The European market has shown resilience, with the pan-European STOXX Europe 600 Index rising by 0.65% amid easing trade tensions and expectations of potential interest rate cuts due to slowing inflation in major economies like France, Spain, and Italy. In this environment, high growth tech stocks in Europe are garnering attention for their potential to capitalize on technological advancements and innovation amidst broader economic shifts.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.14% | 56.14% | ★★★★★★ |

| argenx | 21.50% | 26.61% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

GPI (BIT:GPI)

Simply Wall St Growth Rating: ★★★★☆☆

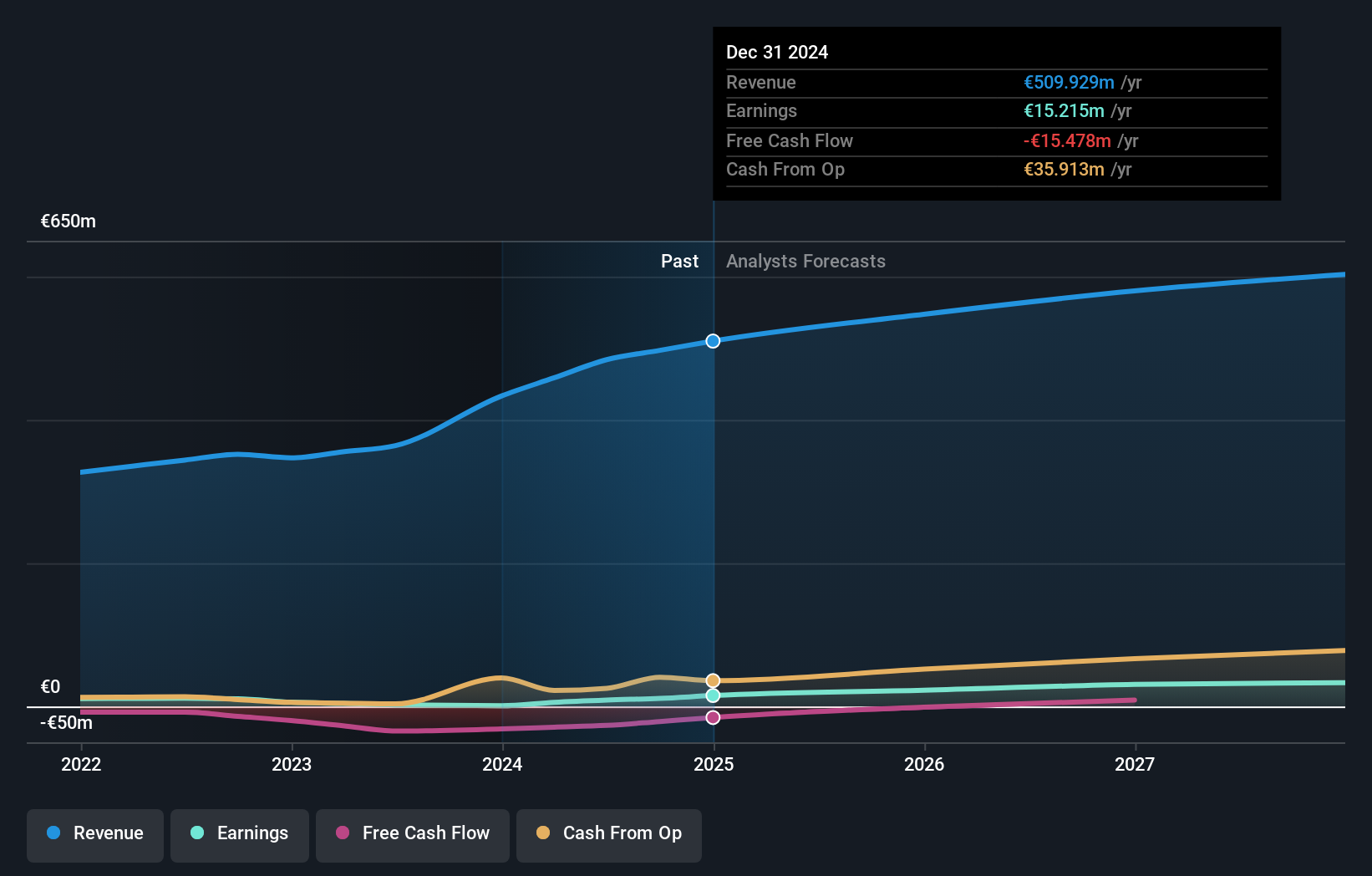

Overview: GPI S.p.A. offers social-healthcare and information technology hi-tech services across Italy and internationally, with a market capitalization of approximately €304.24 million.

