European Market: 3 Stocks That May Be Trading Below Their Estimated Value

Reviewed by Simply Wall St

As the European market navigates mixed signals with indices like Germany's DAX seeing gains while others such as France's CAC 40 experience declines, investors are closely watching central bank policies and economic data for cues. In this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities, particularly when considering factors such as growth prospects and financial health in a fluctuating market landscape.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK18.50 | SEK36.57 | 49.4% |

| Straumann Holding (SWX:STMN) | CHF95.02 | CHF187.47 | 49.3% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.284 | €8.53 | 49.8% |

| Ottobock SE KGaA (XTRA:OBCK) | €69.45 | €138.59 | 49.9% |

| Koskisen Oyj (HLSE:KOSKI) | €9.18 | €18.23 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK379.65 | NOK753.94 | 49.6% |

| Inission (OM:INISS B) | SEK48.60 | SEK95.97 | 49.4% |

| Exel Composites Oyj (HLSE:EXL1V) | €0.392 | €0.78 | 49.6% |

| Esautomotion (BIT:ESAU) | €3.12 | €6.15 | 49.3% |

| AutoStore Holdings (OB:AUTO) | NOK10.45 | NOK20.72 | 49.6% |

Let's take a closer look at a couple of our picks from the screened companies.

MFE-Mediaforeurope (BIT:MFEB)

Overview: MFE-Mediaforeurope N.V. operates in the television industry across Italy and Spain, with a market cap of €2.30 billion.

Operations: MFE-Mediaforeurope N.V. generates revenue from its television operations in Italy and Spain.

