- Italy

- /

- Other Utilities

- /

- BIT:A2A

A2A (BIT:A2A) Valuation Check After Completing Its Latest Share Buyback Program

Reviewed by Simply Wall St

A2A (BIT:A2A) has just wrapped up its latest share buyback, adding more than two million treasury shares in early December, which some investors may view as a signal of management’s confidence in its balance sheet and future cash flows.

See our latest analysis for A2A.

That capital return push comes after a choppier spell for the stock, with a 30 day share price return of minus 16.35 percent but a 3 year total shareholder return of 102.97 percent, suggesting that longer term momentum is still very much intact.

If this kind of steady utility story has you thinking about portfolio balance, it could be worth exploring other regulated names alongside A2A by screening for healthcare stocks.

With shares down over the past month but still ahead over three and five years, and analysts seeing upside to the current price, is A2A quietly undervalued right now, or is the market already pricing in its future growth?

Most Popular Narrative Narrative: 15% Undervalued

With A2A last closing at €2.27 against a narrative fair value of about €2.67, the most followed view sees upside even with muted growth.

The analysts are assuming A2A's revenue will decrease by 2.0% annually over the next 3 years. Analysts assume that profit margins will shrink from 6.0% today to 5.4% in 3 years time.

Curious how a shrinking top line and thinner margins can still justify a richer earnings multiple in a regulated utility, and why that could reshape A2A's long term valuation story?

Result: Fair Value of €2.67 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, regulatory decisions on concessions and A2A's heavy reliance on aggressive CapEx could quickly undermine margins and the case for a higher earnings multiple.

Find out about the key risks to this A2A narrative.

Another Lens on Value

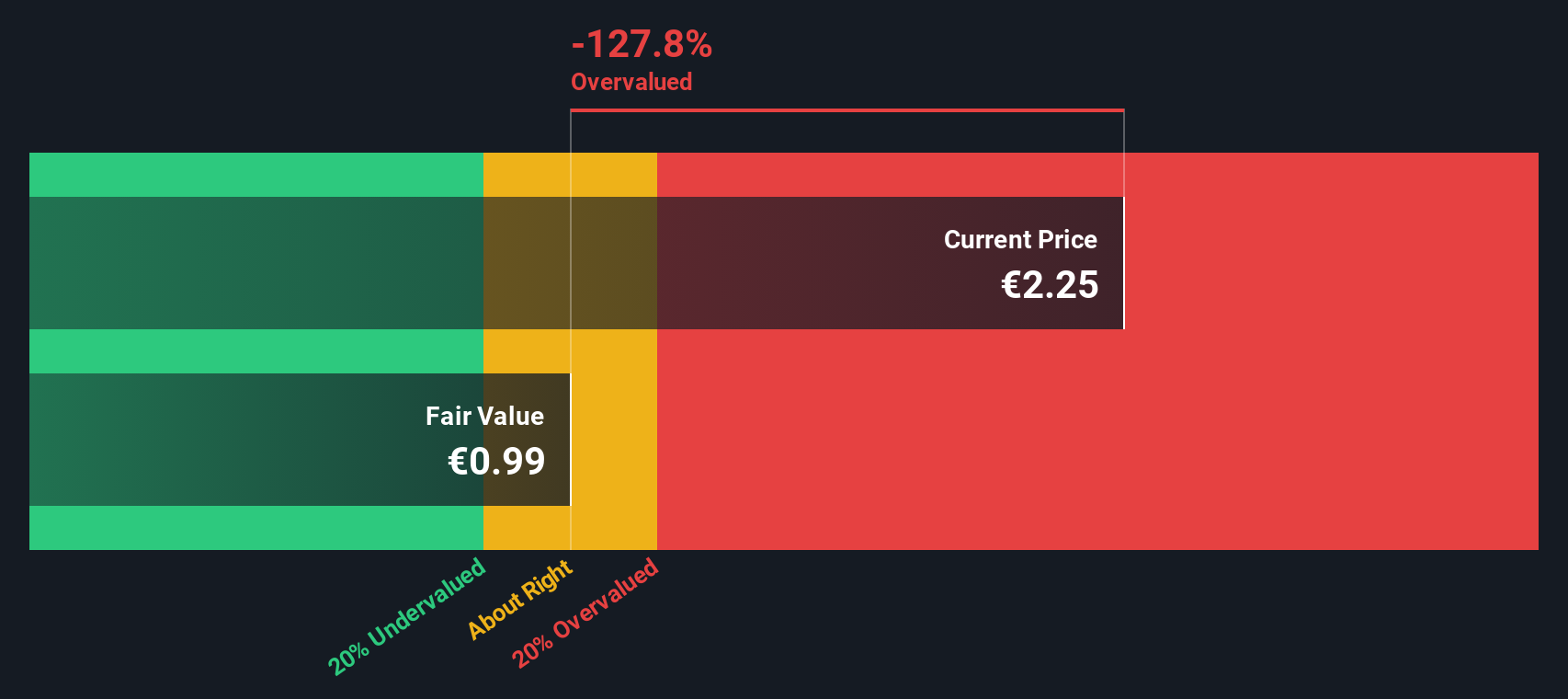

While the narrative points to upside based on future earnings and margins, our DCF model is far more cautious. It puts fair value closer to €0.91 per share, which suggests A2A could actually be overvalued at current prices. Which story do you think better reflects reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out A2A for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 905 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own A2A Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom view in minutes: Do it your way.

A great starting point for your A2A research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Ready for more investment ideas?

Before the market moves on without you, lock in your next opportunities using targeted stock screens that surface quality ideas you might otherwise miss.

- Capture high-upside potential early by scanning these 3609 penny stocks with strong financials that pair speculative growth with improving fundamentals and financial discipline.

- Position your portfolio at the heart of the AI shift by focusing on these 25 AI penny stocks building real products, revenues, and defensible advantages.

- Strengthen long term returns with these 12 dividend stocks with yields > 3% that combine reliable income streams with balance sheets built to handle tougher markets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:A2A

A2A

Engages in the production, sale, and distribution of gas and electricity, and district heating in Italy and internationally.

Average dividend payer and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Dollar general to grow

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026