Operations: GPI S.p.A. generates revenue primarily through its Software segment (€304.10 million) and Care services (€162.20 million). The company operates within the social-healthcare and information technology sectors, serving both domestic and international markets.

GPI S.p.A. has demonstrated a remarkable turnaround, with its latest earnings report showing a net income increase to €104.04 million from just €5.57 million the previous year, reflecting an astounding 485.4% growth which significantly outpaces the Healthcare Services industry's average. This surge is supported by robust sales growth, up from €424.62 million to €496.47 million annually, and revenue climbing to €509.93 million from €433.42 million in the same period—marking a 5.7% annual increase that exceeds the broader Italian market's growth rate of 4.2%. Additionally, GPI's recent strategic moves include issuing €50 million in sustainable floating-rate bonds and maintaining a steady dividend payout at EUR 0.50 per share, underscoring its commitment to both growth and shareholder returns despite challenges like insufficient coverage of interest payments by earnings.

- Click here and access our complete health analysis report to understand the dynamics of GPI.

Examine GPI's past performance report to understand how it has performed in the past.

Fortnox (OM:FNOX)

Simply Wall St Growth Rating: ★★★★★☆

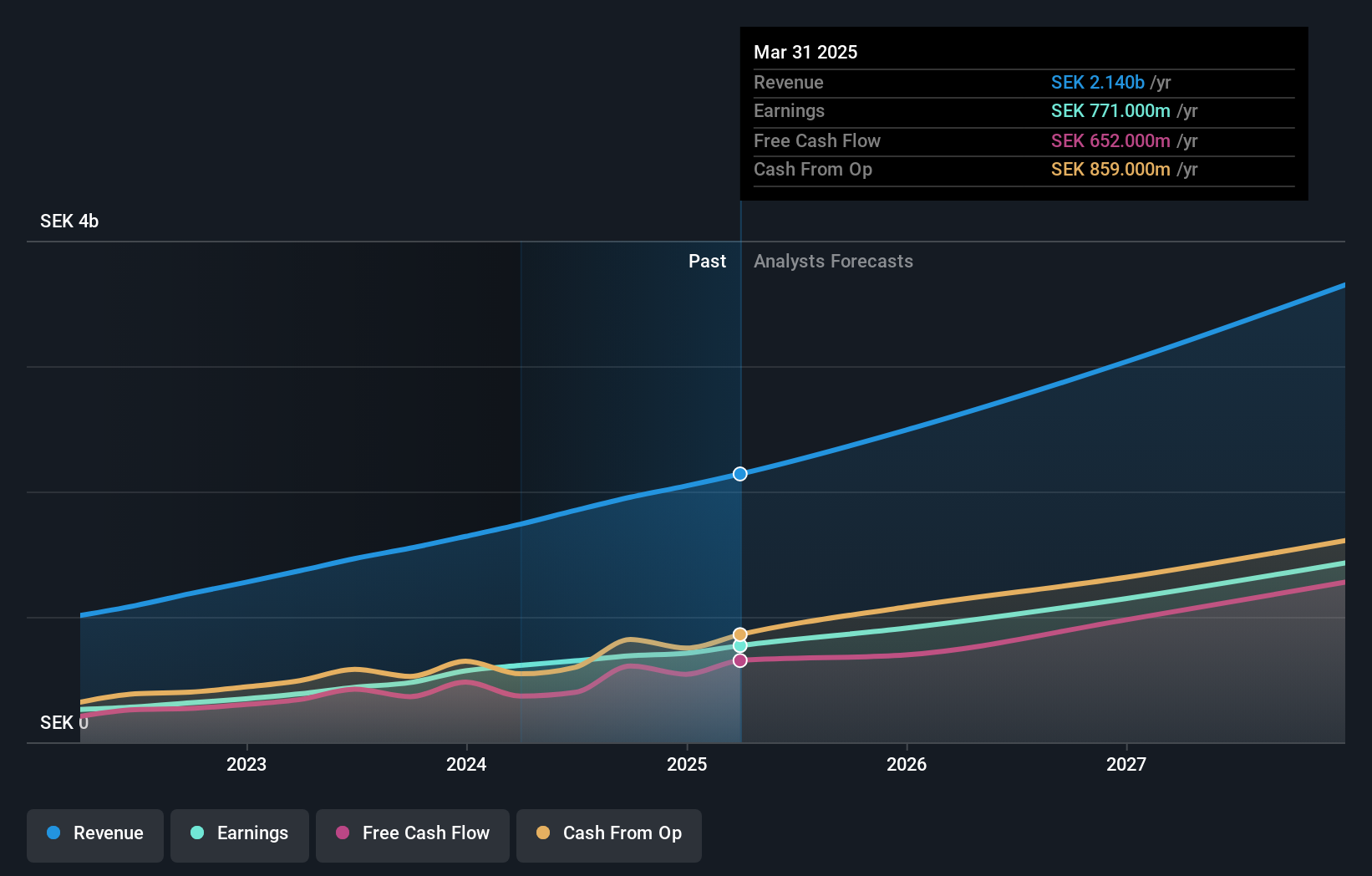