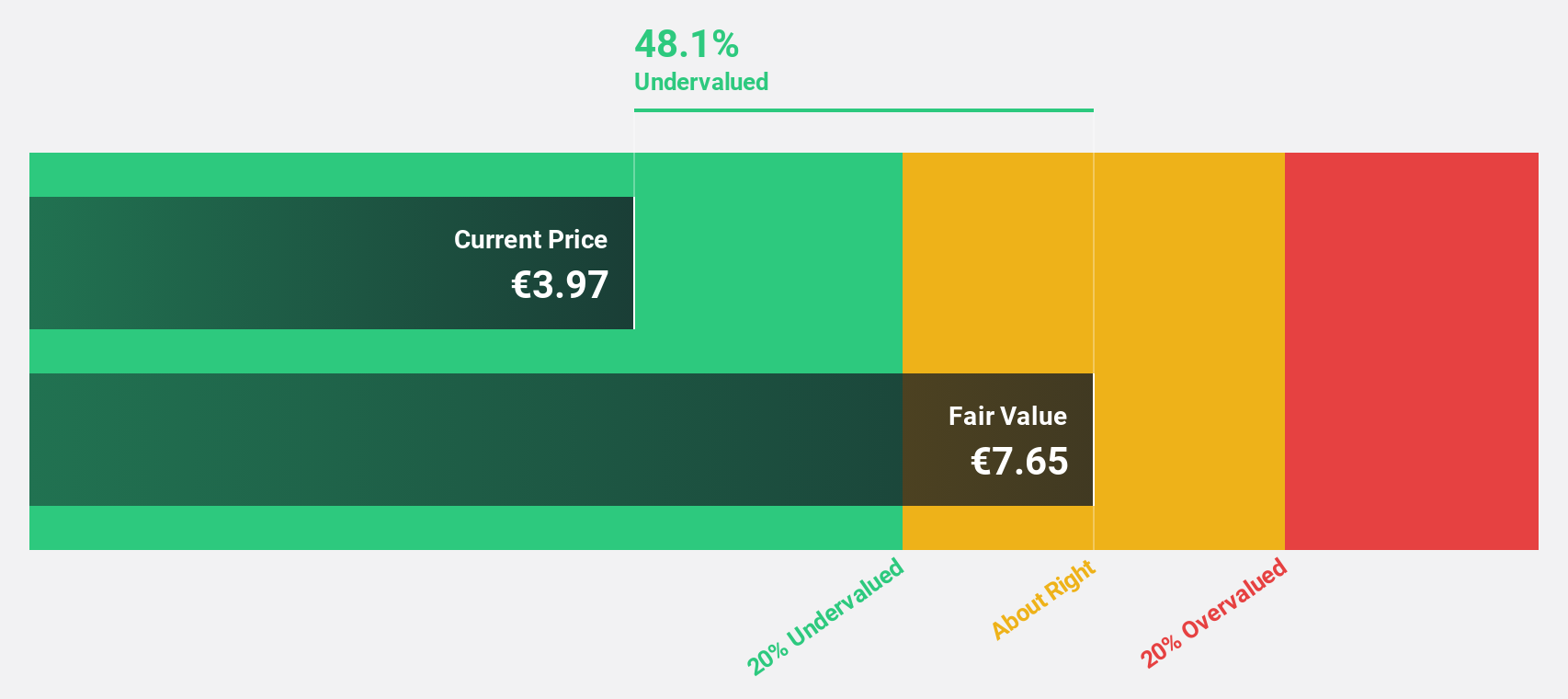

Estimated Discount To Fair Value: 48.1%

MFE-Mediaforeurope is trading at €3.97, significantly below its estimated fair value of €7.65, suggesting it may be undervalued based on cash flows. Despite high debt levels and recent insider selling, the company's earnings grew by 21.5% over the past year and are forecast to grow 17.09% annually, outpacing the Italian market's growth rate of 10%. Revenue is expected to rise by 28% per year, although a dividend yield of 6.8% isn't well covered by earnings.

- The growth report we've compiled suggests that MFE-Mediaforeurope's future prospects could be on the up.

- Delve into the full analysis health report here for a deeper understanding of MFE-Mediaforeurope.

Ambu (CPSE:AMBU B)

Overview: Ambu A/S, along with its subsidiaries, is engaged in the research, development, manufacturing, marketing, and sale of medical technology solutions across North America, Europe, and globally; it has a market cap of DKK23.26 billion.

Operations: The company's revenue segment is primarily comprised of Medical Technology Solutions, which generated DKK6.04 billion.

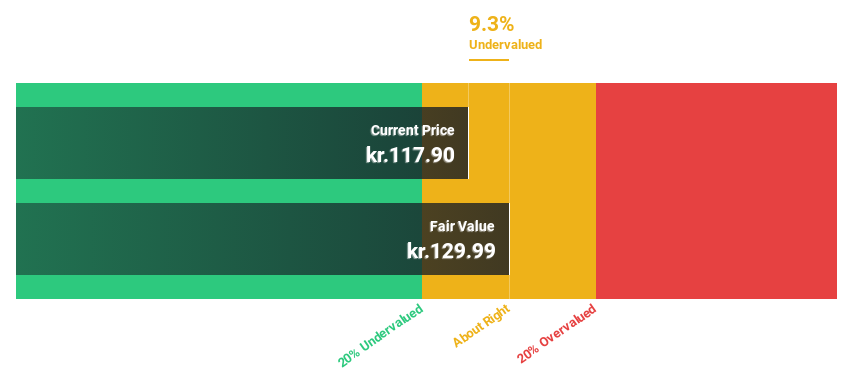

Estimated Discount To Fair Value: 33.1%

Ambu A/S is trading at DKK 87.25, which is below its estimated fair value of DKK 130.46, highlighting potential undervaluation based on cash flows. The company's earnings grew by a very large margin over the past year and are projected to increase significantly at 20% annually, surpassing both Danish market growth and revenue growth forecasts of 10.6%. Recent share repurchase announcements further support the stock's attractiveness despite its low forecasted return on equity in three years.

- In light of our recent growth report, it seems possible that Ambu's financial performance will exceed current levels.

- Navigate through the intricacies of Ambu with our comprehensive financial health report here.

Outokumpu Oyj (HLSE:OUT1V)

Overview: Outokumpu Oyj is a global producer and seller of stainless steel products, operating in regions including Europe, North America, and the Asia-Pacific, with a market cap of €2.02 billion.

Operations: The company's revenue is primarily derived from its Europe segment at €3.88 billion, followed by the Americas segment at €1.66 billion, and the Ferrochrome segment contributing €454 million.

