- Italy

- /

- Entertainment

- /

- BIT:LMG

Downgrade: The Latest Revenue And EPS Forecasts For Lucisano Media Group S.p.A. (BIT:LMG)

Today is shaping up negative for Lucisano Media Group S.p.A. (BIT:LMG) shareholders, with the covering analyst delivering a substantial negative revision to this year's forecasts. This report focused on revenue estimates, and it looks as though the consensus view of the business has become substantially more conservative.

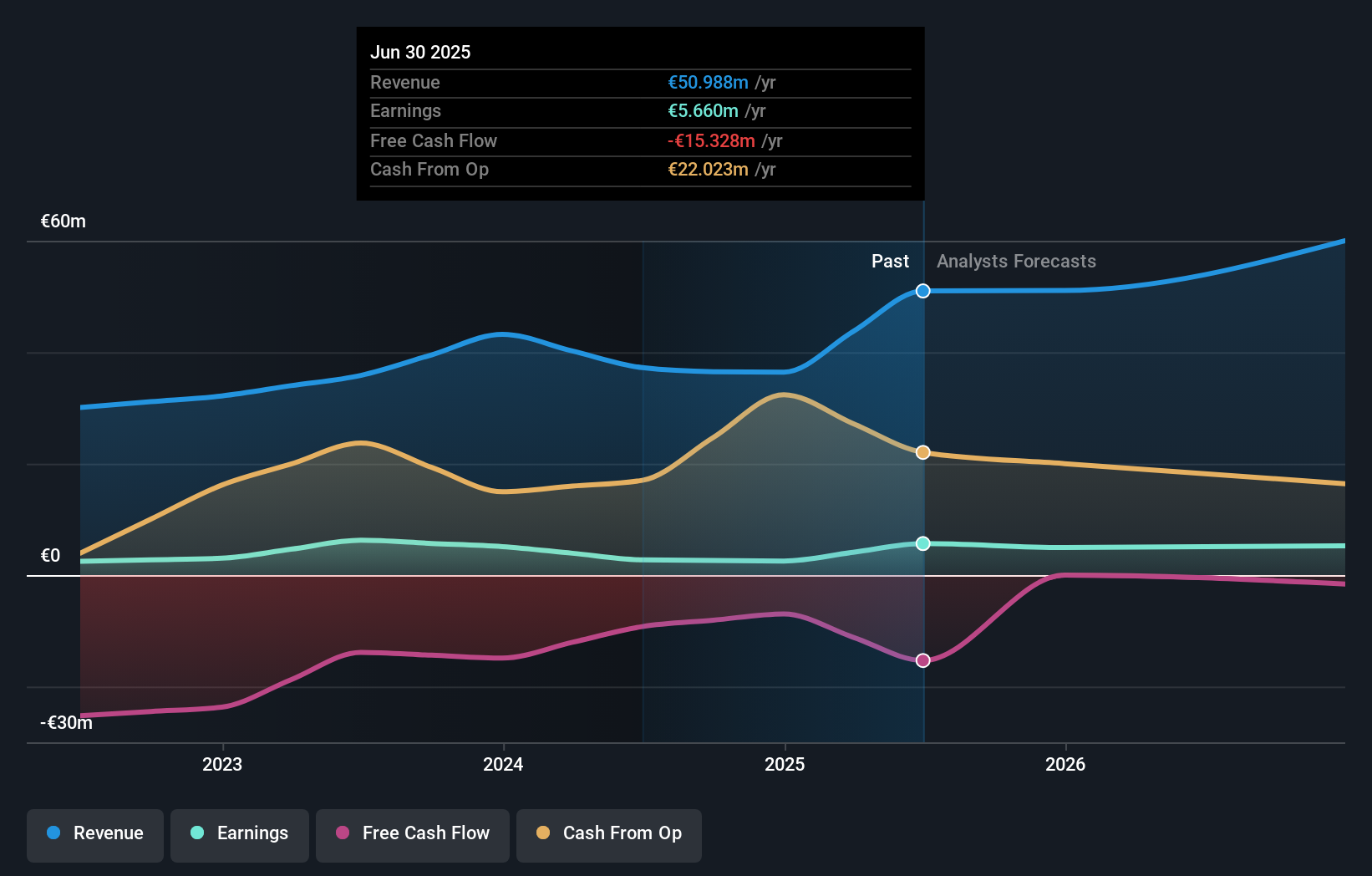

Following the latest downgrade, Lucisano Media Group's single analyst currently expects revenues in 2025 to be €51m, approximately in line with the last 12 months. Before the latest update, the analyst was foreseeing €63m of revenue in 2025. The consensus view seems to have become more pessimistic on Lucisano Media Group, noting the measurable cut to revenue estimates in this update.

See our latest analysis for Lucisano Media Group

Looking at the bigger picture now, one of the ways we can make sense of these forecasts is to see how they measure up against both past performance and industry growth estimates. We would highlight that Lucisano Media Group's revenue growth is expected to slow, with the forecast 0.1% annualised growth rate until the end of 2025 being well below the historical 13% p.a. growth over the last five years. By way of comparison, the other companies in this industry with analyst coverage are forecast to grow their revenue at 12% per year. Factoring in the forecast slowdown in growth, it seems obvious that Lucisano Media Group is also expected to grow slower than other industry participants.

The Bottom Line

The clear low-light was that the analyst slashing their revenue forecasts for Lucisano Media Group this year. They're also anticipating slower revenue growth than the wider market. After a cut like that, investors could be forgiven for thinking the analyst is a lot more bearish on Lucisano Media Group, and a few readers might choose to steer clear of the stock.

So things certainly aren't looking great, and you should also know that we've spotted some potential warning signs with Lucisano Media Group, including concerns around earnings quality. Learn more, and discover the 3 other flags we've identified, for free on our platform here.

You can also see our analysis of Lucisano Media Group's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BIT:LMG

Lucisano Media Group

Engages in the film production and cinema management activities in Italy.

Excellent balance sheet with moderate risk.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)