See our latest analysis for Reply.

Momentum has started to build for Reply, as the stock shook off a sluggish start to the year and has been climbing in recent weeks. While the latest share price return remains modest compared to last year, Reply's five-year total shareholder return of 33% shows that patient investors have been rewarded over the long run.

If you're exploring new sectors alongside digital transformation, it is a great moment to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading at a notable discount compared to analysts' price targets, the big question is whether Reply offers genuine value at current levels or if investors have already taken the company’s future prospects into account.

Price-to-Earnings of 19.6x: Is it justified?

Reply's current price-to-earnings (P/E) ratio stands at 19.6x, reflecting a valuation that sits below the average for its IT industry peer group. With the last close at €124, this suggests the market is not pricing in aggressive growth compared to hotter sectors.

The P/E ratio is a valuable gauge of investor sentiment, indicating what buyers are willing to pay today for a euro of Reply’s earnings. For a software and services company navigating rapid digital transformation, this multiple signals a balanced outlook between past performance and future expectations.

Looking closely, Reply’s P/E is below the broader IT industry average of 21.5x and sits well below the peer group average of 30.5x. Interestingly, it is also under the company's estimated fair price-to-earnings ratio of 25.7x. This gives room for movement. If Reply delivers earnings growth that justifies a higher multiple, the valuation could converge toward that fair level.

Explore the SWS fair ratio for Reply

Result: Price-to-Earnings of 19.6x (ABOUT RIGHT)

However, slower recent share returns and potential setbacks in digital transformation demand close attention. These factors could challenge Reply’s current valuation narrative.

Find out about the key risks to this Reply narrative.

Another View: SWS DCF Model Signals Overvaluation

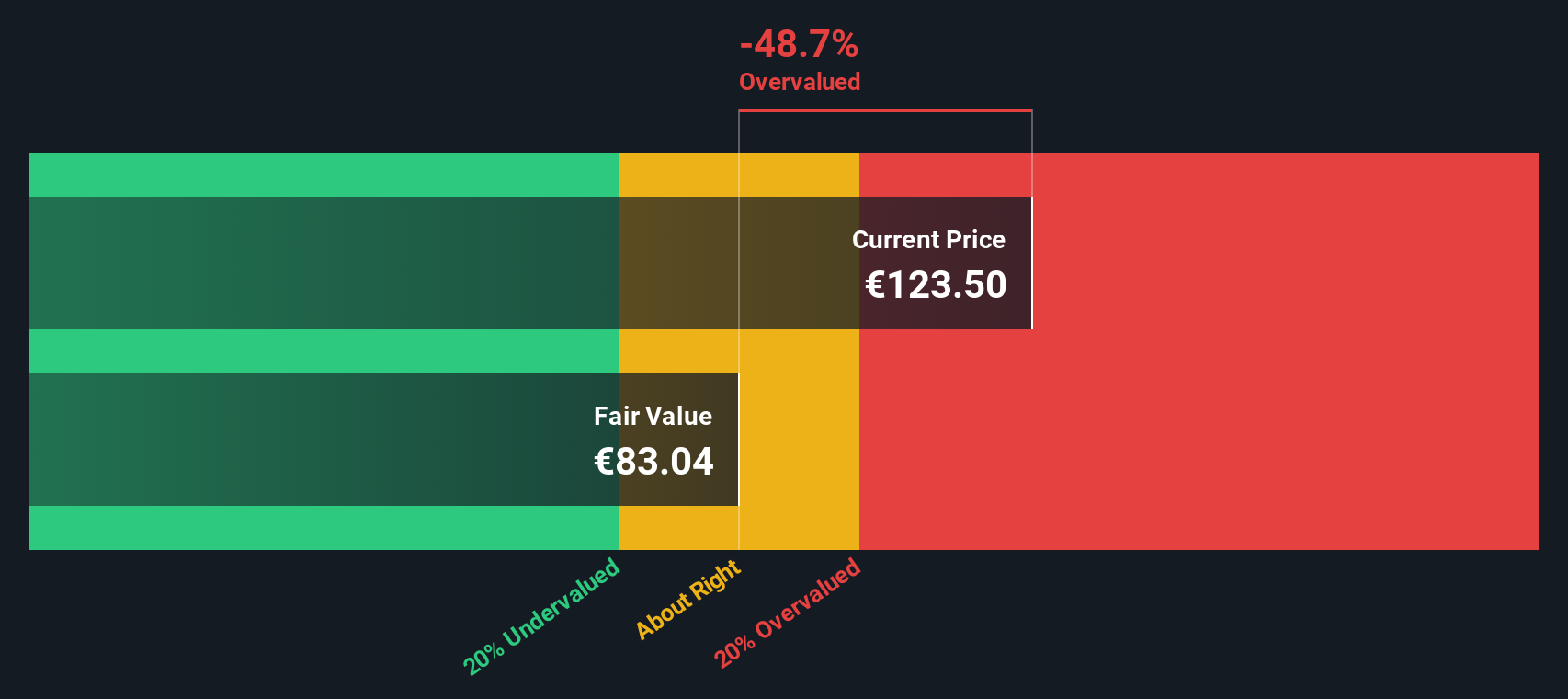

While Reply's earnings multiple appears attractive compared to peers and the fair ratio, the SWS DCF model tells a different story. According to this discounted cash flow approach, the current share price of €124 is well above our estimate of fair value at €82.86. This result suggests the market may be factoring in more optimistic assumptions than the model supports. This raises the question of which outlook investors should trust at today's levels.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Reply for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Reply Narrative

If you see the numbers differently or think another angle deserves attention, you can easily create your own perspective in just a few minutes with Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Reply.

Looking for more investment ideas?

Markets move fast, but opportunities await bold investors. Uncover fresh themes, niche sectors, or high-potential companies with targeted ideas from our advanced Screeners.

- Unlock high yields and build a robust income stream when you check out these 19 dividend stocks with yields > 3% with impressive returns above 3%.

- Position yourself at the forefront of innovation by tracking real opportunities in artificial intelligence with these 24 AI penny stocks.

- Seize exceptional value and make your capital work harder by searching for tomorrow’s winners among these 909 undervalued stocks based on cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:REY

Reply

Provides consulting, system integration, and digital services based on communication channels and digital media in Italy and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)