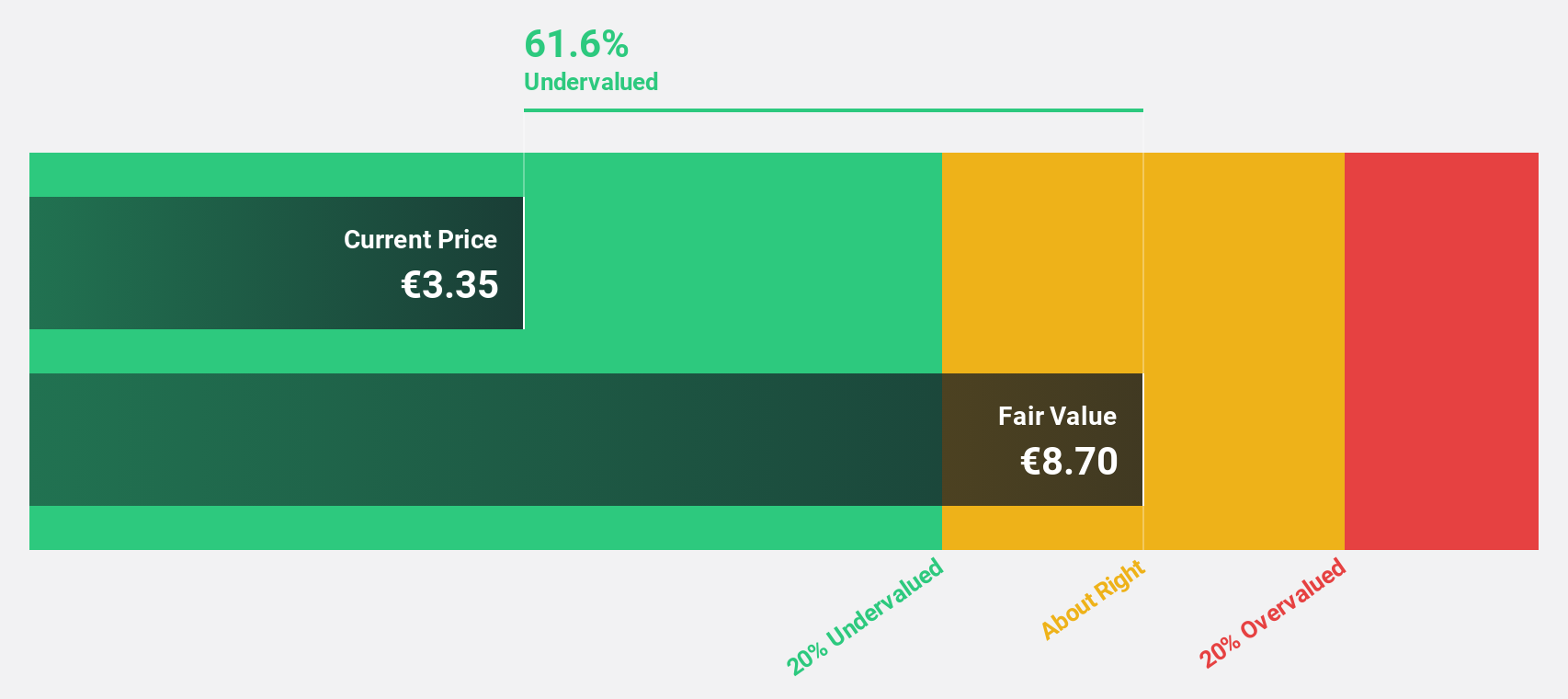

Estimated Discount To Fair Value: 49.8%

Outokumpu Oyj, trading at €4.28, is significantly undervalued compared to its estimated fair value of €8.53, based on cash flow analysis. Despite recent financial challenges with a net loss of €72 million for the first nine months of 2025 and a dividend not well covered by earnings, the company is expected to become profitable in three years with anticipated revenue growth outpacing the Finnish market. Recent strategic investments and restructuring efforts aim to enhance future profitability and operational efficiency.

- According our earnings growth report, there's an indication that Outokumpu Oyj might be ready to expand.

- Click here to discover the nuances of Outokumpu Oyj with our detailed financial health report.

Where To Now?

- Click through to start exploring the rest of the 192 Undervalued European Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:MFEB

MFE-Mediaforeurope

Operates in the television industry in Italy and Spain.

Undervalued with reasonable growth potential and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)