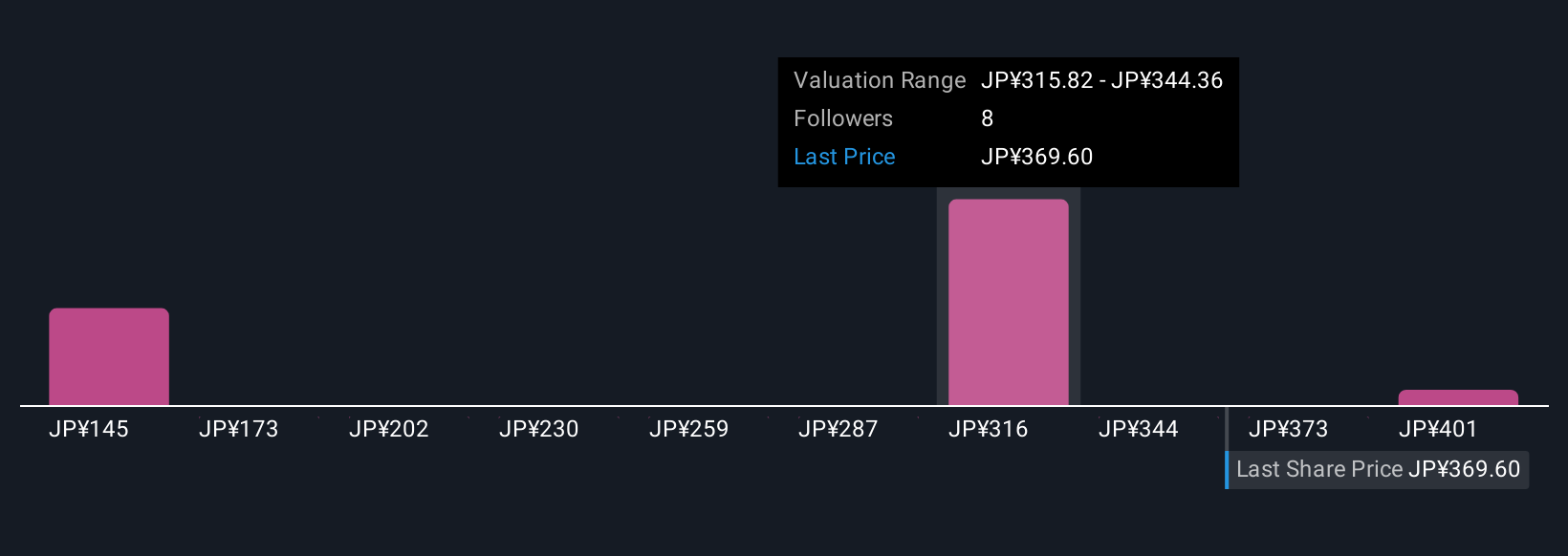

Upgrade Your Decision Making: Choose your Nissan Motor Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple framework on Simply Wall St’s Community page that lets you attach a clear story to your numbers by linking your view of Nissan Motor’s strategy and risks to explicit forecasts for revenue, earnings and margins, and then to a fair value you can compare against today’s share price to decide whether to buy, hold or sell. The platform dynamically updates your Narrative as new news or earnings arrive, so you can see, for example, how one investor’s optimistic view that EV launches, alliances and cost cuts will lift earnings towards the higher analyst estimates and justify a fair value closer to ¥430 can sit alongside another investor’s more cautious Narrative that focuses on China weakness, cash flow pressure and tariffs, leading them to anchor on the lower end of expectations and a fair value nearer ¥250 instead.

Do you think there's more to the story for Nissan Motor? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nissan Motor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7201

Nissan Motor

Manufactures and sells vehicles and automotive parts worldwide.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

PSIX The timing of insider sales is a serious question mark

The Great Strategy Swap – Selling "Old Auto" to Buy "Future Light"

Not a Bubble, But the "Industrial Revolution 4.0" Engine

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026