Three Stocks That Might Be Estimated Below Their True Value In December 2024

Reviewed by Simply Wall St

As of December 2024, global markets have been characterized by a divergence in major U.S. stock indexes, with growth stocks significantly outperforming value stocks amid record highs for the S&P 500, Dow Jones Industrial Average, and Nasdaq Composite. In this environment of mixed economic signals and geopolitical uncertainties, identifying undervalued stocks requires a focus on companies that demonstrate strong fundamentals and potential for growth despite current market volatility.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Round One (TSE:4680) | ¥1266.00 | ¥2527.81 | 49.9% |

| NBT Bancorp (NasdaqGS:NBTB) | US$50.06 | US$99.93 | 49.9% |

| Proya CosmeticsLtd (SHSE:603605) | CN¥92.22 | CN¥184.30 | 50% |

| BMC Medical (SZSE:301367) | CN¥68.53 | CN¥136.81 | 49.9% |

| Acerinox (BME:ACX) | €9.98 | €19.93 | 49.9% |

| Grupo Traxión. de (BMV:TRAXION A) | MX$19.71 | MX$39.28 | 49.8% |

| North Electro-OpticLtd (SHSE:600184) | CN¥11.08 | CN¥22.00 | 49.6% |

| Sands China (SEHK:1928) | HK$20.20 | HK$40.33 | 49.9% |

| Equifax (NYSE:EFX) | US$266.82 | US$530.98 | 49.7% |

| iFLYTEKLTD (SZSE:002230) | CN¥51.82 | CN¥102.95 | 49.7% |

Let's uncover some gems from our specialized screener.

TXT e-solutions (BIT:TXT)

Overview: TXT e-solutions S.p.A., along with its subsidiaries, offers software and service solutions both in Italy and internationally, with a market cap of €429.64 million.

Operations: The company's revenue segments consist of Smart Solutions (€57.03 million), Digital Advisory (€43.22 million), and Software Engineering (€184.35 million).

