- Italy

- /

- Renewable Energy

- /

- BIT:ERG

Analysts Just Made A Major Revision To Their ERG S.p.A. (BIT:ERG) Revenue Forecasts

The latest analyst coverage could presage a bad day for ERG S.p.A. (BIT:ERG), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic. Shares are up 5.8% to €30.16 in the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

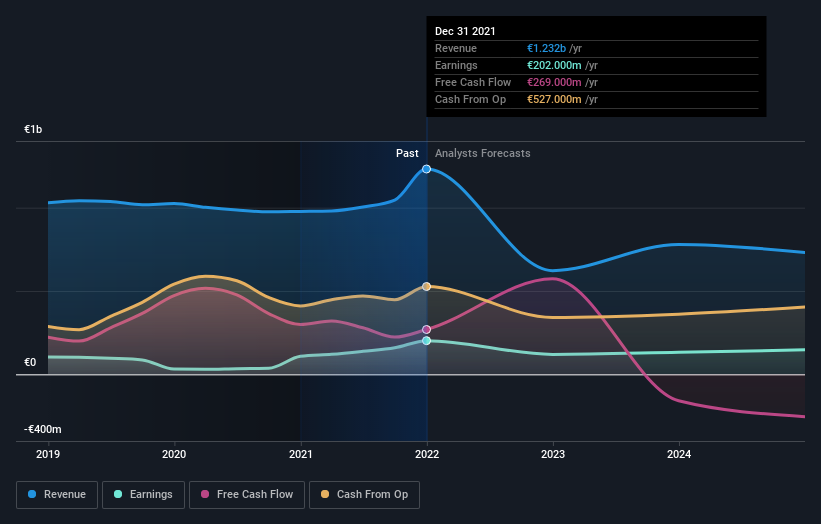

Following the latest downgrade, the six analysts covering ERG provided consensus estimates of €622m revenue in 2022, which would reflect a stressful 49% decline on its sales over the past 12 months. Statutory earnings per share are supposed to plummet 41% to €0.80 in the same period. Previously, the analysts had been modelling revenues of €833m and earnings per share (EPS) of €0.79 in 2022. Indeed we can see that the consensus opinion has undergone some fundamental changes following the recent consensus updates, with a sizeable cut to revenues and some minor tweaks to earnings numbers.

See our latest analysis for ERG

The consensus has reconfirmed its price target of €32.61, showing that the analysts don't expect weaker sales expectationsthis year to have a material impact on ERG's market value. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. There are some variant perceptions on ERG, with the most bullish analyst valuing it at €38.00 and the most bearish at €26.00 per share. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

These estimates are interesting, but it can be useful to paint some more broad strokes when seeing how forecasts compare, both to the ERG's past performance and to peers in the same industry. These estimates imply that sales are expected to slow, with a forecast annualised revenue decline of 49% by the end of 2022. This indicates a significant reduction from annual growth of 0.04% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the industry are forecast to see their revenue decline 0.9% annually for the foreseeable future. The forecasts do look bearish for ERG, since they're expecting it to shrink faster than the industry.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Unfortunately they also cut their revenue estimates for this year, and they expect sales to lag the wider market. That said, earnings per share are more important for creating value for shareholders. Given the stark change in sentiment, we'd understand if investors became more cautious on ERG after today.

A high debt burden combined with a downgrade of this magnitude always gives us some reason for concern, especially if these forecasts are just the first sign of a business downturn. You can learn more about our debt analysis for free on our platform here.

Another thing to consider is whether management and directors have been buying or selling stock recently. We provide an overview of all open market stock trades for the last twelve months on our platform, here.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if ERG might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:ERG

ERG

Through its subsidiaries, produces energy through renewable sources in Italy, France, Germany, the United Kingdom, Poland, Bulgaria, Sweden, Romania, and Spain.

Average dividend payer with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)