Overview: Fortnox AB (publ) offers innovative technical solutions for financial and administrative applications to small and medium-sized enterprises, accounting firms, and organizations in Sweden, with a market cap of SEK53.07 billion.

Operations: Fortnox AB (publ) generates revenue through its suite of technical products and services designed for financial and administrative applications, catering primarily to small and medium-sized enterprises, accounting firms, and organizations in Sweden. The company focuses on providing smart integrations that streamline business operations within these sectors.

Fortnox AB has shown a robust financial performance with a 24% increase in net income and a 22.5% rise in revenue for the first quarter of 2025, signaling strong operational efficiency. Amidst this growth, Fortnox is poised to be acquired by First Kraft Ab and EQT AB for SEK 44.5 billion, reflecting a premium of 38%, which underscores the high valuation confidence by major stakeholders. This strategic move could potentially enhance Fortnox's market position and resource base, supporting its forecasted annual earnings growth of over 20%. Moreover, with an expected revenue growth rate surpassing the Swedish market average at 17.5%, Fortnox is well-positioned to leverage its advancements in software solutions to further penetrate the tech industry.

- Navigate through the intricacies of Fortnox with our comprehensive health report here.

Gain insights into Fortnox's historical performance by reviewing our past performance report.

Basler (XTRA:BSL)