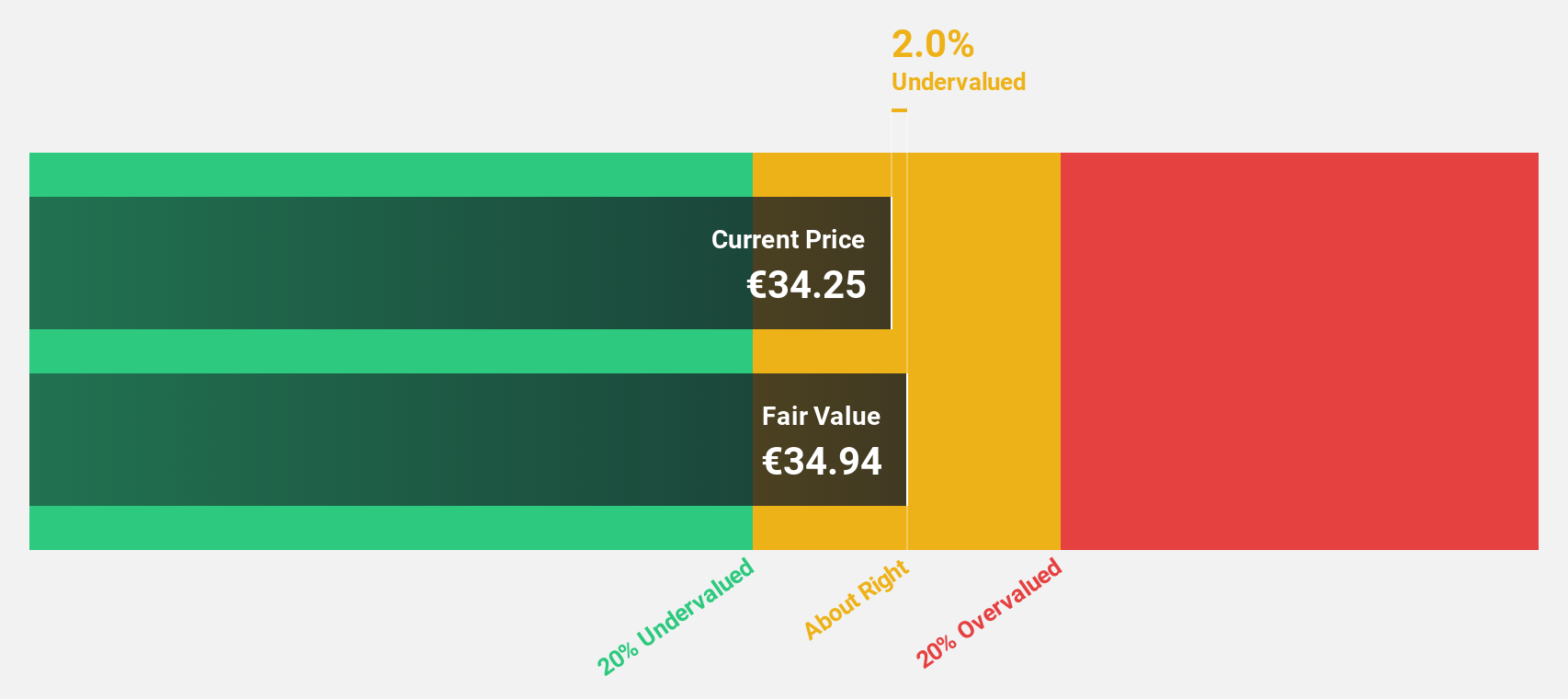

Estimated Discount To Fair Value: 42.8%

TXT e-solutions is trading at €35.55, significantly below its estimated fair value of €62.11, indicating potential undervaluation based on cash flows. The company reported strong earnings growth with third-quarter sales reaching €81.37 million and net income of €4.02 million, up from last year. Despite shareholder dilution and debt coverage concerns, TXT's earnings are expected to grow at 22.93% annually, outpacing the Italian market's forecasted growth rate of 7.1%.

- Our comprehensive growth report raises the possibility that TXT e-solutions is poised for substantial financial growth.

- Take a closer look at TXT e-solutions' balance sheet health here in our report.

Outokumpu Oyj (HLSE:OUT1V)

Overview: Outokumpu Oyj is a company that produces and sells stainless steel products across Finland, Europe, North America, the Asia-Pacific, and internationally with a market cap of €1.38 billion.

Operations: The company's revenue segments include €1.72 billion from the Americas, €491 million from Ferrochrome, and €4.21 billion from Europe (excluding Ferrochrome).