Simply Wall St Growth Rating: ★★★★☆☆

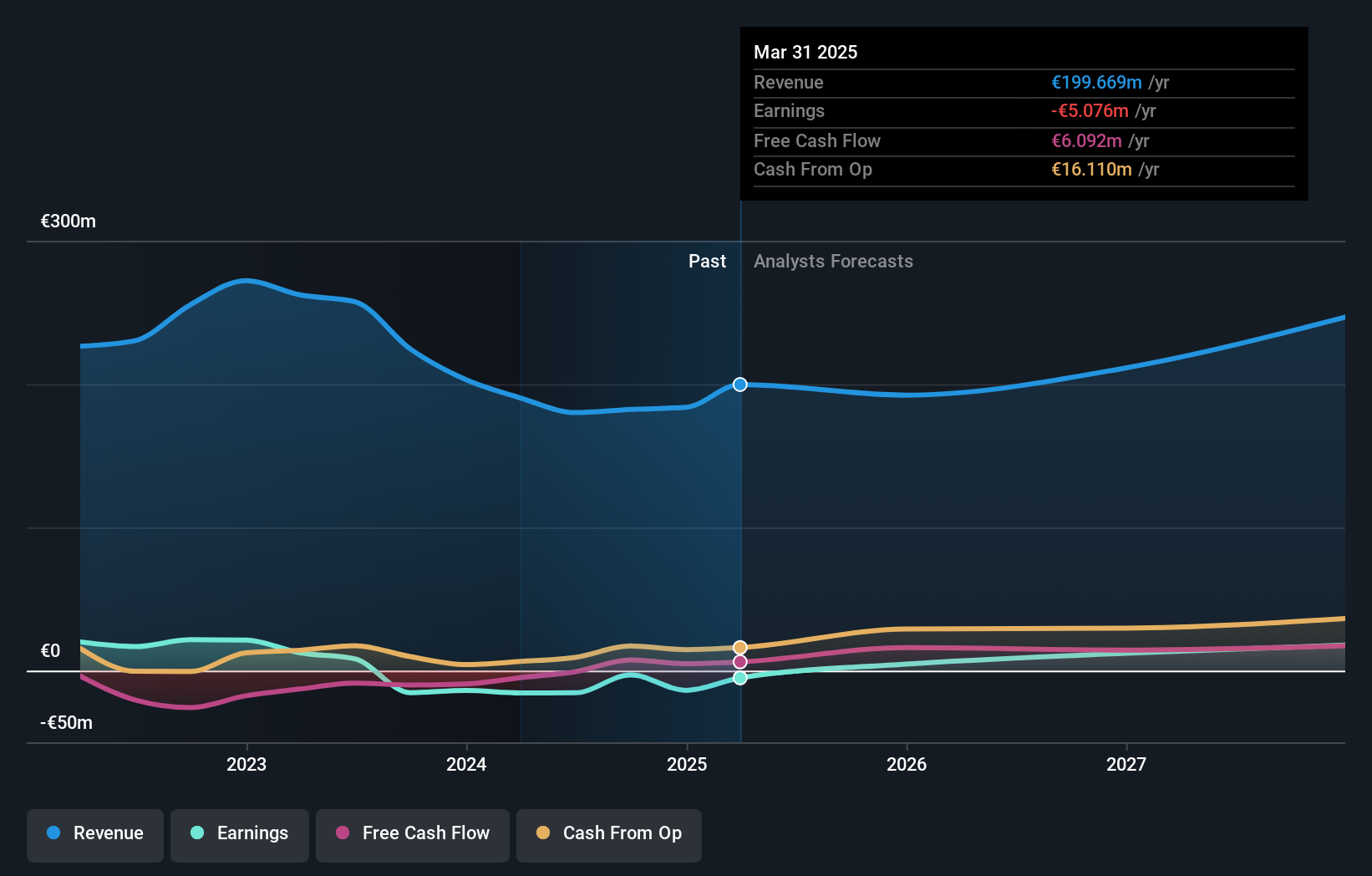

Overview: Basler Aktiengesellschaft specializes in developing, manufacturing, and selling digital cameras for professional users both in Germany and internationally, with a market capitalization of €282.84 million.

Operations: Basler Aktiengesellschaft generates revenue primarily through its camera segment, amounting to €199.67 million. The company's focus is on providing digital imaging solutions for professional markets across various regions.

Basler's recent pivot towards an enhanced R&D strategy, allocating substantial resources to innovation, underscores its commitment to staying competitive in the high-tech landscape. With a significant 36% increase in R&D spending compared to last year, totaling €15 million, the firm is poised to refine its tech offerings. This strategic emphasis is evident as Basler reported a robust first-quarter sales growth of 37%, amounting to €59.46 million. Despite past profitability challenges, these moves signal a promising shift towards sustainable growth and market adaptability, especially with projections setting the 2025 sales target between €186 million and €198 million. Moreover, Basler's proactive adjustments in corporate governance and remuneration systems reflect its readiness to align with evolving industry standards and stakeholder expectations.

- Get an in-depth perspective on Basler's performance by reading our health report here.

Assess Basler's past performance with our detailed historical performance reports.

Next Steps

- Delve into our full catalog of 228 European High Growth Tech and AI Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Basler might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BSL

Basler

Engages in the development, manufacture, and sale of digital cameras for professional users in Germany and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026