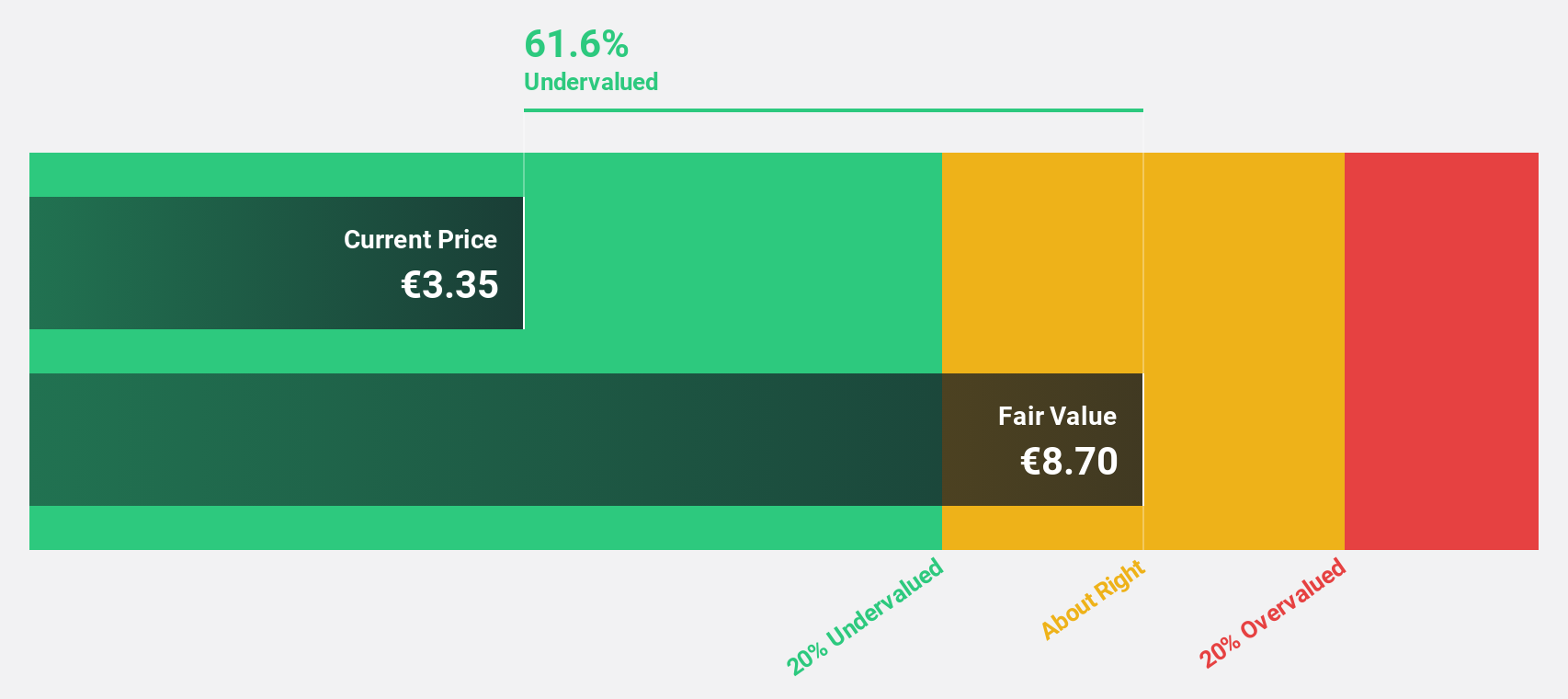

Estimated Discount To Fair Value: 46%

Outokumpu Oyj is trading at €3.26, well below its estimated fair value of €6.03, suggesting it may be undervalued based on cash flows. Despite a challenging year with sales dropping to €4.54 billion for the first nine months and a net loss of €8 million, the company is forecasted to achieve profitability within three years, surpassing average market growth expectations. However, dividend sustainability remains questionable given current earnings coverage concerns.

- Our growth report here indicates Outokumpu Oyj may be poised for an improving outlook.

- Click here to discover the nuances of Outokumpu Oyj with our detailed financial health report.

Proya CosmeticsLtd (SHSE:603605)

Overview: Proya Cosmetics Co., Ltd. is a beauty and personal care company that researches, develops, produces, and sells cosmetics in China with a market cap of CN¥36.34 billion.

Operations: Proya Cosmetics Co., Ltd. generates its revenue primarily from the research, development, production, and sale of cosmetics within China.

Estimated Discount To Fair Value: 50%

Proya Cosmetics Ltd. trades at CNY 92.22, significantly below its estimated fair value of CNY 184.3, indicating potential undervaluation based on cash flows. The company reported strong earnings growth of 35.5% over the past year, with revenue reaching CNY 6.97 billion for the first nine months of 2024. While earnings are expected to grow significantly at 20.4% annually, they may lag behind broader market growth rates in China.

- The analysis detailed in our Proya CosmeticsLtd growth report hints at robust future financial performance.

- Navigate through the intricacies of Proya CosmeticsLtd with our comprehensive financial health report here.

Taking Advantage

- Discover the full array of 884 Undervalued Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if TXT e-solutions might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:TXT

TXT e-solutions

Provides software and service solutions in Italy and internationally.

High growth potential and good value.

Market Insights

Community Narratives